Kansas Income Tax Rate

Income taxes play a crucial role in shaping the financial landscape of any state, and Kansas is no exception. The Kansas income tax system is a vital component of the state's economy, impacting individuals, businesses, and the overall fiscal health of the region. Understanding the income tax rate in Kansas provides valuable insights into the state's economic policies and their potential impact on residents and investors alike.

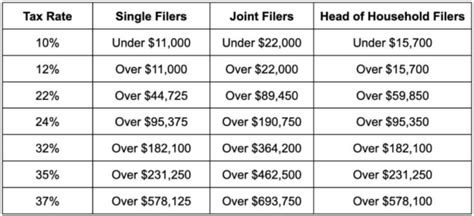

The Kansas Department of Revenue administers the state's income tax system, which is structured with various tax rates and brackets to ensure fairness and equity. The income tax rate in Kansas is a progressive system, meaning that as taxable income increases, the tax rate also increases. This progressive nature aims to distribute the tax burden equitably across different income levels.

Kansas Income Tax Rates and Brackets

As of my last update in January 2023, the income tax rates in Kansas are as follows:

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1st Bracket | $0 - $15,000 | 2.55% |

| 2nd Bracket | $15,001 - $30,000 | 3.05% |

| 3rd Bracket | $30,001 - $75,000 | 4.65% |

| 4th Bracket | $75,001 and above | 5.7% |

These tax rates are applicable to individuals, estates, and trusts residing in Kansas. For married couples filing jointly, the tax brackets are doubled, providing a more favorable tax situation for couples with combined incomes.

It's important to note that Kansas also offers various tax credits and deductions that can reduce the taxable income and, consequently, the tax liability. These include credits for dependent care, education, property taxes, and more. Additionally, Kansas allows taxpayers to itemize deductions for expenses such as medical costs, charitable donations, and certain business expenses, further reducing the overall tax burden.

Impact of Income Tax Rates on Kansas Residents

The income tax rates in Kansas have a significant influence on the financial well-being of its residents. For individuals with lower incomes, the lower tax brackets ensure that a smaller percentage of their income is subject to taxation, promoting financial stability and disposable income. Conversely, for higher-income earners, the progressive tax structure means that they contribute a larger share of their income to the state’s revenue, which can be beneficial for funding public services and infrastructure.

The income tax system in Kansas also impacts businesses operating within the state. The corporate income tax rate in Kansas is 4%, which is applied to the net income of corporations doing business in the state. While this rate is relatively low compared to some other states, the progressive nature of the individual income tax system can still affect businesses, especially those with highly compensated employees.

Furthermore, the income tax rates in Kansas can influence economic development and business attraction. Lower tax rates can make the state more appealing to businesses considering relocation or expansion, potentially leading to job creation and economic growth. Conversely, higher tax rates might deter businesses from choosing Kansas as their base of operations.

Future Considerations and Policy Changes

The income tax rates in Kansas are subject to periodic reviews and potential adjustments. The Kansas Legislature has the authority to propose and enact changes to the tax system, which can include modifications to the tax rates, brackets, or deductions. These changes are often driven by economic considerations, revenue needs, and political priorities.

In recent years, there has been ongoing debate surrounding the fairness and efficiency of the Kansas tax system. Some argue that the progressive income tax structure is necessary to ensure that higher-income earners contribute their fair share, while others advocate for tax reforms that could include flattening the tax rates or implementing a single-rate system to simplify the tax code and reduce administrative burdens.

Additionally, the COVID-19 pandemic and its economic repercussions have brought attention to the need for a resilient tax system. The state's ability to manage revenue fluctuations and adapt to changing economic conditions will be crucial in maintaining fiscal stability and supporting the recovery of Kansas' economy.

Conclusion

The income tax rate in Kansas is a critical component of the state’s fiscal policy, impacting individuals, businesses, and the overall economic landscape. The progressive nature of the tax system aims to distribute the tax burden fairly across different income levels. However, ongoing discussions about tax fairness, efficiency, and resilience highlight the need for a continuous evaluation of the state’s tax policies to ensure they align with the evolving economic needs of Kansas and its residents.

Are there any tax exemptions or credits available in Kansas for specific industries or sectors?

+Yes, Kansas offers a range of tax incentives and credits to encourage economic development and support specific industries. These include tax credits for manufacturing, agriculture, renewable energy, and more. The state also provides targeted tax incentives for business retention and expansion, aiming to create a competitive business environment.

How does Kansas compare to neighboring states in terms of income tax rates?

+Kansas’ income tax rates are generally competitive with neighboring states. For example, Missouri has a flat income tax rate of 5.3%, while Nebraska’s rate is 6.84%. Kansas’ progressive system, with its lower tax rates for lower incomes, can make it an attractive option for individuals and businesses compared to these states.

What are the potential implications of a flat tax rate system in Kansas?

+Implementing a flat tax rate system in Kansas would mean that all income levels would be taxed at the same rate. While this could simplify the tax code, it might also lead to a shift in the tax burden, potentially impacting lower-income earners. A flat tax rate would eliminate the progressive nature of the current system, which is designed to distribute the tax burden more equitably.