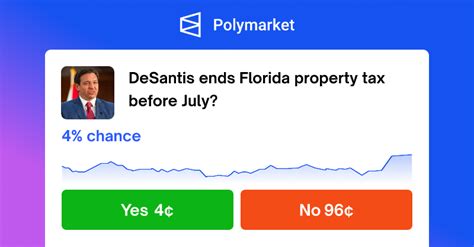

Desantis Property Tax

In the state of Florida, the issue of property taxes and their assessment has become a prominent topic of discussion, especially with regards to Governor Ron DeSantis' recent initiatives. Property taxes are a significant concern for homeowners and investors alike, as they directly impact financial planning and the overall cost of living. This article aims to delve into the specifics of the DeSantis Property Tax initiatives, exploring their implications, potential benefits, and the overall impact on Florida's residents.

Unraveling the DeSantis Property Tax Initiatives

Governor Ron DeSantis, known for his conservative fiscal policies, has made property tax reform a key focus of his administration. The DeSantis Property Tax initiatives aim to provide relief to Florida’s homeowners and encourage economic growth by making property ownership more affordable and sustainable.

Key Components of the DeSantis Property Tax Plan

The DeSantis administration has proposed a series of measures to achieve its property tax reform goals. These include:

- Homestead Exemption Expansion: The homestead exemption, which provides a tax break to homeowners, has been proposed for expansion. This would mean a larger portion of a homeowner’s property value would be exempt from taxation, reducing the overall tax burden.

- Portability of Save Our Homes (SOH) Benefits: The SOH program, designed to limit property tax increases for long-term homeowners, is being made more flexible. DeSantis’ plan aims to make these benefits portable, allowing homeowners to transfer their SOH savings when they move within the state.

- Limiting Millage Rates: The governor has proposed capping the millage rates that local governments can levy on properties. This would prevent excessive property tax increases and provide predictability for homeowners.

- Enhanced Tax Relief for Low-Income Homeowners: The DeSantis plan includes provisions for additional tax relief for low-income homeowners, making property ownership more affordable for those who need it most.

Impact on Florida’s Property Market

The DeSantis Property Tax initiatives are expected to have a significant impact on Florida’s real estate market. By reducing the tax burden on homeowners, the governor aims to make Florida an even more attractive place to live and invest. This could lead to increased property values and a boost in the state’s economy.

| Metric | Projected Impact |

|---|---|

| Property Values | Potential increase due to enhanced affordability and investor confidence. |

| Homeownership Rates | Expected to rise as property taxes become more manageable. |

| Economic Growth | Boosted by increased consumer spending and business investment. |

Analysis of Potential Challenges and Benefits

While the DeSantis Property Tax initiatives offer several benefits, they also present some challenges that need careful consideration.

Benefits of the DeSantis Property Tax Reforms

- Affordability: By reducing property taxes, the reforms make homeownership more affordable, especially for first-time buyers and those on lower incomes.

- Stability: Capping millage rates provides stability for homeowners, allowing them to plan their finances more effectively.

- Economic Growth: The initiatives are likely to boost Florida’s economy by encouraging investment and consumer spending.

Potential Challenges

Despite the advantages, there are some potential challenges associated with these reforms:

- Revenue Loss for Local Governments: Limiting millage rates could result in reduced revenue for local governments, potentially impacting essential services.

- Complexity in Implementation: Making the SOH benefits portable could introduce complexities in tax assessment and administration.

- Impact on Rental Market: Reduced property taxes might lead to increased investment in rental properties, potentially affecting the availability and affordability of rental housing.

Case Studies: Impact on Different Stakeholders

To understand the real-world implications of the DeSantis Property Tax initiatives, let’s examine some case studies:

Case Study 1: Long-Term Homeowners

John and Mary Smith have owned their home in Florida for over 20 years. The SOH program has been a significant benefit for them, limiting their property tax increases over the years. With the proposed portability of SOH benefits, the Smiths can now consider moving to a different part of the state without losing the tax savings they’ve accumulated.

Case Study 2: First-Time Buyers

Sarah and David are a young couple looking to buy their first home. With the expanded homestead exemption and enhanced tax relief for low-income homeowners, they can now afford a larger portion of their dream home, making their journey to homeownership more achievable.

Case Study 3: Local Businesses

The ABC Corporation, a local business in Florida, has been concerned about rising property taxes, which have impacted their bottom line. With the DeSantis Property Tax reforms, they can expect a more stable tax environment, allowing them to plan their business strategies with greater certainty.

Future Outlook and Implications

The DeSantis Property Tax initiatives are a significant step towards making Florida a more attractive place to live and do business. If successfully implemented, these reforms could:

- Boost Florida’s economy by encouraging investment and consumer spending.

- Increase homeownership rates, especially among younger generations.

- Provide stability and predictability for homeowners and businesses.

However, it is essential to monitor the implementation process and assess the impact on various stakeholders to ensure the reforms achieve their intended goals without unintended consequences.

Conclusion

The DeSantis Property Tax initiatives represent a comprehensive approach to property tax reform, with potential benefits for homeowners, investors, and the state’s economy. While challenges exist, the overall impact is expected to be positive, fostering a more sustainable and prosperous Florida.

How will the DeSantis Property Tax reforms impact rental housing availability and affordability?

+The reforms might encourage more investment in rental properties due to reduced tax burdens. This could lead to an increase in rental housing options but might also impact affordability if not enough new units are developed to meet demand.

What is the expected timeline for the implementation of these reforms?

+The implementation timeline will depend on legislative approval and the development of administrative processes. It is likely that some reforms will take effect immediately, while others may require a more gradual roll-out over several years.

How can homeowners benefit from the SOH portability provision?

+The SOH portability provision allows homeowners to transfer their accumulated SOH savings when they move within the state. This means they can continue to enjoy the tax benefits they’ve accrued, making it more financially viable to move without facing significant tax increases.