Buncombe County Property Tax

Welcome to a comprehensive guide on Buncombe County Property Tax, a crucial aspect of homeownership and an essential topic for any resident or prospective homeowner in this beautiful North Carolina county. As we delve into the intricacies of property taxes in Buncombe County, we will explore the factors that influence tax assessments, the process of calculating and paying these taxes, and the various avenues available for taxpayers to understand and potentially reduce their tax liabilities.

Understanding Buncombe County Property Tax Assessments

Buncombe County, known for its vibrant cities like Asheville and vibrant rural communities, utilizes a property tax system that is both fair and transparent. The ad valorem property tax system is based on the assessed value of real property, ensuring that homeowners pay taxes proportional to the worth of their properties. This system is designed to fund essential county services, including education, public safety, and infrastructure development.

The Buncombe County Tax Assessor's Office plays a pivotal role in this process, responsible for determining the value of all taxable property within the county. This includes residential, commercial, and agricultural properties, as well as personal property like vehicles and aircraft.

The assessment process involves several key steps. First, the Assessor's Office conducts a physical inspection of each property to gather data on its characteristics, such as size, location, age, and recent improvements. This data is then analyzed using various appraisal methods, including the cost approach, income approach, and market data approach, to arrive at a fair market value for the property.

Once the fair market value is determined, the Assessor's Office applies the county's tax rate, which is set annually by the Board of Commissioners. This rate, expressed as a percentage, is applied to the assessed value of the property to calculate the property tax bill. For example, if the tax rate is set at 0.65% and a property is assessed at $250,000, the annual property tax bill would be $1,625.

Appealing Property Tax Assessments

Homeowners who believe their property has been overvalued or who have concerns about their tax assessment have the right to appeal. The Buncombe County Board of Equalization and Review (BOER) is an independent body that hears these appeals. The BOER is responsible for ensuring that all assessments are accurate and equitable, and it can adjust assessments if it finds errors or inconsistencies.

To initiate an appeal, homeowners must submit a written request to the BOER within a specified timeframe, typically 30 days after receiving their tax notice. The request should include evidence supporting the claim that the property is overvalued, such as recent sales of similar properties or an independent appraisal.

| Assessment Year | Total Property Value | Tax Rate | Estimated Property Tax |

|---|---|---|---|

| 2023 | $300,000 | 0.65% | $1,950 |

| 2022 | $280,000 | 0.67% | $1,876 |

| 2021 | $260,000 | 0.68% | $1,768 |

The Buncombe County Property Tax Payment Process

Once the tax assessment process is complete and the tax rates are set, homeowners receive their property tax bills. In Buncombe County, these bills are typically mailed in early October, with the first installment due by January 5th of the following year. The second installment is due by July 1st.

Taxpayers have several options for paying their property taxes. They can pay online through the Buncombe County Tax Office website, which offers a secure payment portal. This method is convenient and provides taxpayers with an immediate receipt. Alternatively, taxpayers can pay by mail, sending a check or money order along with the remittance portion of their tax bill to the Buncombe County Tax Office. For those who prefer in-person payments, the Tax Office accepts cash, checks, and money orders at its physical location during regular business hours.

It's important for taxpayers to ensure that their payments are received on time to avoid late fees and penalties. The Buncombe County Tax Office is strict about these deadlines and enforces a 2% penalty for late payments, which accrues monthly until the bill is paid in full.

Property Tax Exemptions and Relief Programs

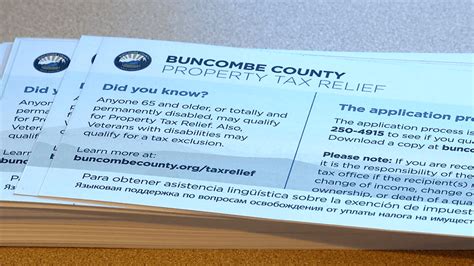

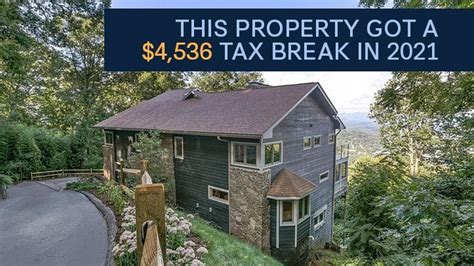

Buncombe County offers several property tax exemptions and relief programs to assist certain homeowners. These programs are designed to provide financial relief to eligible taxpayers, including seniors, veterans, and homeowners with limited incomes.

For instance, the Disabled Veterans Exemption provides a full or partial exemption from property taxes for qualifying veterans with service-connected disabilities. Similarly, the Elderly Citizen Exemption offers a partial exemption for homeowners aged 65 or older with limited incomes. Other programs, such as the Homestead Exemption and the Farmland Preservation Program, provide relief for specific types of property owners.

To apply for these exemptions, homeowners must complete the appropriate forms and provide supporting documentation. These forms are available on the Buncombe County Tax Office website, and the office staff is available to assist with the application process. It's important for homeowners to be aware of these programs and to apply early, as there are often specific deadlines and eligibility criteria.

Navigating Property Tax Changes and Challenges

Understanding and managing property taxes in Buncombe County can be complex, especially when property values fluctuate or when taxpayers face unique circumstances. Here are some additional considerations and strategies to navigate these challenges.

Understanding Property Tax Increases

Property tax increases in Buncombe County can occur for various reasons. One primary factor is the annual reassessment process, where the county reassesses property values to ensure they reflect the current market. This reassessment can lead to higher property tax bills, especially if the market value of the property has increased significantly.

Additionally, changes in tax rates can also impact property tax liabilities. The Buncombe County Board of Commissioners has the authority to adjust tax rates annually to fund county operations and maintain essential services. Tax rate increases, coupled with rising property values, can result in substantial increases in property tax bills.

To better understand these changes, homeowners can refer to the annual tax notice they receive from the Buncombe County Tax Office. This notice provides a detailed breakdown of the assessed value, tax rate, and the calculated tax amount. Homeowners should carefully review this information to identify any significant changes and understand the reasons behind them.

Challenging Property Tax Assessments

If homeowners believe their property tax assessment is inaccurate or unfair, they have the right to challenge it through the formal appeals process. The Buncombe County Board of Equalization and Review (BOER) is responsible for hearing these appeals and making determinations based on the evidence presented.

To initiate an appeal, homeowners must file a written petition with the BOER within a specified timeframe, typically within 30 days of receiving their tax notice. The petition should include a detailed explanation of why the assessment is believed to be incorrect, along with supporting documentation such as recent property sales, appraisals, or other relevant evidence.

It's important to note that the appeals process can be complex and may require the assistance of a qualified tax professional or attorney. Homeowners should carefully consider their options and gather all necessary evidence to support their case. The BOER will review the petition and may request additional information or schedule a hearing to make a final determination.

Strategies for Managing Property Tax Bills

Managing property tax bills can be a challenge, especially for homeowners on a fixed income or those facing financial difficulties. Here are some strategies to consider:

- Stay Informed: Keep up-to-date with property tax rates, assessment schedules, and any changes to tax laws or exemptions. This knowledge can help homeowners anticipate and plan for potential increases.

- Budgeting: Incorporate property taxes into your annual budget. Consider setting aside a portion of your income each month to cover these expenses, ensuring you have the funds available when tax bills are due.

- Explore Exemptions: Research and apply for any property tax exemptions or relief programs for which you may be eligible. These can provide significant savings and ease the financial burden of property taxes.

- Consider Refinancing: If you have a mortgage, refinancing your home loan at a lower interest rate can potentially reduce your monthly payments, freeing up more funds to cover property taxes.

- Seek Professional Advice: Consult with a tax professional or financial advisor who can provide personalized advice based on your specific circumstances. They can help you understand your options and develop a strategy to manage your property tax obligations effectively.

Conclusion: A Comprehensive Guide to Buncombe County Property Taxes

In conclusion, navigating the world of property taxes in Buncombe County requires a solid understanding of the assessment process, payment options, and available exemptions. By staying informed, actively participating in the assessment process, and taking advantage of relief programs when eligible, homeowners can better manage their property tax obligations.

As the vibrant communities of Buncombe County continue to thrive, property taxes will remain an essential part of the county's financial landscape. By providing essential services and maintaining the infrastructure that makes Buncombe County a desirable place to live, these taxes play a crucial role in the county's prosperity and well-being.

We hope this guide has provided you with valuable insights into Buncombe County's property tax system. Remember, knowledge is power, and understanding your property tax obligations can lead to more effective financial planning and a smoother homeownership experience.

How often are property values reassessed in Buncombe County?

+Property values in Buncombe County are reassessed every year as part of the annual reassessment process. This ensures that property taxes remain fair and proportional to the current market value of the property.

What happens if I miss the deadline to pay my property taxes?

+If you miss the deadline to pay your property taxes, you may be subject to late fees and penalties. The Buncombe County Tax Office enforces a 2% penalty for late payments, which accrues monthly until the bill is paid in full. It’s important to pay your taxes on time to avoid these additional costs.

Are there any tax relief programs for senior citizens in Buncombe County?

+Yes, Buncombe County offers the Elderly Citizen Exemption, which provides a partial exemption from property taxes for homeowners aged 65 or older with limited incomes. This exemption can significantly reduce the property tax burden for eligible seniors.

Can I appeal my property tax assessment if I disagree with the value assigned to my property?

+Yes, if you believe your property has been overvalued or you have concerns about your tax assessment, you have the right to appeal. The Buncombe County Board of Equalization and Review (BOER) hears these appeals and can adjust assessments if errors or inconsistencies are found.