Washington State Gas Tax

In the state of Washington, the gas tax is a significant aspect of the transportation funding system, playing a crucial role in the maintenance and development of the state's infrastructure. This tax, officially known as the Motor Fuel Tax, has a long history and a complex structure that influences the prices consumers pay at the pump. Let's delve into the specifics of Washington's gas tax and its impact on the state's economy and transportation network.

Understanding Washington’s Gas Tax Structure

Washington’s gas tax is a multi-faceted levy that consists of several components, each serving a specific purpose. The primary elements of this tax structure are:

State Gas Tax

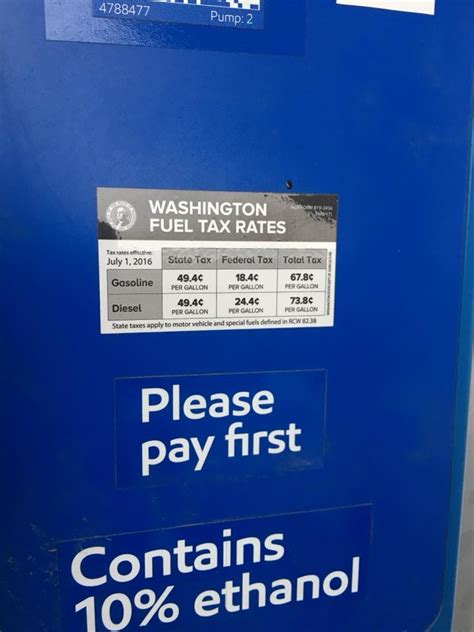

The state of Washington imposes a flat rate gas tax, currently set at 0.494 per gallon</strong> for gasoline and <strong>0.575 per gallon for diesel fuel. This tax is adjusted annually to account for inflation, ensuring that the revenue generated keeps pace with the rising costs of transportation projects.

Local Option Gas Tax

In addition to the state tax, some local jurisdictions in Washington have the authority to impose an additional gas tax. These local taxes, often referred to as local option gas taxes, are typically levied to fund specific transportation projects or to address regional transportation needs. The rates for these local taxes can vary, with some counties opting for higher rates to accelerate infrastructure development.

Other Fuel Taxes and Fees

Washington also levies taxes on other fuel types, such as alternative fuels and aviation gasoline. These taxes are designed to ensure that all fuel users contribute to the state’s transportation system, promoting fairness and sustainability. Additionally, there are various fees associated with fuel distribution and storage, further contributing to the overall tax burden on fuel.

Impact on Fuel Prices

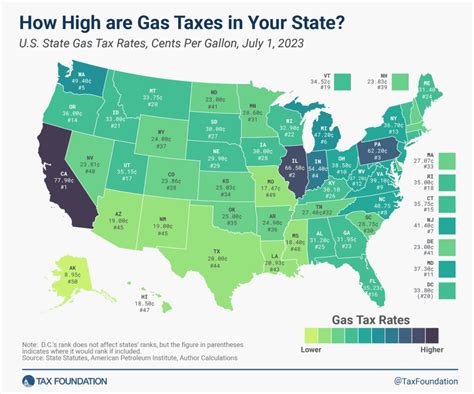

The cumulative effect of these taxes and fees significantly influences the price of fuel in Washington. While the state’s gas tax rates are not the highest in the nation, they contribute to the overall cost of fuel, which can vary considerably across the state due to the local option taxes. This variation in fuel prices can impact consumer behavior, with some residents choosing to fill up their tanks in areas with lower tax rates, leading to a potential loss of revenue for certain regions.

Revenue Allocation and Transportation Funding

The revenue generated from Washington’s gas tax is a vital source of funding for the state’s transportation system. This funding is carefully allocated to various transportation projects and initiatives, ensuring the maintenance and improvement of roads, bridges, and other critical infrastructure.

State Transportation Fund

The majority of the revenue from the state gas tax is deposited into the State Transportation Fund, which serves as the primary funding source for the Washington State Department of Transportation (WSDOT). This fund supports a wide range of transportation projects, including:

- Road construction and maintenance

- Bridge repairs and replacements

- Public transit initiatives

- Bicycle and pedestrian infrastructure

- Freight mobility projects

Local Transportation Projects

Revenue from the local option gas tax is directed towards specific transportation projects within the jurisdiction that imposed the tax. This allows local governments to address regional transportation needs and fund initiatives that may not be a priority at the state level. These projects can range from road improvements to the development of public transportation systems.

Transportation Improvement Board (TIB)

The Transportation Improvement Board (TIB) is another key recipient of gas tax revenue. The TIB is responsible for allocating funds to counties and cities for various transportation purposes. These funds can be used for a wide array of projects, from road safety enhancements to the construction of bike lanes and sidewalks.

The Future of Washington’s Gas Tax

As the state’s transportation needs evolve and infrastructure ages, the role of the gas tax is likely to change. Washington, like many other states, is facing challenges related to funding transportation projects in an era of changing fuel efficiency and emerging alternative fuel technologies.

Electric Vehicles and the Gas Tax

The increasing popularity of electric vehicles (EVs) presents a unique challenge to the gas tax model. As more drivers switch to EVs, the revenue generated from the gas tax will decline, potentially impacting the funding available for transportation projects. To address this, some states are considering alternative methods of taxation, such as road usage fees or vehicle miles traveled (VMT) taxes, which would apply to all vehicles regardless of their fuel type.

Potential Reforms and Innovations

Washington is exploring innovative solutions to ensure sustainable transportation funding. One such initiative is the Move Ahead Washington package, which aims to improve transportation infrastructure and provide stable funding for future projects. This package includes a variety of funding sources, such as bond issuances and revenue from new vehicle registrations, to supplement the traditional gas tax.

Environmental Considerations

With a growing focus on environmental sustainability, Washington is also considering the role of the gas tax in promoting cleaner transportation options. The state is exploring ways to incentivize the adoption of electric and hybrid vehicles, potentially through tax credits or other incentives, while also ensuring that the revenue needed for transportation projects is maintained.

Conclusion: Washington’s Gas Tax in Context

Washington’s gas tax is a complex system that plays a critical role in funding the state’s transportation network. While the state has made efforts to ensure stable funding through various tax measures, the changing landscape of transportation technology presents new challenges. As Washington continues to adapt its tax policies, the focus remains on balancing the need for sustainable revenue with the state’s evolving transportation demands.

How often is the state gas tax rate adjusted for inflation?

+The state gas tax rate is adjusted annually on July 1st to account for inflation. This adjustment ensures that the revenue generated from the tax keeps pace with the rising costs of transportation projects.

What is the primary purpose of the local option gas tax?

+The local option gas tax allows local jurisdictions to fund specific transportation projects or address regional transportation needs. It provides a mechanism for local governments to direct revenue towards initiatives that may not be a priority at the state level.

How is the revenue from the gas tax distributed among different transportation projects?

+The revenue from the state gas tax is primarily allocated to the State Transportation Fund, which funds a wide range of transportation projects. Local option gas tax revenue is directed towards specific transportation projects within the jurisdiction that imposed the tax. Additionally, the Transportation Improvement Board (TIB) allocates funds to counties and cities for various transportation purposes.

What are some of the challenges Washington faces with its current gas tax system?

+Washington faces challenges related to the declining revenue from the gas tax as more drivers switch to electric vehicles. The state is exploring alternative funding sources and taxation methods to ensure sustainable revenue for transportation projects in the face of changing fuel technologies.