Tax Id Number Lookup California

The Tax Identification Number (TIN) is a crucial piece of information for businesses and individuals alike in California, as it is used for various tax-related purposes, including filing taxes, opening business accounts, and complying with state regulations. In this comprehensive guide, we will delve into the world of Tax ID Number lookups in California, exploring the process, its importance, and the benefits it offers to both businesses and individuals.

Understanding the Tax ID Number in California

In California, the Tax ID Number serves as a unique identifier for entities and individuals in their interactions with the state’s tax system. It is a vital tool for the California Franchise Tax Board (FTB) to manage and track tax obligations effectively. The TIN is a nine-digit number assigned to businesses and certain individuals, ensuring accurate identification and efficient tax administration.

The Tax ID Number is not limited to businesses; it also plays a significant role for individuals who are self-employed, freelancers, or have specific tax obligations. For instance, sole proprietors often use their Social Security Number (SSN) as their TIN for tax purposes. However, it's important to note that using the SSN as a TIN carries certain risks, as it may expose sensitive personal information. Therefore, obtaining a dedicated TIN is often recommended for better privacy and security.

The Importance of Tax ID Number Lookup

The ability to lookup and verify Tax ID Numbers in California offers numerous benefits to both businesses and individuals. Here’s why this process is essential:

- Compliance and Due Diligence: Tax ID Number lookups help businesses and individuals ensure compliance with state tax regulations. By verifying the TIN of their partners, clients, or employees, they can avoid potential penalties and legal issues associated with non-compliance.

- Risk Mitigation: TIN lookups allow entities to assess and mitigate risks associated with financial transactions. By verifying the TIN of counterparties, businesses can identify potential fraud or tax evasion, protecting their interests and maintaining financial integrity.

- Improved Data Quality: The process of TIN lookup contributes to the accuracy and reliability of tax-related data. It helps entities maintain updated and correct tax information, reducing errors and enhancing the efficiency of tax administration.

- Tax Obligation Awareness: Tax ID Number lookups provide individuals and businesses with a clear understanding of their tax obligations. By obtaining a TIN and staying informed about tax requirements, entities can plan their financial strategies and ensure timely compliance.

How to Lookup Tax ID Numbers in California

In California, the process of Tax ID Number lookup involves several methods, each catering to specific needs and circumstances. Here’s a detailed guide on how to conduct a TIN lookup:

1. Online Lookup Tools

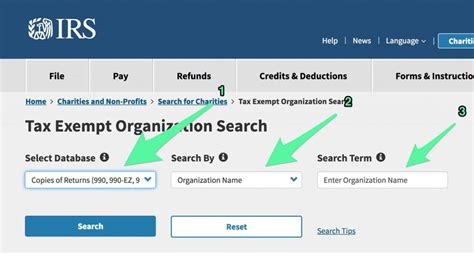

The California Franchise Tax Board (FTB) offers an online tool called the “Business Entity Search” for public access. This tool allows users to search for business entities registered in California and retrieve their TINs. Here’s how to use it:

- Access the FTB Website: Visit the official website of the California Franchise Tax Board at www.ftb.ca.gov.

- Navigate to the Search Tool: Look for the "Business Entity Search" or a similar option on the website. This tool is usually found in the "Services" or "Information" section.

- Enter Business Details: Enter the name of the business you wish to search for. You can also provide additional information like the city, county, or registration number to narrow down the results.

- Review Results: The search tool will display a list of matching business entities. Review the results to identify the correct entity.

- Retrieve the TIN: Once you've identified the correct business, you can access its Tax ID Number and other relevant information, such as the business address and registration details.

2. Direct Communication with Businesses

For entities that are not registered with the FTB or have limited online presence, direct communication may be necessary to obtain their Tax ID Number. Here’s how you can proceed:

- Identify the Business: Determine the name and contact details of the business you wish to verify. This can be done through online research, industry directories, or personal referrals.

- Contact the Business: Reach out to the business using their provided contact information. You can send an email, make a phone call, or even schedule a meeting if possible.

- Explain Your Purpose: Clearly communicate your intention to verify their Tax ID Number. Explain the purpose and benefits of TIN verification, emphasizing the importance of compliance and risk management.

- Request the TIN: Politely ask the business representative to provide their Tax ID Number. Ensure that you have their consent and understanding before proceeding.

- Record the TIN: Once you obtain the TIN, make a note of it and store it securely. Ensure that you have the correct and updated TIN for future reference.

3. Professional Services and Third-Party Providers

In some cases, especially for larger-scale TIN verification projects or complex business structures, engaging professional services or third-party providers can be beneficial. These experts offer specialized tools and expertise to streamline the TIN lookup process.

Professional services, such as accounting firms or tax consultants, can assist in verifying TINs for businesses or individuals. They often have access to proprietary databases and can provide comprehensive TIN verification services. Additionally, there are third-party providers who specialize in business information and TIN verification. These services can be particularly useful for high-volume TIN lookups or when dealing with a diverse range of business entities.

Tips for Effective Tax ID Number Lookup

To ensure a successful and accurate Tax ID Number lookup in California, consider the following tips and best practices:

- Use Official Sources: Always prioritize official sources, such as the California Franchise Tax Board (FTB) website, for accurate and up-to-date information. Avoid relying solely on third-party websites or unverified sources.

- Verify Multiple Times: To ensure accuracy, cross-reference the obtained TIN with other official sources. This helps confirm the authenticity of the TIN and reduces the risk of errors.

- Stay Informed about Changes: Tax regulations and business registration requirements can evolve over time. Stay updated with the latest information and changes to ensure compliance and accurate TIN verification.

- Maintain Privacy and Security: Handle Tax ID Numbers with care and respect the privacy of the entities you are verifying. Ensure that you have the necessary consent and permission to access and use TINs.

- Seek Professional Guidance: If you encounter complex situations or have specific requirements, consider consulting with tax professionals or legal experts. They can provide specialized advice and guidance to navigate any unique challenges.

Future of Tax ID Number Lookup in California

The landscape of Tax ID Number lookup in California is continuously evolving, driven by advancements in technology and changing regulatory environments. Here are some potential future developments and their implications:

- Digital Transformation: The California FTB is likely to embrace digital transformation further, making TIN lookup processes more efficient and accessible. This may involve the development of mobile apps, enhanced online platforms, and integration with other state services.

- Data Security and Privacy: With increasing concerns about data security and privacy, the FTB may implement stricter measures to protect sensitive tax information. This could include enhanced encryption, two-factor authentication, and improved access controls.

- Interoperability and Integration: The future may see greater interoperability between different state agencies and their systems. This integration could streamline TIN verification processes, allowing for seamless data exchange and reducing administrative burdens.

- Automated Verification: Automated TIN verification systems may become more prevalent, leveraging machine learning and artificial intelligence to enhance accuracy and efficiency. These systems could analyze large datasets and identify potential discrepancies or fraudulent activities.

- Expanded TIN Usage: As the importance of TINs grows, they may be used for additional purposes beyond tax administration. This could include enhanced identification for financial transactions, regulatory compliance, and even access to certain government services.

Conclusion

Tax ID Number lookup in California is a vital process that contributes to the efficiency and integrity of the state’s tax system. By understanding the importance of TIN verification and following the appropriate methods, businesses and individuals can ensure compliance, mitigate risks, and maintain accurate tax-related data. As the landscape evolves, staying informed about the latest developments and best practices will be essential for a seamless and effective TIN lookup experience.

Can I use my Social Security Number as my Tax ID Number in California?

+Yes, individuals who are self-employed or have specific tax obligations can use their Social Security Number (SSN) as their Tax ID Number (TIN) for tax purposes in California. However, it’s important to note that using the SSN as a TIN may expose sensitive personal information. Obtaining a dedicated TIN, such as an Employer Identification Number (EIN), is often recommended for better privacy and security.

How often should I verify Tax ID Numbers for my business partners or clients?

+The frequency of Tax ID Number verification depends on various factors, including the nature of your business, the level of risk associated with your transactions, and the regulatory requirements you must adhere to. As a general practice, it is recommended to verify TINs periodically, especially when there are changes in business relationships, new contracts, or when you suspect potential risks.

Are there any penalties for not verifying Tax ID Numbers in California?

+Failing to verify Tax ID Numbers in California can lead to potential compliance issues and penalties. While the specific penalties may vary depending on the circumstances, not verifying TINs can result in fines, legal actions, or even loss of business reputation. It is essential to prioritize TIN verification to ensure compliance and avoid any negative consequences.