Dallas County Property Tax Search

Welcome to the comprehensive guide on the Dallas County Property Tax Search, an essential tool for homeowners, investors, and anyone with an interest in real estate within the vibrant Dallas County. This article will delve into the intricacies of the property tax system, offering a detailed understanding of how it works, why it matters, and how you can navigate it with ease.

Understanding Dallas County’s Property Tax Landscape

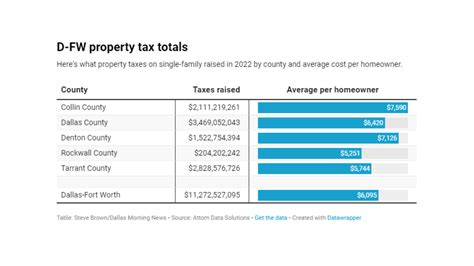

Dallas County, known for its dynamic business environment and diverse communities, boasts a robust property market. The property tax system plays a pivotal role in funding vital public services and infrastructure, making it an essential aspect of local governance.

How Property Taxes are Determined

Property taxes in Dallas County are calculated based on the appraised value of the property and the tax rate set by various taxing entities, including the county, cities, school districts, and special districts. The appraisal process, conducted by the Dallas Central Appraisal District (DCAD), is an annual event where the property's worth is assessed.

The tax rate is expressed as $1 per $100 of valuation and is applied to the property's appraised value. For instance, a property with an appraised value of $200,000 and a tax rate of $0.40 per $100 would have a total tax liability of $800.

| Taxing Entity | Tax Rate ($/100) |

|---|---|

| Dallas County | 0.274000 |

| Dallas ISD | 1.412200 |

| City of Dallas | 0.431000 |

| Special Districts | Varies |

The Property Tax Cycle

The property tax cycle in Dallas County typically follows these steps:

- Appraisal: DCAD appraises properties annually, taking into account recent sales, improvements, and market trends.

- Notice of Appraised Value: Property owners receive a notice by May 1st, detailing the appraised value of their property.

- Protest: If a property owner disagrees with the appraised value, they have the right to protest to the Appraisal Review Board (ARB) within a specified timeframe.

- Tax Rate Adoption: Taxing entities, such as cities and school districts, adopt their tax rates by late summer or early fall.

- Tax Bill: Property owners receive their tax bill by October, detailing the tax amount due and payment options.

- Payment: Taxes are typically due by January 31st of the following year. Failure to pay on time can result in penalties and interest.

Exploring the Dallas County Property Tax Search Tool

The Dallas County Property Tax Search is a powerful online resource provided by the Dallas County Tax Office to assist residents and property owners in understanding their tax obligations. This tool offers a wealth of information, making it an indispensable resource for managing property tax matters efficiently.

Accessing the Property Tax Search

To access the Dallas County Property Tax Search, visit the official website of the Dallas County Tax Office at https://www.dallascad.com/tax-office. From the homepage, navigate to the "Property Search" section. Here, you can enter your Property ID, Account Number, or Address to access detailed property tax information.

Key Features of the Property Tax Search Tool

- Property Details: The search tool provides comprehensive property details, including the owner's name, address, legal description, and appraised value.

- Tax Information: Users can view the tax rate, tax amount, and payment status for the current year, as well as historical tax data for previous years.

- Online Payment: The platform offers a secure online payment gateway, allowing property owners to pay their taxes conveniently without any additional fees.

- Tax Certificate: Property owners can download and print a tax certificate, which is often required for various legal and financial transactions.

- Tax History: The search tool provides a detailed tax history, showing changes in tax rates, appraised values, and payments over the years.

Maximizing the Benefits of the Property Tax Search

The Dallas County Property Tax Search is not just a tool for tax payment; it’s a powerful resource for making informed decisions about your property. Here’s how you can leverage it to your advantage:

1. Stay Informed About Tax Obligations

Regularly checking the property tax search tool keeps you updated on your tax obligations. This helps in budgeting and planning for tax payments, avoiding late fees, and ensuring timely payments to maintain a good standing with the county.

2. Monitor Property Value Changes

The tool provides historical data on property values, allowing you to track changes over time. This is particularly useful for understanding the market value of your property, especially when considering home improvements or refinancing options.

3. Compare Tax Rates

With detailed tax information, you can compare your tax rates with those of similar properties in the area. This transparency ensures fairness and can help identify potential discrepancies or errors in your tax assessment.

4. Efficient Online Payments

The online payment feature saves time and eliminates the need for checks or visits to the tax office. It’s a secure and convenient way to pay your taxes, and you can even set up automatic payments to ensure timely submissions.

Conclusion: Empowering Property Owners in Dallas County

The Dallas County Property Tax Search is a testament to the county’s commitment to transparency and efficiency. By providing an accessible and user-friendly platform, the Dallas County Tax Office ensures that property owners have the tools they need to manage their tax obligations effectively. With this guide, you’re equipped with the knowledge to navigate the property tax system with confidence and take full advantage of the resources at your disposal.

How often are property taxes due in Dallas County?

+Property taxes in Dallas County are due by January 31st of each year. However, you can pay them in two installments, with the first installment due by January 31st and the second by July 1st.

Can I protest my property’s appraised value?

+Yes, if you believe your property’s appraised value is incorrect, you have the right to protest. You must file a protest with the Appraisal Review Board (ARB) by May 31st or 30 days after you receive your notice of appraised value, whichever is later.

What happens if I don’t pay my property taxes on time?

+Failure to pay property taxes on time can result in penalties and interest. The county may also place a tax lien on your property, which can lead to foreclosure if the taxes remain unpaid.

How can I estimate my property tax bill before receiving it?

+You can estimate your property tax bill by multiplying your property’s appraised value by the tax rate. Keep in mind that this is an estimate and the actual tax bill may vary based on changes in tax rates and other factors.