Dade Property Tax

Dade Property Tax is a significant topic for homeowners and property owners in Miami-Dade County, Florida. Understanding the intricacies of property taxes is crucial for managing finances and planning effectively. This comprehensive guide aims to delve into the specifics of Dade Property Tax, covering its calculation, payment options, exemptions, and strategies to navigate this complex yet essential aspect of property ownership.

Understanding the Basics: Dade Property Tax

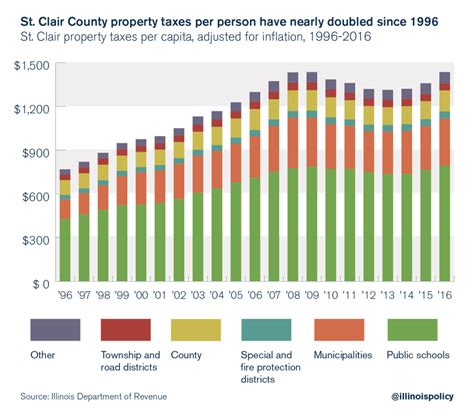

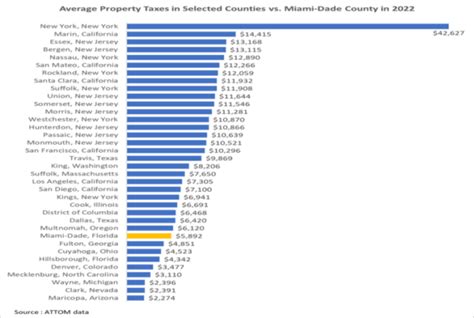

Dade Property Tax is an annual levy imposed on real estate property owners within Miami-Dade County. The tax is calculated based on the assessed value of the property and is a primary source of revenue for the county’s operations and services. The property tax system in Miami-Dade County is designed to ensure that residents contribute to the development and maintenance of their community.

How is Dade Property Tax Calculated?

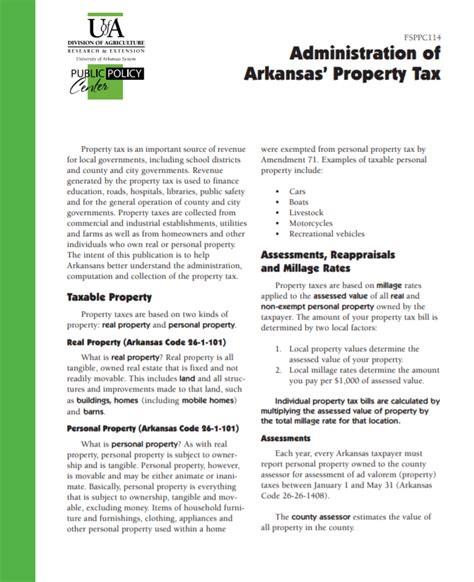

The calculation of Dade Property Tax involves a few key steps. Firstly, the property’s assessed value is determined by the Miami-Dade Property Appraiser’s Office. This value is typically a percentage of the property’s fair market value, which is the price the property would likely sell for in an open market. The assessed value is then multiplied by the millage rate, which is set by various taxing authorities, including the county, school board, and special districts.

The millage rate is expressed in mills, where one mill is equivalent to $1 of tax for every $1,000 of assessed value. For instance, if a property has an assessed value of $200,000 and the millage rate is 10 mills, the property tax would be calculated as follows:

| Assessed Value | $200,000 |

|---|---|

| Millage Rate | 10 mills |

| Property Tax | $2,000 |

In this example, the property owner would owe $2,000 in property taxes for the year.

Key Factors Influencing Property Tax

- Property Value: The higher the assessed value of the property, the higher the property tax.

- Millage Rate: The millage rate can vary each year and is influenced by the budget needs of the county and other taxing authorities.

- Exemptions and Discounts: Certain properties may qualify for exemptions or discounts, reducing the overall tax liability.

Navigating Dade Property Tax: Strategies and Options

Managing Dade Property Tax effectively involves a combination of understanding the tax system, staying informed about exemptions, and exploring payment options. Here are some strategies to consider:

Exemptions and Discounts

Miami-Dade County offers various exemptions and discounts to eligible property owners. These can significantly reduce the property tax burden. Some common exemptions include:

- Homestead Exemption: This exemption is available to permanent residents of Miami-Dade County. It provides a reduction in the assessed value of the primary residence, resulting in lower property taxes. The exemption amount increases over time, offering long-term savings.

- Senior Exemption: Property owners aged 65 or older may be eligible for an additional exemption, further reducing their property taxes.

- Disability Exemption: Certain disabilities can qualify property owners for an exemption, making it crucial to understand the specific criteria.

It's essential to research and apply for these exemptions to maximize savings. The Miami-Dade County Property Appraiser's Office provides detailed information on eligibility criteria and application processes.

Payment Options and Discounts

Miami-Dade County offers a range of payment options for property taxes. Understanding these options can help property owners manage their finances effectively. Here are some common payment methods:

- Early Payment Discount: Property owners who pay their taxes early can receive a discount. The discount percentage varies each year but can provide significant savings.

- Installment Plans: For those who prefer to spread out their payments, installment plans are available. This option allows property owners to pay their taxes in multiple installments, making it more manageable.

- Online Payment: Miami-Dade County offers an online payment portal, providing a convenient and secure way to pay property taxes. This option is especially useful for those who prefer digital transactions.

Stay Informed: Annual Notices and Due Dates

Property owners in Miami-Dade County receive an annual Notice of Proposed Property Taxes, which outlines the proposed tax amount and provides important information. This notice is typically sent in the summer and includes details on exemptions, payment options, and due dates. It’s crucial to review this notice carefully and take action if necessary.

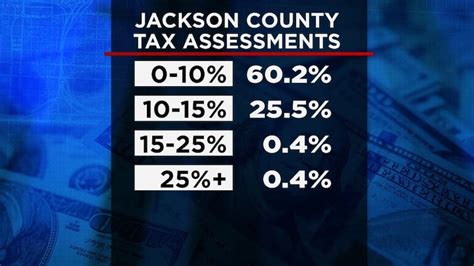

Appealing Property Assessments

In some cases, property owners may disagree with the assessed value of their property. Miami-Dade County provides a process for appealing property assessments. This process involves submitting evidence and justifications for a lower assessment. It’s essential to understand the appeal process and gather the necessary documentation.

Dade Property Tax: A Community Investment

Dade Property Tax is not just a financial obligation but also an investment in the community. The revenue generated from property taxes contributes to various essential services and infrastructure development. These funds support public schools, emergency services, road maintenance, and other vital aspects of community life.

By understanding and managing their property taxes effectively, residents can actively participate in the growth and well-being of their community. It's a shared responsibility that ensures the continued development and prosperity of Miami-Dade County.

Conclusion: Empowering Property Owners

Navigating Dade Property Tax requires a combination of knowledge, strategic planning, and community engagement. By understanding the calculation process, exploring exemptions, and utilizing payment options, property owners can manage their tax obligations effectively. Additionally, staying informed about annual notices and due dates ensures timely payments and avoids penalties.

Furthermore, appealing property assessments when necessary demonstrates a proactive approach to managing finances. It's essential to view property taxes as a contribution to the community's development, fostering a sense of ownership and responsibility.

In conclusion, this comprehensive guide aims to empower property owners in Miami-Dade County by providing a deep understanding of Dade Property Tax. With this knowledge, residents can make informed decisions, maximize savings, and actively participate in the growth of their community.

How often are property taxes assessed in Miami-Dade County?

+Property taxes are assessed annually in Miami-Dade County. The assessment is based on the property’s value as of January 1st of each year.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in late fees and penalties. It’s important to stay informed about due dates and consider setting reminders to avoid any financial penalties.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or excessive. The appeal process involves submitting evidence and justifications for a lower assessment. It’s recommended to consult with a professional for guidance.

Are there any tax breaks or incentives for energy-efficient homes in Miami-Dade County?

+Miami-Dade County does offer tax incentives for energy-efficient homes. These incentives can reduce the assessed value of the property, resulting in lower property taxes. It’s worth exploring these options to maximize savings.