Canada Lottery Winnings Tax Free

Canada is known for its diverse lottery offerings, providing residents and visitors alike with a chance to win big. One of the key advantages for winners is the absence of a federal tax on lottery winnings. This unique feature of the Canadian tax system sets it apart from many other countries and has made Canada an attractive destination for lottery enthusiasts.

In this comprehensive guide, we will delve into the world of tax-free lottery winnings in Canada, exploring the laws, regulations, and implications for both residents and non-residents. By understanding the intricacies of this system, we can uncover the true value of lottery wins and the potential benefits they offer.

The Tax-Free Lottery System in Canada

Canada’s tax system operates on a progressive income tax model, which means individuals are taxed based on their earnings. However, lottery winnings are treated differently and are considered a unique form of income. Here’s how the tax-free lottery system works in Canada:

Federal Lottery Tax Exemption

The Canadian government does not impose federal taxes on lottery winnings. This means that when you win the lottery in Canada, whether it’s the popular Lotto Max, Lotto 6⁄49, or any other provincial lottery, the entire amount of your prize is yours to keep. There are no deductions or withholdings at the federal level.

This exemption is a significant advantage for lottery winners, as it ensures that the advertised jackpot or prize amounts are exactly what winners receive. For example, if you win the Lotto Max jackpot, currently set at a minimum of $10 million, you will walk away with the full $10 million, tax-free.

Provincial Lottery Taxes

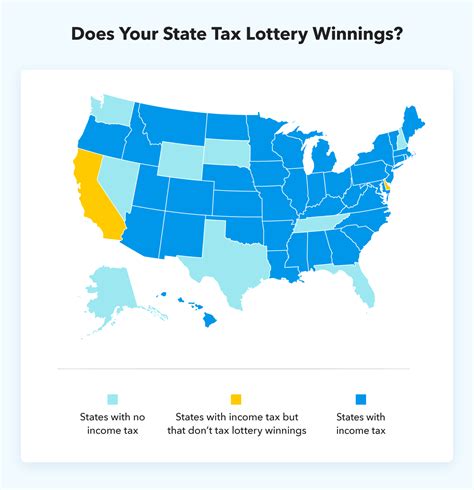

While federal taxes are waived for lottery winnings, some provinces in Canada do impose their own taxes. These provincial taxes vary depending on the jurisdiction and the type of lottery game played.

| Province | Lottery Tax |

|---|---|

| Ontario | None |

| Quebec | 50% for winnings over $1,000 |

| British Columbia | 10% for winnings over $10,000 |

| Manitoba | 10% for winnings over $5,000 |

| Saskatchewan | 10% for winnings over $10,000 |

| Alberta | 15% for winnings over $5,000 |

| Nova Scotia | 15% for winnings over $1,000 |

| New Brunswick | None |

| Prince Edward Island | 15% for winnings over $1,000 |

| Newfoundland and Labrador | None |

| Northwest Territories | None |

| Yukon | None |

| Nunavut | None |

It's important to note that these provincial taxes are typically withheld by the lottery corporation at the time of the win, ensuring a seamless process for the winner. The amounts and thresholds for taxation vary, so it's crucial to check the specific regulations in your province.

Impact on Non-Resident Winners

The tax-free nature of Canadian lottery winnings extends to non-residents as well. Whether you’re a visitor or a temporary resident, you can participate in Canadian lotteries and enjoy the same tax advantages as Canadian citizens. This makes Canada an appealing destination for lottery players from around the world.

Understanding the Value of Tax-Free Winnings

The absence of federal taxes on lottery winnings in Canada has a significant impact on the value and potential of these prizes. Here’s a closer look at how tax-free winnings benefit winners:

Maximizing Jackpot Potential

With no federal tax deductions, the advertised jackpots in Canadian lotteries represent the actual amount a winner can expect. For example, the Lotto Max jackpot, which can reach up to $70 million, is a true reflection of the prize money. This transparency ensures that winners receive the full value of their winnings, without any hidden deductions.

Financial Freedom and Flexibility

Tax-free winnings provide winners with complete financial freedom. They have the option to use their winnings however they choose, whether it’s paying off debts, investing, starting a business, or simply enjoying a comfortable retirement. The absence of taxes allows winners to make decisions based on their personal goals and aspirations.

Estate Planning and Inheritance

The tax-free nature of lottery winnings extends to their distribution after a winner’s passing. This means that if a lottery winner passes away, their winnings can be passed on to their heirs without any additional taxes. This provides peace of mind for winners and their families, ensuring that their legacy is protected.

Case Studies: Real-Life Lottery Winners

To illustrate the impact of tax-free lottery winnings, let’s explore a few real-life examples of Canadian lottery winners and how their lives were transformed:

The Quebec Winner

In 2021, a Quebec resident won the Lotto Max jackpot, taking home the entire $60 million prize. With no federal taxes to worry about, the winner had the full amount to invest in their future. They chose to pay off their mortgage, start a business, and support various charities close to their heart.

The Ontario Family

An Ontario family of four won the Lotto 6⁄49 jackpot, walking away with $23 million. The tax-free nature of their winnings allowed them to provide a secure future for their children, including funding their education and helping them start their own businesses. The family also donated a significant portion of their winnings to local charities.

The British Columbia Entrepreneur

A British Columbia resident won a substantial amount in the BC 49 lottery. With no federal taxes to pay, they used their winnings to expand their business and create new job opportunities in their community. This winner’s story showcases how tax-free winnings can have a positive impact on local economies.

Tips for Managing Lottery Winnings

While the absence of taxes on lottery winnings is a significant advantage, it’s important for winners to approach their newfound wealth wisely. Here are some tips for managing your lottery winnings effectively:

- Seek Professional Advice: Consult with financial advisors, tax experts, and legal professionals to ensure you make informed decisions about your winnings.

- Create a Financial Plan: Develop a comprehensive plan for your winnings, including short-term and long-term goals. Consider paying off debts, investing, and planning for retirement.

- Diversify Your Investments: Spread your winnings across different investment options to minimize risk and maximize potential returns.

- Consider a Trust: Setting up a trust can provide asset protection and ensure your winnings are managed and distributed according to your wishes.

- Give Back: Many lottery winners choose to donate a portion of their winnings to charities or causes they care about. This can have a significant impact on your community and provide a sense of fulfillment.

Future Implications and Trends

The tax-free nature of lottery winnings in Canada is a significant advantage for winners and has contributed to the popularity of Canadian lotteries worldwide. As the lottery industry continues to evolve, here are some potential future implications and trends to consider:

Increased Lottery Participation

The tax-free status of lottery winnings is a unique selling point for Canadian lotteries. As more people become aware of this advantage, it could lead to increased participation from both residents and non-residents, boosting lottery revenues and providing additional funding for various causes supported by lottery corporations.

Potential Changes in Provincial Taxes

While federal taxes are waived, provincial lottery taxes vary and could change in the future. It’s essential for lottery winners to stay informed about any potential changes in their province’s tax regulations to ensure they understand the full financial implications of their winnings.

Innovation in Lottery Games

Canadian lottery corporations continuously strive to introduce new and exciting games to attract players. With the tax-free advantage, they have an incentive to develop innovative lottery formats, offering even more opportunities for winners to claim substantial prizes.

Responsible Gambling Initiatives

As the lottery industry grows, so does the importance of responsible gambling initiatives. Lottery corporations are likely to continue investing in educational programs and support services to promote responsible play and ensure a positive impact on the communities they serve.

Are there any exceptions to the tax-free rule for lottery winnings in Canada?

+While federal taxes are waived for lottery winnings, some provinces do impose their own taxes. It’s essential to check the regulations in your province to understand any potential deductions.

How do non-resident winners claim their tax-free lottery winnings in Canada?

+Non-resident winners can claim their winnings through the same process as residents. They will need to provide the necessary identification and documentation, and the lottery corporation will handle any applicable provincial taxes.

Can I invest my tax-free lottery winnings in Canada?

+Absolutely! The tax-free nature of your winnings allows you to invest in various financial instruments, such as stocks, bonds, or real estate, without any additional tax implications.

What should I do if I win the lottery and want to remain anonymous?

+Privacy is a crucial aspect of winning the lottery. Contact the lottery corporation and inquire about their policies regarding anonymity. Some provinces offer options to maintain confidentiality.