Scott County Property Tax

Welcome to an in-depth exploration of the Scott County property tax system. This article aims to provide a comprehensive guide, offering valuable insights into the various aspects of property taxation in Scott County. By understanding the intricacies of this system, homeowners and investors can make informed decisions regarding their real estate holdings and financial planning.

Unraveling the Scott County Property Tax System

Scott County, nestled in the heart of Minnesota, boasts a vibrant real estate market and a well-established property tax framework. The county’s property tax system is a vital component of its economic landscape, impacting residents, businesses, and investors alike. Let’s delve into the key elements that define property taxation in Scott County.

Understanding Property Assessment

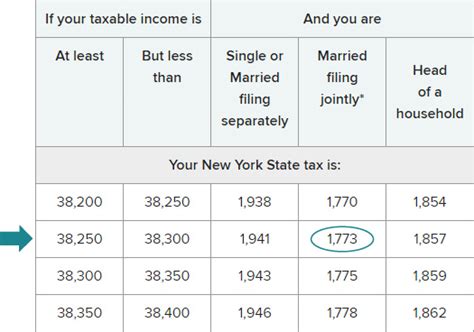

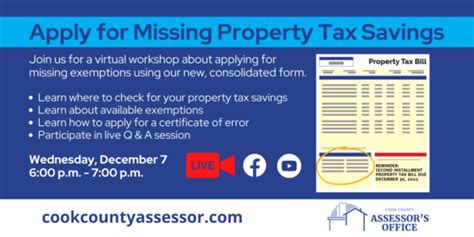

The foundation of any property tax system lies in the assessment process. In Scott County, property assessments are conducted to determine the taxable value of real estate properties. This value is based on a combination of factors, including the property’s market value, location, and improvements made. The Scott County Assessor’s Office plays a pivotal role in this process, ensuring fair and accurate assessments.

Each year, property owners receive a notice of assessment, detailing the estimated value of their property. This assessment forms the basis for calculating property taxes. Homeowners can review their assessments and have the opportunity to appeal if they believe the value is incorrect or unfair. The appeals process is designed to ensure transparency and fairness in the system.

| Assessment Period | Assessment Due Date |

|---|---|

| Annual Assessments | Late April to Early May |

| New Construction/Renovations | Within 30 days of completion |

Tax Rates and Calculations

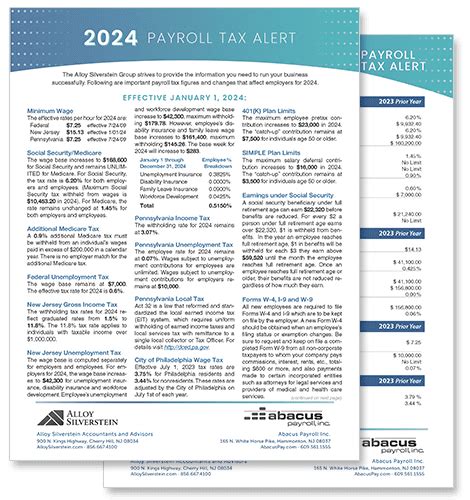

The property tax rate in Scott County is determined by a combination of factors, including local government budgets, school district needs, and special levies. These rates are expressed as a percentage of the property’s assessed value. The higher the assessed value, the higher the property taxes owed.

To calculate the property tax liability, the assessed value is multiplied by the applicable tax rate. For instance, if a property has an assessed value of $300,000 and the tax rate is 1.5%, the annual property tax would amount to $4,500. This calculation provides a clear understanding of the financial obligations associated with owning real estate in Scott County.

Tax Payment Options and Deadlines

Scott County offers a range of payment options to accommodate different preferences and circumstances. Property owners can choose to pay their taxes in full or opt for installment plans. The county provides convenient online payment portals, allowing for secure and efficient transactions.

| Payment Method | Payment Options |

|---|---|

| Online Payments | Credit/Debit Card, eCheck, Wire Transfer |

| Mail-In Payments | Check, Money Order |

| In-Person Payments | Cash, Check, Money Order |

It's crucial for property owners to be aware of tax payment deadlines to avoid penalties and interest. Late payments can incur additional fees, impacting the overall financial burden. The Scott County Treasurer's Office provides detailed information on payment due dates and any applicable grace periods.

Tax Relief Programs and Exemptions

Scott County recognizes the diverse needs of its residents and offers a range of tax relief programs and exemptions to ease the financial burden on certain property owners. These programs aim to provide assistance to eligible individuals, ensuring fairness and accessibility in the tax system.

- Homestead Credit: Property owners who qualify as homesteads can receive a credit on their property taxes. This credit is designed to provide relief for primary residents, making homeownership more affordable.

- Senior Citizen Property Tax Deferral: Eligible seniors can defer their property taxes, allowing them to delay payments until the property is sold or the owner passes away. This program offers financial flexibility for retired individuals.

- Veteran Exemptions: Scott County honors its veterans by offering property tax exemptions. Qualified veterans may be eligible for reduced or waived property taxes, recognizing their service and sacrifice.

To determine eligibility and understand the application process for these programs, property owners can reach out to the Scott County Assessor's Office or the Minnesota Department of Revenue. Each program has specific criteria and documentation requirements, ensuring a fair and transparent process.

Online Tools and Resources

Scott County understands the importance of accessibility and convenience in the digital age. The county’s official website offers a wealth of online tools and resources to assist property owners in navigating the property tax system.

- Property Search: Property owners can easily locate their property records, including assessment information, tax history, and payment status, through an intuitive search interface.

- Tax Estimate Calculator: This online tool allows homeowners to estimate their property taxes based on their assessed value and applicable tax rates. It provides a quick and convenient way to budget for tax obligations.

- Payment History: Property owners can access their payment history, including past due dates, amounts paid, and any outstanding balances. This feature ensures transparency and helps in financial planning.

Staying Informed and Engaged

Navigating the Scott County property tax system requires staying informed and engaged. Property owners should familiarize themselves with the assessment process, tax rates, and available resources. Regularly reviewing assessment notices, understanding tax calculations, and exploring relief programs can empower homeowners to make informed decisions.

Additionally, engaging with local government officials, attending public meetings, and staying updated on any changes or proposed amendments to the tax system can ensure active participation in the community. This involvement not only benefits individual property owners but also contributes to the overall well-being and fairness of the Scott County property tax landscape.

Conclusion: Empowering Property Owners in Scott County

The Scott County property tax system is a vital component of the local economy, impacting the lives and finances of residents. By understanding the assessment process, tax calculations, and available resources, property owners can navigate this system with confidence. The county’s commitment to transparency, fairness, and accessibility ensures that homeowners and investors have the tools they need to make informed decisions about their real estate holdings.

As Scott County continues to thrive, its property tax system remains a crucial element in the community's growth and development. With a well-structured framework and a focus on resident well-being, the county ensures that property ownership is a rewarding and financially manageable endeavor.

How often are property assessments conducted in Scott County?

+Property assessments in Scott County are conducted annually, with notices typically sent out in late April or early May. This ensures that property values are up-to-date and reflect any changes or improvements made during the previous year.

Can I appeal my property assessment if I disagree with the value assigned?

+Absolutely! Scott County provides a fair and transparent appeals process for property owners who believe their assessment is incorrect or unfair. You can initiate the appeals process by contacting the Scott County Assessor’s Office and providing supporting documentation to support your case.

Are there any tax relief programs for low-income homeowners in Scott County?

+Yes, Scott County offers the Homestead Credit program, which provides property tax relief for eligible low-income homeowners. To qualify, homeowners must meet certain income criteria and apply through the Scott County Assessor’s Office. This program aims to make homeownership more affordable for those in need.