Business Tax Planning

Business tax planning is a crucial aspect of financial management for any enterprise, whether it's a startup or an established corporation. Effective tax planning strategies can help businesses optimize their tax liabilities, ensure compliance with regulations, and maximize their financial performance. In this comprehensive guide, we will delve into the world of business tax planning, exploring the key concepts, strategies, and considerations that can make a significant impact on a company's financial health.

Understanding the Fundamentals of Business Taxation

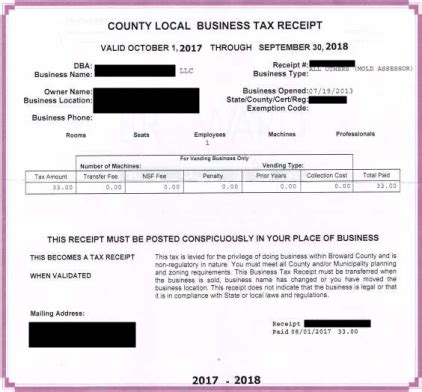

Before delving into tax planning strategies, it’s essential to grasp the fundamentals of business taxation. Every business, regardless of its size or industry, is subject to various taxes imposed by federal, state, and local governments. These taxes include income tax, payroll tax, sales tax, property tax, and more.

Business income tax is a major consideration, as it can significantly impact a company's profitability. Income tax is calculated based on the business's net income, which is the revenue generated after deducting all allowable expenses. Understanding the tax laws and regulations specific to your business entity type (sole proprietorship, partnership, corporation, etc.) is crucial for accurate tax reporting.

Payroll taxes are another critical aspect, as they involve withholding and remitting taxes on behalf of employees. These taxes include federal income tax, Social Security tax, Medicare tax, and state and local taxes. Proper payroll tax management is essential to avoid penalties and ensure employee satisfaction.

Sales tax, applicable to most retail businesses, is collected from customers and remitted to the government. The sales tax rate varies by jurisdiction, and businesses must stay updated with the latest rates to avoid undercharging or overcharging customers.

Property tax, imposed on real estate and business assets, is often a significant expense for businesses. Understanding the assessment process and appealing unfair assessments are crucial aspects of effective tax planning.

Key Tax Planning Strategies for Businesses

Business tax planning involves a range of strategies to minimize tax liabilities and maximize financial benefits. Here are some essential strategies that businesses should consider:

1. Choosing the Right Business Entity

The choice of business entity can have a significant impact on tax obligations. Different entities, such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, have distinct tax implications. For instance, an LLC can provide pass-through taxation, where business profits are reported on the owners’ personal tax returns, while a corporation can offer tax advantages through various deductions and credits.

Business owners should carefully evaluate the tax advantages and disadvantages of each entity type based on their specific circumstances and goals.

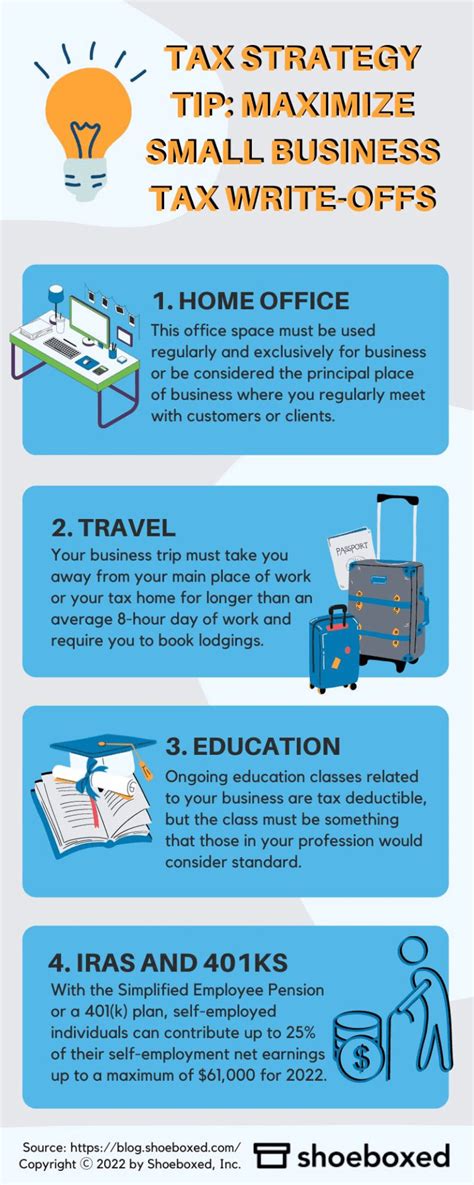

2. Maximizing Tax Deductions and Credits

Tax deductions and credits can significantly reduce a business’s tax liability. Deductions are expenses that can be subtracted from the business’s gross income, thereby lowering the taxable income. Common deductions include business expenses, depreciation, and interest paid on business loans.

Tax credits, on the other hand, provide a direct reduction in the amount of tax owed. Businesses should stay updated with the latest tax incentives and credits offered by the government, such as the Research and Development (R&D) Tax Credit or the Work Opportunity Tax Credit. These credits can provide substantial savings and should be explored as part of an effective tax planning strategy.

3. Utilizing Tax-Advantaged Retirement Plans

Tax-advantaged retirement plans, such as 401(k)s and Simplified Employee Pension (SEP) IRAs, offer significant tax benefits for businesses and their employees. These plans allow businesses to make pre-tax contributions to employees’ retirement accounts, reducing the business’s taxable income and providing employees with tax-deferred or tax-free growth on their retirement savings.

Implementing these plans can not only lower the business's tax burden but also enhance employee retention and satisfaction.

4. Strategic Timing of Expenses and Revenue Recognition

The timing of expenses and revenue recognition can impact a business’s tax liability. By carefully managing the timing of expenses and revenue, businesses can optimize their tax position. For instance, accelerating deductible expenses or deferring income recognition can reduce the business’s taxable income in the current tax year.

Additionally, businesses should consider the impact of tax law changes and economic conditions when making decisions related to expense timing and revenue recognition.

5. Tax-Efficient Investment Strategies

Investment decisions can have tax implications, and businesses should consider tax efficiency when making investment choices. For instance, investing in tax-exempt municipal bonds can provide a lower tax burden compared to taxable bonds. Similarly, investing in growth stocks or real estate can offer capital gains tax benefits over time.

Businesses should work with financial advisors and tax professionals to develop tax-efficient investment strategies that align with their financial goals.

Performance Analysis and Future Implications

Effective tax planning is an ongoing process that requires regular analysis and evaluation. Businesses should analyze their tax performance annually to identify areas of improvement and ensure compliance with changing tax laws.

As the tax landscape evolves, businesses must stay updated with new regulations and tax reforms. The recent passage of the Tax Cuts and Jobs Act (TCJA) in the United States, for example, brought significant changes to corporate tax rates and deductions. Businesses must adapt their tax planning strategies to comply with these changes and take advantage of new opportunities.

Looking ahead, businesses should also consider the potential impact of emerging technologies and trends on tax planning. For instance, the rise of cryptocurrency and blockchain technology presents new tax challenges and opportunities that businesses should understand and navigate.

Additionally, as businesses expand globally, they must navigate the complex web of international tax laws and regulations. Effective tax planning in a global context requires expertise in transfer pricing, double taxation agreements, and local tax regulations.

Expert Insights and Real-World Examples

To illustrate the impact of effective tax planning, let’s consider a real-world example. ABC Inc., a mid-sized manufacturing company, faced significant tax liabilities due to its high revenue and complex business structure. By implementing strategic tax planning measures, such as optimizing expense timing, utilizing tax credits, and restructuring their business entity, ABC Inc. was able to reduce their tax liability by over 20% in the first year.

This success story highlights the importance of proactive tax planning and the potential financial benefits it can bring. It also emphasizes the value of working with tax professionals who can provide tailored strategies based on a business's unique circumstances.

FAQs

What are the key differences in tax obligations between sole proprietorships and corporations?

+Sole proprietorships and corporations have distinct tax obligations. Sole proprietorships are taxed as pass-through entities, where business profits are reported on the owner’s personal tax return. Corporations, on the other hand, are taxed separately and can offer tax advantages through deductions and credits.

How can businesses maximize tax deductions and credits?

+Businesses can maximize tax deductions and credits by keeping detailed records of all business expenses, understanding the latest tax incentives, and working with tax professionals to identify applicable deductions and credits.

What are some common tax-advantaged retirement plans for businesses and their employees?

+Common tax-advantaged retirement plans include 401(k)s, which allow pre-tax contributions, and Simplified Employee Pension (SEP) IRAs, which provide a simplified process for business owners to contribute to their employees’ retirement accounts.

How can strategic timing of expenses impact tax liability?

+Strategic timing of expenses can impact tax liability by accelerating deductible expenses in the current tax year or deferring income recognition to a future tax year. This can lower taxable income and optimize the business’s tax position.

What are some tax-efficient investment strategies for businesses?

+Tax-efficient investment strategies for businesses include investing in tax-exempt municipal bonds, considering growth stocks for potential capital gains tax benefits, and understanding the tax implications of investing in real estate or cryptocurrency.