Regional Income Tax Authority

Welcome to this comprehensive guide on the Regional Income Tax Authority (RITA), a vital entity responsible for managing and enforcing income tax regulations within a specified geographic region. This article aims to provide an in-depth analysis of RITA's operations, its significance in the tax landscape, and its impact on individuals and businesses.

Understanding the Regional Income Tax Authority (RITA)

RITA, an acronym for Regional Income Tax Authority, serves as a centralized body tasked with administering and collecting income taxes from individuals and businesses operating within its designated region. This authority plays a crucial role in maintaining fiscal stability and ensuring compliance with tax laws and regulations.

The concept of a regional tax authority is not new, but RITA's structure and functions have evolved to meet the dynamic needs of modern taxation. With an ever-growing population and diverse economic activities, the need for efficient tax collection and management has become more critical than ever.

Historical Perspective

The establishment of regional tax authorities dates back to the early 20th century when the complexities of taxation and the need for efficient administration became apparent. Over the years, these authorities have adapted to changing economic landscapes, technological advancements, and evolving tax policies.

In the case of RITA, its formation was driven by the recognition that a centralized tax body could streamline processes, enhance compliance, and provide a more accessible service for taxpayers within its jurisdiction.

Jurisdiction and Scope

RITA’s jurisdiction covers a specific geographic region, typically comprising multiple counties or municipalities. This regional focus allows for a more localized approach to tax administration, taking into account the unique economic and demographic characteristics of the area.

Within its scope, RITA is responsible for the following key functions:

- Tax Collection: RITA collects income taxes from individuals and businesses, ensuring timely and accurate remittance of tax payments.

- Tax Administration: It administers tax laws, providing guidance and support to taxpayers to ensure compliance.

- Enforcement: RITA has the authority to enforce tax laws, investigate non-compliance, and take appropriate legal action.

- Taxpayer Services: The authority offers a range of services, including assistance with tax filing, payment plans, and resolving tax-related issues.

The Role of RITA in Income Tax Management

RITA's role in income tax management is multifaceted and crucial to the effective functioning of the tax system within its region. Here's an in-depth look at its key responsibilities and impact.

Tax Collection and Administration

At the core of RITA’s operations is the collection and administration of income taxes. This process involves a series of intricate steps, each designed to ensure efficient and accurate tax collection.

Taxpayers within RITA's jurisdiction are required to register with the authority, providing relevant information such as personal details, income sources, and tax identification numbers. RITA then assigns unique taxpayer IDs, which are used for all future interactions and tax filings.

Once registered, taxpayers receive guidance on their tax obligations, including filing deadlines, payment methods, and any applicable tax credits or deductions. RITA provides a range of resources, such as online portals, tax calculators, and educational materials, to assist taxpayers in understanding and meeting their tax responsibilities.

During the tax filing season, RITA's role becomes even more critical. The authority processes thousands of tax returns, verifying the accuracy of the information provided and calculating the tax liability for each taxpayer. This process involves complex calculations, data analysis, and cross-referencing with other government databases to ensure compliance.

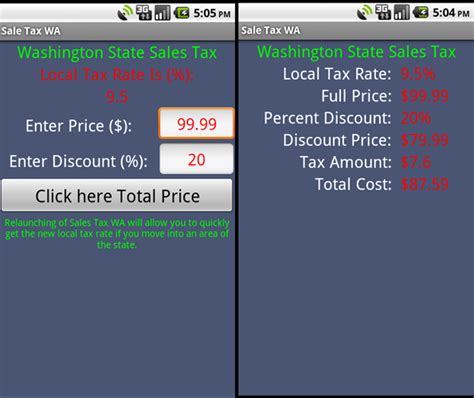

To facilitate timely tax payments, RITA offers a variety of payment options, including online payment portals, direct bank transfers, and traditional methods such as checks or money orders. The authority also provides payment plans for taxpayers who may have difficulty making a lump-sum payment.

| Payment Methods | Description |

|---|---|

| Online Payment Portal | Secure online platform for making tax payments using credit/debit cards or e-checks. |

| Direct Bank Transfer | Taxpayers can transfer funds directly from their bank account to RITA's designated account. |

| Checks/Money Orders | Traditional method of payment by mail or in-person, requiring a check or money order made payable to RITA. |

RITA's tax administration extends beyond collection. The authority also provides ongoing support and guidance to taxpayers, offering assistance with tax-related queries, resolving disputes, and providing information on tax laws and regulations.

Compliance and Enforcement

Ensuring compliance with tax laws is a critical aspect of RITA’s mandate. The authority employs a range of strategies to promote voluntary compliance and deter tax evasion.

RITA's compliance efforts begin with education and outreach. The authority conducts public awareness campaigns, organizes workshops and seminars, and provides educational resources to inform taxpayers about their rights and responsibilities.

For taxpayers who may face challenges in meeting their tax obligations, RITA offers assistance programs. These programs provide guidance on tax planning, offer payment arrangements, and help taxpayers resolve issues such as tax debt or penalties.

However, in cases where taxpayers fail to comply with tax laws, RITA has the authority to take enforcement action. This may include conducting audits, issuing penalties for non-compliance, and, in severe cases, pursuing legal action through the courts.

RITA's enforcement activities are guided by a set of principles that prioritize fairness, transparency, and due process. The authority aims to treat all taxpayers equitably, ensuring that those who meet their tax obligations are not disadvantaged by the actions taken against non-compliant taxpayers.

Taxpayer Services and Support

RITA recognizes that effective tax administration goes beyond collection and compliance. The authority understands the importance of providing accessible and responsive services to taxpayers.

To this end, RITA offers a range of taxpayer services, including:

- Taxpayer Assistance Centers: Physical locations where taxpayers can receive in-person assistance with tax-related queries, filing, and payment.

- Online Tax Portals: Secure websites that allow taxpayers to file tax returns, make payments, and access their tax records online.

- Taxpayer Hotline: A dedicated phone line staffed by trained professionals who provide real-time assistance to taxpayers.

- Email and Live Chat Support: Online channels for taxpayers to seek assistance and receive prompt responses.

RITA's taxpayer services are designed to be user-friendly and accessible to all. The authority strives to make tax administration as seamless and convenient as possible, recognizing that satisfied and supported taxpayers are more likely to comply with tax laws.

Impact of RITA on Individuals and Businesses

The Regional Income Tax Authority’s influence extends far beyond its operational functions. Its impact on individuals and businesses within its jurisdiction is profound and multifaceted.

Individual Taxpayers

For individual taxpayers, RITA’s presence simplifies the often-complex process of income tax management. The authority provides a centralized point of contact for all tax-related matters, offering guidance, support, and a clear understanding of tax obligations.

RITA's services, such as taxpayer assistance centers and online portals, make it easier for individuals to navigate the tax system. Taxpayers can access their tax records, track the status of refunds, and seek assistance with tax-related issues without the need to navigate multiple government agencies.

The authority's focus on compliance and enforcement also benefits individual taxpayers. By promoting voluntary compliance, RITA ensures that all taxpayers are treated fairly and that the tax burden is distributed equitably. This fosters a sense of trust and transparency in the tax system.

Additionally, RITA's assistance programs provide valuable support to individuals facing financial challenges. Taxpayers who may struggle to meet their tax obligations can receive guidance on payment plans, tax relief options, and other forms of assistance, ensuring that they can fulfill their tax responsibilities without undue hardship.

Businesses and Economic Impact

RITA’s impact on businesses is equally significant. The authority’s role in tax administration and compliance directly affects the economic health and stability of the region.

For businesses operating within RITA's jurisdiction, the authority provides a clear and consistent framework for tax management. Businesses can rely on RITA's guidance and resources to ensure compliance with tax laws, minimizing the risk of penalties and legal issues.

RITA's efficient tax collection processes benefit businesses by reducing administrative burdens. The authority's online portals and payment options streamline tax payments, allowing businesses to manage their tax obligations with greater ease and efficiency.

Moreover, RITA's enforcement efforts help maintain a level playing field for businesses. By deterring tax evasion and ensuring compliance, the authority protects businesses that play by the rules from unfair competition. This fosters a business environment that is fair, transparent, and conducive to growth and innovation.

The economic impact of RITA's work extends beyond individual businesses. By effectively managing tax revenues, the authority contributes to the overall fiscal health of the region. Tax revenues collected by RITA are used to fund essential public services, infrastructure development, and economic initiatives, benefiting the entire community.

Future Implications and Innovations

As technology advances and tax landscapes evolve, the Regional Income Tax Authority is poised to embrace new opportunities and innovations to enhance its operations and better serve taxpayers.

Digital Transformation

RITA recognizes the potential of digital technologies to revolutionize tax administration. The authority is actively pursuing a digital transformation strategy to enhance taxpayer services, streamline processes, and improve overall efficiency.

One key area of focus is the development of a comprehensive digital tax platform. This platform will serve as a one-stop solution for taxpayers, offering online tax filing, payment options, and real-time access to tax records. The platform will be designed with user-friendly interfaces and robust security measures to ensure a seamless and secure experience.

In addition to the digital tax platform, RITA is exploring the use of advanced analytics and data-driven insights to improve tax administration. By leveraging big data and predictive analytics, the authority aims to enhance its compliance efforts, identify potential tax evasion, and optimize its resource allocation.

Taxpayer Experience and Engagement

RITA is committed to enhancing the taxpayer experience, recognizing that satisfied and engaged taxpayers are essential to effective tax administration.

The authority is investing in taxpayer engagement initiatives, such as social media campaigns and community outreach programs, to improve communication and foster a positive relationship with taxpayers. By actively listening to taxpayer feedback and incorporating it into its operations, RITA aims to continuously improve its services.

Furthermore, RITA is exploring innovative ways to simplify tax processes and reduce the administrative burden on taxpayers. This includes initiatives such as pre-populated tax forms, based on data sharing agreements with other government agencies, and the use of artificial intelligence to automate routine tax tasks.

Regional Collaboration and Coordination

RITA understands the importance of collaboration and coordination with other regional tax authorities and government agencies. By sharing best practices, resources, and expertise, these collaborations can lead to more efficient tax administration and better taxpayer services.

The authority is actively engaging in regional forums and networks to foster collaboration and knowledge sharing. Through these platforms, RITA can learn from the experiences of other tax authorities, adapt successful strategies, and contribute its own insights and innovations.

Conclusion

The Regional Income Tax Authority plays a pivotal role in the tax landscape, ensuring the efficient management and collection of income taxes within its jurisdiction. Through its multifaceted operations, RITA not only fulfills its mandate but also provides valuable services and support to taxpayers, fostering a culture of compliance and transparency.

As RITA embraces digital transformation and innovative strategies, its impact on individuals, businesses, and the region's economy is set to become even more profound. The authority's commitment to continuous improvement and its focus on taxpayer experience position it well to meet the challenges and opportunities of the future, ensuring a sustainable and prosperous tax system for all.

How can I register with RITA as a taxpayer?

+To register with RITA, you can visit their official website or contact their taxpayer assistance center. You will need to provide personal information, such as your name, address, and tax identification number. RITA will guide you through the registration process and assign you a unique taxpayer ID.

What payment methods does RITA accept for tax payments?

+RITA accepts a variety of payment methods, including online payment portals, direct bank transfers, checks, and money orders. You can find detailed information on payment options and instructions on RITA’s website or by contacting their taxpayer services.

How does RITA ensure compliance with tax laws?

+RITA employs a multi-pronged approach to ensure compliance. This includes education and outreach programs, taxpayer assistance, and enforcement actions. The authority aims to promote voluntary compliance while taking necessary steps to deter and address non-compliance.

What support does RITA offer to taxpayers facing financial difficulties?

+RITA provides assistance programs to support taxpayers who are struggling to meet their tax obligations. These programs offer guidance on tax planning, payment arrangements, and tax relief options. Taxpayers can contact RITA’s taxpayer services to explore their options and receive personalized assistance.

How does RITA contribute to the region’s economic development?

+RITA plays a crucial role in the region’s economic development by efficiently managing tax revenues. These funds are used to support public services, infrastructure projects, and economic initiatives. By ensuring fair and effective tax administration, RITA contributes to a stable and prosperous regional economy.