New Jersey Tax Payment Employer

Welcome to an in-depth exploration of the New Jersey tax payment process for employers. In this comprehensive guide, we will delve into the intricacies of managing tax obligations as an employer in the Garden State. Whether you're a seasoned business owner or a newcomer to the world of employment taxes, understanding the steps involved and the resources available is crucial for compliance and financial well-being.

New Jersey, with its vibrant business landscape and diverse economy, offers numerous opportunities for growth and success. However, navigating the tax landscape can be a complex task, especially when it comes to meeting your employer tax responsibilities. This article aims to provide a detailed roadmap, ensuring you have the knowledge and tools to efficiently manage tax payments and stay compliant with state regulations.

Understanding Your Employer Tax Obligations in New Jersey

As an employer in New Jersey, you have a range of tax obligations that extend beyond federal requirements. These taxes not only contribute to the state’s revenue but also support vital public services and programs. Let’s break down the key taxes you need to consider and understand the importance of each.

Withholding and Remitting Income Taxes

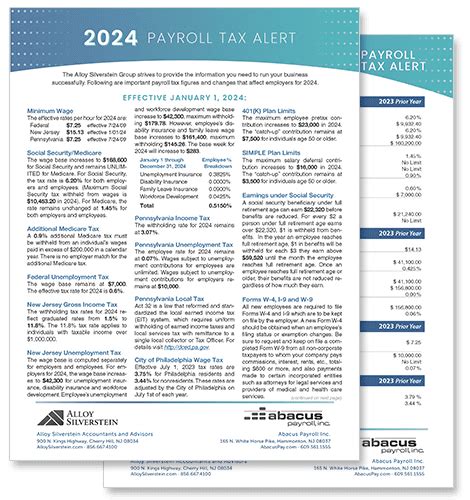

One of the primary responsibilities is withholding income taxes from your employees’ wages. This involves calculating the appropriate tax amount based on the employee’s earnings and tax withholding status. The state of New Jersey requires employers to remit these withheld taxes on a regular basis, typically monthly or quarterly, depending on the size and nature of your business.

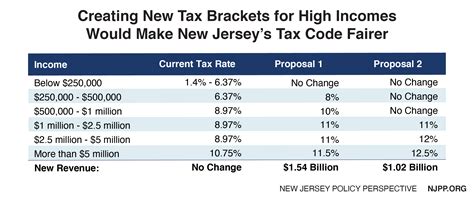

To ensure accurate withholding, employers must stay updated with the latest tax tables and guidelines provided by the New Jersey Division of Taxation. This includes understanding the tax brackets, allowances, and any applicable deductions or credits that may impact the amount of tax withheld. Failure to withhold and remit income taxes accurately can result in penalties and interest charges.

Unemployment and Disability Insurance Taxes

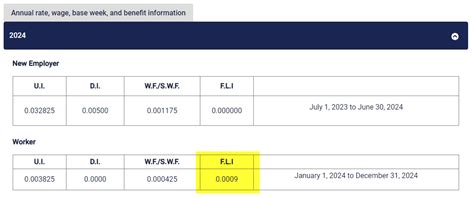

New Jersey employers are also responsible for contributing to the state’s unemployment and disability insurance programs. These taxes are essential for providing financial support to unemployed workers and those facing temporary disability. The New Jersey Department of Labor and Workforce Development administers these programs, and employers must register and pay taxes accordingly.

The unemployment tax rate is determined based on an employer's experience rating, which is influenced by the company's history of layoffs and unemployment claims. This system encourages employers to maintain stable employment and minimize workforce disruptions. Disability insurance taxes, on the other hand, provide benefits to workers who suffer from non-work-related injuries or illnesses, ensuring they have income support during their recovery.

Other Employer Taxes and Compliance Requirements

Beyond income and unemployment taxes, New Jersey employers must also comply with various other tax obligations. These may include payroll taxes, such as Social Security and Medicare taxes, which are remitted to the federal government. Additionally, certain industries or businesses may have specific taxes, such as sales tax collection for retailers or franchise taxes for franchisors.

Furthermore, employers must adhere to workplace regulations and reporting requirements. This includes maintaining accurate payroll records, providing wage statements to employees, and complying with minimum wage and overtime laws. Failure to meet these compliance standards can result in legal consequences and impact an employer's standing with the state.

Navigating the Tax Payment Process: A Step-by-Step Guide

Now that we’ve outlined the key tax obligations, let’s walk through the process of paying employer taxes in New Jersey. This comprehensive guide will ensure you cover all the necessary steps and utilize the available resources effectively.

Step 1: Register Your Business and Obtain Tax Accounts

Before you can begin paying taxes, you must register your business with the appropriate state agencies. This typically involves obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and registering with the New Jersey Division of Revenue and Enterprise Services to obtain your business tax accounts.

The registration process may vary depending on the type of business entity and the specific taxes you are required to pay. It's essential to carefully review the registration requirements and provide accurate information to avoid delays or complications.

Step 2: Calculate and Withhold Taxes Accurately

As mentioned earlier, accurate tax withholding is crucial. Employers must calculate the correct tax amounts based on employee earnings and tax withholding forms (such as W-4s). This process involves understanding the employee’s filing status, allowances, and any additional deductions or credits they may be eligible for.

To ensure accuracy, employers can utilize tax withholding calculators or software that integrates with their payroll systems. These tools help automate the calculation process, reducing the risk of errors and ensuring compliance with the latest tax laws and regulations.

Step 3: Remit Taxes to the Appropriate Authorities

Once you have withheld the necessary taxes from employee wages, it’s time to remit these funds to the appropriate tax authorities. The frequency of tax payments depends on your business size and tax liability. Generally, employers with larger tax liabilities are required to make more frequent payments.

For income tax withholding, you'll need to remit these taxes to the New Jersey Division of Taxation. The state provides various payment methods, including electronic funds transfer (EFT), credit card payments, and paper checks. It's important to choose the method that best suits your business needs and ensure timely payments to avoid penalties.

Step 4: Stay Updated with Tax Laws and Regulations

Tax laws and regulations are subject to change, and it’s crucial for employers to stay informed about any updates or amendments. This includes keeping up with federal and state tax reforms, as well as industry-specific tax changes. By staying informed, you can ensure your tax processes remain compliant and avoid unexpected surprises.

The New Jersey Division of Taxation provides resources and updates on their website, including tax guides, newsletters, and announcements. It's a good practice to subscribe to these resources and periodically review them to stay ahead of any changes that may impact your tax obligations.

Step 5: Utilize Available Resources and Support

Managing tax obligations can be complex, but New Jersey offers various resources and support to assist employers. The New Jersey Business Action Center provides a range of services, including tax assistance and guidance. They can help you navigate the tax landscape, provide answers to specific questions, and offer tailored support based on your business needs.

Additionally, the New Jersey Division of Taxation offers online tools, such as tax calculators, payment schedules, and filing instructions. These resources are designed to simplify the tax payment process and ensure employers have the information they need to comply with state regulations.

Maximizing Efficiency and Compliance: Best Practices for Employers

To ensure a smooth and compliant tax payment process, employers should adopt best practices that streamline operations and minimize errors. Here are some key strategies to consider:

- Automate Tax Calculations: Invest in payroll software or accounting systems that integrate tax calculations and withholdings. This reduces the risk of manual errors and ensures accuracy.

- Implement Regular Reviews: Periodically review your tax processes and procedures to identify areas for improvement. This includes reviewing tax rates, withholding calculations, and payment methods to ensure they align with the latest regulations.

- Stay Organized: Maintain accurate and organized records of tax payments, filings, and communications with tax authorities. This simplifies the audit process and helps you respond promptly to any inquiries.

- Seek Professional Advice: Consider consulting with tax professionals or accountants who specialize in employer taxes. They can provide tailored guidance, help you navigate complex tax scenarios, and ensure you meet all compliance requirements.

- Stay Informed about Tax Reforms: Keep an eye on federal and state tax reforms that may impact your business. Stay updated with news and announcements to understand how these changes may affect your tax obligations and plan accordingly.

Real-World Example: Streamlining Tax Payments with Technology

Let’s explore a real-world example of how technology can revolutionize the tax payment process for employers. ABC Inc., a medium-sized retail business in New Jersey, faced challenges with manual tax calculations and remittances. They decided to implement an integrated payroll and tax management system.

By leveraging this technology, ABC Inc. automated their tax withholding calculations, ensuring accuracy and compliance. The system integrated with their existing payroll software, streamlining the process and reducing the risk of errors. Additionally, the system provided real-time tax rate updates and notifications, keeping the business up to date with any changes.

Furthermore, the system offered a centralized platform for tax payment management. ABC Inc. could easily schedule and make payments, track payment histories, and generate reports. This not only improved efficiency but also provided a clear audit trail, reducing the time and effort required for tax-related inquiries.

| Tax Type | Payment Frequency |

|---|---|

| Income Tax Withholding | Monthly |

| Unemployment Tax | Quarterly |

| Disability Insurance Tax | Annually |

Through this technology-driven approach, ABC Inc. not only improved their tax payment process but also enhanced their overall financial management. They reduced administrative burdens, minimized the risk of penalties, and gained valuable insights into their tax obligations.

Future Outlook and Continuous Compliance

As we look ahead, it’s essential to consider the future implications and ongoing compliance requirements for employers in New Jersey. The tax landscape is dynamic, and staying informed and adaptable is crucial for long-term success.

Embracing Technological Advancements

The integration of technology in tax management is set to continue, offering employers enhanced efficiency and accuracy. Cloud-based tax solutions, artificial intelligence, and machine learning will likely play a significant role in automating tax processes and providing real-time insights.

By leveraging these advancements, employers can further streamline their tax operations, reduce costs, and improve overall financial management. The ability to access and analyze tax data in real time will enable businesses to make informed decisions and stay ahead of any regulatory changes.

Staying Informed about Tax Reforms

Tax reforms and amendments are an ongoing reality, and employers must remain vigilant in staying updated. Federal tax reforms, such as the Tax Cuts and Jobs Act, have already had significant impacts on businesses. Similarly, state-level reforms may introduce changes to tax rates, deductions, or compliance requirements.

It's essential for employers to monitor tax news, subscribe to relevant updates, and consult with tax professionals to understand the implications of these reforms. By staying informed, businesses can proactively adapt their tax strategies and ensure compliance with any new regulations.

Emphasizing Continuous Compliance

Compliance with tax obligations is not a one-time task but an ongoing commitment. Employers must maintain a culture of compliance, ensuring that tax processes are regularly reviewed, updated, and improved. This includes staying informed about changing regulations, implementing best practices, and seeking professional guidance when needed.

By fostering a culture of compliance, employers can mitigate the risk of penalties, audits, and legal consequences. It also demonstrates a commitment to ethical business practices and strengthens relationships with employees, customers, and stakeholders.

FAQs

What is the penalty for late tax payments in New Jersey?

+Late tax payments in New Jersey may result in penalties and interest charges. The specific penalty amount depends on the tax type and the timeliness of the payment. It’s important to remit taxes on time to avoid these additional costs and maintain compliance.

How can I stay updated with tax law changes in New Jersey?

+To stay updated with tax law changes, employers can subscribe to newsletters and updates from the New Jersey Division of Taxation and the New Jersey Business Action Center. These resources provide timely information on tax reforms, amendments, and important announcements.

Are there any tax incentives or credits available for employers in New Jersey?

+Yes, New Jersey offers various tax incentives and credits to support businesses and promote economic growth. These may include tax credits for hiring certain individuals, investing in specific industries, or implementing environmentally friendly practices. It’s worth exploring these incentives to see if your business qualifies.

How often should I review my tax withholding calculations for accuracy?

+Employers should review their tax withholding calculations regularly, especially when there are changes in tax laws or employee circumstances. It’s recommended to conduct an annual review and make adjustments as needed to ensure accuracy and compliance.

What resources are available to assist employers with tax compliance in New Jersey?

+New Jersey provides a range of resources to assist employers with tax compliance. These include the New Jersey Division of Taxation website, which offers tax guides, calculators, and payment instructions. Additionally, the New Jersey Business Action Center provides personalized support and guidance to businesses, helping them navigate the tax landscape effectively.