Understanding Louisiana Sales Tax: What You Need to Know

Louisiana’s sales tax system presents a complex mosaic of state and local levies, often perplexing newcomers and seasoned businesses alike. With a history rooted in municipal autonomy and diverse economic landscapes—from bustling New Orleans to the rural echoes of Acadiana—understanding how sales tax functions in Louisiana is paramount for compliance, financial planning, and effective business operations. In this detailed exploration, I will guide you through the intricacies, historical context, and practical considerations for navigating Louisiana sales tax, ensuring you have a firm grasp of essential concepts and current legislative nuances.

深入理解路易斯安那州销售税的结构与演变

Louisiana’s sales tax framework is characterized by a layered structure where the state imposes a baseline rate, supplemented by various local jurisdictions that generate their own additional levies. This mosaic approach reflects the state’s historical emphasis on local governance, permitting parishes and municipalities to tailor tax rates to their fiscal needs. As of 2023, the Louisiana state sales tax rate stands at 4.45%, but when combined with local rates, it can reach an effective rate exceeding 10% in certain jurisdictions—making Louisiana one of the higher tax jurisdictions nationwide.

州与地方税的结合方式

The combined sales tax rate in Louisiana results from the sum of state, parish, and local district taxes. Each jurisdiction has the authority to set their own rates within state-mandated maximums, leading to notable variations across the state. For instance, Orleans Parish, home to New Orleans, often features the highest rates, whereas rural parishes may levy significantly lower rates. This variation impacts retail pricing, consumer behavior, and compliance obligations for sellers operating across multiple jurisdictions.

| Relevant Category | Substantive Data |

|---|---|

| State Sales Tax Rate | 4.45% as of 2023, subject to legislative adjustments |

| Maximum Local Rate | Up to 5%, with variations across jurisdictions |

| Effective Combined Rate | Typically between 8% and 10% depending on location |

关键法规与征税基础:定义应税交易及例外

Louisiana law designates tangible personal property as the primary taxable good, with a broad but clearly defined scope that encompasses goods physically transferred for consideration. In addition, certain services are taxed, including but not limited to telecommunications, installation services, and certain digital products.

应税交易的界定

Determining whether a transaction is taxable hinges on several factors: the nature of the product or service, the location of the transaction, and the type of buyer. For example, in Louisiana, the sale of tangible personal property is generally taxable unless explicitly exempted by law. This includes items such as clothing, electronics, and vehicles, although specific exemptions apply—like sales for resale or manufacturing purposes.

| Relevant Category | Substantive Data |

|---|---|

| Taxable Goods | Tangible personal property, certain digital products, specified services |

| Tax Exemptions | Resale, manufacturing, nonprofit organizations, certain agricultural inputs |

| Taxable Transactions | Sale for consideration within Louisiana, including online and remote sales |

纳税责任人:谁需要收取并上缴销售税?

In Louisiana, the legal obligation to collect sales tax typically rests on the seller—whether local brick-and-mortar stores, online merchants, or out-of-state vendors with economic nexus in the state. Nexus is established through physical presence, economic thresholds, or affiliate relationships. As of 2023, Louisiana requires remote sellers exceeding $100,000 in sales or 200 transactions annually to register for a sales tax permit.

义务和注册流程

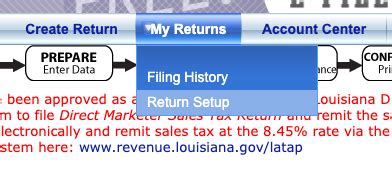

Merchants must register with the Louisiana Department of Revenue (LDR), collect the appropriate tax at the point of sale, and remit it periodically—monthly, quarterly, or annually, based on volume. Non-compliance risks penalty imposition and potential loss of good standing, emphasizing the importance of diligent record keeping and timely filings.

| Relevant Category | Substantive Data |

|---|---|

| Nexus Thresholds | $100,000 in sales or 200 transactions annually (current as of 2023) |

| Registration Requirement | Mandatory for qualifying remote sellers and in-state retailers |

| Filing Frequency | Typically monthly or quarterly, with options for annual filings depending on volume |

消费税的计算与报告:实际操作中的要点

Calculating Louisiana sales tax involves applying the sum of applicable rates to the transaction amount. For instance, a 100 purchase in New Orleans (where the combined rate is approximately 10%) results in a 10 tax burden. Clear invoicing, accurate rate determination, and detailed record-keeping are critical to maintain compliance and facilitate audits.

税务发票与记录保留

Taxpayers are required to issue receipts that clearly state the collected tax and retain detailed records for at least three years. This documentation must include invoices, exemption certificates, and correspondence to substantiate tax exemptions or credit claims.

| Relevant Category | Substantive Data |

|---|---|

| Tax Calculation | Transaction Amount x applicable combined rate |

| Record Retention | Minimum 3 years after the filing period |

| Audit Readiness | Maintaining complete, accurate records and exemption certificates |

特殊情况与常见误区:规避风险的实用建议

Several pitfalls trap unwary sellers. Misclassifying exempt versus taxable transactions leads to penalties. Confusing nexus thresholds with physical presence can cause non-compliance for remote sellers. Additionally, many overlook that services can be taxable—particularly digital or installation services—prompting unexpected tax liabilities.

避免常见错误的策略

Regularly reviewing exemption certificates, leveraging automated compliance software, and consulting with tax professionals familiar with Louisiana law are prudent steps. Awareness of recent legislative updates, such as temporary exemption programs or rate changes, is also crucial to maintain accuracy.

| Relevant Category | Substantive Data |

|---|---|

| Common Pitfalls | Misclassification of exemptions, neglecting nexus thresholds, failure to update rates |

| Mitigation Strategies | Regular training, software tools, professional consultation |

| Legislative Changes | Stay informed about amendments via Louisiana Department of Revenue updates |

未来展望:新时代的路易斯安那州销售税

Looking ahead, Louisiana’s sales tax landscape is poised for evolution driven by technological advancements and legislative reforms. Digital transformation enables real-time rate adjustments, automated reporting, and integrated exemption validations. Furthermore, efforts to harmonize local rates and simplify compliance could emerge, driven by increased administrative coordination.

新技术与政策趋势

Artificial intelligence and blockchain automation promise enhanced transparency and audit efficiency. Additionally, legislative efforts might focus on streamlining remote seller compliance and expanding exemptions for certain sectors, further complicating the landscape but also offering clarity in regulations.

| Relevant Category | Projected Trends |

|---|---|

| Technological Innovations | AI-driven compliance tools, real-time tax rate updates |

| Policy Directions | Potential rate harmonization, expanded exemptions |

| Impact on Businesses | Increased need for adaptive systems, ongoing legal awareness |

如何确定我的业务是否在路易斯安那州有纳税义务?

+要判断是否有纳税义务,您需要评估是否符合州或地方的经济或实体 nexus标准。这包括是否在州内拥有实体存在、达到了销售金额或交易数量的阈值,以及通过网络或合作关系建立联系。建议定期核查最新的法规和标准,确保合规。

我应如何正确计算在不同县市的销售税?

+首先,确定交易发生地点对应的全部税率,包括州税和地方附加税。可以使用官方税率表或自动化税率工具,确保每笔交易正确应用对应的税率。保持详细发票和交易记录,有助于日后审计和申报时的准确。

有哪些交易在路易斯安那州是免征销售税的?

+常见免税交易包括销售给注册为转售的商户、慈善组织、农业用材料、出口交易以及某些特定的制造业材料。确认免税资格时,应收集并妥善保存相关的免税证书,并在申报时正确标记。