Erie County Tax

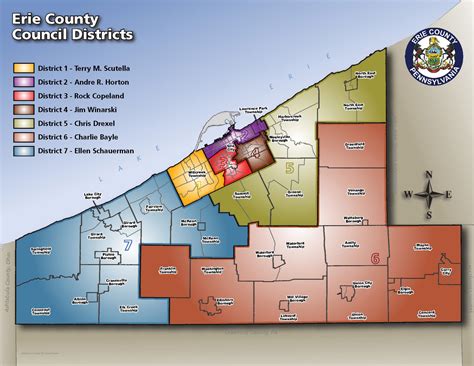

The topic of Erie County Tax is an important one for residents and businesses alike, as it impacts their financial obligations and the services they receive in return. Erie County, located in the state of New York, has a unique tax system that covers various aspects, from property taxes to sales taxes and more. This article aims to provide a comprehensive guide to understanding and navigating the world of Erie County taxes, shedding light on the various tax categories, rates, and implications for the county's residents and taxpayers.

Understanding Erie County’s Tax Structure

Erie County’s tax structure is a comprehensive system designed to fund essential public services and infrastructure. It consists of a range of taxes, each with its own purpose and rate. Understanding this structure is crucial for taxpayers to plan their financial strategies effectively and ensure compliance with the law.

Property Taxes: A Key Revenue Source

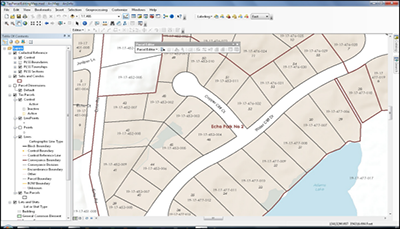

One of the primary sources of revenue for Erie County is property taxes. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The Erie County Department of Real Property Tax Services assesses the value of each property, which forms the basis for calculating the tax liability.

Property taxes in Erie County are determined by a combination of the property's assessed value and the tax rate, which varies depending on the type of property and its location within the county. The tax rate is typically expressed as a percentage, and it is subject to change annually, reflecting the budgetary needs of the county.

| Property Type | Average Assessed Value | Tax Rate (%) |

|---|---|---|

| Residential | $150,000 | 1.85 |

| Commercial | $500,000 | 2.2 |

| Land | $200,000 | 1.9 |

For instance, a residential property with an assessed value of $150,000 would incur an annual property tax of $2,775 (1.85% of $150,000). These property taxes fund vital services such as public schools, emergency services, road maintenance, and other local government functions.

Sales and Use Taxes: Consumer Impact

In addition to property taxes, Erie County levies sales and use taxes on various goods and services. These taxes are an essential source of revenue for the county and are imposed on retail sales, rentals, and certain services.

The sales tax is added to the purchase price of goods and services at the point of sale. The current sales tax rate in Erie County is 8%, which includes both the state and county sales tax. This means that for every $100 spent on taxable items, consumers pay an additional $8 in sales tax.

The use tax, on the other hand, is applicable when goods or services are purchased from out-of-state vendors or online retailers. It ensures that Erie County residents pay taxes on items they purchase, regardless of where the transaction takes place. The use tax rate is the same as the sales tax rate, ensuring fairness and consistency.

Other Tax Categories

Erie County’s tax system also includes other categories of taxes, each with its own purpose and administration.

- Real Property Transfer Tax: This tax is levied on the transfer of real property within the county. It is typically paid by the seller and is calculated as a percentage of the property's sale price.

- Mortgage Recording Tax: Erie County imposes a tax on the recording of mortgages. This tax is paid by the borrower and is a percentage of the mortgage amount.

- Hotel and Motel Tax: To support tourism and local infrastructure, Erie County imposes a tax on accommodations provided by hotels and motels. This tax is typically passed on to guests as part of their room charges.

- Estate and Inheritance Taxes: Erie County also collects taxes on estates and inheritances, which are managed by the Erie County Surrogate's Court.

Tax Payment and Compliance

Ensuring timely tax payments and compliance with Erie County’s tax regulations is essential for residents and businesses. Late payments can result in penalties and interest, which can add up quickly.

Payment Options and Deadlines

Erie County offers a variety of payment options for taxpayers, including online payment portals, mail-in payments, and in-person payments at designated locations. The county’s website provides detailed information on payment methods and due dates.

Property taxes, for instance, are typically due in two installments, with the first installment due in January and the second in September. Failure to pay by the due date may result in late fees and potential penalties.

Tax Assistance and Exemptions

Erie County recognizes the financial challenges that some residents and businesses may face and offers assistance programs and exemptions to ease the tax burden.

- The Senior Citizen Tax Exemption program provides eligible seniors with a reduction in their property tax liability.

- The Veterans' Exemption offers tax relief to veterans who meet certain criteria, reducing their property tax obligations.

- For businesses, the Small Business Tax Relief Program provides incentives to encourage economic growth and investment.

Additionally, the county offers taxpayer assistance through its Department of Finance, providing guidance and support to individuals and businesses navigating the tax system.

Impact and Implications

The Erie County tax system has a significant impact on the county’s economy and the well-being of its residents. It funds essential services, infrastructure development, and social programs, shaping the quality of life in the community.

Economic Development and Job Creation

Tax revenues play a vital role in Erie County’s economic development initiatives. The county uses these funds to attract businesses, create jobs, and support local industries. Tax incentives, such as those offered through the Small Business Tax Relief Program, encourage entrepreneurship and business growth.

Infrastructure and Community Services

Property taxes and other revenue sources fund critical infrastructure projects, including road repairs, bridge maintenance, and public transportation improvements. These investments enhance the county’s connectivity and overall quality of life.

Additionally, tax revenues support a range of community services, from public libraries and parks to healthcare facilities and social services, ensuring that residents have access to essential resources.

Fairness and Equity in Taxation

Erie County strives to maintain a fair and equitable tax system. The tax rates and regulations are designed to ensure that the tax burden is distributed fairly among residents and businesses. The county’s tax relief programs and exemptions aim to alleviate financial strain for those who need it most.

Conclusion

Understanding and navigating Erie County’s tax system is crucial for residents and businesses to effectively manage their financial obligations and contribute to the county’s prosperity. By providing a comprehensive overview of the various tax categories, rates, and implications, this article aims to empower taxpayers with the knowledge they need to make informed decisions.

As Erie County continues to evolve and adapt to changing economic conditions, its tax system remains a key tool for funding essential services and driving economic growth. By staying informed and engaged, taxpayers can actively participate in shaping the future of their community.

How can I estimate my property taxes in Erie County?

+To estimate your property taxes, you can use the Erie County Real Property Tax Services website. Enter your property’s assessed value and the applicable tax rate for your property type to calculate your estimated tax liability.

Are there any tax incentives for green energy initiatives in Erie County?

+Yes, Erie County offers tax incentives for green energy initiatives through the Clean Energy Fund. These incentives can reduce property taxes for homeowners who install renewable energy systems or make energy-efficient upgrades to their properties.

What happens if I fail to pay my taxes on time in Erie County?

+Late tax payments in Erie County may result in penalties and interest charges. It’s important to stay informed about payment deadlines and take advantage of the county’s online payment portal or other payment options to ensure timely payments.