West Virginia State Income Taxes

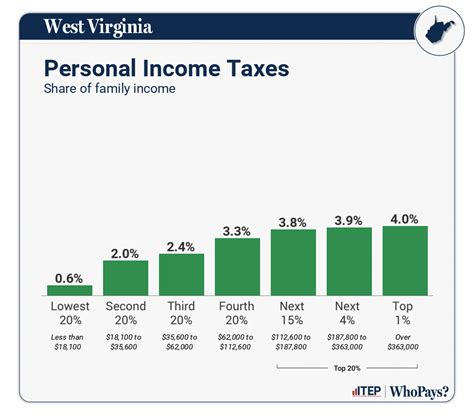

West Virginia is one of the states in the United States that imposes a graduated income tax on its residents and nonresidents with income sourced within the state. The state's income tax structure is designed to provide a fair and progressive system for taxpayers, with rates increasing as income levels rise. Understanding the intricacies of West Virginia's income tax system is essential for individuals and businesses operating within the state.

The West Virginia Income Tax System

The West Virginia Department of Revenue is responsible for administering and collecting income taxes within the state. The income tax system is based on a percentage of taxable income, which is calculated after applying various deductions and credits.

Taxable Income Categories

West Virginia’s income tax is categorized into five brackets, each with its own tax rate. The brackets are determined based on the taxpayer’s filing status and the amount of taxable income. The current tax brackets for the 2023 tax year are as follows:

| Filing Status | Tax Bracket | Tax Rate |

|---|---|---|

| Single | Up to $10,000 | 3.0% |

| Single | $10,001 - $25,000 | 4.0% |

| Single | $25,001 - $40,000 | 4.5% |

| Single | $40,001 - $60,000 | 5.5% |

| Single | Over $60,000 | 6.5% |

| Married Filing Jointly | Up to $20,000 | 3.0% |

| Married Filing Jointly | $20,001 - $50,000 | 4.0% |

| Married Filing Jointly | $50,001 - $80,000 | 4.5% |

| Married Filing Jointly | $80,001 - $120,000 | 5.5% |

| Married Filing Jointly | Over $120,000 | 6.5% |

| Head of Household | Up to $15,000 | 3.0% |

| Head of Household | $15,001 - $35,000 | 4.0% |

| Head of Household | $35,001 - $60,000 | 4.5% |

| Head of Household | $60,001 - $90,000 | 5.5% |

| Head of Household | Over $90,000 | 6.5% |

It's important to note that these tax rates are subject to change, and taxpayers should refer to the latest tax guidelines provided by the West Virginia Department of Revenue for the most accurate information.

Deductions and Credits

West Virginia offers various deductions and credits to reduce the taxable income and provide tax relief to individuals and businesses. Some common deductions include the standard deduction, which varies based on filing status, and itemized deductions such as medical expenses, charitable contributions, and certain tax-deductible business expenses.

Additionally, the state provides tax credits for specific situations, such as the West Virginia Earned Income Tax Credit (EITC), which benefits low- to moderate-income working individuals and families. Other credits include the West Virginia Child and Dependent Care Tax Credit and the West Virginia Credit for Contributions to Education.

Filing and Payment Options

Taxpayers in West Virginia have several options for filing their income tax returns and making payments. The West Virginia Department of Revenue offers an online filing system called eFileWV, which allows taxpayers to file their returns electronically and securely. This system is user-friendly and provides real-time status updates on tax returns.

For those who prefer traditional methods, paper tax forms are available and can be submitted by mail. Taxpayers can also opt for electronic funds transfer (EFT) to make their tax payments directly from their bank accounts.

Tax Deadlines and Extensions

The standard deadline for filing West Virginia income tax returns is April 15th, aligning with the federal tax deadline. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day. It’s crucial for taxpayers to be aware of these deadlines to avoid late filing penalties.

In certain circumstances, taxpayers may request an extension of time to file their returns. To do so, they must submit Form IT-121, Application for Extension of Time to File West Virginia Income Tax Return, before the original due date. The extension provides an additional six months to file the return but does not extend the time for paying any taxes due.

Special Considerations for Businesses

Businesses operating in West Virginia, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), are subject to the state’s income tax laws. The tax rates and brackets for business entities may differ from those applicable to individuals.

Business Income Tax Rates

The income tax rates for businesses in West Virginia are generally lower than the individual tax rates. The current tax rates for business entities are as follows:

| Business Type | Tax Rate |

|---|---|

| Sole Proprietorships and Partnerships | 6.5% |

| Corporations | 6.5% |

| Limited Liability Companies (LLCs) | 6.5% |

It's important for business owners to consult with tax professionals or refer to the West Virginia Department of Revenue's guidelines to ensure they are applying the correct tax rates and meeting all necessary requirements.

Business Deductions and Credits

Businesses in West Virginia can also take advantage of various deductions and credits to reduce their taxable income. Common deductions include business expenses such as rent, utilities, payroll, and advertising costs. Additionally, businesses may be eligible for tax credits related to research and development, investment, and job creation.

The Impact of West Virginia’s Income Tax System

West Virginia’s income tax system plays a significant role in the state’s economy and its residents’ financial well-being. The progressive tax structure ensures that higher-income earners contribute a larger share of their income towards state revenue, promoting fairness and equity.

Economic Growth and Revenue Generation

The income tax revenue generated by the state helps fund essential public services, infrastructure development, and education. It contributes to the overall economic growth and stability of West Virginia, providing resources for various sectors and improving the quality of life for its residents.

Additionally, the tax system encourages businesses to invest in the state by offering competitive tax rates and incentives. This, in turn, creates job opportunities and stimulates economic activity, benefiting both businesses and the local communities.

Challenges and Future Considerations

While West Virginia’s income tax system has its advantages, there are also challenges to consider. One of the primary concerns is the state’s relatively low population, which can limit the tax base and revenue potential. As a result, the state may face difficulties in maintaining and improving public services without raising tax rates or finding alternative revenue streams.

Furthermore, the dynamic nature of the tax landscape requires constant monitoring and adaptation. Tax laws and regulations may change at the federal level, impacting the state's tax system. It is crucial for West Virginia to stay updated and make necessary adjustments to ensure its tax system remains competitive and aligns with national trends.

As the state continues to evolve, exploring options such as tax reform, streamlining tax processes, and implementing innovative revenue-generating strategies may become essential to sustain economic growth and meet the evolving needs of its residents and businesses.

Conclusion

West Virginia’s income tax system is designed to be progressive and fair, providing a solid foundation for the state’s economic growth and development. By understanding the tax brackets, deductions, and credits available, taxpayers can navigate the system effectively and plan their financial strategies accordingly.

For businesses, the state offers a supportive environment with competitive tax rates and incentives. However, staying informed about the latest tax regulations and exploring available tax advantages is crucial for long-term success and sustainability.

As West Virginia continues to navigate economic challenges and opportunities, its income tax system will remain a vital component, shaping the state's fiscal health and contributing to the overall prosperity of its communities.

How can I estimate my West Virginia income tax liability?

+

To estimate your West Virginia income tax liability, you can use the state’s income tax calculator available on the West Virginia Department of Revenue website. This calculator considers your filing status, taxable income, and applicable deductions and credits to provide an estimated tax amount.

Are there any income tax reciprocity agreements with other states?

+

West Virginia has income tax reciprocity agreements with certain neighboring states, which can simplify tax filing for residents who work in one state but live in another. These agreements allow for a credit or exemption on the resident’s home state tax return for taxes paid to the other state.

What are the penalties for late filing or non-payment of West Virginia income taxes?

+

Late filing of West Virginia income tax returns can result in penalties and interest charges. The penalty for late filing is typically 5% of the unpaid tax amount per month, up to a maximum of 25%. Non-payment of taxes can also incur additional penalties and interest, so it’s important to meet the deadlines and make timely payments.

Are there any tax incentives for small businesses in West Virginia?

+

Yes, West Virginia offers various tax incentives for small businesses to encourage growth and investment. These incentives include tax credits for job creation, research and development, and investment in certain industries. Small business owners should explore these incentives and consult with tax professionals to maximize their benefits.

How can I stay updated on changes to West Virginia’s income tax laws and regulations?

+

To stay informed about changes to West Virginia’s income tax laws and regulations, you can subscribe to updates from the West Virginia Department of Revenue. They provide regular updates and notifications about tax law changes, deadlines, and any new tax incentives or programs. Additionally, consulting with tax professionals or tax preparation services can ensure you receive timely and accurate information.