Taxable And Tax Exempt Bonds

Taxable and Tax-Exempt Bonds: Navigating the Financial Landscape

In the world of investments and financial instruments, bonds play a crucial role in generating stable returns and diversifying portfolios. Among the various types of bonds available, taxable and tax-exempt bonds stand out as unique offerings with distinct features and implications for investors. Understanding the nuances of these bond categories is essential for making informed investment decisions.

This comprehensive guide aims to delve into the intricacies of taxable and tax-exempt bonds, shedding light on their characteristics, advantages, and potential drawbacks. By exploring real-world examples and providing industry insights, we aim to equip investors with the knowledge needed to navigate this complex yet rewarding segment of the bond market.

Taxable Bonds: A Common Investment Vehicle

Taxable bonds, as the name suggests, are subject to taxation at both the federal and state levels. These bonds are issued by a wide range of entities, including corporations, municipalities, and even the federal government itself. Their widespread availability and familiarity make them a common choice for investors seeking stable income streams.

Key Characteristics of Taxable Bonds

- Diverse Issuers: Taxable bonds can be issued by corporations, often referred to as corporate bonds, as well as by various government entities. The diversity of issuers provides investors with a broad selection of investment options.

- Federal and State Taxation: Investors in taxable bonds must pay federal income tax on the interest earned. Additionally, they may also be subject to state income tax, depending on their residence and the bond's issuer.

- Interest Payments: Taxable bonds typically make interest payments semi-annually, providing investors with a steady stream of income. The interest rate is determined by factors such as the creditworthiness of the issuer and prevailing market conditions.

Advantages of Taxable Bonds

Taxable bonds offer several advantages that make them attractive to investors:

- Wider Availability: With a diverse range of issuers, taxable bonds provide investors with numerous options to choose from, allowing for customization of investment portfolios.

- Potential for Higher Returns: Taxable bonds often offer higher interest rates compared to their tax-exempt counterparts, making them appealing to investors seeking greater income potential.

- Federal Tax Treatment: While taxable bonds are subject to federal income tax, certain investors, such as those in higher tax brackets, may benefit from the tax deductibility of interest expenses.

Considerations and Drawbacks

However, taxable bonds also come with certain considerations and potential drawbacks:

- Tax Implications: The taxation of interest income can reduce the overall return on investment, especially for investors in higher tax brackets. Careful tax planning is essential to optimize the after-tax returns.

- Credit Risk: Taxable bonds issued by corporations carry credit risk, as the issuer's ability to make interest and principal payments may be affected by their financial health. Investors should assess the creditworthiness of the issuer before investing.

- Market Risk: Interest rate fluctuations can impact the market value of taxable bonds. When interest rates rise, the value of existing bonds may decline, leading to potential capital losses.

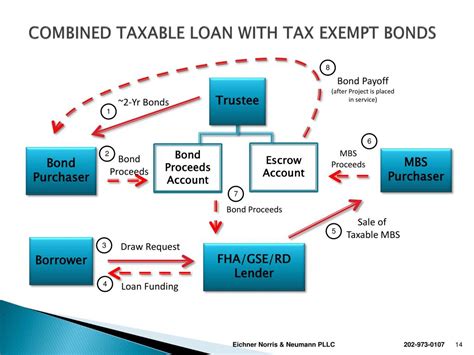

Tax-Exempt Bonds: A Tax-Advantaged Option

Tax-exempt bonds, on the other hand, offer a unique proposition to investors by providing tax-free income. These bonds are primarily issued by state and local governments, as well as certain non-profit organizations, and the interest earned on them is exempt from federal income tax.

Key Characteristics of Tax-Exempt Bonds

- State and Local Issuers: Tax-exempt bonds are predominantly issued by state and municipal governments, with a smaller portion issued by non-profit entities. These bonds are used to fund a variety of projects, including infrastructure development and public services.

- Federal Tax Exemption: The standout feature of tax-exempt bonds is the exemption from federal income tax on interest income. This makes them particularly attractive to investors in higher tax brackets.

- Limited Availability: Compared to taxable bonds, tax-exempt bonds have a more limited supply, as they are primarily issued by state and local governments. This can make them less accessible to some investors.

Advantages of Tax-Exempt Bonds

Tax-exempt bonds offer several advantages that make them a popular choice for certain investors:

- Tax-Free Income: The primary advantage of tax-exempt bonds is the tax-free status of interest income. Investors can enjoy the full benefit of their investment returns without the burden of federal income tax.

- Reduced Tax Liability: For investors in high tax brackets, tax-exempt bonds can significantly reduce their overall tax liability, making them an attractive option for tax-efficient investing.

- Diversification: Tax-exempt bonds provide investors with an opportunity to diversify their portfolios, especially when combined with taxable bonds to create a balanced investment strategy.

Considerations and Drawbacks

Despite their advantages, tax-exempt bonds also come with certain considerations:

- Limited Supply: The restricted supply of tax-exempt bonds can make them less accessible to some investors, especially those seeking larger investment amounts. This limited availability can impact the overall investment strategy.

- State Taxation: While tax-exempt bonds offer federal tax exemption, they may still be subject to state income tax. Investors should consider their state tax situation before investing in these bonds.

- Lower Interest Rates: Due to the tax-free nature of their interest income, tax-exempt bonds often offer lower interest rates compared to taxable bonds. This can make them less attractive to investors seeking higher income potential.

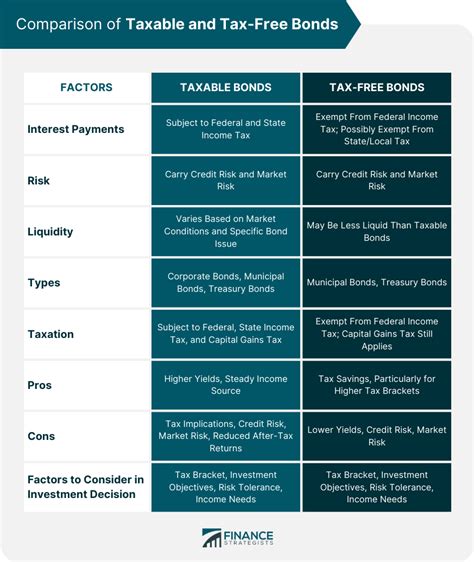

Performance Analysis and Comparison

When evaluating the performance of taxable and tax-exempt bonds, it is essential to consider both their absolute returns and their after-tax returns. The following table presents a comparison of the key metrics for both bond types:

| Bond Type | Interest Rate | Taxation | Potential Returns |

|---|---|---|---|

| Taxable Bonds | Varies (typically higher) | Federal and State Income Tax | Higher absolute returns, but after-tax returns may be reduced |

| Tax-Exempt Bonds | Lower than taxable bonds | No Federal Income Tax, potential state tax | Lower absolute returns, but tax-free status boosts after-tax returns |

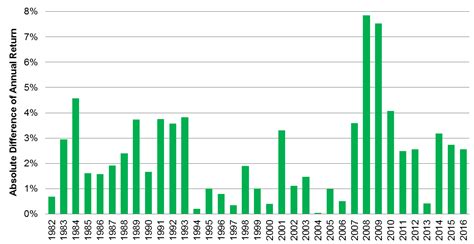

The actual returns on taxable and tax-exempt bonds can vary based on market conditions, interest rates, and the specific bond issues. However, the tax implications play a significant role in determining the overall returns for investors.

Navigating the Tax Landscape

Understanding the tax implications of taxable and tax-exempt bonds is crucial for optimizing investment strategies. Here are some key considerations for investors:

- Tax Bracket Analysis: Investors should evaluate their tax brackets to determine the potential impact of taxation on their investment returns. Higher tax brackets may make tax-exempt bonds more appealing due to the reduced tax liability.

- State Tax Implications: State tax laws vary, and investors should consider the state tax treatment of both taxable and tax-exempt bonds. Some states may offer tax benefits for certain bond types, while others may have unique tax considerations.

- Portfolio Diversification: Combining taxable and tax-exempt bonds in a portfolio can provide a balanced approach. Taxable bonds can offer higher income potential, while tax-exempt bonds can reduce overall tax liability.

Real-World Examples and Industry Insights

Let's explore some real-world examples and industry insights to better understand the implications of taxable and tax-exempt bonds:

Case Study: Taxable Bonds

Imagine an investor, Mr. Smith, who purchases a taxable corporate bond with an interest rate of 5% and a face value of $1,000. Mr. Smith is in the 32% federal tax bracket and resides in a state with a 5% income tax rate.

- Mr. Smith earns $50 in interest income annually from the bond.

- He must pay $16 in federal income tax ($50 x 0.32) and $2.50 in state income tax ($50 x 0.05), reducing his after-tax return to $31.50.

- Despite the tax implications, the bond still provides a positive return, and Mr. Smith can benefit from the higher interest rate compared to tax-exempt bonds.

Case Study: Tax-Exempt Bonds

Consider Ms. Johnson, who invests in a tax-exempt municipal bond with an interest rate of 3% and a face value of $1,000. Ms. Johnson is in the 24% federal tax bracket and resides in a state with no income tax.

- Ms. Johnson earns $30 in interest income annually from the bond.

- Due to the tax-exempt status, she does not pay any federal income tax on the interest income.

- Her after-tax return is $30, which is the full interest earned, providing her with a tax-efficient investment.

Industry Insights

The market for taxable and tax-exempt bonds is dynamic, influenced by various factors such as economic conditions, interest rate movements, and investor preferences. Here are some key industry insights:

- Municipal Bond Market: The municipal bond market, which primarily consists of tax-exempt bonds, has seen a resurgence in recent years as investors seek tax-efficient investment opportunities. The market has experienced strong demand, particularly from high-net-worth individuals and institutional investors.

- Corporate Bond Demand: Taxable corporate bonds continue to be a popular choice for investors seeking higher income potential. The demand for these bonds is driven by their relatively higher interest rates and the diversification benefits they offer.

- Tax Reform Impact: Changes in tax laws, such as the Tax Cuts and Jobs Act of 2017, can significantly impact the attractiveness of taxable and tax-exempt bonds. Investors should stay informed about tax reforms and their potential effects on their investment strategies.

Future Implications and Investment Strategies

The landscape of taxable and tax-exempt bonds is subject to change, influenced by economic trends, regulatory shifts, and investor behavior. As we look ahead, here are some considerations for investors:

- Interest Rate Movements: Changes in interest rates can impact the attractiveness of both taxable and tax-exempt bonds. Investors should monitor interest rate trends and consider the potential impact on their bond holdings.

- Tax Policy Changes: Future tax reforms could alter the tax treatment of taxable and tax-exempt bonds. Investors should stay informed about potential policy changes and their implications for their investment strategies.

- Alternative Investment Options: The bond market offers a wide range of investment options, including convertible bonds, floating rate notes, and international bonds. Investors should explore these alternatives to diversify their portfolios and optimize their returns.

In conclusion, taxable and tax-exempt bonds are integral components of the investment landscape, offering distinct advantages and considerations. By understanding the characteristics, tax implications, and real-world examples, investors can make informed decisions to optimize their bond portfolios. As the financial markets evolve, staying informed and adapting investment strategies is key to navigating the complexities of the bond market.

What are the key differences between taxable and tax-exempt bonds?

+Taxable bonds are subject to federal and state income tax, while tax-exempt bonds offer tax-free interest income. Taxable bonds often have higher interest rates but may result in reduced returns after tax, while tax-exempt bonds provide tax-efficient returns but may offer lower interest rates.

Who benefits the most from investing in tax-exempt bonds?

+Investors in higher tax brackets can benefit significantly from tax-exempt bonds due to the reduced tax liability. The tax-free status of interest income makes these bonds an attractive option for tax-efficient investing.

Are there any drawbacks to investing in taxable bonds?

+Taxable bonds may result in reduced after-tax returns, especially for investors in higher tax brackets. Additionally, they carry credit risk, as the issuer’s financial health can impact their ability to make interest and principal payments.

How can investors diversify their bond portfolios using taxable and tax-exempt bonds?

+Investors can combine taxable and tax-exempt bonds in their portfolios to create a balanced approach. Taxable bonds offer higher income potential, while tax-exempt bonds reduce overall tax liability. This diversification strategy can help optimize returns and manage risk.

What should investors consider when navigating the tax landscape for bonds?

+Investors should analyze their tax brackets and state tax laws to determine the potential impact of taxation on their investment returns. They should also consider the availability and characteristics of both taxable and tax-exempt bonds to make informed investment decisions.