Virginia Tax Brackets

The Virginia tax system operates on a progressive basis, meaning that individuals and couples pay different tax rates depending on their income levels. Understanding the Virginia tax brackets is crucial for taxpayers to comprehend how their income is taxed and to plan their financial strategies accordingly. This article provides an in-depth analysis of the Virginia tax brackets, covering everything from the latest tax rates to strategies for effective tax management.

Understanding Virginia’s Progressive Tax Structure

Virginia’s tax system is designed to be progressive, which means that as an individual’s income increases, so does the tax rate applied to their earnings. This approach ensures that those with higher incomes contribute a larger proportion of their earnings to the state’s revenue. The Virginia tax brackets are divided into five income levels, each with its own tax rate.

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 1 | 2% | Up to $3,000 |

| 2 | 3% | $3,001 - $5,000 |

| 3 | 5% | $5,001 - $17,000 |

| 4 | 5.75% | $17,001 - $250,000 |

| 5 | 5.75% | Over $250,000 |

It's important to note that Virginia's tax brackets are based on taxable income, which is the amount remaining after deductions and exemptions are applied. This means that individuals can strategically reduce their taxable income by utilizing various tax deductions and credits, potentially moving into a lower tax bracket and reducing their overall tax liability.

Strategies for Effective Tax Management

Understanding Virginia’s tax brackets provides an essential foundation for effective tax management. Here are some strategies taxpayers can employ to optimize their tax situation:

Maximizing Deductions and Credits

Virginia offers a range of deductions and credits that can reduce taxable income, such as the Standard Deduction, which is 3,000 for single filers and 6,000 for joint filers. Additionally, Virginia allows itemized deductions for expenses such as medical costs, state and local taxes, and charitable contributions. By carefully tracking and claiming eligible deductions, taxpayers can reduce their taxable income and potentially move into a lower tax bracket.

Virginia also offers various tax credits, including the Low-Income Senior Tax Credit, the Disabled Veteran Tax Credit, and the Dependent Care Tax Credit. These credits can directly reduce tax liability, providing further opportunities for taxpayers to optimize their tax situation.

Strategic Income Management

For those with variable income or multiple sources of income, strategic income management can be a powerful tool for tax optimization. By carefully timing income recognition and utilizing tax-deferred or tax-advantaged accounts, taxpayers can potentially reduce their overall tax burden. For example, maximizing contributions to retirement accounts like 401(k)s or IRAs can lower taxable income in the current year, providing immediate tax savings.

Estate and Inheritance Planning

For high-net-worth individuals, estate and inheritance planning is crucial for minimizing tax liability. Virginia has an estate tax, which is imposed on the transfer of assets upon death. By employing strategies such as gifting, establishing trusts, and utilizing life insurance, individuals can potentially reduce the tax burden on their heirs and preserve more of their wealth for future generations.

The Impact of Virginia’s Tax Structure on Residents

Virginia’s tax structure, with its progressive brackets, has a significant impact on the financial lives of its residents. For those with lower incomes, the lower tax rates provide a sense of fairness and ensure that a larger proportion of their income is retained. This can be especially beneficial for individuals and families who are already managing their finances on a tight budget.

On the other hand, individuals with higher incomes may face a greater tax burden, particularly in the top tax bracket. However, it's important to recognize that the progressive tax structure is designed to ensure that those with greater financial means contribute a larger share of their income to support the state's public services and infrastructure. This balance between tax fairness and revenue generation is a key consideration for Virginia's tax policy.

The Role of Localities in Virginia’s Tax System

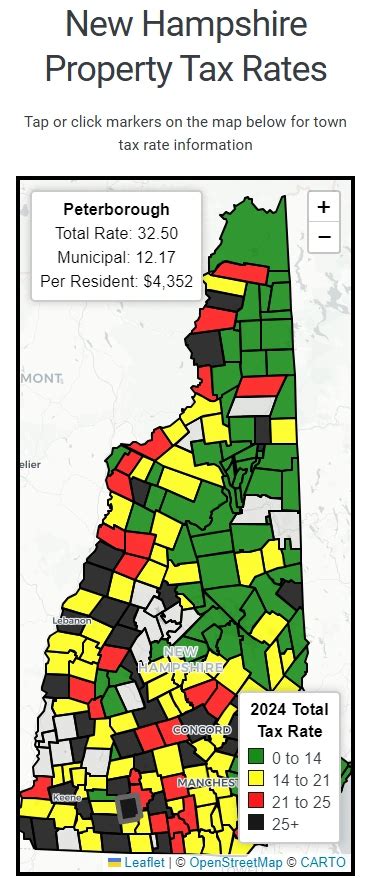

It’s worth noting that in addition to the state income tax, Virginia residents also pay local income taxes. Localities have the authority to impose their own income tax rates, which can vary significantly across the state. This means that an individual’s overall tax burden can depend not only on their state income tax bracket but also on the specific locality in which they reside.

For example, while the state income tax rates are consistent across Virginia, localities like Arlington County and Alexandria City have their own income tax rates, which can add a substantial additional tax burden for residents in those areas. Understanding the interplay between state and local taxes is crucial for individuals to gain a comprehensive view of their overall tax situation.

Future Implications and Potential Changes

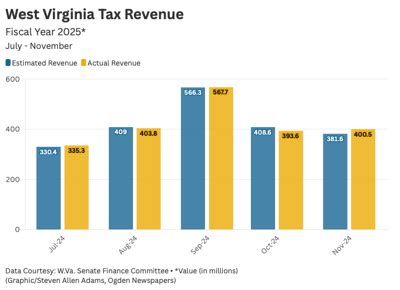

Virginia’s tax brackets are subject to periodic review and adjustment by the state legislature. While the current tax rates have been in place since 2018, there have been discussions about potential changes to the tax structure, particularly in response to economic shifts and revenue needs.

One potential area of change is the top tax bracket. As Virginia's economy continues to grow and income levels rise, there may be pressure to adjust the income threshold for the top tax bracket or increase the tax rate itself. This could impact a significant number of taxpayers, particularly those in high-income professions or with substantial investment income.

Additionally, there have been ongoing discussions about the implementation of a state-level Earned Income Tax Credit (EITC). The EITC is a federal tax credit designed to benefit low- to moderate-income working individuals and families, and it has been shown to be an effective tool for reducing poverty and encouraging workforce participation. Implementing a state-level EITC could provide significant benefits to Virginia's lower-income residents, potentially offsetting the impact of rising income tax rates.

How often are Virginia’s tax brackets updated?

+Virginia’s tax brackets are typically reviewed and updated on a biennial basis, with the most recent changes taking effect in 2018. However, special legislative sessions or budget adjustments can lead to more frequent updates.

Are there any plans to change the number of tax brackets in Virginia?

+While there are ongoing discussions about tax reform in Virginia, there are currently no concrete plans to change the number of tax brackets. However, changes to the income thresholds or tax rates within the existing brackets are possible.

What are the tax rates for corporations in Virginia?

+Virginia imposes a flat corporate income tax rate of 6% on taxable income. However, there are various deductions and credits available to corporations, which can reduce their effective tax rate.