Florida Auto Sales Tax

When purchasing a vehicle in Florida, understanding the auto sales tax is crucial for budgeting and financial planning. This article aims to provide an in-depth analysis of Florida's auto sales tax, its implications, and how it impacts vehicle buyers. By exploring the state's tax regulations, we can gain a comprehensive understanding of the costs associated with vehicle ownership in Florida.

Understanding Florida’s Auto Sales Tax

Florida, like many other states, imposes a sales tax on the purchase of motor vehicles. This tax is an essential source of revenue for the state, contributing to various public services and infrastructure development. While the tax rate may seem straightforward, there are several factors and nuances that buyers should be aware of when navigating the auto sales tax landscape in Florida.

The Tax Rate and Its Application

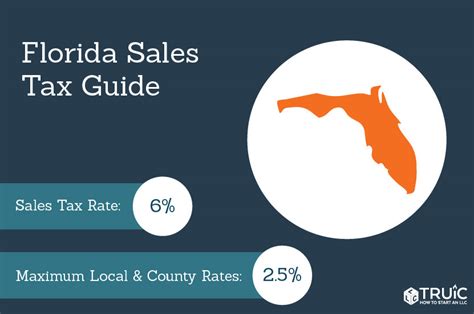

Florida’s auto sales tax is calculated as a percentage of the vehicle’s purchase price. As of [current year], the state sales tax rate for vehicles is set at 6%. This rate is applied uniformly across the state, ensuring consistency in tax payments regardless of the location of the dealership or the buyer’s residence.

However, it's important to note that the 6% tax rate is not the only consideration. Local governments in Florida also have the authority to impose additional taxes on vehicle purchases. These local taxes can vary significantly, with some counties adding an extra 1% to 2% on top of the state tax. This means that the total sales tax rate can range from 7% to 8% depending on the specific county where the vehicle is purchased.

| County | Additional Tax Rate | Total Tax Rate |

|---|---|---|

| Miami-Dade County | 1.5% | 7.5% |

| Hillsborough County | 2% | 8% |

| Broward County | 1% | 7% |

| Palm Beach County | 1% | 7% |

Exemptions and Special Considerations

While the majority of vehicle purchases in Florida are subject to sales tax, there are certain scenarios where exemptions or reduced tax rates apply. These exemptions are designed to accommodate specific circumstances and promote particular industries or initiatives.

- Military Personnel: Active-duty military members stationed in Florida may be eligible for a reduced sales tax rate. This exemption applies to the purchase of a vehicle for personal use and is a token of appreciation for their service.

- Trade-Ins: When trading in an old vehicle as part of a new purchase, the sales tax is calculated based on the difference in value between the new and old vehicles. This means that if the trade-in value exceeds the purchase price of the new vehicle, the tax liability may be reduced or eliminated.

- Leased Vehicles: Florida's sales tax regulations treat leased vehicles differently from purchased vehicles. Instead of paying the sales tax upfront, lessees pay a monthly tax amount calculated as a percentage of the lease payment. This tax is typically included in the lease agreement.

- Electric and Hybrid Vehicles: In an effort to promote environmentally friendly transportation, Florida offers tax incentives for the purchase of electric and hybrid vehicles. These incentives can take the form of reduced sales tax rates or even tax exemptions, making these vehicles more affordable for eco-conscious buyers.

Impact on Vehicle Ownership

The auto sales tax in Florida significantly impacts the overall cost of vehicle ownership. For a typical passenger vehicle with a purchase price of 30,000</strong>, the 6% state sales tax would amount to <strong>1,800. When factoring in the potential additional local taxes, the total sales tax could increase to $2,400 or more, representing a substantial portion of the vehicle’s cost.

This tax not only affects the initial purchase but also influences the resale value of vehicles in Florida. When selling a used vehicle, the original sales tax paid becomes a factor in determining the vehicle's worth. Buyers of used vehicles may negotiate the price based on the remaining value of the sales tax paid by the previous owner.

Comparative Analysis: Florida vs. Other States

Florida’s auto sales tax rate is relatively competitive compared to other states. While some states have higher rates, such as California with a 7.25% state sales tax, others have lower rates, like Texas with a 6.25% state sales tax. However, it’s important to consider the cumulative effect of state and local taxes when comparing states.

For instance, while Florida's state tax rate is 6%, the addition of local taxes can push the total rate higher. In contrast, states like Texas have a uniform sales tax rate across the state, making it more straightforward to estimate the tax liability. This variation in tax structures underscores the importance of researching and understanding the specific tax landscape in each state.

Future Implications and Potential Changes

The auto sales tax in Florida, like any tax policy, is subject to potential changes and adjustments. While it’s difficult to predict future modifications, certain trends and initiatives could influence the tax landscape.

One potential area of change is the increasing focus on electric and hybrid vehicles. As more states implement incentives to promote sustainable transportation, Florida may consider enhancing its existing tax incentives or introducing new measures to encourage the adoption of eco-friendly vehicles. This could take the form of expanded tax credits, rebates, or even dedicated infrastructure investments.

Additionally, with the evolving nature of the automotive industry, Florida may explore innovative tax structures to accommodate emerging technologies. For instance, as autonomous vehicles become more prevalent, the state may need to reconsider how sales tax is applied to these vehicles, ensuring that the tax system remains fair and effective in the face of technological advancements.

Conclusion

Florida’s auto sales tax is a crucial aspect of vehicle ownership in the state. Understanding the tax rate, local variations, and potential exemptions is essential for buyers to make informed decisions and accurately budget for their vehicle purchases. While the state’s tax rate is relatively competitive, the addition of local taxes can significantly impact the overall cost.

As the automotive industry continues to evolve, Florida's tax policies will need to adapt to accommodate new technologies and promote sustainable transportation initiatives. By staying informed about tax regulations and exploring available incentives, vehicle buyers in Florida can navigate the auto sales tax landscape with confidence and make the most of their vehicle purchases.

Are there any ways to reduce the sales tax burden when purchasing a vehicle in Florida?

+Yes, there are a few strategies to consider. First, researching dealerships in counties with lower additional tax rates can save you money. Additionally, if you’re an active-duty military member, you may be eligible for a reduced tax rate. Finally, when trading in a vehicle, the sales tax is calculated based on the difference in value, so a higher trade-in value can reduce your tax liability.

How do I know if I’m eligible for tax exemptions or reduced rates in Florida?

+Eligibility for tax exemptions or reduced rates depends on specific circumstances. Active-duty military members, for instance, should provide proof of their status. For electric or hybrid vehicles, buyers may need to consult the state’s guidelines for qualifying models. It’s always best to consult with a tax professional or dealership to understand your specific eligibility.

Are there any online resources to help calculate the total sales tax for my vehicle purchase in Florida?

+Yes, there are several online calculators and tools available to estimate the total sales tax for your vehicle purchase. These calculators consider the state tax rate, local taxes, and any applicable exemptions or incentives. By inputting the purchase price and relevant details, you can get a more accurate estimate of the sales tax you’ll owe.