Taxes On A Vehicle In Texas

Understanding the taxation system for vehicles in Texas is crucial for both residents and potential newcomers. Texas has a unique approach to vehicle taxation, which differs significantly from other states. In this comprehensive guide, we will delve into the intricacies of vehicle taxes in Texas, covering everything from registration fees to sales tax and usage-based taxation. By the end of this article, you'll have a clear understanding of the financial responsibilities associated with owning a vehicle in the Lone Star State.

Vehicle Registration Fees in Texas

In Texas, vehicle registration is a mandatory process that involves paying specific fees to the Texas Department of Motor Vehicles (TxDMV). These fees are determined by various factors, including the type of vehicle, its weight, and the county of registration. Here’s a breakdown of the key aspects of vehicle registration fees in Texas:

Registration Types and Fees

Texas offers different registration types based on vehicle usage. The most common types include:

- Passenger Vehicle Registration: Fees range from 25 to 63, depending on the county. This covers standard cars, SUVs, and light trucks.

- Commercial Vehicle Registration: Trucks and commercial vehicles have higher registration fees, starting at 123 and increasing based on weight and usage.</li> <li><strong>Motorcycle Registration</strong>: Fees for motorcycles are generally lower, ranging from 17 to $34.

Additional Registration Costs

Apart from the base registration fees, there are additional costs to consider:

- Title Transfer Fee: When purchasing a used vehicle, a title transfer fee of 33 is applicable.</li> <li><strong>Personalized License Plate Fee</strong>: Customized license plates come with an extra fee, typically around 40 for a standard design.

- County-Specific Fees: Certain counties in Texas may impose additional surcharges or fees on top of the standard registration costs.

| Vehicle Type | Registration Fee Range |

|---|---|

| Passenger Vehicle | $25 - $63 |

| Commercial Vehicle | $123 and above |

| Motorcycle | $17 - $34 |

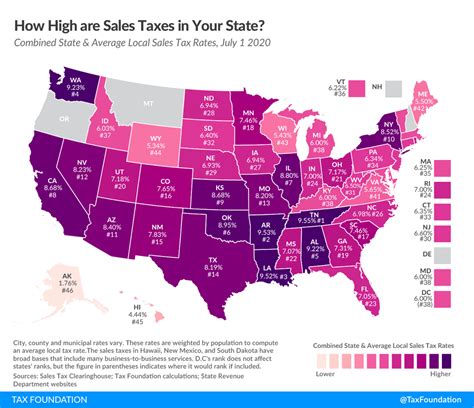

Sales Tax on Vehicle Purchases

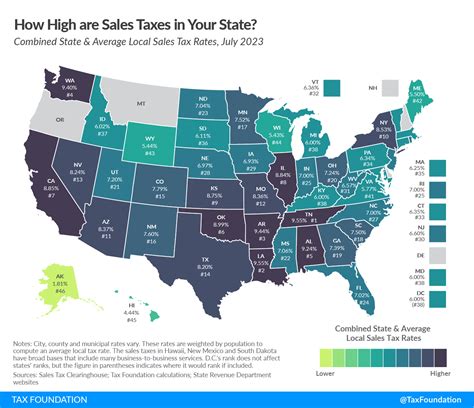

Texas imposes a sales tax on the purchase of vehicles, which is an important consideration for both new and used car buyers. The sales tax rate varies across the state, with an average rate of 6.25%. However, some cities and counties may have additional local sales taxes, bringing the total rate to around 8.25%.

Calculating Sales Tax

The sales tax on a vehicle purchase is calculated based on the purchase price. Here’s a step-by-step guide:

- Determine the purchase price of the vehicle, including any additional fees and accessories.

- Multiply the purchase price by the applicable sales tax rate (6.25% or the local rate).

- Add the sales tax amount to the purchase price to get the total cost.

For example, if you purchase a car for $25,000 in a county with an 8.25% sales tax rate, the calculation would be as follows:

- Sales Tax Amount = $25,000 x 0.0825 = $2,062.50

- Total Cost = $25,000 + $2,062.50 = $27,062.50

Sales Tax Exemptions

Texas offers certain exemptions from sales tax for specific vehicle purchases. These exemptions include:

- Disabled Veterans: Veterans with a disability rating of 100% are exempt from paying sales tax on vehicle purchases.

- Military Personnel: Active-duty military members may be eligible for sales tax exemptions if they meet specific criteria.

- Low-Emission Vehicles: Some electric and hybrid vehicles are exempt from sales tax to encourage eco-friendly transportation.

Usage-Based Taxation: The Texas Vehicle Inventory Tax

Texas employs a unique taxation system known as the Vehicle Inventory Tax, which is based on the number of days a vehicle is registered in the state. This tax is in addition to the registration fees and sales tax.

How the Vehicle Inventory Tax Works

The Vehicle Inventory Tax is calculated annually and is proportional to the number of days the vehicle is registered in Texas. Here’s a simplified explanation:

- The tax rate is set at 0.25 per 100 of the vehicle’s value.

- The value of the vehicle is determined by the National Automobile Dealers Association (NADA) guide.

- The tax is prorated based on the number of days the vehicle is registered in Texas during the calendar year.

For instance, if your vehicle has a value of $20,000 according to the NADA guide, the annual Vehicle Inventory Tax would be calculated as follows:

- Tax Rate = $0.25 / $100

- Vehicle Value = $20,000

- Inventory Tax = $20,000 x 0.0025 = $50

Payment and Exemptions

The Vehicle Inventory Tax is typically paid when renewing your vehicle registration. However, certain exemptions apply:

- Non-Resident Exemption: If you are a non-resident of Texas and only use the vehicle temporarily in the state, you may be exempt from this tax.

- New Residents: If you recently moved to Texas, you may be eligible for a partial exemption based on the number of days you were a resident during the tax year.

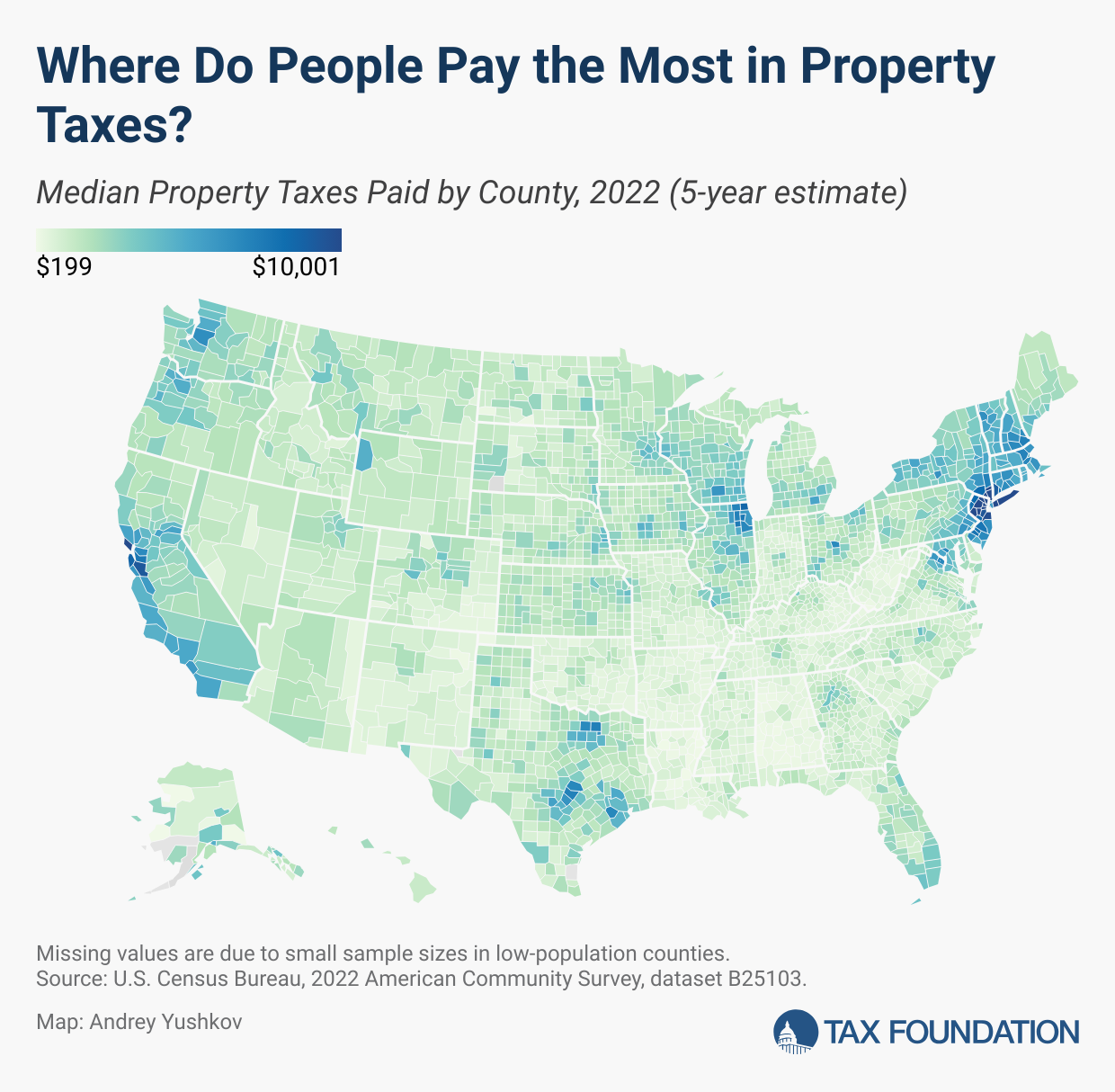

Property Tax on Vehicles

Unlike many other states, Texas does not have a specific property tax on vehicles. Instead, the state relies on the Vehicle Inventory Tax and other registration fees to generate revenue. This means that vehicle owners in Texas do not need to worry about an additional property tax assessment for their vehicles.

County-Level Property Taxes

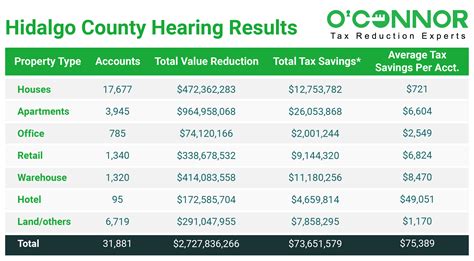

While there is no statewide property tax on vehicles, some counties in Texas may impose a local property tax on certain types of vehicles, such as heavy trucks or commercial vehicles. It’s essential to check with your county’s tax assessor’s office to understand any potential local property taxes.

Fuel Taxes and Other Motor Vehicle-Related Taxes

In addition to the taxes mentioned above, Texas imposes various other taxes related to vehicle ownership and usage.

Fuel Taxes

Texas has a fuel tax that is applied to gasoline and diesel fuel. The tax rate is currently set at 0.20 per gallon for gasoline and 0.23 per gallon for diesel. These taxes contribute to the state’s transportation infrastructure fund.

Motor Vehicle Rental Tax

When renting a vehicle in Texas, a motor vehicle rental tax is applicable. This tax is typically included in the rental agreement and is calculated as a percentage of the rental cost.

Toll Road Fees

Texas has an extensive network of toll roads, and using these roads incurs toll fees. The fees vary based on the road and the method of payment. Some toll roads offer discounts for frequent users.

Tax Benefits and Incentives for Electric Vehicles

Texas is committed to promoting the adoption of electric vehicles (EVs) and offers various tax incentives to encourage their use.

Sales Tax Exemption

Texas provides a sales tax exemption for the purchase of new electric vehicles. This exemption applies to the first $50,000 of the purchase price, including any dealer-installed options.

Income Tax Credit

The state also offers an income tax credit for the purchase or lease of an electric vehicle. The credit amount varies depending on the vehicle’s battery capacity, with a maximum credit of $2,500.

Electric Vehicle Charging Incentives

Texas offers incentives for the installation of electric vehicle charging stations. These incentives can cover a portion of the installation costs, making it more affordable for businesses and individuals to set up charging infrastructure.

Tax Deductions and Credits for Vehicle-Related Expenses

Vehicle owners in Texas may be eligible for certain tax deductions and credits when filing their state income taxes.

Business-Related Vehicle Expenses

If you use your vehicle for business purposes, you can deduct a portion of the expenses, including fuel, maintenance, and registration fees. The IRS provides guidelines for calculating these deductions.

Medical Expense Deduction

If you use your vehicle for medical reasons, such as transporting a disabled family member, you may be able to deduct a portion of your vehicle-related expenses as a medical expense on your tax return.

State Tax Credits

Texas offers various state tax credits, such as the Texas Enterprise Fund and the Texas Emerging Technology Fund, which can provide tax benefits for businesses investing in certain sectors, including transportation-related industries.

Conclusion: Navigating Vehicle Taxes in Texas

Understanding the complex web of vehicle taxes in Texas is essential for anyone considering purchasing or owning a vehicle in the state. From registration fees to sales tax, usage-based taxation, and various incentives, Texas has a unique approach to vehicle taxation. By staying informed about these taxes and taking advantage of available exemptions and incentives, vehicle owners can navigate the financial responsibilities associated with owning a vehicle in Texas with confidence.

FAQ

Are there any ways to reduce my vehicle-related taxes in Texas?

+Yes, there are several strategies to reduce your vehicle-related taxes. You can take advantage of sales tax exemptions for certain vehicle purchases, such as electric vehicles. Additionally, if you use your vehicle for business purposes, you may be eligible for deductions on your state income tax return. Staying informed about county-specific registration fees and exemptions can also help minimize costs.

How often do I need to renew my vehicle registration in Texas?

+Vehicle registration renewal in Texas is typically required annually. However, the specific renewal date may vary based on the month your vehicle was initially registered. It’s important to renew your registration on time to avoid penalties and ensure continuous compliance with Texas regulations.

Can I transfer my vehicle registration from another state to Texas?

+Yes, you can transfer your vehicle registration to Texas when you become a resident. You’ll need to provide proof of insurance, complete a Vehicle Transfer Notification form, and pay the applicable registration fees. It’s advisable to visit the TxDMV website for detailed instructions on the transfer process.