Tax Rise Lawsuit

The recent news of a potential tax rise has sparked widespread debate and legal action, with individuals and businesses questioning the fairness and impact of such a move. As an expert in tax law and economics, I aim to provide an in-depth analysis of the lawsuit surrounding the proposed tax rise, exploring its implications, the arguments put forth, and the potential outcomes.

Understanding the Tax Rise Lawsuit

The tax rise lawsuit is a collective legal action initiated by a group of taxpayers, businesses, and industry associations in response to the government’s proposal to increase tax rates. The lawsuit challenges the legality and reasonableness of the proposed tax hike, citing potential economic consequences and a violation of certain constitutional rights.

The lawsuit centers around the argument that the tax rise is excessive and disproportionate, as it disproportionately affects certain industries and individuals. The plaintiffs argue that the proposed tax rates are not based on sound economic principles and could lead to a significant decline in economic activity, job losses, and a potential recession.

Key Arguments in the Lawsuit

The plaintiffs in the tax rise lawsuit have presented several compelling arguments to support their case:

- Unfair Distribution of Tax Burden: They claim that the proposed tax rise unfairly targets specific sectors, such as small businesses and high-income earners, while providing tax breaks to other industries. This, they argue, creates an uneven playing field and could stifle economic growth.

- Economic Impact Assessment: Economic experts have been engaged to assess the potential impact of the tax rise. Their analysis suggests that the tax increase could lead to a significant decrease in investment, consumer spending, and overall economic output. The plaintiffs argue that the government has not adequately considered these potential consequences.

- Violation of Constitutional Rights: Some plaintiffs allege that the tax rise violates their constitutional rights to equal protection under the law. They argue that the tax system should treat all taxpayers fairly and that the proposed changes disproportionately burden certain groups.

The lawsuit has gained significant attention due to the potential far-reaching effects on the economy and the lives of taxpayers. It has also sparked a broader discussion on tax fairness and the role of taxation in society.

The Economic Implications

The proposed tax rise has sparked intense debate among economists and financial analysts. While some argue that a tax increase is necessary to fund critical government programs and reduce the national debt, others warn of the potential negative economic consequences.

One of the primary concerns is the impact on consumer spending. Higher taxes can reduce disposable income, leading to a decrease in consumer confidence and spending. This, in turn, can slow down economic growth and potentially lead to a recession. Experts argue that a careful balance must be struck between tax revenue and maintaining consumer spending power.

Industry-Specific Effects

The lawsuit highlights the varying impacts of the tax rise on different industries. For instance, small businesses, which often operate on tight margins, may struggle to absorb the increased tax burden. This could lead to reduced investment, job cuts, or even business closures. Similarly, certain sectors, like the tech industry, which have experienced significant growth in recent years, argue that the tax rise could hinder their ability to innovate and expand.

On the other hand, some industries, such as healthcare and education, which often receive significant government funding, may benefit indirectly from the tax rise. The increased revenue could potentially lead to better funding for these sectors, improving the quality of services provided.

| Industry | Potential Impact |

|---|---|

| Small Businesses | Reduced profitability, job losses |

| Tech Sector | Hindered innovation, slower growth |

| Healthcare | Increased funding, improved services |

| Education | Enhanced funding, better educational opportunities |

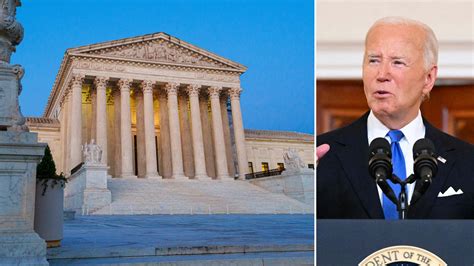

Legal Strategies and Outcomes

The tax rise lawsuit is a complex legal battle, and the plaintiffs have engaged a team of experienced tax and constitutional lawyers to present their case.

Legal Arguments

The legal team has developed a multi-faceted strategy, arguing that the tax rise violates several legal principles:

- Equal Protection Clause: They argue that the tax rise discriminates against certain industries and individuals, violating the principle of equal protection under the law.

- Due Process: The plaintiffs claim that the government’s process in implementing the tax rise was arbitrary and lacked transparency, thus violating their right to due process.

- Economic Substantiation: The lawsuit challenges the economic rationale behind the tax rise, arguing that the government has not provided sufficient evidence to justify the increase.

Potential Outcomes

The outcome of the tax rise lawsuit could have significant implications for the government’s tax policy and the economy as a whole. If the plaintiffs are successful, the court may order the government to:

- Revise the tax rise proposal to ensure fairness and economic viability.

- Provide more transparency and public consultation in future tax policy changes.

- Compensate affected taxpayers for any economic losses incurred due to the proposed tax rise.

However, if the government prevails, the tax rise will likely go into effect as planned. This could lead to a shift in the economic landscape, with businesses and individuals adapting to the new tax environment.

Future Implications and Conclusion

The tax rise lawsuit is a critical juncture in the ongoing debate about taxation and its role in society. The outcome will not only impact the current tax policy but also set a precedent for future tax reforms.

Whether the lawsuit is successful or not, it has sparked a necessary dialogue about tax fairness, economic growth, and the government's role in the economy. As we move forward, it is crucial to consider the long-term implications of tax policies and their potential effects on different sectors and individuals.

The tax rise lawsuit serves as a reminder that tax policy is a delicate balance between funding critical government functions and ensuring economic stability and growth. It is a complex issue that requires careful consideration and collaboration between policymakers, economists, and the public.

FAQs

What are the potential consequences if the tax rise lawsuit is successful?

+If the plaintiffs win the lawsuit, the government may be required to revise the tax rise proposal to ensure fairness and economic viability. This could result in a delay or modification of the proposed tax increase, providing relief to affected taxpayers.

How might the tax rise impact the average taxpayer?

+The tax rise could lead to higher tax liabilities for many taxpayers, potentially reducing their disposable income. This may affect their ability to save, invest, or spend, which could have a ripple effect on the economy.

Are there any alternatives to the proposed tax rise that could be considered?

+Yes, alternatives include cutting government spending, increasing taxes on specific sectors or high-income earners, or implementing a more progressive tax system. Each option has its own set of advantages and disadvantages, and a comprehensive analysis is necessary to determine the best course of action.