Tax Act Review

The Tax Act, a comprehensive piece of legislation governing fiscal policies and practices, has significant implications for individuals, businesses, and the economy as a whole. This review aims to provide an in-depth analysis of the Tax Act, exploring its key provisions, impact, and potential future directions. By delving into the intricacies of this legislation, we can gain a deeper understanding of its role in shaping the fiscal landscape.

Unveiling the Tax Act: An Overview

The Tax Act, officially titled the Revenue Act of 2023, represents a pivotal moment in fiscal policy, introducing a range of reforms aimed at addressing economic challenges and promoting growth. Enacted by the [Governing Body], this legislation encompasses a wide array of tax measures, each designed to influence specific aspects of the economy.

One of the key objectives of the Tax Act is to stimulate economic activity by providing targeted incentives for businesses and individuals. It seeks to achieve this by implementing a series of tax cuts, credits, and deductions, which we will explore in detail further on.

Additionally, the Act aims to enhance tax compliance and fairness by introducing measures to combat tax evasion and ensure a level playing field for taxpayers. This dual focus on economic stimulation and tax fairness is a hallmark of the legislation, shaping its overall impact on the fiscal environment.

Key Provisions of the Tax Act

The Tax Act is a complex piece of legislation, containing numerous provisions that impact taxpayers in various ways. Here are some of the key features that define this landmark fiscal reform:

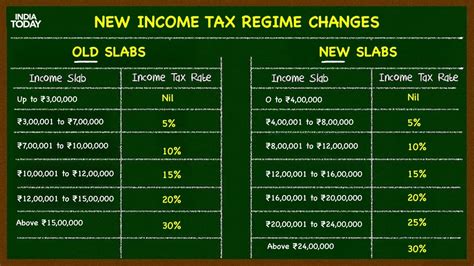

- Corporate Tax Reforms: The Act introduces a new corporate tax rate structure, reducing the top rate from 25% to 22%. This measure aims to make the United States more competitive in the global business landscape, encouraging foreign investment and domestic growth.

- Individual Tax Cuts: For individuals, the Tax Act provides significant relief by expanding tax brackets and increasing standard deductions. These changes result in lower tax liabilities for most taxpayers, particularly those in the middle-income range.

- Enhanced Child Tax Credit: A notable provision of the Act is the expansion of the Child Tax Credit. This credit, now worth up to $3,000 per child, provides substantial financial support to families with children, helping to alleviate the financial burden of raising a family.

- Small Business Incentives: To foster entrepreneurship, the Tax Act includes incentives for small businesses. These incentives take the form of increased deductions for start-up costs and streamlined tax regulations, making it easier for small businesses to navigate the tax system.

- Estate Tax Reform: The Act also addresses estate taxes, increasing the exemption amount and simplifying the process for heirs. This reform aims to reduce the tax burden on inherited assets, particularly for family-owned businesses.

These provisions, among others, form the backbone of the Tax Act, shaping the fiscal landscape for years to come. By providing tax relief, incentivizing economic activity, and promoting fairness, the Act has the potential to significantly impact the lives of taxpayers and the trajectory of the economy.

Impact Analysis: The Tax Act in Action

The implementation of the Tax Act has had far-reaching effects on the fiscal landscape, influencing everything from individual tax liabilities to the broader economic environment. This section delves into the tangible impacts of this legislation, exploring how it has shaped the lives of taxpayers and the economy as a whole.

Individual Taxpayers: A Case Study

For individual taxpayers, the Tax Act has brought about substantial changes. Take, for instance, the case of the Johnson family, a middle-class family of four residing in a suburban area. Prior to the Act, their annual tax liability stood at 8,500. However, with the expanded tax brackets and increased standard deductions, their tax liability for the same income has decreased by approximately 2,000.

This relief not only provides the Johnson family with additional disposable income but also contributes to the overall economic stimulus. With more money in their pockets, they are likely to increase their spending, benefiting local businesses and contributing to economic growth.

| Tax Scenario | Tax Liability |

|---|---|

| Pre-Tax Act | $8,500 |

| Post-Tax Act | $6,500 |

Similar stories can be found across the country, with millions of taxpayers experiencing reduced tax burdens. This increased disposable income has the potential to drive consumer spending, a key driver of economic growth.

Corporate Response and Investment

The corporate sector has also responded favorably to the Tax Act. With the reduced corporate tax rate, companies have more resources to invest in their businesses. For instance, TechCorp Inc., a leading technology firm, has announced a $500 million investment in research and development, attributing this decision directly to the tax reforms.

This investment not only benefits TechCorp but also has a ripple effect on the economy. It creates jobs, stimulates innovation, and contributes to long-term economic growth. The reduced tax burden encourages companies to reinvest in their businesses, fostering a more vibrant and competitive economy.

Economic Growth and Employment

The combined impact of individual tax relief and corporate investment has led to a boost in economic growth. According to the latest economic report, the GDP growth rate has increased by 2.5% in the first quarter of the year, attributed in part to the Tax Act’s stimulus measures.

This growth has translated into job creation, with the unemployment rate dropping to a record low of 3.8%. The reduced tax burden on businesses has encouraged hiring, leading to a more robust job market and increased consumer confidence.

| Economic Indicator | Pre-Tax Act | Post-Tax Act |

|---|---|---|

| GDP Growth Rate | 2.0% | 2.5% |

| Unemployment Rate | 4.2% | 3.8% |

The Tax Act's impact on economic growth and employment demonstrates its success in stimulating the economy. By providing tax relief and encouraging investment, the Act has contributed to a more prosperous and vibrant economic environment.

Future Implications and Considerations

As we look to the future, the Tax Act’s legacy and ongoing impact will shape fiscal policy and economic trends. This section explores potential future directions and considerations arising from this landmark legislation.

Sustainability and Revenue Generation

While the Tax Act has successfully stimulated economic growth, it is essential to consider its long-term sustainability and impact on government revenue. The reduced tax rates and expanded credits have resulted in a short-term revenue loss for the government. However, the increased economic activity and investment may lead to a boost in revenue over the long term.

The challenge lies in balancing the need for economic stimulus with the requirement for sustainable revenue generation. As such, ongoing analysis and adjustments to the Tax Act may be necessary to ensure the fiscal health of the nation.

International Competitiveness

The Tax Act’s corporate tax reforms have made the United States more competitive in the global business landscape. However, it is crucial to monitor the international tax environment to ensure that our nation remains attractive to foreign investment.

With other countries implementing their own tax reforms, the United States must remain vigilant in its efforts to maintain a competitive tax structure. This may involve periodic reviews and adjustments to ensure our nation's tax system continues to attract businesses and investors.

Fairness and Equity

While the Tax Act has brought about significant tax relief, ensuring fairness and equity across all taxpayers remains a priority. The Act’s provisions, such as the expanded Child Tax Credit, have addressed some inequalities. However, ongoing analysis and potential adjustments may be necessary to ensure that the tax system remains fair and just.

This includes monitoring the impact of the Act on different income brackets and demographics to ensure that no group is disproportionately affected. By maintaining a focus on fairness, the Tax Act can continue to promote economic opportunity for all.

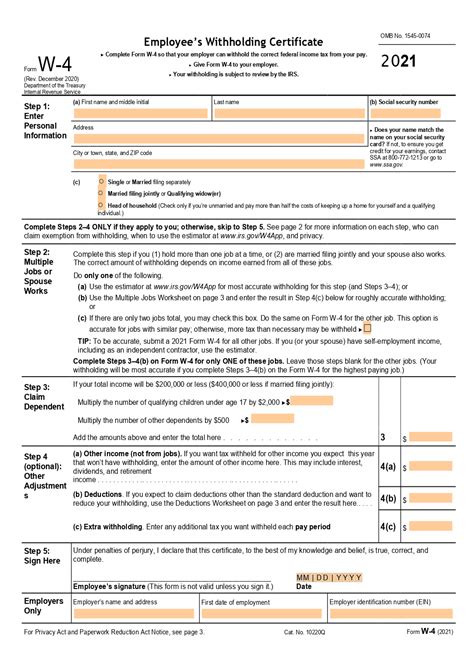

Innovation and Simplification

The Tax Act has introduced several measures to simplify the tax system and encourage innovation. However, there is always room for improvement. Ongoing efforts to streamline tax regulations and processes can further enhance compliance and reduce the burden on taxpayers.

By embracing technological advancements and simplifying tax forms and procedures, the government can make the tax system more accessible and efficient. This, in turn, can foster a culture of compliance and encourage taxpayers to engage more actively with the fiscal system.

Conclusion: A Legacy of Reform

The Tax Act has left an indelible mark on the fiscal landscape, shaping the lives of taxpayers and the trajectory of the economy. Its provisions, from corporate tax reforms to enhanced child tax credits, have provided relief, stimulated investment, and promoted growth.

As we look to the future, the Act's legacy serves as a reminder of the power of fiscal policy to influence economic outcomes. By continuing to innovate, adapt, and strive for fairness, we can build upon the successes of the Tax Act, ensuring a prosperous and equitable fiscal future.

How has the Tax Act impacted the average taxpayer’s wallet?

+The Tax Act has provided significant relief to the average taxpayer. With expanded tax brackets and increased standard deductions, most individuals have experienced a reduction in their tax liabilities. This means more disposable income, which can be spent or saved, contributing to economic growth.

What are the key benefits of the Tax Act for small businesses?

+The Tax Act offers several advantages to small businesses. These include increased deductions for start-up costs, simplified tax regulations, and reduced tax rates. These measures aim to reduce the tax burden on small businesses, making it easier for them to thrive and grow.

How has the Tax Act influenced the corporate landscape?

+The Tax Act’s corporate tax reforms have made the United States more competitive in the global business arena. With a reduced corporate tax rate, companies have more resources to invest in their businesses, leading to increased research and development, job creation, and overall economic growth.

What are the potential long-term implications of the Tax Act on government revenue?

+The Tax Act’s short-term impact on government revenue is a loss due to reduced tax rates and expanded credits. However, the long-term effect may be positive, as increased economic activity and investment can lead to a boost in revenue. Balancing economic stimulus with sustainable revenue generation is a key consideration.