Vegas Sales Tax

Sales tax is an essential aspect of doing business in any state, and Nevada, with its vibrant city of Las Vegas, is no exception. The sales tax system in Nevada is a crucial component of the state's revenue generation, influencing the cost of goods and services for both residents and visitors. In this article, we delve into the specifics of the Vegas sales tax, exploring its rates, applicability, and the unique considerations it presents for businesses and consumers alike.

Understanding the Vegas Sales Tax Structure

The sales tax in Las Vegas, Nevada, is a consumer tax levied on the sale of goods and certain services. It is a crucial revenue stream for the state and local governments, contributing significantly to the funding of public services and infrastructure.

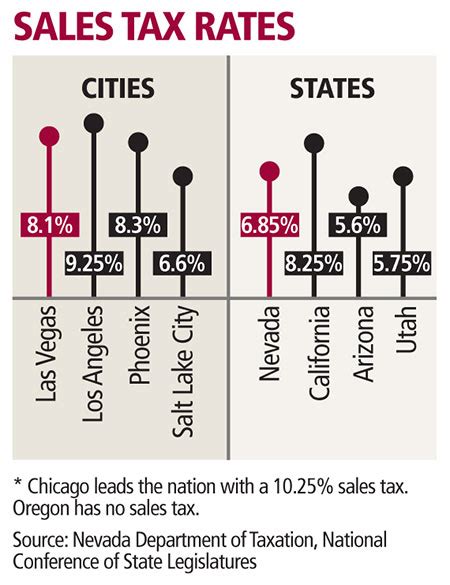

The sales tax rate in Nevada is comprised of both state and local components. The state sales tax rate is a flat 6.85%, which is applicable across the state. However, the local sales tax rate varies depending on the county and even the city. In Clark County, where Las Vegas is located, the local sales tax rate is an additional 2.65%, bringing the total sales tax rate to 9.5% in Las Vegas.

The Vegas sales tax is imposed on a wide range of goods and services, including tangible personal property, admissions, rental of living quarters, public utilities, and more. However, there are certain exemptions and special considerations, such as the sale of food and medicine, which are generally exempt from sales tax.

For businesses operating in Las Vegas, understanding the sales tax system is vital. They are responsible for collecting and remitting the sales tax to the appropriate tax authorities, ensuring compliance with the law. The sales tax is typically added to the selling price of goods or services, and it is the consumer who ultimately bears the cost of the tax.

The Impact of Tourism on Vegas Sales Tax

Las Vegas, renowned for its vibrant entertainment and tourism industry, attracts millions of visitors each year. The city’s thriving tourism sector significantly impacts the sales tax revenue generated. Tourists often spend money on a variety of goods and services, from hotel accommodations and dining to shopping and entertainment, all of which are subject to the sales tax.

The Vegas sales tax plays a crucial role in supporting the city's infrastructure and services that cater to tourists. A significant portion of the sales tax revenue is allocated towards funding tourist attractions, maintaining public spaces, and enhancing the overall visitor experience. This ensures that Las Vegas remains a world-class destination, continually improving its offerings and amenities.

Moreover, the impact of tourism on sales tax revenue extends beyond the city limits. A portion of the sales tax collected in Las Vegas is distributed to other counties and the state as a whole, contributing to the overall economic development and welfare of Nevada.

Exemptions and Special Considerations in Vegas Sales Tax

While the sales tax in Las Vegas applies to a broad range of goods and services, there are certain exemptions and special considerations to be aware of. As mentioned earlier, the sale of food and medicine is generally exempt from sales tax. However, there are specific criteria and categories that determine which food items are exempt, such as unprepared food items and over-the-counter medications.

Additionally, certain services are exempt from sales tax, including professional services like legal advice, medical services, and accounting services. Other exemptions include sales to government entities, charitable organizations, and certain religious institutions. It's crucial for businesses to stay informed about these exemptions to ensure they are compliant with the law and avoid any potential penalties.

| Sales Tax Rate | Total Tax (%) |

|---|---|

| State Sales Tax | 6.85% |

| Local Sales Tax (Clark County) | 2.65% |

| Total Sales Tax in Las Vegas | 9.5% |

Compliance and Reporting for Businesses

For businesses operating in Las Vegas, ensuring compliance with the sales tax regulations is a critical aspect of their operations. The Nevada Department of Taxation provides comprehensive guidelines and resources to assist businesses in understanding their sales tax obligations.

Businesses are required to register for a sales tax permit and obtain a unique identification number. This permit allows them to collect and remit sales tax to the state and local authorities. The process of registration typically involves providing basic business information, such as the legal name, address, and taxpayer identification number.

Once registered, businesses must collect the appropriate sales tax from their customers at the point of sale. This involves calculating the tax based on the applicable rate and adding it to the selling price. It's essential to ensure accurate calculation and collection to avoid potential penalties and legal issues.

Additionally, businesses must file periodic sales tax returns with the Nevada Department of Taxation. The frequency of these returns can vary depending on the business's sales volume and other factors. The returns provide a detailed account of the sales tax collected and remitted during a specific period, ensuring transparency and accountability.

Challenges and Best Practices in Sales Tax Compliance

Compliance with the Vegas sales tax regulations can present certain challenges for businesses. The varying tax rates across counties and the need to stay updated on tax law changes can be complex and time-consuming. To overcome these challenges, businesses can consider the following best practices:

- Utilize sales tax software: Investing in sales tax software can streamline the tax calculation, collection, and reporting processes. These tools can automate many of the complex tasks, reducing the risk of errors and ensuring compliance.

- Stay informed on tax law changes: The sales tax landscape can evolve over time, with new regulations and exemptions being introduced. Businesses should subscribe to relevant newsletters, attend webinars, and consult tax professionals to stay updated on any changes.

- Implement robust internal controls: Establishing clear policies and procedures for sales tax management can help businesses maintain accuracy and consistency. This includes regular training for staff, implementing checks and balances, and conducting internal audits.

Consumer Perspective: Understanding Sales Tax

For consumers, understanding the Vegas sales tax is essential for making informed purchasing decisions. The sales tax adds to the overall cost of goods and services, impacting the consumer’s budget and spending power. By being aware of the tax rates and exemptions, consumers can better plan their purchases and make more cost-effective choices.

When shopping in Las Vegas, consumers should expect to pay the total sales tax rate, which includes both the state and local components. This means that the price they see on the shelf or menu is not the final cost, as the sales tax will be added at the point of sale. It's a good practice for consumers to budget accordingly and factor in the sales tax when comparing prices and making purchases.

Additionally, consumers should be aware of their rights and responsibilities regarding sales tax. If they believe they have been overcharged or if they have a dispute regarding the sales tax, they can contact the Nevada Department of Taxation for assistance. Consumers also have the right to request a sales tax receipt, which serves as proof of payment and can be useful for record-keeping and potential refunds.

The Role of Sales Tax in Consumer Behavior

The Vegas sales tax can significantly influence consumer behavior and purchasing decisions. For instance, consumers may opt to purchase goods or services that are exempt from sales tax to save money. Alternatively, they may choose to make larger purchases in areas with lower sales tax rates, particularly if they are close to county or state borders.

Furthermore, the sales tax can impact the overall competitiveness of businesses in the market. Businesses with lower sales tax rates may have an advantage over their competitors, particularly for larger ticket items where the sales tax can significantly impact the final price. This can drive consumers to seek out businesses in areas with more favorable sales tax rates, influencing their shopping habits and preferences.

The Future of Vegas Sales Tax: Trends and Considerations

As Las Vegas continues to evolve and adapt to changing economic conditions, the sales tax system is likely to undergo transformations as well. Several trends and considerations may shape the future of the Vegas sales tax landscape.

Potential Tax Rate Changes

The sales tax rates in Nevada, including Las Vegas, are subject to change. While the current rates have remained stable for some time, there is always the possibility of rate adjustments in response to economic factors, budget constraints, or changing political landscapes. Businesses and consumers should stay informed about any potential changes to the sales tax rates to ensure they can adapt their strategies accordingly.

Expansion of Sales Tax Base

As technology and consumer behavior evolve, the sales tax base may also expand to include new categories of goods and services. For instance, the growing popularity of online shopping and the rise of the gig economy may lead to the taxation of certain digital services or platform-based transactions. Businesses operating in these sectors should anticipate potential changes and be prepared to adapt their sales tax strategies accordingly.

Simplification of Sales Tax Regulations

The complexity of the sales tax system, with varying rates across counties, can be a challenge for both businesses and consumers. In response, there may be efforts to simplify the sales tax regulations, potentially by implementing a uniform tax rate across the state. While this could bring administrative benefits, it may also impact the revenue streams for local governments, which currently benefit from the additional local sales tax.

How often do businesses need to file sales tax returns in Las Vegas?

+The frequency of sales tax return filings in Las Vegas depends on the business's sales volume and other factors. Typically, businesses with higher sales volumes are required to file more frequently, often on a monthly or quarterly basis. However, smaller businesses may be eligible for annual filing. It's essential for businesses to consult the Nevada Department of Taxation to determine their specific filing requirements.

Are there any special considerations for online businesses operating in Las Vegas?

+Yes, online businesses operating in Las Vegas must also comply with the sales tax regulations. They are required to collect and remit sales tax on transactions made with Nevada residents, regardless of whether the sale was made online or in-person. The specific requirements may vary depending on the business model and sales volume. Online businesses should consult the Nevada Department of Taxation for detailed guidance.

What happens if a business fails to collect or remit sales tax in Las Vegas?

+Failing to collect or remit sales tax in Las Vegas can result in significant penalties and legal consequences for businesses. The Nevada Department of Taxation may impose fines, interest charges, and even suspend the business's sales tax permit. It's crucial for businesses to prioritize sales tax compliance to avoid these potential issues and maintain their good standing with the tax authorities.

In conclusion, the Vegas sales tax is a vital component of the state’s revenue generation and a critical consideration for both businesses and consumers. With its unique structure and impact on the vibrant tourism industry, understanding the sales tax system in Las Vegas is essential for successful business operations and informed consumer decisions. As the city continues to evolve, staying informed about sales tax regulations and potential changes will be key to navigating the dynamic economic landscape of Las Vegas.