Chicago Property Tax Rate

Property taxes are a significant consideration for homeowners and real estate investors, and understanding the tax rates in different cities is crucial for financial planning. In this comprehensive guide, we delve into the property tax landscape of Chicago, Illinois, exploring the rates, factors influencing them, and their impact on residents and the local economy.

Unraveling Chicago’s Property Tax Structure

Chicago, the vibrant city by the lake, boasts a unique and intricate property tax system. Unlike some other cities, Chicago’s property tax rates are not a flat percentage applied uniformly across the city. Instead, they are determined by a combination of factors, creating a complex yet fascinating financial landscape.

Assessed Value: The Foundation

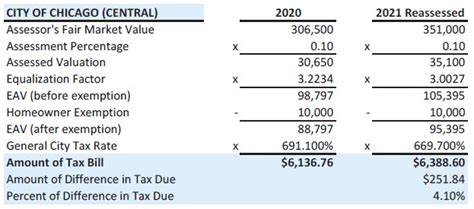

The journey towards understanding Chicago’s property tax begins with the assessed value of a property. This value is not the same as the market value; instead, it’s a figure determined by the Cook County Assessor’s office. The assessor considers various factors, including recent sales of comparable properties, location, and property features, to arrive at an assessed value.

The assessed value is crucial because it forms the basis for calculating property taxes. In Chicago, the tax rate is applied to this assessed value, resulting in the tax bill for the year.

Tax Rates: A Multifaceted Picture

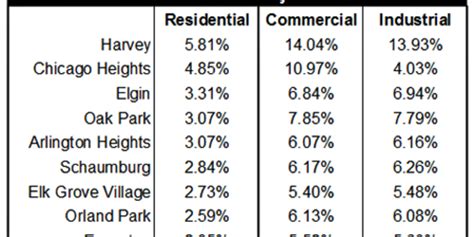

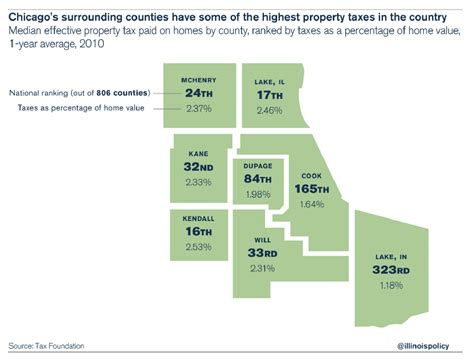

Chicago’s property tax rates are not a single, city-wide percentage. Instead, they vary based on the type of property and its location within the city. For instance, residential properties might have different tax rates compared to commercial or industrial properties.

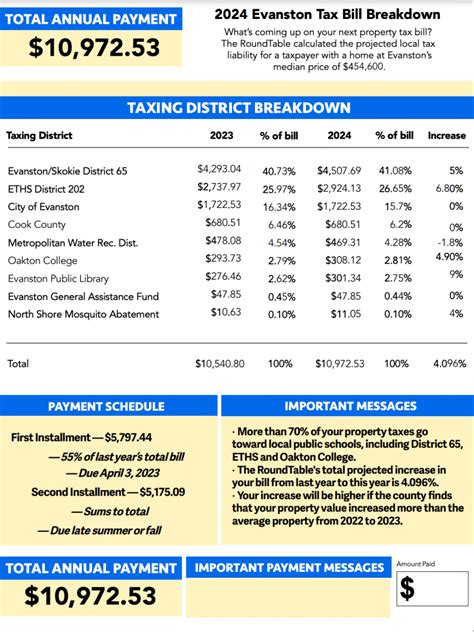

Furthermore, Chicago is divided into various tax assessment areas, each with its own unique tax rate. These rates can vary significantly, with some areas experiencing higher taxes due to the services and infrastructure they support. For instance, areas with extensive public transportation networks or high-quality schools might have higher tax rates to fund these amenities.

Additionally, Chicago has a homestead exemption for owner-occupied residences. This exemption reduces the assessed value of a property, thereby lowering the tax bill. This exemption is a significant relief for homeowners and encourages homeownership within the city.

The Impact on Residents

Chicago’s property tax system has a direct impact on its residents. For homeowners, property taxes are a significant financial obligation, often forming a large portion of their annual expenses. The varying tax rates across the city can lead to different financial considerations for residents in different neighborhoods.

Investors and landlords also feel the impact of property taxes. The tax burden can influence investment strategies, with some areas offering more attractive returns due to lower tax rates. On the other hand, areas with higher taxes might require more creative financial planning to ensure profitability.

Analyzing Property Tax Rates Across Chicago

To truly understand Chicago’s property tax landscape, let’s delve into some real-world examples and data. These insights will provide a clearer picture of how property taxes vary across the city and the factors influencing these variations.

Residential Properties: A Case Study

Let’s consider a single-family home in the Lakeview neighborhood of Chicago. This home, with an assessed value of 350,000, is subject to a tax rate of 2.15%. Applying this rate, the annual property tax bill for this home amounts to 7,575.

Now, let's compare this to a similar home in the West Loop neighborhood. This property, with an assessed value of $400,000, is subject to a higher tax rate of 2.35%. As a result, the annual property tax bill for this home is $9,400.

| Neighborhood | Assessed Value | Tax Rate | Annual Tax Bill |

|---|---|---|---|

| Lakeview | $350,000 | 2.15% | $7,575 |

| West Loop | $400,000 | 2.35% | $9,400 |

Commercial Properties: A Different Perspective

The property tax landscape for commercial properties in Chicago offers a different dynamic. These properties often face higher tax rates compared to residential properties, but the impact can vary based on the nature of the business and the neighborhood.

For instance, a retail store in the bustling downtown area might face a tax rate of 3.25%, while a similar store in a less commercialized neighborhood might have a rate of 2.85%. This difference in tax rates can influence business strategies, with some businesses opting for locations that offer a more favorable tax environment.

Factors Influencing Property Tax Rates

Chicago’s property tax rates are not arbitrary. They are influenced by a myriad of factors, each playing a crucial role in shaping the financial landscape of the city.

City Services and Infrastructure

One of the primary drivers of property tax rates is the cost of providing city services and maintaining infrastructure. Areas with more extensive services, such as advanced transportation networks, high-quality schools, or robust public safety measures, often require higher tax rates to fund these amenities.

For instance, neighborhoods with highly-rated public schools might have higher tax rates to support the educational system. Similarly, areas with efficient public transportation might face higher taxes to fund the maintenance and expansion of these networks.

Economic Development Initiatives

Chicago, like many cities, has areas that are designated for economic development. These areas often receive special tax treatment to encourage investment and growth. For instance, a neighborhood undergoing a redevelopment project might have a temporary tax break to attract businesses and investors.

Historical Factors

Chicago’s history also plays a role in its property tax rates. Some neighborhoods, due to their historical significance or cultural value, might have different tax rates to preserve their unique character. These areas often require more funding for preservation efforts, leading to higher tax rates.

Navigating Chicago’s Property Tax Landscape

Understanding Chicago’s property tax system is crucial for both residents and investors. It allows for informed financial planning and can influence decisions about where to buy or invest in real estate.

For homeowners, being aware of the tax rates in their neighborhood can help budget effectively. Investors, on the other hand, can use this knowledge to identify areas that offer the best returns based on tax considerations. Additionally, understanding the factors that influence tax rates can provide insights into the potential future trajectory of these rates.

Future Implications and Potential Changes

As with any financial system, Chicago’s property tax landscape is not static. It evolves with changes in the economy, city services, and political decisions. While it’s challenging to predict exact future tax rates, understanding the current dynamics can provide a framework for anticipating potential changes.

For instance, as Chicago continues to invest in infrastructure and services, especially in response to the city's growth and changing needs, tax rates might need to adjust to fund these initiatives. On the other hand, economic downturns or changes in political leadership could lead to tax rate adjustments as well.

Additionally, as Chicago continues its efforts to attract businesses and residents, it might consider tax incentives or reforms to make the city more competitive. These changes could influence the tax landscape significantly, offering new opportunities for investors and homeowners alike.

Conclusion: A Complex Yet Vital Financial System

Chicago’s property tax system is a complex web of rates, exemptions, and assessment areas, each with its unique characteristics. Understanding this system is crucial for navigating the city’s real estate market and financial landscape.

Whether you're a homeowner looking to budget effectively or an investor seeking profitable opportunities, knowledge of Chicago's property tax rates and the factors influencing them is a powerful tool. It allows for informed decision-making and can influence the financial trajectory of individuals and businesses within the city.

How often do property tax rates change in Chicago?

+

Property tax rates in Chicago can change annually, as they are influenced by various factors, including the city’s budget, economic conditions, and political decisions. The Cook County Assessor’s office reviews and adjusts property values periodically, which can impact tax rates.

Are there any tax breaks or incentives for homeowners in Chicago?

+

Yes, Chicago offers several tax breaks and incentives for homeowners. The most notable is the homestead exemption, which reduces the assessed value of owner-occupied residences, thereby lowering property taxes. Other incentives include the Senior Citizen Homestead Exemption and the Senior Citizen Assessment Freeze Homestead Exemption.

How do property taxes impact the real estate market in Chicago?

+

Property taxes can significantly influence the real estate market in Chicago. Higher tax rates can make certain areas less attractive to buyers and investors, while lower rates can boost demand. Property taxes also impact the overall affordability of homes, especially for first-time buyers.

What steps can homeowners take to reduce their property taxes in Chicago?

+

Homeowners in Chicago can take several steps to potentially reduce their property taxes. This includes ensuring their property’s assessed value is accurate and challenging any potential overassessments. They can also explore the various tax exemption programs offered by the city to see if they qualify.