Sf Tax Rate

The tax system in San Francisco, often referred to as SF, is an intricate framework that plays a pivotal role in the city's economic landscape. It encompasses various tax categories, each designed to contribute to the city's revenue and influence its fiscal policies. This article delves into the SF tax rate, providing an in-depth analysis of its components, impacts, and future prospects.

Unraveling the SF Tax Structure

San Francisco’s tax structure is a multifaceted system, comprising both state and city-specific taxes. At its core, it includes income tax, sales tax, property tax, and a range of other taxes and fees, each serving a distinct purpose in funding the city’s operations and development.

Income Tax: A Significant Revenue Stream

Income tax forms a substantial part of SF’s tax revenue. The city imposes an income tax on its residents and businesses, with rates varying based on income brackets. For instance, individuals with taxable income up to 20,000 are subject to a rate of 1.5%, while those with higher incomes face progressively higher rates, reaching up to 3.5% for incomes over 1 million.

Similarly, businesses in SF are taxed on their net income. The city's business income tax rates range from 1.5% to 1.7%, depending on the type of business and its revenue. This tax is a significant source of revenue for the city, supporting its infrastructure and public services.

| Income Bracket | Income Tax Rate |

|---|---|

| Up to $20,000 | 1.5% |

| $20,001 - $40,000 | 2% |

| $40,001 - $60,000 | 2.25% |

| $60,001 - $1 million | 2.5% |

| Over $1 million | 3.5% |

The city's income tax system is designed to be progressive, ensuring that higher-income earners contribute a larger proportion of their income to the city's coffers. This approach is in line with the principles of economic fairness and aims to maintain a balanced revenue stream.

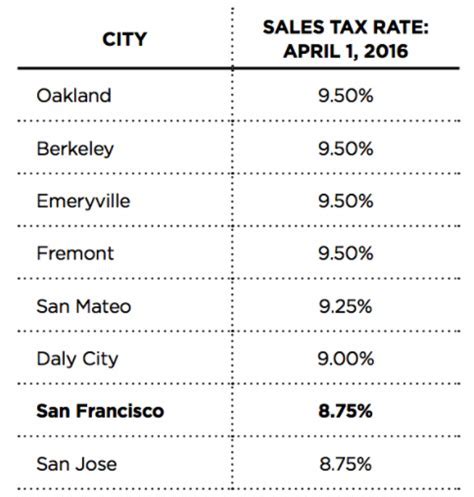

Sales Tax: A Key Source of Revenue

Sales tax is another vital component of SF’s tax landscape. It is a tax levied on the sale of goods and services within the city. The sales tax rate in San Francisco is currently 8.5%, which includes both the state and city components. This tax is collected from consumers at the point of sale and is a significant revenue generator for the city.

The sales tax in SF is comprised of various components. The state of California imposes a base sales tax rate of 7.25%, while San Francisco adds a local sales tax of 1.25%. Additionally, there is a countywide transportation tax of 0.5%, bringing the total sales tax rate to 8.5%.

This tax is particularly important for funding public transportation, as the countywide transportation tax is dedicated to improving and maintaining the city's transport infrastructure. It also contributes to other essential services, such as education, healthcare, and public safety.

| Tax Component | Rate |

|---|---|

| State Sales Tax | 7.25% |

| San Francisco Local Tax | 1.25% |

| Countywide Transportation Tax | 0.5% |

Property Tax: A Stable Revenue Source

Property tax is a cornerstone of SF’s tax system, providing a stable and predictable revenue stream. This tax is levied on the value of real estate properties within the city, including residential, commercial, and industrial properties.

The property tax rate in San Francisco is 1.5% of the assessed value of the property. This rate is set by Proposition 13, a state law that limits property tax increases to a maximum of 2% per year unless there is a change in ownership. This stability in property tax rates provides a reliable income source for the city.

Property tax revenues fund a wide range of city services, including schools, fire and police departments, libraries, and parks. It is a significant contributor to SF's fiscal health and plays a crucial role in maintaining the city's infrastructure and public amenities.

Impact of SF Tax Rates on Residents and Businesses

The tax rates in San Francisco have a profound impact on both residents and businesses. While they contribute to the city’s fiscal stability and the provision of essential services, they also influence economic decisions and growth.

Resident Perspectives

For residents, the tax system in SF can be both a burden and a benefit. The progressive income tax structure means that higher-income earners contribute more to the city’s revenue, which can be seen as a form of economic fairness. However, it also means that those with higher incomes face a larger tax burden.

Sales tax, while a common feature in most cities, can be a significant expense for residents. The 8.5% sales tax rate in SF adds a considerable cost to everyday purchases, from groceries to electronics. This can impact residents' purchasing power and their overall cost of living.

On the other hand, property tax rates in SF, while higher than in some other cities, are relatively stable due to Proposition 13. This stability provides predictability for homeowners and can make the city more attractive for those seeking a long-term residence.

Business Implications

Businesses operating in San Francisco face a unique set of tax challenges and opportunities. The city’s business income tax rates, while relatively low compared to some other major cities, still add to the overall cost of doing business.

The sales tax, at 8.5%, can be a significant expense for businesses, especially those selling tangible goods. This tax is often passed on to consumers, impacting the competitiveness of local businesses in the market. However, it also provides a significant revenue stream for the city, which can be beneficial for businesses that rely on city-funded infrastructure and services.

Property tax, while stable, can be a substantial cost for businesses, especially those operating in commercial or industrial spaces. This tax is a major contributor to the city's revenue and is a key factor in the city's fiscal health.

Future Prospects and Policy Considerations

Looking ahead, the future of SF’s tax rates is a subject of ongoing debate and policy formulation. With changing economic landscapes and evolving community needs, the city’s tax system must adapt to remain effective and equitable.

Policy Directions

One of the key considerations for SF’s tax policy is the balance between revenue generation and economic competitiveness. While the city needs a robust tax system to fund essential services and infrastructure, high tax rates can deter businesses and impact the local economy.

There is an ongoing discussion about the potential for tax reforms to make the system more equitable and efficient. This includes proposals to adjust tax brackets, introduce new taxes on specific industries or services, and explore alternative revenue streams, such as tourism taxes or digital service taxes.

Economic and Social Impact

Changes to tax rates can have far-reaching implications. Lower tax rates could attract new businesses and residents, boosting the local economy. However, they might also lead to reduced revenue, impacting the city’s ability to provide services and maintain its infrastructure.

Conversely, higher tax rates could generate more revenue, enabling the city to invest in critical services and infrastructure upgrades. However, this might also make the city less attractive to businesses and residents, potentially leading to economic stagnation.

The city's tax policy is therefore a delicate balance, requiring careful consideration of economic, social, and environmental factors to ensure a sustainable and equitable future for all San Franciscans.

How does San Francisco’s tax system compare to other major cities in California or the US?

+San Francisco’s tax system, with its combination of income, sales, and property taxes, is similar to that of other major cities in California and the US. However, there are some variations in rates and structures. For instance, SF’s income tax rates are lower than those of New York City, while its sales tax rate is comparable to many other large cities. Property tax rates in SF are influenced by Proposition 13, which limits annual increases, making them more stable than in some other cities.

Are there any tax incentives or programs in San Francisco to encourage business growth or attract specific industries?

+Yes, San Francisco offers various tax incentives and programs to promote business growth and attract specific industries. These include tax breaks for renewable energy projects, incentives for film and television production, and tax exemptions for certain technology companies. The city also provides assistance and incentives for small businesses and startups, aiming to foster a vibrant entrepreneurial ecosystem.

How does San Francisco allocate its tax revenue, and what are some key areas of expenditure?

+San Francisco’s tax revenue is allocated across various sectors to fund essential services and infrastructure. Key areas of expenditure include public education, public safety (police and fire departments), healthcare, transportation, and environmental initiatives. The city also invests in affordable housing, homeless services, and community development projects.