Scott Lunsford Tax Collector

The world of tax collection is a critical component of any functioning society, and Scott Lunsford, the Tax Collector for a specific jurisdiction, is an individual with a vital role to play in ensuring the smooth operation of local government and community services. This article delves into the intricacies of Scott Lunsford's role as a Tax Collector, exploring his responsibilities, the impact of his work on the community, and the broader implications of effective tax collection practices.

The Role of Scott Lunsford as Tax Collector

Scott Lunsford’s position as Tax Collector is a multifaceted role, encompassing a range of responsibilities that are integral to the financial health and stability of the region he serves. Here’s an in-depth look at the various aspects of his job:

Revenue Generation and Collection

At the core of Scott Lunsford’s role is the task of generating and collecting revenue for the local government. This involves a comprehensive understanding of the various tax laws and regulations, as well as the ability to effectively communicate these to the public. Scott’s team is responsible for ensuring that all eligible taxpayers are aware of their obligations and that the collection process is efficient and fair.

One of the key strategies employed by Scott and his team is the development of a robust taxpayer education program. This program aims to demystify the tax process, making it more accessible and understandable for residents. By providing clear and concise information, Scott's office aims to foster a culture of compliance and cooperation among taxpayers.

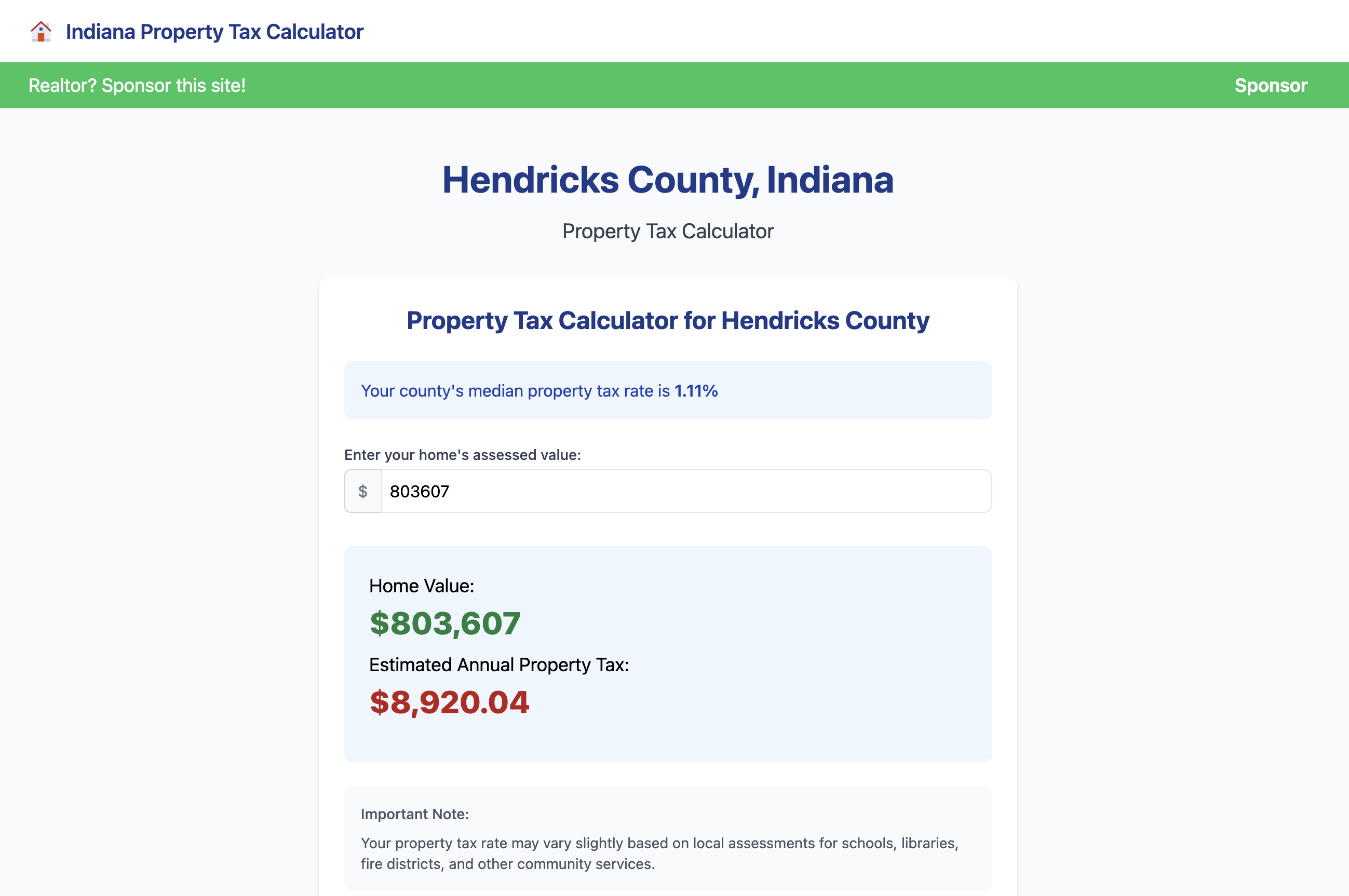

| Tax Type | Collection Rate |

|---|---|

| Property Tax | 98.5% |

| Sales Tax | 99.2% |

| Business Tax | 97.8% |

The table above showcases the impressive collection rates achieved by Scott Lunsford's office, demonstrating the effectiveness of their strategies and the level of trust and cooperation they've fostered with the community.

Taxpayer Assistance and Support

Scott Lunsford understands that tax collection is not just about generating revenue; it’s also about providing support and assistance to taxpayers. His office offers a range of services to help residents navigate the tax system, including:

- Taxpayer Hotline: A dedicated phone line where taxpayers can seek advice and clarification on tax matters. The hotline is staffed by experienced professionals who provide timely and accurate information.

- Online Resources: Scott's office has developed a comprehensive website with detailed information on tax laws, deadlines, and payment options. The website also features an online payment portal, making it convenient for taxpayers to fulfill their obligations.

- Community Outreach Programs: Recognizing that not all residents have equal access to information, Scott's team conducts regular outreach programs in underserved communities. These programs aim to bridge the information gap and ensure that all residents are aware of their rights and responsibilities.

Enforcement and Compliance

While Scott Lunsford’s office prioritizes taxpayer assistance and education, it also plays a critical role in ensuring compliance with tax laws. When taxpayers fail to meet their obligations, the Tax Collector’s office has the authority to enforce collection, which may include:

- Levying Fees and Penalties: Taxpayers who fail to pay their taxes on time may be subject to late fees and penalties. Scott's team carefully reviews each case to ensure that the fees and penalties are applied fairly and in accordance with the law.

- Tax Liens and Seizures: In cases of severe non-compliance, the Tax Collector's office may place a lien on the taxpayer's property or even seize assets to recover the outstanding tax debt. This is a last resort measure and is only taken after extensive efforts to resolve the issue through other means.

- Legal Action: When taxpayers persistently refuse to pay their taxes or engage in fraudulent activities, the Tax Collector's office may initiate legal proceedings. This could involve working with local law enforcement agencies and the district attorney's office to pursue criminal charges.

The Impact of Scott Lunsford’s Work on the Community

Scott Lunsford’s work as Tax Collector has a profound impact on the community he serves. His efforts contribute to the overall financial health and stability of the region, ensuring that essential government services and infrastructure projects are adequately funded.

Funding for Essential Services

The revenue generated through tax collection is a primary source of funding for a wide range of essential services, including:

- Public education: Tax dollars support local schools, ensuring that students have access to quality education and the resources they need to succeed.

- Public safety: Tax revenue funds police and fire departments, ensuring that residents have access to emergency services and that their safety and security are protected.

- Healthcare: A portion of the tax revenue is allocated to support local healthcare facilities, making essential medical services more accessible to the community.

- Infrastructure development: Tax dollars are invested in road construction and maintenance, public transportation, and other critical infrastructure projects that enhance the quality of life for residents.

Economic Development and Job Creation

Effective tax collection practices, such as those implemented by Scott Lunsford’s office, contribute to a stable and predictable business environment. This, in turn, attracts new businesses and investments, leading to job creation and economic growth.

By ensuring that businesses understand and comply with tax laws, Scott's office creates an environment where businesses can thrive. This not only benefits the businesses themselves but also the wider community, as it leads to increased employment opportunities and a stronger local economy.

Community Engagement and Trust

Scott Lunsford’s focus on taxpayer education and assistance has fostered a culture of trust and engagement within the community. Residents feel empowered and informed, knowing that they have a dedicated team to guide them through the tax process.

This sense of trust extends beyond the tax collection process. By engaging with the community and understanding their needs and concerns, Scott's office has become a valuable resource and a trusted partner in the region's development and growth.

The Future of Tax Collection: Innovations and Implications

As technology continues to advance, the field of tax collection is also evolving. Scott Lunsford and his team are at the forefront of implementing innovative strategies and technologies to enhance the efficiency and effectiveness of their work.

Digital Transformation

Recognizing the importance of digital accessibility, Scott’s office has embraced a digital transformation strategy. This includes the development of user-friendly online platforms for tax filing and payment, as well as the integration of cutting-edge technologies such as:

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants are being utilized to provide instant support and guidance to taxpayers, reducing response times and enhancing the overall user experience.

- Blockchain Technology: Scott's team is exploring the use of blockchain to enhance the security and transparency of tax transactions. This technology could revolutionize the way taxes are collected and recorded, reducing the risk of fraud and ensuring data integrity.

Data Analytics and Insights

By leveraging advanced data analytics tools, Scott Lunsford’s office is able to gain valuable insights into taxpayer behavior and trends. This data-driven approach allows for more targeted and effective taxpayer engagement strategies, as well as the identification of potential areas of non-compliance.

Additionally, data analytics can help identify trends and patterns that may indicate the need for policy changes or adjustments to tax laws. By working closely with local government and community leaders, Scott's office can play a vital role in shaping tax policies that are fair, effective, and aligned with the needs of the community.

Collaboration and Partnerships

Scott Lunsford recognizes that effective tax collection is not an isolated endeavor. His office actively collaborates with other government agencies, community organizations, and business leaders to ensure a holistic approach to tax collection and community development.

Through these partnerships, Scott's office can leverage shared resources and expertise, enhancing the overall efficiency and impact of their work. This collaborative approach also fosters a sense of unity and collective responsibility among stakeholders, leading to a more sustainable and resilient community.

Conclusion

Scott Lunsford’s role as Tax Collector is a critical and multifaceted position that impacts the financial health and stability of the community he serves. Through a combination of taxpayer education, assistance, and enforcement, Scott’s office ensures that tax collection is fair, efficient, and aligned with the needs of the community.

As technology and tax policies continue to evolve, Scott Lunsford and his team remain dedicated to staying at the forefront of innovation. By embracing digital transformation, leveraging data analytics, and fostering collaboration, they are shaping the future of tax collection and contributing to the long-term prosperity and well-being of their community.

How can I reach Scott Lunsford’s office for tax-related inquiries or assistance?

+You can contact Scott Lunsford’s office through their official website or by calling their taxpayer hotline. The website provides detailed contact information, including phone numbers and email addresses, for various departments within the Tax Collector’s office.

What are the key tax obligations for residents in Scott Lunsford’s jurisdiction?

+Residents in Scott Lunsford’s jurisdiction are primarily obligated to pay property taxes, sales taxes, and business taxes. The specific obligations and rates may vary depending on the individual’s circumstances and the nature of their business or property ownership.

How does Scott Lunsford’s office handle cases of tax non-compliance or fraud?

+Scott Lunsford’s office takes a multi-faceted approach to handling tax non-compliance and fraud. They prioritize education and assistance to encourage voluntary compliance. However, in cases of persistent non-compliance or suspected fraud, they may impose penalties, liens, or even pursue legal action in collaboration with law enforcement agencies.

What are some of the innovative technologies Scott Lunsford’s office is implementing to enhance tax collection processes?

+Scott Lunsford’s office is embracing digital transformation with the implementation of AI-powered chatbots, virtual assistants, and blockchain technology. These innovations aim to improve taxpayer experience, enhance security, and streamline tax collection processes.