Sales Tax Car Georgia

The topic of sales tax on cars in the state of Georgia is an important consideration for both residents and those looking to purchase vehicles in this region. Sales tax is a significant source of revenue for state and local governments, and understanding the rules and regulations surrounding it can help consumers make informed decisions and potentially save money.

In this comprehensive guide, we will delve into the specifics of sales tax on cars in Georgia, exploring the rates, exemptions, and processes involved. By providing an in-depth analysis, we aim to offer valuable insights to car buyers and ensure a smoother purchasing experience.

Understanding Sales Tax in Georgia

Sales tax in Georgia is a consumption tax imposed on the purchase of goods and certain services. It is an essential component of the state’s revenue system, contributing to the funding of public services, infrastructure, and education. While sales tax rates may vary across states, Georgia’s sales tax structure is relatively straightforward, with a uniform rate applied to most taxable items.

The state of Georgia imposes a base sales tax rate of 4%, which is applicable to the majority of retail sales. However, it is important to note that local municipalities and counties have the authority to add additional sales tax rates, resulting in a combined sales tax rate that can vary from one location to another.

Sales Tax on Vehicles in Georgia

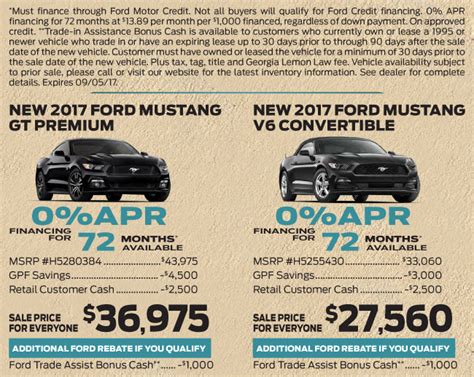

When it comes to purchasing a vehicle, understanding the sales tax implications is crucial. In Georgia, the sales tax rate for cars, trucks, and motorcycles is generally higher than the base rate. As of my last update in January 2023, the sales tax rate for vehicles in Georgia is set at 7%, which includes the state’s base rate and an additional 3% local tax. This rate is applied to the total purchase price of the vehicle, including any options, accessories, and dealer preparation fees.

For example, if you are purchasing a new car priced at $30,000, the sales tax calculated at 7% would amount to $2,100. This tax is due at the time of purchase and is typically included in the final transaction cost.

It is worth noting that the sales tax rate for vehicles can vary depending on the specific location within Georgia. Some counties may have slightly different rates, so it is advisable to check with the local tax authority or consult a reputable tax advisor for the most accurate and up-to-date information.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Cars, Trucks, and Motorcycles | 7% |

| RVs, Trailers, and Motorhomes | 3% |

Exemptions and Special Considerations

While the standard sales tax rate applies to most vehicle purchases, there are certain exemptions and special cases to be aware of. Georgia offers exemptions for specific types of vehicles and under certain circumstances. Here are some notable exemptions:

RVs, Trailers, and Motorhomes

For Recreational Vehicles (RVs), trailers, and motorhomes, the sales tax rate is significantly lower at 3%. This reduced rate applies to the purchase of these vehicles, providing a financial benefit to buyers. However, it is important to note that this rate may vary depending on the county where the purchase is made.

Trade-Ins and Used Vehicles

When trading in a vehicle or purchasing a used car, the sales tax calculation can be slightly different. In Georgia, the sales tax is applied to the difference between the trade-in value and the purchase price of the new vehicle. This ensures that the tax is calculated based on the net amount involved in the transaction.

For example, if you trade in your old car valued at $5,000 and purchase a new vehicle for $30,000, the sales tax would be calculated on the difference of $25,000 ($30,000 - $5,000). This approach ensures fairness and prevents double taxation.

Military and Veteran Benefits

Georgia extends special considerations to military personnel and veterans when it comes to vehicle sales tax. Under certain conditions, active-duty military members, reservists, and veterans may be eligible for tax exemptions or reduced rates. It is recommended to consult with the appropriate military tax offices or legal advisors to understand the specific requirements and qualifications for these benefits.

Sales Tax Calculation and Payment Process

Calculating and paying sales tax on a vehicle purchase in Georgia involves a few key steps. Here’s a simplified breakdown of the process:

- Determine the Purchase Price: The first step is to establish the total purchase price of the vehicle, including all applicable fees and charges. This price forms the basis for calculating the sales tax.

- Calculate the Sales Tax: Multiply the purchase price by the applicable sales tax rate. For vehicles, this rate is typically 7%, but it's essential to verify the exact rate for your specific location.

- Add the Sales Tax to the Total: The calculated sales tax amount is then added to the original purchase price to determine the final transaction cost. This amount is what you will pay to the dealership or seller.

- Make the Payment: Sales tax on vehicles is typically due at the time of purchase. The dealership or seller will collect the sales tax and remit it to the appropriate tax authorities on your behalf.

It's important to note that while the dealership handles the tax collection and remittance, it is the buyer's responsibility to ensure that the sales tax is accurately calculated and paid. In the event of any discrepancies, it is advisable to consult with a tax professional or the relevant tax authorities for guidance.

Future Implications and Tips for Buyers

Understanding the sales tax landscape in Georgia is crucial for making informed decisions when purchasing a vehicle. Here are some key takeaways and considerations for car buyers:

- Research Local Rates: Sales tax rates can vary across counties in Georgia. Before finalizing your purchase, research the specific sales tax rate applicable to your location to ensure accurate calculations.

- Consider Trade-Ins: Trading in your old vehicle can provide tax benefits by reducing the taxable amount. Evaluate the trade-in value and negotiate with dealerships to maximize the potential savings.

- Explore Financing Options: Financing a vehicle can impact the sales tax calculation. Consider different financing options and consult with lenders to understand how it affects your overall tax liability.

- Stay Informed on Exemptions: Keep yourself updated on any potential exemptions or special programs that may apply to your situation. Military personnel, veterans, and individuals with specific disabilities may be eligible for tax benefits.

- Seek Professional Advice: If you have complex financial circumstances or are unsure about the sales tax implications, it is advisable to consult with a tax professional or financial advisor who can provide personalized guidance.

Frequently Asked Questions

What is the sales tax rate for vehicles in Georgia in 2023?

+

The sales tax rate for vehicles in Georgia is 7% as of 2023, which includes the state’s base rate and an additional local tax.

Are there any exemptions for sales tax on vehicles in Georgia?

+

Yes, there are exemptions for certain types of vehicles and under specific circumstances. For example, RVs, trailers, and motorhomes have a reduced sales tax rate of 3%. Military personnel and veterans may also be eligible for tax benefits.

How is sales tax calculated on a vehicle trade-in in Georgia?

+

When trading in a vehicle, the sales tax is calculated on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that the tax is applied to the net amount involved in the transaction.

Can I negotiate the sales tax on a vehicle purchase in Georgia?

+

While the sales tax rate is generally non-negotiable, you can negotiate the overall purchase price of the vehicle, which indirectly affects the sales tax amount. Additionally, exploring trade-in options and financing deals can provide opportunities for savings.

What happens if I don’t pay the sales tax on my vehicle purchase in Georgia?

+

Failing to pay the sales tax on a vehicle purchase can result in penalties, interest charges, and potential legal consequences. It is important to ensure that the sales tax is paid in full at the time of purchase.