How To Refile Taxes

Taxes are an unavoidable aspect of our financial lives, and sometimes, despite our best efforts, we may find ourselves needing to refile our tax returns. Refiling taxes can be a complex process, but with the right knowledge and guidance, it can be a smooth and stress-free experience. In this comprehensive guide, we will delve into the world of tax refiling, providing you with expert insights and step-by-step instructions to navigate this often-daunting task.

Understanding the Reasons for Refiling Taxes

Before we dive into the refiling process, it’s crucial to understand the common reasons why individuals may need to refile their taxes. Here are some scenarios that might prompt you to take this step:

- Mistakes or Errors: Sometimes, simple mistakes can occur during the initial tax filing process. These errors could range from incorrect calculations to missed deductions or credits. Refiling allows you to correct these oversights and ensure you receive the accurate tax refund or minimize any owed amounts.

- Missing or Incomplete Information: If you realize that crucial information was left out of your original tax return, such as income from a side gig or deductions for medical expenses, refiling becomes necessary. This ensures you capture all eligible deductions and credits, maximizing your tax benefits.

- Changes in Filing Status: Life events such as marriage, divorce, or the birth of a child can impact your filing status and tax liability. Refiling allows you to adjust your tax return to reflect these changes accurately, potentially leading to a more favorable tax outcome.

- Audit or Review: In some cases, the IRS or state tax authorities may initiate an audit or review of your tax return. If they identify discrepancies or errors, they may require you to refile to correct the issues and provide supporting documentation.

- Additional Income or Deductions: After filing your taxes, you may discover new sources of income or eligible deductions that you missed during the initial filing period. Refiling enables you to incorporate this additional information and potentially reduce your tax liability.

Preparing for the Refiling Process

Now that we’ve identified some common reasons for refiling, let’s explore the steps you need to take to prepare for the process.

- Gather Your Documents: Start by collecting all the necessary documents and records related to your income, deductions, and credits. This includes pay stubs, W-2 forms, 1099 forms, receipts for expenses, and any other relevant financial documents. Ensure you have accurate and up-to-date information to support your refiled return.

- Review Your Original Return: Carefully examine your original tax return to identify the areas that need correction or adjustment. Compare it with the new information you have gathered to ensure you address all necessary changes.

- Calculate the Differences: Determine the differences between your original return and the revised one. Calculate any additional income, deductions, or credits you are claiming. This step is crucial to ensure accuracy and avoid further complications.

- Choose the Refiling Method: You have the option to refile your taxes manually or use tax preparation software. If you are comfortable with tax forms and calculations, you can opt for the manual method. However, tax software can simplify the process and reduce the risk of errors.

- Consider Professional Assistance: If you are unsure about the refiling process or have complex tax situations, seeking the guidance of a tax professional or accountant can be beneficial. They can provide expert advice and ensure your refiled return is accurate and compliant with tax regulations.

Key Considerations for Refiling Taxes

As you prepare to refile your taxes, keep the following considerations in mind to streamline the process:

- Deadlines: Be mindful of the deadlines for refiling taxes. The IRS typically allows a certain period for correcting errors or amending returns. Missing these deadlines could result in penalties or additional complications.

- Amended Return Form: If you are refiling due to a mistake or change in circumstances, you will need to file an Amended U.S. Individual Income Tax Return (Form 1040-X). This form allows you to correct your original return and recalculate your tax liability.

- Record-Keeping: Maintain thorough records of your tax-related documents, both for your original return and the refiled one. This practice ensures you have the necessary evidence to support your claims and simplifies the process if any further questions arise.

- Communication with the IRS: If you are refiling due to an audit or review, stay in communication with the IRS. Provide them with the requested information and documents promptly to resolve the issue efficiently.

Step-by-Step Guide to Refiling Taxes

Now, let’s walk through the step-by-step process of refiling your taxes, ensuring a smooth and accurate outcome.

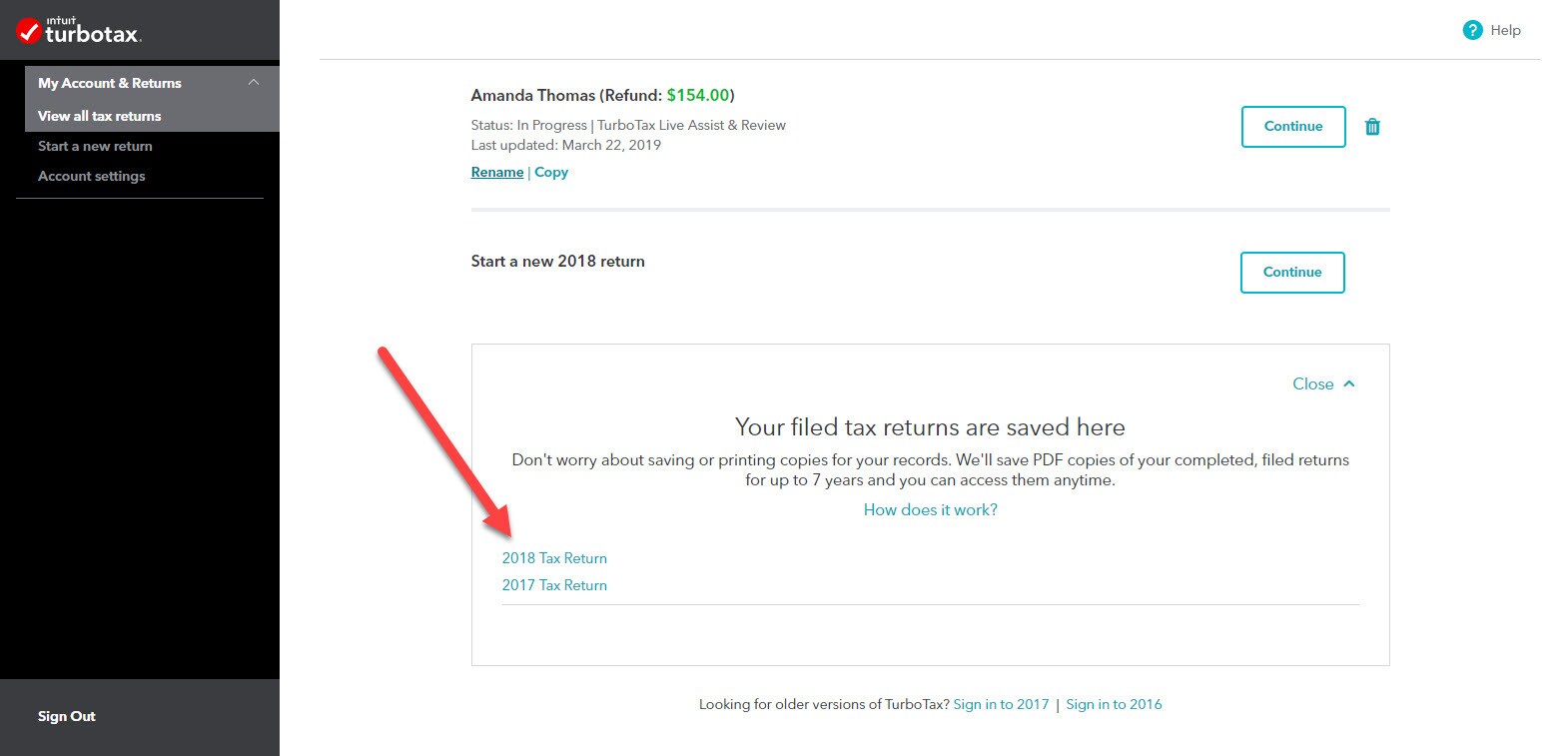

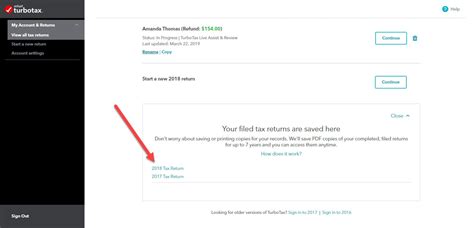

- Choose Your Refiling Method: As mentioned earlier, you have the option to refile manually or use tax preparation software. Consider your comfort level and the complexity of your tax situation when making this decision.

- Gather Required Forms and Information: Whether you choose to refile manually or use software, you will need specific forms and information. These include Form 1040-X for amended returns, as well as supporting documentation such as W-2 forms, 1099 forms, and receipts.

- Correct Errors or Add Missing Information: Review your original return and identify the errors or missing information that need correction. Make the necessary adjustments, ensuring accuracy and completeness.

- Recalculate Your Tax Liability: Using the corrected information, recalculate your tax liability. This involves adjusting your income, deductions, and credits to reflect the changes. Be precise and double-check your calculations to avoid further errors.

- Complete the Amended Return Form: If you are refiling due to an error or change in circumstances, complete Form 1040-X. Follow the instructions carefully, providing all the necessary details and explanations for the amendments.

- Attach Supporting Documents: Along with the amended return form, attach any supporting documents that validate the changes you have made. This could include additional W-2 forms, expense receipts, or other relevant records.

- Sign and Date the Return: Before submitting your refiled return, sign and date it. Ensure that your signature matches the one on your original return to maintain consistency.

- Submit Your Refiled Return: Follow the instructions provided by the IRS or your state tax authority for submitting amended returns. You can mail the completed forms and supporting documents or use electronic filing options, depending on your preference and eligibility.

- Track Your Return Status: Once you have submitted your refiled return, track its status to ensure it has been processed successfully. The IRS provides online tools and resources to help you monitor the progress of your amended return.

- Await Response or Refund: Depending on the nature of your refiled return, you may receive a response from the IRS or your state tax authority. In some cases, you might be required to provide additional information or documentation. If you are due a refund, it will be processed and sent to you according to the specified timeline.

Common Challenges and How to Overcome Them

Refiling taxes can present certain challenges, but with the right strategies, you can navigate them effectively.

Challenge: Missing or Lost Documents

If you realize that you are missing important documents or records, take the following steps:

- Contact your employer or financial institutions to request duplicate copies of W-2 forms, 1099 forms, or other necessary documents.

- Check your email or online accounts for electronic copies of tax-related documents.

- Reach out to your tax preparer or accountant if they have access to the required information.

- If all else fails, contact the IRS or state tax authority to request transcripts of your tax returns, which can provide some of the necessary details.

Challenge: Complex Tax Situations

If your tax situation is complex or involves multiple sources of income and deductions, consider these strategies:

- Seek professional assistance from a tax expert or accountant who can guide you through the refiling process and ensure compliance.

- Use tax preparation software that offers advanced features and can handle complex tax scenarios.

- Research and educate yourself about the specific tax laws and regulations applicable to your situation.

Tips for a Successful Refiling Experience

To ensure a positive and stress-free refiling experience, keep these tips in mind:

- Start Early: Don’t wait until the last minute to refile your taxes. Starting early gives you ample time to gather documents, review your return, and make necessary corrections.

- Double-Check Your Work: Accuracy is paramount when refiling taxes. Double-check your calculations, forms, and supporting documents to minimize the risk of errors.

- Stay Organized: Maintain a well-organized system for your tax-related documents. This simplifies the refiling process and makes it easier to locate information when needed.

- Keep Records: Retain copies of your original return, refiled return, and all supporting documents. This practice ensures you have a comprehensive record of your tax history and simplifies future tax-related matters.

- Seek Help When Needed: Don’t hesitate to seek professional assistance if you encounter complex tax situations or are unsure about any aspect of the refiling process. Tax professionals can provide valuable guidance and peace of mind.

Conclusion

Refiling taxes may seem daunting, but with the right knowledge and preparation, it can be a manageable task. By understanding the reasons for refiling, gathering the necessary documents, and following the step-by-step guide provided, you can successfully navigate the refiling process. Remember to stay organized, seek help when needed, and maintain accurate records to ensure a positive tax experience.

Can I refile my taxes if I already received a refund for the original return?

+

Yes, you can refile your taxes even if you have already received a refund for the original return. If you discover errors or missing information that could result in a larger refund, you have the right to amend your return and receive the additional amount. However, keep in mind that the refiling process may trigger a review by the IRS, so it’s important to have accurate and supporting documentation.

How long does it take for the IRS to process an amended tax return?

+

The processing time for amended tax returns can vary. In most cases, it takes the IRS approximately 16 weeks to process an amended return. However, this timeline can be influenced by factors such as the complexity of the amendments and the workload of the IRS during peak tax seasons. It’s advisable to monitor the status of your amended return through the IRS website.

Are there any penalties for refiling taxes?

+

Refiling taxes to correct errors or provide additional information typically does not result in penalties. However, if you refile to claim additional refunds or reduce your tax liability significantly, the IRS may scrutinize your return more closely. In some cases, if the IRS determines that you intentionally understated your tax liability, penalties and interest may apply. It’s crucial to provide accurate and honest information when refiling.