Qbi Tax Deduction

When it comes to financial planning and tax strategies, Qbi Tax Deduction has emerged as a crucial concept for business owners and investors, offering significant advantages and opportunities for tax optimization. This article delves into the intricacies of Qbi Tax Deduction, exploring its definition, eligibility criteria, and the potential benefits it brings to the table.

Understanding Qbi Tax Deduction

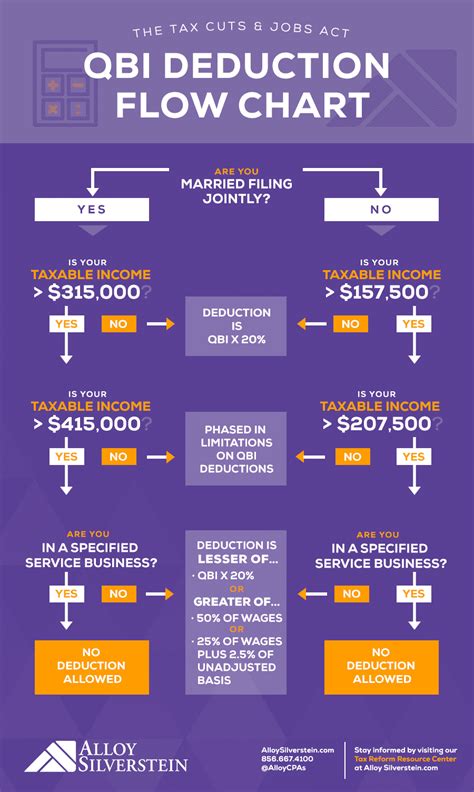

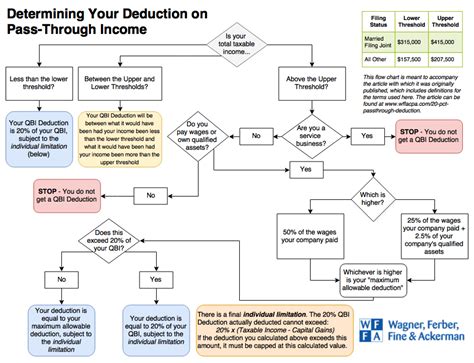

Qbi Tax Deduction, short for Qualified Business Income Deduction, is a provision introduced by the Tax Cuts and Jobs Act in the United States, which came into effect in 2018. This tax reform initiative aimed to provide tax relief for pass-through entities, such as sole proprietorships, partnerships, and S corporations, by allowing a deduction on their qualified business income.

The Qbi Tax Deduction offers a unique opportunity for business owners to reduce their taxable income, thereby decreasing their overall tax liability. It is a significant shift in tax policy, providing a boost to small businesses and encouraging entrepreneurship.

How Qbi Tax Deduction Works

The Qbi Tax Deduction is calculated as a percentage of the qualified business income earned by pass-through entities. The deduction is taken directly against the taxpayer’s income, resulting in a lower tax bill. The exact percentage of the deduction varies based on the taxpayer’s income level and the type of business.

For example, let's consider a sole proprietor named Sarah who runs a consulting business. Her qualified business income for the year is $100,000. With the Qbi Tax Deduction, she can potentially reduce her taxable income by a certain percentage, depending on her income bracket. This reduction leads to substantial savings on her tax liability.

Eligibility Criteria

Not all businesses or taxpayers are eligible for the Qbi Tax Deduction. Here are the key criteria to consider:

- Business Type: The deduction is primarily designed for pass-through entities, which include sole proprietorships, partnerships, and S corporations. C corporations and certain types of trusts and estates are not eligible.

- Income Thresholds: The Qbi Tax Deduction is subject to income thresholds. For taxpayers with taxable income above a certain level, the deduction may be phased out or limited. These thresholds vary based on filing status.

- Business Activities: To qualify for the deduction, the business must engage in trade or business activities within the United States. This includes providing services, manufacturing products, or conducting other commercial activities.

It's important to note that the eligibility criteria can be complex, and business owners should consult with tax professionals to ensure they meet all the requirements.

Benefits of Qbi Tax Deduction

The introduction of the Qbi Tax Deduction has brought about several significant advantages for business owners and investors:

Lower Tax Liability

The most apparent benefit of the Qbi Tax Deduction is the potential for reduced tax liability. By deducting a percentage of their qualified business income, business owners can lower their taxable income, leading to substantial tax savings. This is especially beneficial for high-income earners, as it can significantly reduce their tax burden.

Encouragement for Entrepreneurship

The Qbi Tax Deduction acts as an incentive for individuals to start and grow their own businesses. By offering tax relief, the government aims to promote entrepreneurship and support small business owners. This deduction can make the financial aspect of running a business more attractive and feasible, encouraging more people to pursue their entrepreneurial dreams.

Flexibility in Business Planning

The Qbi Tax Deduction provides business owners with an opportunity to strategically plan their tax obligations. By understanding the deduction rules and eligibility, business owners can make informed decisions about their business activities, income levels, and investments. This flexibility allows for better financial management and tax optimization.

Support for Small Businesses

Small businesses often face unique challenges when it comes to tax compliance and financial management. The Qbi Tax Deduction offers a much-needed relief to these businesses, helping them stay competitive and invest in their growth. By reducing their tax burden, small businesses can allocate more resources to operations, research, and development.

Performance Analysis and Case Studies

To understand the real-world impact of the Qbi Tax Deduction, let’s explore a few case studies:

Case Study 1: John’s Consulting Firm

John, a sole proprietor, runs a successful consulting firm with an annual income of $200,000. With the Qbi Tax Deduction, he was able to reduce his taxable income by 20%, resulting in substantial tax savings. This allowed him to reinvest in his business, hire additional staff, and expand his client base.

Case Study 2: Jane’s E-commerce Business

Jane, an online retailer, operates her e-commerce business as an S corporation. With the Qbi Tax Deduction, she was able to reduce her tax liability by a significant amount. This enabled her to invest in new marketing strategies, improve her website, and expand her product offerings, ultimately boosting her business growth.

Case Study 3: Small Business Collaboration

A group of small business owners formed a partnership to collaborate on projects and share resources. By combining their efforts and qualifying for the Qbi Tax Deduction, they were able to reduce their collective tax liability. This collaboration not only benefited their individual businesses but also created a strong network for future growth and success.

| Case Study | Business Type | Annual Income | Qbi Tax Deduction | Impact |

|---|---|---|---|---|

| John's Consulting Firm | Sole Proprietorship | $200,000 | 20% | Reinvestment and business expansion |

| Jane's E-commerce | S Corporation | $150,000 | 15% | Investment in marketing and product growth |

| Small Business Collaboration | Partnership | $350,000 (Combined) | 25% | Collaboration and shared resources for growth |

Future Implications and Tax Strategies

As the Qbi Tax Deduction continues to shape the tax landscape, business owners and investors should consider the following future implications and strategies:

Long-Term Tax Planning

The Qbi Tax Deduction provides an opportunity for business owners to plan their tax strategies for the long term. By understanding the deduction rules and income thresholds, they can make informed decisions about their business structure, income levels, and investments. This long-term planning ensures optimal tax efficiency and business growth.

Compliance and Record-Keeping

To qualify for the Qbi Tax Deduction, business owners must maintain accurate and detailed records of their business activities and income. This includes proper documentation of expenses, income, and any relevant business transactions. Staying compliant with tax regulations is crucial to maximize the benefits of the deduction.

Consulting Tax Professionals

The Qbi Tax Deduction can be complex, especially with varying income thresholds and eligibility criteria. Business owners should consider consulting tax professionals who specialize in pass-through entities and tax optimization. These experts can provide personalized advice and ensure compliance with the latest tax regulations.

Exploring Investment Opportunities

With the potential tax savings from the Qbi Tax Deduction, business owners can explore new investment opportunities. This could include investing in research and development, expanding their business operations, or even diversifying their investment portfolio. The deduction provides a financial boost to support these strategic initiatives.

Conclusion

The Qbi Tax Deduction has revolutionized the tax landscape for pass-through entities, offering significant tax relief and strategic advantages. By understanding the eligibility criteria and maximizing the benefits, business owners can optimize their tax obligations and focus on long-term growth. As the tax landscape continues to evolve, staying informed and consulting professionals is key to making the most of these tax opportunities.

What is the maximum Qbi Tax Deduction percentage I can claim?

+The maximum Qbi Tax Deduction percentage varies based on your taxable income and the type of business. For most businesses, the deduction is 20% of qualified business income. However, there are income thresholds and limitations to consider. Consult a tax professional to determine the exact deduction percentage applicable to your situation.

Are there any restrictions on the types of businesses that can qualify for the Qbi Tax Deduction?

+Yes, the Qbi Tax Deduction is primarily designed for pass-through entities, including sole proprietorships, partnerships, and S corporations. C corporations and certain types of trusts and estates are not eligible. Additionally, there are income thresholds and limitations based on business activities and income levels.

How does the Qbi Tax Deduction impact my tax liability in the long term?

+The Qbi Tax Deduction can significantly reduce your tax liability in the short term. However, to maintain the benefits in the long term, it’s important to stay informed about tax regulations, income thresholds, and any changes to the deduction rules. Consulting a tax professional regularly can help you plan and optimize your tax strategy.

Can I claim the Qbi Tax Deduction if I have multiple businesses?

+Yes, you can potentially claim the Qbi Tax Deduction for each of your businesses, provided they meet the eligibility criteria. However, it’s important to calculate the deduction separately for each business and consider the income thresholds and limitations for each entity. Consult a tax professional for guidance on claiming deductions for multiple businesses.