Pay New York Property Tax

Navigating the process of paying property taxes in New York can be a complex task, especially for those who are new to the city or are unfamiliar with its unique tax system. With a diverse range of property types and varying tax rates, understanding the steps involved and staying on top of deadlines is crucial for property owners and residents alike. This guide aims to provide a comprehensive and expert-level breakdown of the process, offering a clear and concise roadmap for paying New York property taxes efficiently and effectively.

Understanding the New York Property Tax System

New York City’s property tax system is renowned for its complexity, owing to the city’s diverse property landscape and the intricacies of its assessment and billing processes. Property taxes in NYC are levied on both residential and commercial properties, with rates varying significantly based on location, property type, and other factors.

The tax year in New York City begins on July 1st and ends on June 30th of the following year. This means that property taxes are due in two installments, with the first installment typically due in January and the second in July. However, the exact due dates can vary slightly depending on the borough and the specific property.

Property taxes in New York are calculated based on the assessed value of the property and the tax rate set by the local government. The assessed value is determined by the city's Department of Finance, which conducts periodic assessments to ensure fairness and accuracy in the tax system. This value can be influenced by various factors, including recent sales of similar properties, improvements made to the property, and the overall real estate market conditions.

Tax Rates and Assessments

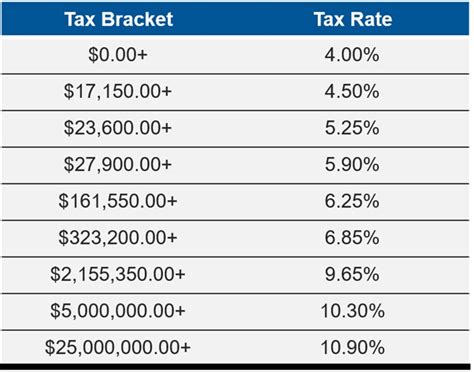

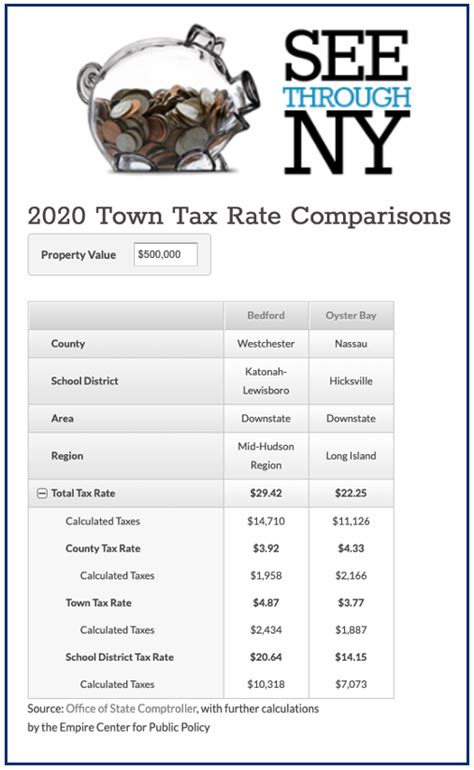

New York City’s property tax rates are among the highest in the nation, with the rate varying depending on the property’s location within the five boroughs. The tax rate is expressed as a percentage of the property’s assessed value and can range from approximately 1.8% to 3.0% across the city.

For instance, a residential property in Manhattan with an assessed value of $1 million would be subject to a tax rate of approximately 2.5%, resulting in an annual property tax bill of $25,000. On the other hand, a similar property in Staten Island might have a slightly lower tax rate, say 2.2%, leading to an annual tax bill of $22,000.

| Borough | Tax Rate (approx.) |

|---|---|

| Manhattan | 2.5% |

| Brooklyn | 2.1% |

| Queens | 1.9% |

| Bronx | 2.0% |

| Staten Island | 2.2% |

It's important to note that these tax rates are subject to change annually, as they are influenced by the city's budget and economic conditions. Property owners should stay informed about any shifts in tax rates to accurately calculate their property tax obligations.

The Payment Process

Paying property taxes in New York City involves a straightforward, yet meticulous process that requires attention to detail and timely action. Here’s a step-by-step guide to ensure you meet your obligations effectively:

Step 1: Obtain Your Tax Bill

The first step in the process is to obtain your property tax bill, which is typically mailed to the property owner’s address on record. This bill outlines the assessed value of your property, the applicable tax rate, and the amount you owe for the current tax year. It’s crucial to review this bill carefully to ensure its accuracy and to identify any potential errors or discrepancies.

If you haven't received your tax bill by the expected date, it's advisable to contact the New York City Department of Finance to request a duplicate bill. Delays in receiving your bill can lead to late payment fees and other complications, so it's best to stay proactive and reach out if there's any delay.

Step 2: Review and Verify the Bill

Once you have your tax bill in hand, it’s essential to review it thoroughly. Check the following details to ensure they are accurate and up-to-date:

- Property Address: Confirm that the address on the bill matches the address of your property.

- Assessed Value: Verify that the assessed value aligns with your expectations and any recent property improvements or changes.

- Tax Rate: Ensure that the tax rate corresponds to the correct borough and is in line with the current rates set by the city.

- Total Amount Due: Calculate the total amount due and compare it with the bill to ensure there are no discrepancies.

If you identify any errors or inconsistencies, it's crucial to contact the Department of Finance immediately to rectify the issue. Timely action can prevent potential late fees and ensure a smooth payment process.

Step 3: Choose Your Payment Method

New York City offers several convenient payment methods for property taxes, allowing you to choose the option that best suits your needs and preferences:

- Online Payment: The most efficient and convenient method, allowing you to pay your taxes securely through the NYC Property Tax Online Payment System. You'll need your bill number and credit/debit card or bank account information for online payments.

- Mail-in Payment: If you prefer a more traditional approach, you can mail your payment along with the remittance stub from your tax bill. Ensure you allow sufficient time for mailing and processing to avoid late fees.

- In-Person Payment: For those who prefer a personal touch, in-person payments can be made at designated NYC Finance Offices or at authorized payment locations. Bring your tax bill and the appropriate payment method (cash, check, or money order) to complete the transaction.

Regardless of the payment method you choose, ensure you keep a record of your payment for future reference and tax purposes. It's also advisable to retain a copy of the receipt or confirmation number for your records.

Step 4: Meet the Payment Deadline

Timely payment of your property taxes is crucial to avoid late fees and potential legal consequences. New York City typically imposes strict deadlines for property tax payments, with late fees accruing daily until the outstanding balance is paid in full.

The exact payment deadlines can vary based on the borough and the specific property. It's essential to refer to your tax bill for the precise due dates and plan your payment accordingly. Mark these dates on your calendar to ensure you don't miss the payment window.

If you anticipate difficulties in meeting the payment deadline, it's advisable to contact the Department of Finance to explore potential options for extensions or payment plans. Being proactive and communicating with the city can help mitigate potential penalties and maintain a positive relationship with the tax authority.

Tips and Considerations

Paying property taxes in New York City can be a complex process, but with careful planning and attention to detail, it can be managed efficiently. Here are some additional tips and considerations to keep in mind:

Understand the Assessment Process

The assessment process in New York City is a critical component of the property tax system. The city’s Department of Finance conducts periodic assessments to determine the value of each property, which in turn influences the tax rate and the amount you owe. Understanding this process can help you anticipate changes in your property taxes and plan your finances accordingly.

Explore Tax Abatements and Exemptions

New York City offers various tax abatements and exemptions to eligible property owners, which can significantly reduce your property tax burden. These include exemptions for senior citizens, veterans, and properties used for certain charitable or educational purposes. Researching and understanding these options can help you take advantage of any applicable tax savings.

Consider Escrow Accounts

If you own rental properties or have a mortgage, consider setting up an escrow account to manage your property taxes. This account allows you to make regular contributions towards your tax obligations, ensuring you have the funds available when they are due. It can also simplify your tax payments and provide a layer of financial protection.

Stay Informed and Seek Professional Advice

The property tax landscape in New York City is dynamic and can change with new legislation or economic shifts. Stay informed about any changes in tax rates, assessment processes, or available tax incentives. Consider consulting with a tax professional or accountant who specializes in real estate taxes to ensure you are optimizing your tax obligations and taking advantage of all available benefits.

Frequently Asked Questions

How can I pay my New York City property taxes online?

+

To pay your NYC property taxes online, visit the NYC Property Tax Online Payment System. You’ll need your bill number and credit/debit card or bank account information to complete the transaction securely.

What happens if I miss the property tax payment deadline in NYC?

+

Missing the property tax payment deadline in NYC can result in late fees and penalties. The city imposes daily late fees until the outstanding balance is paid in full. To avoid these fees, it’s important to plan your payments carefully and mark the due dates on your calendar.

Are there any tax exemptions or abatements available in New York City for property owners?

+

Yes, New York City offers various tax exemptions and abatements to eligible property owners. These include exemptions for senior citizens, veterans, and properties used for certain charitable or educational purposes. It’s important to research and understand these options to take advantage of any applicable tax savings.

How can I appeal my property’s assessed value in NYC?

+

If you believe your property’s assessed value is incorrect, you can file an appeal with the NYC Department of Finance. The process involves submitting an application for correction of assessment and providing evidence to support your claim. It’s advisable to consult with a tax professional or attorney to ensure a successful appeal.

What are the consequences of not paying property taxes in New York City?

+

Not paying property taxes in NYC can have serious consequences, including late fees, penalties, and potential legal action. In severe cases, the city may place a lien on your property or even initiate foreclosure proceedings. It’s crucial to stay current with your tax obligations to avoid these outcomes.