Tax Rate In Orange County Ca

When it comes to understanding the tax landscape, it's crucial to delve into the specifics of each region. In this article, we will explore the tax rates in Orange County, California, shedding light on the various aspects that impact residents and businesses alike. Orange County, known for its vibrant communities and thriving economy, has a unique tax structure that affects property owners, income earners, and businesses. Let's uncover the intricacies of this region's tax system and provide a comprehensive guide for those seeking clarity.

Understanding Orange County’s Tax Structure

Orange County, situated in the heart of Southern California, boasts a diverse economic landscape, ranging from thriving coastal cities to vibrant inland communities. The tax system in this region is multifaceted, encompassing various taxes that contribute to the overall revenue generation. Here’s a detailed breakdown of the key tax rates in Orange County:

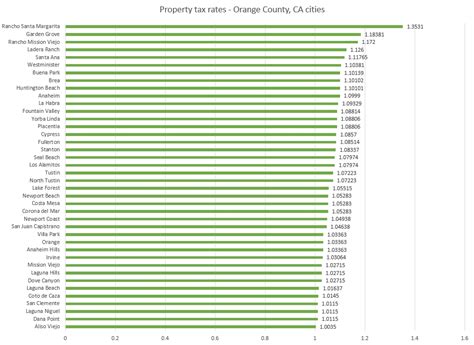

Property Tax Rates

One of the primary sources of revenue for Orange County is property taxes. The property tax rate in Orange County is determined by a combination of factors, including the assessed value of the property and the tax rate set by local jurisdictions. The County of Orange assesses property values annually, and these assessments are used to calculate the property tax owed by homeowners and business owners. As of the latest assessment, the property tax rate in Orange County is 1.08% of the assessed value, which is applied to both residential and commercial properties.

However, it's important to note that the property tax rate can vary slightly depending on the specific city or special district within Orange County. For instance, cities like Newport Beach and Laguna Beach have slightly higher property tax rates due to additional assessments for local services. These variations in tax rates reflect the unique needs and priorities of each community within the county.

| City | Property Tax Rate |

|---|---|

| Anaheim | 1.08% |

| Santa Ana | 1.08% |

| Irvine | 1.08% |

| Huntington Beach | 1.08% |

| Newport Beach | 1.10% |

Additionally, Orange County offers various exemptions and deductions for property taxes, such as the Homeowner's Exemption, which reduces the taxable value of a primary residence, and the Senior Citizen Exemption, which provides relief for homeowners aged 65 and older. These exemptions aim to alleviate the tax burden on specific segments of the population, making property ownership more affordable.

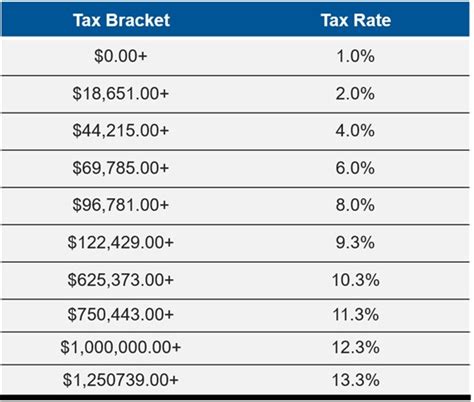

Income Tax Rates

In addition to property taxes, Orange County residents and businesses are subject to income taxes. The state of California has a progressive income tax system, which means that higher income levels are taxed at higher rates. As of the latest tax year, the state income tax rates in California range from 1% to 13.3%, depending on taxable income. These rates apply to both individuals and businesses, with the highest rate typically reserved for high-income earners.

Within Orange County, there are additional local taxes that impact income. The County of Orange imposes a 1% local income tax on top of the state rates. This supplementary tax is used to fund various county services and infrastructure projects. Furthermore, specific cities within the county may have their own local income taxes, adding an extra layer of complexity to the income tax landscape.

| Income Bracket (Single Filers) | State Tax Rate | Local Tax Rate |

|---|---|---|

| $0 - $8,374 | 1% | 1% |

| $8,375 - $27,913 | 2% | 1% |

| $27,914 - $52,755 | 4% | 1% |

| $52,756 - $112,237 | 6% | 1% |

| $112,238 - $262,073 | 8% | 1% |

| $262,074 - $532,637 | 9.3% | 1% |

| $532,638 and above | 13.3% | 1% |

For businesses operating in Orange County, it's important to note that the income tax structure is slightly different. Corporations and limited liability companies (LLCs) are subject to a minimum franchise tax of $800 per year, regardless of their income level. Additionally, there are various business-specific deductions and credits available, such as the Research and Development Tax Credit and the Hiring Credit for Veterans, which can reduce the overall tax liability for eligible businesses.

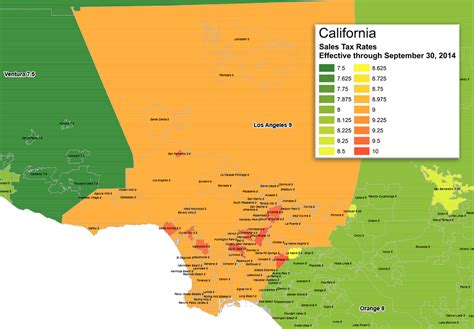

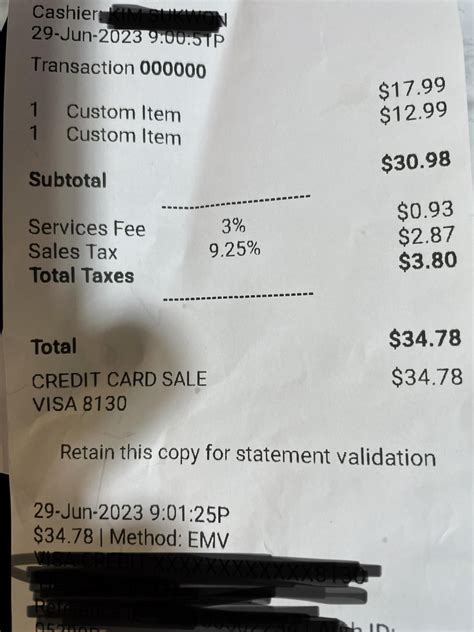

Sales and Use Taxes

Orange County, like the rest of California, imposes sales and use taxes on various goods and services. The sales tax rate in the county is 7.25%, which includes both the state and local sales tax components. This rate applies to most retail purchases, including clothing, electronics, and other tangible personal property. However, certain categories of goods, such as groceries and prescription medications, are exempt from sales tax, providing some relief for consumers.

The County of Orange also collects a use tax on goods purchased outside the county and brought into the county for use. This tax ensures that residents and businesses pay their fair share, even if they make purchases from out-of-state retailers or online platforms. The use tax rate mirrors the sales tax rate, so residents should be mindful of their obligations when making purchases outside of Orange County.

| City | Sales Tax Rate |

|---|---|

| Anaheim | 7.25% |

| Santa Ana | 7.25% |

| Irvine | 7.25% |

| Garden Grove | 7.25% |

| Huntington Beach | 7.25% |

Businesses operating in Orange County must register for a Seller's Permit and collect sales tax from customers. Failure to comply with sales tax regulations can result in penalties and interest charges. It's essential for businesses to stay informed about their sales tax obligations and ensure accurate reporting to avoid any legal consequences.

Vehicle Registration and Gas Taxes

Orange County residents who own vehicles are subject to vehicle registration fees and gas taxes. The vehicle registration fee in California is based on the value of the vehicle and the weight of the vehicle. For instance, a standard passenger vehicle with a value of 20,000 would incur a registration fee of approximately <strong>128 per year. Additionally, Orange County, like the rest of California, imposes a 1.75% excise tax on the purchase or lease of a new vehicle.

Gasoline taxes in Orange County contribute to the maintenance and improvement of roads and infrastructure. As of the latest tax year, the combined state and local gas tax rate in California is 62.9 cents per gallon, which includes both excise taxes and sales taxes on gasoline. This rate is subject to change based on legislative decisions and can impact the cost of fuel for residents and businesses alike.

Business Taxes and Permits

Orange County is a hub for businesses, and the county’s tax system accommodates a range of business entities. Businesses operating within the county are required to obtain various permits and licenses, depending on their industry and location. These permits ensure compliance with local regulations and contribute to the overall tax revenue.

For instance, restaurants and food establishments in Orange County must obtain a Health Permit from the local health department. This permit ensures that food safety standards are met and is a crucial aspect of operating a successful food business. Similarly, construction and development projects require Building Permits, which are issued by the relevant city or county department.

In terms of business taxes, Orange County businesses are subject to the California Franchise Tax, which applies to all entities doing business in the state. The tax rate for corporations is 8.84% of taxable income, while LLCs and partnerships are taxed at the individual member's rate. Additionally, certain businesses, such as hotels and motels, are subject to a Transient Occupancy Tax, which is collected from guests and remitted to the county.

Tax Incentives and Programs in Orange County

While Orange County’s tax rates may seem extensive, there are various tax incentives and programs in place to support businesses and individuals. These initiatives aim to promote economic growth, encourage entrepreneurship, and provide relief to specific segments of the population.

Small Business Tax Incentives

Orange County recognizes the vital role small businesses play in the local economy and has implemented several tax incentives to support their growth. One such incentive is the California Small Business Tax Credit, which offers eligible small businesses a tax credit of up to $100,000 over five years. This credit is designed to offset the cost of doing business and provide a financial boost to small enterprises.

Additionally, the County of Orange offers a Business Resource Center, which provides support and resources to small business owners. This center offers guidance on tax compliance, permits, and licensing, helping businesses navigate the complex regulatory landscape. By providing these resources, the county aims to foster a thriving business environment and encourage entrepreneurship.

Green Energy and Sustainability Incentives

Orange County is committed to promoting sustainable practices and has implemented tax incentives to encourage the adoption of green energy solutions. The California Solar Initiative offers rebates and incentives for residents and businesses that install solar panels and other renewable energy systems. These incentives can significantly reduce the upfront costs of transitioning to clean energy, making it more accessible for property owners.

Furthermore, the County of Orange has implemented the Green Building Program, which provides incentives for developers and property owners who incorporate sustainable design and construction practices. This program aims to reduce the environmental impact of new developments and promote energy efficiency in existing buildings. By offering these incentives, Orange County is leading the way in sustainable development.

Tax Relief for Seniors and Low-Income Residents

Recognizing the financial challenges faced by seniors and low-income residents, Orange County has implemented tax relief programs to provide support. The California Property Tax Postponement Program allows eligible seniors to defer the payment of their property taxes until their property is sold, transferred, or they pass away. This program ensures that seniors can maintain their homes without the burden of high property taxes.

Additionally, the County of Orange offers the Low-Income Taxpayer Clinic, which provides free tax assistance and representation to low-income individuals who are facing tax-related issues. This clinic ensures that vulnerable residents have access to the resources they need to navigate the complex tax system and resolve any disputes they may encounter.

Tax Preparation and Compliance in Orange County

Navigating the tax landscape in Orange County can be complex, especially for individuals and businesses with unique circumstances. It’s crucial to stay informed and seek professional guidance to ensure compliance and maximize potential tax benefits.

Tax Professionals and Resources

Engaging the services of a qualified tax professional can be invaluable for individuals and businesses in Orange County. These professionals, such as Certified Public Accountants (CPAs) and Enrolled Agents (EAs), have the expertise to navigate the intricate tax system and provide tailored advice. They can assist with tax planning, compliance, and even represent clients during audits or tax disputes.

For those seeking resources and information, the County of Orange provides a comprehensive Tax Resource Center on its official website. This center offers guides, forms, and updates on tax-related matters, ensuring that residents and businesses have access to the latest information. Additionally, the California Franchise Tax Board and the Internal Revenue Service (IRS) provide extensive resources and guidance on state and federal tax matters, respectively.

Tax Filing Deadlines and Extensions

Understanding the tax filing deadlines is crucial to avoid penalties and ensure timely compliance. In Orange County, the tax filing deadlines align with the state and federal timelines. For personal income taxes, the filing deadline is typically April 15th of each year. However, it’s important to note that certain extensions may be available for individuals and businesses who require additional time to gather necessary documentation or complete their tax returns.

For businesses, the tax filing deadlines may vary depending on the type of entity and the tax year-end. Corporations, for instance, typically have a tax filing deadline of March 15th for the previous tax year. It's essential for businesses to stay informed about their specific filing requirements and deadlines to avoid any penalties or delays.

Tax Audits and Appeals

In the event of a tax audit, it’s crucial to remain calm and seek professional guidance. Tax audits can be triggered by various factors, such as discrepancies in tax returns or random selections. Engaging a tax professional or legal counsel during an audit can help navigate the process and ensure a fair outcome. The County of Orange and the IRS provide guidelines and resources for individuals and businesses facing audits, ensuring a transparent and fair process.

If a taxpayer disagrees with the outcome of an audit or tax assessment, they have the right to appeal. The appeals process allows taxpayers to present their case and provide additional evidence to support their position. It's important to note that the appeals process can be complex, and seeking professional representation is often recommended to increase the chances of a successful outcome.

Future Outlook and Tax Reforms in Orange County

The tax landscape in Orange County, like any other region, is subject to change and evolution. As economic conditions shift and legislative decisions are made, the tax system may undergo reforms and adjustments. Staying informed about potential changes is crucial for individuals and businesses to adapt their tax strategies and planning accordingly.

Proposed Tax Reforms

In recent years, there have been discussions and proposals for tax reforms in Orange County and California as a whole. One proposed reform is the Split Roll Property Tax Initiative, which aims to revise the way commercial and industrial properties are taxed. This initiative seeks to apply a higher tax rate to commercial properties while maintaining the Proposition 13 protections for residential properties. The goal is to generate additional revenue for the state and county without increasing the tax burden on homeowners.

Additionally, there have been proposals to simplify the state's income tax system and reduce the number of tax brackets. Such reforms aim to make the tax system more straightforward and reduce the complexity faced by taxpayers. While these proposals are still in the discussion phase, they highlight the ongoing efforts to modernize and improve the tax landscape in Orange County and California.

Impact of Economic Changes

The economic landscape of Orange County, like any region, is subject to fluctuations and changes. Economic growth, recession, and shifts in industry dynamics can all impact the tax revenue and tax rates in the county. For instance, during periods of economic prosperity, tax revenue may increase due to higher income levels and business activity. Conversely, economic downturns can lead to reduced tax revenue and potential adjustments in tax rates to compensate for the loss.

It's essential for individuals and businesses to stay informed about the economic trends in Orange County and their potential impact on tax rates. By understanding the economic landscape, taxpayers can make informed decisions about their financial planning and tax strategies.

Conclusion

Understanding the tax rates in Orange County, California, is crucial for individuals and businesses alike. The county’s tax system encompasses various taxes, including property taxes,