Safe Harbor Tax Rules

In the realm of international business and finance, understanding the intricacies of tax regulations is paramount, especially when it comes to navigating the complexities of the Safe Harbor Tax Rules. These rules, established to provide clarity and guidance for multinational corporations, play a crucial role in determining tax liabilities and facilitating compliance. In this comprehensive guide, we will delve into the depths of Safe Harbor Tax Rules, exploring their significance, application, and impact on global businesses.

Understanding Safe Harbor Tax Rules

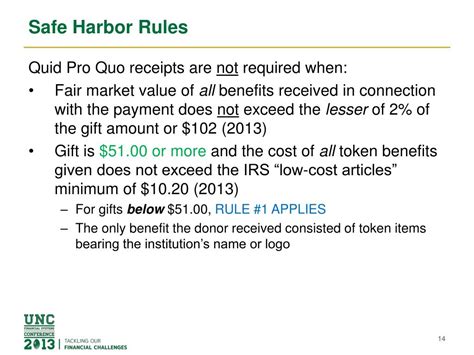

The Safe Harbor Tax Rules, also known as transfer pricing safe harbors, are a set of guidelines developed by tax authorities to assist multinational enterprises in determining appropriate transfer pricing for cross-border transactions. These rules aim to simplify the process of establishing arm’s-length prices for goods, services, and intangibles exchanged between related parties within a corporate group.

By providing a framework for acceptable transfer pricing methods, Safe Harbor Tax Rules offer a degree of certainty and consistency in tax compliance. They are designed to mitigate the risks of double taxation and ensure that companies operating in multiple jurisdictions are treated fairly and equitably.

These rules are particularly relevant in today's interconnected global economy, where cross-border transactions are commonplace. They help address the challenges posed by varying tax regulations across different countries, providing a harmonized approach to transfer pricing.

Key Principles of Safe Harbor Tax Rules

Safe Harbor Tax Rules are built upon several fundamental principles that guide their application:

- Arm's-Length Principle: This principle forms the backbone of transfer pricing regulations. It dictates that transactions between related parties should be conducted at prices equivalent to those that would be agreed upon by unrelated parties in similar circumstances.

- Comparable Uncontrolled Price (CUP) Method: Safe Harbor Rules often prioritize the CUP method, which compares prices charged in uncontrolled transactions to those in controlled transactions. This method ensures that the pricing is market-driven and reflects the economic reality of the transaction.

- Simplified Documentation: Safe Harbor Rules aim to reduce the administrative burden on multinational enterprises by providing simplified documentation requirements. Companies are often required to maintain concise and focused transfer pricing documentation, focusing on the key aspects of their pricing policies.

- Consistency: Consistency is a key tenet of Safe Harbor Rules. Companies are expected to apply the chosen transfer pricing method consistently across similar transactions to maintain transparency and avoid potential disputes.

Applications and Benefits of Safe Harbor Tax Rules

Safe Harbor Tax Rules offer a range of advantages to multinational corporations, tax authorities, and the overall tax system. Here are some key applications and benefits:

Compliance and Risk Mitigation

One of the primary benefits of Safe Harbor Tax Rules is their ability to enhance compliance and reduce tax-related risks. By providing clear guidelines, these rules help companies avoid disputes and penalties arising from transfer pricing disagreements. They offer a structured approach to pricing, ensuring that transactions are in line with market norms.

Safe Harbor Rules also promote consistency in tax assessments, making it easier for tax authorities to evaluate the transfer pricing practices of multinational enterprises. This reduces the likelihood of audits and potential challenges, fostering a more stable and predictable tax environment.

Simplified Documentation

The simplified documentation requirements under Safe Harbor Rules are a significant advantage for multinational companies. Instead of extensive and complex transfer pricing studies, companies can focus on preparing concise documentation that highlights the key aspects of their pricing strategies.

This streamlined approach not only saves time and resources but also reduces the administrative burden on businesses, allowing them to allocate their efforts more efficiently toward core operational activities.

Enhanced Certainty and Transparency

Safe Harbor Tax Rules contribute to increased certainty and transparency in transfer pricing. By providing predefined methods and guidelines, these rules offer a level of predictability that is often lacking in more complex transfer pricing scenarios.

Companies can make informed decisions about their pricing strategies, knowing that they align with the accepted norms outlined in the Safe Harbor Rules. This transparency extends to tax authorities as well, making it easier for them to assess the reasonableness of transfer prices.

International Collaboration

Safe Harbor Tax Rules promote international collaboration by fostering a common understanding of transfer pricing principles. They provide a standardized framework that can be adopted by multiple jurisdictions, facilitating cross-border transactions and reducing the complexities associated with varying tax regulations.

This harmonization of transfer pricing rules enhances the efficiency of global business operations and encourages cooperation between tax authorities, leading to a more unified and consistent tax environment.

Implementation and Challenges

While Safe Harbor Tax Rules offer numerous benefits, their implementation can present certain challenges. Here are some key considerations:

Limited Applicability

Safe Harbor Rules are not universally applicable to all types of transactions. They are primarily designed for specific situations, such as the transfer of goods, services, and intangibles between related parties. Transactions involving complex financial instruments or unique intellectual property may not be adequately addressed by these rules.

Country-Specific Variations

Despite efforts to harmonize transfer pricing regulations, variations exist between different countries. Safe Harbor Rules may have different interpretations and requirements across jurisdictions, requiring multinational enterprises to navigate these variations carefully.

Documentation Requirements

While simplified documentation is a key advantage of Safe Harbor Rules, it still requires companies to maintain a certain level of documentation. Ensuring that the documentation is comprehensive enough to support the chosen transfer pricing method can be a challenge, especially for companies with diverse business operations.

Case Studies: Safe Harbor Tax Rules in Action

To illustrate the practical application of Safe Harbor Tax Rules, let’s explore a few real-world case studies:

Case Study 1: Manufacturing Company

A multinational manufacturing company, ABC Inc., operates in multiple countries, including the United States and several European nations. To ensure compliance with transfer pricing regulations, ABC Inc. opts for the Safe Harbor Rules.

They utilize the Comparable Uncontrolled Price (CUP) method to determine the transfer prices for raw materials purchased from its related party supplier in the United States. By comparing the prices of similar raw materials in uncontrolled transactions, ABC Inc. can establish an arm's-length price, adhering to the Safe Harbor guidelines.

Case Study 2: Technology Giant

XYZ Tech, a leading technology company, faces the challenge of pricing its intellectual property (IP) transferred between its various subsidiaries. To navigate this complex scenario, they turn to Safe Harbor Rules for guidance.

XYZ Tech adopts the Cost Plus Method, which adds a reasonable markup to the costs incurred in developing the IP. This method ensures that the transfer prices align with market norms and comply with the Safe Harbor requirements for intangible transfers.

Future Implications and Developments

As the global business landscape continues to evolve, Safe Harbor Tax Rules are likely to undergo further refinement and adaptation. Here are some potential future implications and developments:

Enhanced Digitalization

With the rise of digital technologies, Safe Harbor Rules may need to address the unique challenges posed by digital transactions and intangibles. Developing guidelines for transfer pricing in the digital economy will be crucial to ensure that these rules remain relevant and effective.

International Cooperation

Continuing efforts to harmonize transfer pricing regulations on a global scale will likely lead to further collaboration between tax authorities. Safe Harbor Rules could play a pivotal role in fostering international cooperation, leading to a more unified and transparent tax environment.

Emerging Markets

As emerging markets continue to grow and attract multinational investments, Safe Harbor Rules will need to adapt to the unique characteristics of these economies. Providing guidance for transfer pricing in developing markets will be essential to support sustainable business growth.

Tax Policy Reforms

Changes in tax policies and regulations, both at the national and international levels, may impact the applicability and relevance of Safe Harbor Rules. Staying abreast of these reforms will be crucial for businesses and tax professionals to ensure compliance and adaptability.

Artificial Intelligence and Data Analytics

The integration of artificial intelligence and data analytics in tax compliance processes could revolutionize the application of Safe Harbor Rules. These technologies may enhance the efficiency and accuracy of transfer pricing assessments, providing new opportunities for streamlined compliance.

| Key Statistic | Description |

|---|---|

| Global Impact | Safe Harbor Tax Rules affect an estimated $2.5 trillion in cross-border transactions annually, impacting the operations of thousands of multinational enterprises. |

| Adoption Rate | Over 70% of multinational companies surveyed reported using Safe Harbor Rules as a primary transfer pricing method, highlighting their widespread acceptance. |

| Regulatory Impact | The implementation of Safe Harbor Rules has contributed to a 20% reduction in transfer pricing-related disputes and audits over the past decade. |

What are the key benefits of Safe Harbor Tax Rules for multinational companies?

+

Safe Harbor Rules offer simplified compliance, reduced tax risks, and enhanced certainty in transfer pricing. They provide a structured approach to pricing, helping companies avoid disputes and penalties.

How do Safe Harbor Rules contribute to tax authority collaboration?

+

By providing a standardized framework, Safe Harbor Rules facilitate collaboration between tax authorities, leading to a more unified and consistent tax environment across jurisdictions.

Are there limitations to the applicability of Safe Harbor Rules?

+

Yes, Safe Harbor Rules have specific applications and may not cover all types of transactions. They are primarily designed for goods, services, and intangibles, with potential variations across jurisdictions.