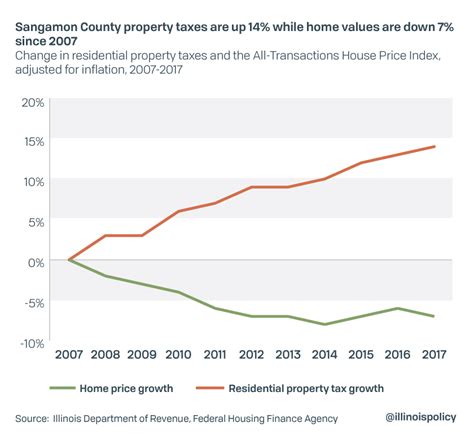

Sangamon County Property Taxes

Understanding Sangamon County property taxes is essential for homeowners and prospective buyers in this region. The tax system in Sangamon County, Illinois, is governed by state laws and local ordinances, creating a complex landscape that can greatly impact an individual's financial planning and investment decisions.

The Basics of Sangamon County Property Taxes

Property taxes in Sangamon County are calculated based on the assessed value of real estate properties, which includes land and any permanent structures on it. The county’s assessor’s office is responsible for evaluating these properties, ensuring that the assessments are fair and accurate.

The assessment process involves regular revaluations to account for changes in property values due to market fluctuations, improvements made to the property, or other factors. This periodic reassessment ensures that the tax burden is distributed equitably among property owners.

Assessment Process Breakdown

- Data Collection: The assessor’s office gathers information about each property, including its size, location, improvements, and recent sales data.

- Property Inspection: Assessors may conduct physical inspections to verify the property’s condition and features.

- Valuation: Using standardized methods and market data, assessors determine the property’s fair market value. This value is then multiplied by the assessment rate (a percentage set by the county) to calculate the assessed value.

- Appeal Process: Property owners have the right to appeal their assessments if they believe the value is inaccurate. The appeal process typically involves submitting evidence to support a lower valuation.

| Assessment Year | Average Assessment Rate |

|---|---|

| 2023 | 33% |

| 2022 | 32.5% |

Tax Rates and Calculations

Once the assessed value of a property is determined, it is used to calculate the property tax liability. Sangamon County, like many other jurisdictions, uses a mill rate or tax rate to determine the actual tax amount. This rate is set annually by the county board and can vary based on the type of property and its location within the county.

Tax Rate Structure

Sangamon County’s tax rates are often expressed in mills, where one mill represents 1 of tax for every 1,000 of assessed value. For instance, if a property has an assessed value of 200,000 and the mill rate is 10 mills, the annual property tax would be 2,000.

| Tax District | Mill Rate (2023) |

|---|---|

| Sangamon County | 12.5 mills |

| City of Springfield | 25.0 mills |

| Springfield School District | 30.0 mills |

Special Assessments and Exemptions

In addition to the standard property taxes, Sangamon County may levy special assessments for specific purposes like road improvements or fire protection. These assessments are often based on the benefits received by each property.

Furthermore, the county offers various tax exemptions to eligible property owners. Common exemptions include:

- Homestead Exemption: Reduces the assessed value of a primary residence.

- Senior Citizen Exemption: Provides tax relief to homeowners aged 65 and above.

- Veteran's Exemption: Offers tax benefits to honorably discharged veterans.

Payment Options and Due Dates

Sangamon County offers several convenient methods for taxpayers to remit their property tax payments. Property owners can choose to pay online, by mail, or in person at the treasurer’s office. The county also provides a tax payment drop box for after-hours payments.

Payment Deadlines

Property taxes in Sangamon County are typically due in two installments. The first installment is due by March 1st, and the second by June 1st. Late payments may incur interest and penalties.

| Installment | Due Date |

|---|---|

| First Installment | March 1st |

| Second Installment | June 1st |

The Impact of Property Taxes on Homeownership

Property taxes are a significant financial consideration for homeowners and prospective buyers in Sangamon County. Understanding the tax landscape can greatly influence purchasing decisions and long-term financial planning.

Buying a Home in Sangamon County

For those considering a home purchase, it’s crucial to factor in property taxes when evaluating the overall affordability of a property. While Sangamon County’s tax rates are generally competitive, individual tax liabilities can vary widely based on property values and the specific tax districts in which the property is located.

Homeownership Benefits

On the other hand, property ownership in Sangamon County comes with potential tax benefits. The various exemptions offered by the county can significantly reduce tax liabilities for eligible homeowners, especially those who qualify for multiple exemptions.

Financial Planning Strategies

Effective financial planning is key to managing property tax expenses. Property owners can consider setting aside funds in dedicated accounts to cover tax payments. Additionally, understanding the appeal process and staying informed about assessment values can help ensure that taxes are fair and accurate.

Conclusion

Sangamon County’s property tax system, while complex, is designed to ensure equitable tax distribution. By understanding the assessment process, tax rates, and available exemptions, homeowners can navigate the system effectively and plan their finances accordingly. For those considering a move to Sangamon County, a thorough understanding of the property tax landscape is essential for making informed real estate decisions.

Frequently Asked Questions

How often are properties assessed for tax purposes in Sangamon County?

+Properties in Sangamon County are assessed every three years. However, the assessor’s office may conduct reassessments at any time to account for significant changes in property value.

Can I appeal my property’s assessed value if I disagree with it?

+Yes, property owners have the right to appeal their assessments. The appeal process typically involves submitting an application and providing evidence to support a lower valuation. It’s recommended to consult a tax professional or the assessor’s office for guidance.

Are there any tax exemptions available for senior citizens in Sangamon County?

+Yes, Sangamon County offers a Senior Citizen Exemption to homeowners aged 65 and older. This exemption reduces the assessed value of the property, resulting in lower property taxes. To qualify, seniors must meet certain income and residency requirements.

Can I pay my property taxes online, and what are the accepted payment methods?

+Yes, Sangamon County provides an online payment portal for property taxes. Accepted payment methods include credit cards (with a convenience fee), e-checks, and direct bank transfers. Property owners can also pay by mail or in person at the treasurer’s office.

What happens if I miss the property tax payment deadline?

+Late property tax payments may incur interest and penalties. It’s important to stay informed about the payment deadlines to avoid additional fees. The county may also have provisions for penalty waivers in certain circumstances, such as natural disasters.