Ma Sales Tax For Cars

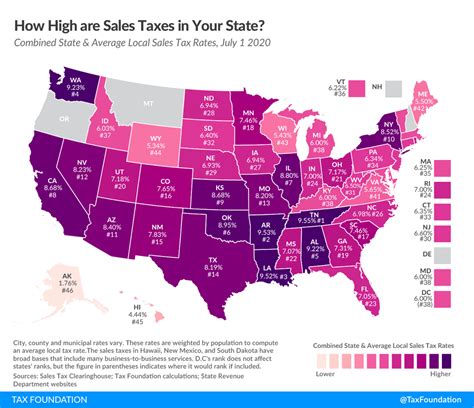

When it comes to purchasing a car, one crucial aspect that buyers often encounter is sales tax. In the United States, sales tax is a state-level tax, meaning the tax rates and regulations can vary significantly from one state to another. This guide will delve into the specifics of Massachusetts' sales tax for cars, providing a comprehensive understanding of the tax process, rates, and implications for both residents and non-residents.

Understanding Massachusetts’ Sales Tax System

Massachusetts, like many other states, imposes a sales and use tax on the sale of tangible personal property and certain services. The Department of Revenue (DOR) is responsible for administering and collecting these taxes, ensuring compliance with state laws and regulations. For car buyers, understanding the sales tax system is essential to navigate the purchasing process smoothly and avoid any unexpected costs.

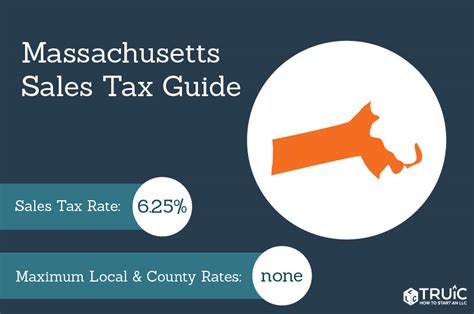

Sales Tax Rates in Massachusetts

The sales tax rate in Massachusetts is generally 6.25%, which applies to most retail sales of tangible personal property. However, it’s important to note that there are certain exemptions and special rates for specific items. When it comes to vehicle sales, the sales tax rate can vary based on the type of vehicle and its intended use.

| Vehicle Type | Sales Tax Rate |

|---|---|

| New Cars and Light Trucks | 6.25% |

| Used Cars and Light Trucks | 6.25% |

| Heavy Trucks and Trailers | Variable (Based on Weight) |

| Motorcycles | 6.25% |

| Electric Vehicles (EVs) | Variable (Based on Battery Size) |

It's crucial to note that while the sales tax rate for new and used cars is the standard 6.25%, there may be additional fees and surcharges that can increase the overall cost. These additional fees often cover registration, titling, and other administrative processes associated with vehicle ownership.

Exemptions and Special Cases

Massachusetts provides certain exemptions and special cases regarding sales tax for cars. For instance, vehicles purchased for commercial use, such as taxis or delivery trucks, may be eligible for a reduced tax rate. Additionally, some charitable organizations and government entities are exempt from paying sales tax on vehicle purchases.

It's essential to consult the DOR's guidelines and seek professional advice to determine if any specific exemptions or special cases apply to your situation. These exemptions can significantly impact the overall cost of purchasing a vehicle, making it crucial to understand the applicable regulations.

Sales Tax Implications for Residents vs. Non-Residents

The sales tax implications for car purchases differ between Massachusetts residents and non-residents. Understanding these differences is crucial for both parties to ensure compliance and avoid potential legal issues.

Residents

Massachusetts residents are subject to the state’s sales tax laws when purchasing a car within the state. The standard sales tax rate of 6.25% applies to most vehicle purchases, as outlined earlier. Residents must pay this tax at the time of purchase, typically to the dealership or seller.

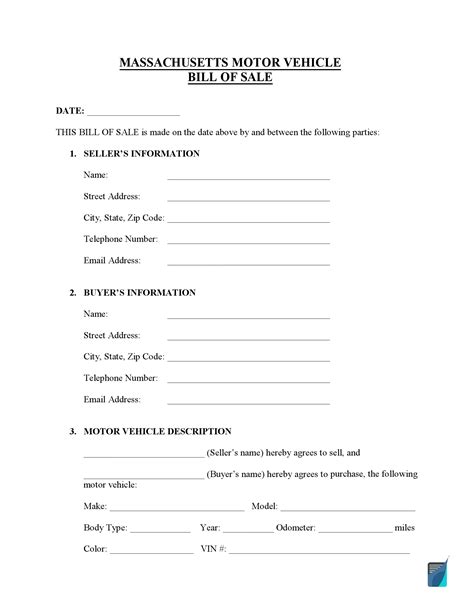

If a Massachusetts resident purchases a vehicle from a private seller, they are responsible for paying the sales tax to the DOR directly. This process involves completing the necessary paperwork and submitting it along with the applicable tax amount. Failure to pay the sales tax can result in penalties and legal consequences.

Non-Residents

Non-residents of Massachusetts who purchase a vehicle within the state are also subject to sales tax. However, the process and implications can differ based on their home state’s tax laws and regulations.

In some cases, non-residents may be able to claim a credit or exemption in their home state for the sales tax paid in Massachusetts. This can reduce the overall tax burden and prevent double taxation. However, the specific rules and requirements vary from state to state, so it's essential for non-residents to understand their home state's tax laws and consult with a tax professional if needed.

Non-residents should also be aware of the potential for additional fees and surcharges, as these can vary based on the vehicle type and intended use. It's advisable to obtain a detailed breakdown of all costs associated with the vehicle purchase to avoid any surprises.

Calculating Sales Tax for Car Purchases

Calculating the sales tax for a car purchase in Massachusetts involves a straightforward process. The sales tax is typically calculated as a percentage of the vehicle’s purchase price, excluding any applicable fees and surcharges.

For example, if you purchase a new car with a price tag of $30,000, the sales tax would be calculated as follows:

Sales Tax = Purchase Price x Sales Tax Rate

Sales Tax = $30,000 x 0.0625

Sales Tax = $1,875

In this case, the sales tax amount would be $1,875, which you would pay in addition to the purchase price. It's important to note that this calculation is a basic example, and the actual sales tax may vary based on the specific vehicle and any applicable exemptions or surcharges.

Additional Fees and Surcharges

In addition to the sales tax, there may be other fees and surcharges associated with purchasing a car in Massachusetts. These fees can include:

- Registration Fee: A fee paid to register the vehicle with the state, ensuring compliance with vehicle regulations and safety standards.

- Title Fee: A fee for obtaining the vehicle's title, which establishes ownership and provides legal proof of ownership.

- Excise Tax: A tax based on the vehicle's weight or battery size, applicable to certain types of vehicles.

- Environmental Surcharge: A fee aimed at promoting environmental sustainability, often applicable to new vehicle purchases.

It's crucial to review the breakdown of fees and surcharges provided by the dealership or seller to understand the total cost of the vehicle purchase. These additional costs can significantly impact the overall expense, so it's essential to plan and budget accordingly.

Future Implications and Considerations

Understanding the sales tax implications for car purchases in Massachusetts is not only essential for the initial transaction but also has long-term implications. Here are some key considerations for buyers:

Resale Value and Tax Liability

When selling a vehicle in Massachusetts, the sales tax paid at the time of purchase may impact the resale value and tax liability. The sales tax is typically considered a cost of ownership and is not refundable upon resale. However, the resale value of the vehicle can be influenced by various factors, including its condition, mileage, and market demand.

Buyers looking to resell their vehicles should be aware of the potential tax implications and consult with tax professionals to ensure compliance with state regulations. Understanding the resale market and the impact of sales tax can help buyers make informed decisions and negotiate better deals.

Tax Benefits and Incentives

Massachusetts, like many other states, offers tax benefits and incentives to promote certain types of vehicle purchases. These incentives often target environmentally friendly vehicles, such as electric or hybrid cars. For example, Massachusetts provides a sales tax exemption for the purchase of electric vehicles with a battery size of 3 kilowatt-hours or more. This incentive can significantly reduce the overall cost of purchasing an EV, making it an attractive option for eco-conscious buyers.

It's important for buyers to stay informed about the latest tax benefits and incentives offered by the state. These incentives can provide significant savings and make the transition to more sustainable transportation options more affordable.

Compliance and Enforcement

The Department of Revenue takes compliance with sales tax laws seriously. Buyers and sellers must adhere to the regulations to avoid penalties and legal consequences. Failure to pay sales tax or provide accurate information can result in fines, interest charges, and even criminal charges in severe cases.

It's essential for buyers and sellers to maintain proper records and documentation related to vehicle purchases. This includes sales contracts, invoices, and any relevant tax forms. By staying organized and compliant, individuals can avoid potential issues and ensure a smooth car-buying experience.

Frequently Asked Questions

What happens if I don’t pay the sales tax for my car purchase in Massachusetts?

+

Failure to pay sales tax for a car purchase in Massachusetts can result in penalties, interest charges, and potential legal consequences. The Department of Revenue takes compliance seriously, and non-payment can lead to enforcement actions. It’s crucial to pay the sales tax promptly to avoid these issues.

Are there any sales tax exemptions for specific types of vehicles in Massachusetts?

+

Yes, Massachusetts offers sales tax exemptions for certain types of vehicles. For example, electric vehicles (EVs) with a battery size of 3 kilowatt-hours or more are exempt from sales tax. Additionally, vehicles purchased for commercial use may be eligible for reduced tax rates. It’s essential to consult the DOR guidelines for specific exemptions.

How do I calculate the sales tax for a used car purchase in Massachusetts?

+

Calculating the sales tax for a used car purchase in Massachusetts involves the same basic formula as for new cars. Multiply the purchase price of the used car by the sales tax rate (6.25%). However, it’s important to note that additional fees and surcharges may apply, so be sure to review the full breakdown of costs.

Can I get a refund for the sales tax paid on my car if I move out of Massachusetts?

+

Generally, the sales tax paid on a car purchase in Massachusetts is considered a cost of ownership and is non-refundable. However, if you move to a state with a lower sales tax rate or different tax laws, you may be able to claim a credit or exemption for the tax paid in Massachusetts. It’s advisable to consult with a tax professional to understand your specific situation.

Are there any online resources or tools to help me estimate the sales tax for my car purchase in Massachusetts?

+

Yes, there are several online calculators and tools available that can help estimate the sales tax for your car purchase in Massachusetts. These tools typically require you to input the vehicle’s purchase price and any applicable fees or surcharges. Using these resources can provide a quick estimate of the sales tax amount.