Ny Income Tax Rate

New York, a bustling state with a diverse population and a thriving economy, has a progressive income tax system that varies based on income levels and residency status. Understanding the New York Income Tax Rate is crucial for individuals and businesses operating within the state, as it directly impacts their financial planning and obligations.

Understanding the New York Income Tax Structure

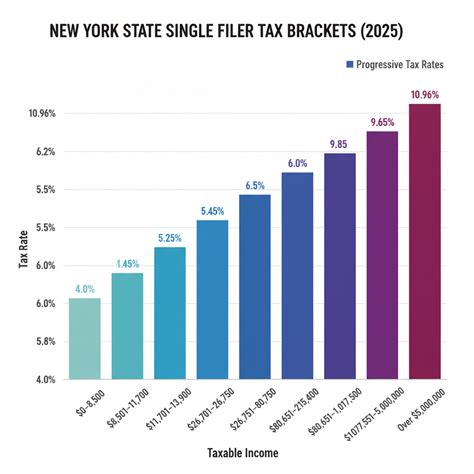

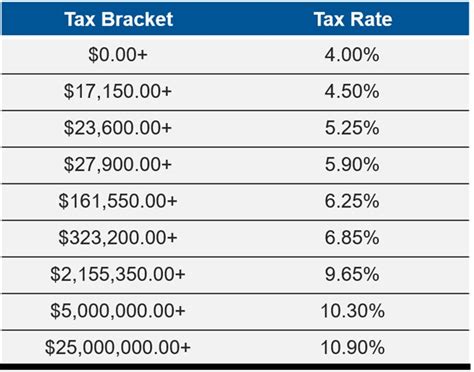

The Empire State employs a progressive tax system, meaning the income tax rate increases as taxable income rises. This approach aims to ensure that higher-income earners contribute a larger share of their income to the state’s revenue.

New York's income tax structure is divided into tax brackets, each with its own marginal tax rate. As your income exceeds the upper limit of one bracket, you move into the next higher bracket, paying the corresponding rate on the income within that bracket. This progressive system ensures fairness and contributes to a more equitable distribution of tax burden.

Residency and Non-Residency Tax Rates

New York distinguishes between residents and non-residents when it comes to income taxation. Residents are individuals who live in New York for most of the year and are subject to tax on their worldwide income. Non-residents, on the other hand, are those who maintain a primary residence outside New York but earn income within the state.

For residents, the income tax rates are based on their statewide income, including earnings from all sources, regardless of where they were generated. Non-residents, however, are taxed only on income derived from New York sources, such as wages earned while working in the state or income from New York-based investments.

| Tax Rate | Taxable Income Range (NYS Residents) |

|---|---|

| 4% | $0 - $11,650 |

| 4.5% | $11,651 - $22,250 |

| 6.5% | $22,251 - $161,550 |

| 6.85% | $161,551 - $220,050 |

| 6.95% | $220,051 - $305,300 |

| 7.85% | $305,301 - $2,150,000 |

| 8.82% | $2,150,001 and above |

Non-residents are taxed at a flat rate of 8.82% on their New York-sourced income. This includes wages, business income, and investment income derived from New York sources.

Taxable Income and Exemptions

Not all income is taxable in New York. Certain types of income, such as interest on municipal bonds, capital gains from the sale of a primary residence, and certain retirement benefits, are exempt from state income tax. These exemptions can significantly reduce an individual’s taxable income and overall tax liability.

Deductions and Credits

New York offers various deductions and credits to reduce taxable income and provide tax relief to individuals and families. Some common deductions include those for medical expenses, mortgage interest, and state and local taxes paid. Additionally, New York provides tax credits for low-income individuals and families, education expenses, and certain energy-efficient home improvements.

| Deduction/Credit | Description |

|---|---|

| Standard Deduction | Available to all taxpayers, this deduction reduces taxable income by a set amount. For 2023, the standard deduction is $2,200 for singles and $4,400 for married filing jointly. |

| Personal Exemption | An additional deduction for each taxpayer and dependent, providing a further reduction in taxable income. The personal exemption amount is $2,200 for 2023. |

| Child and Dependent Care Credit | Offers a credit for expenses related to child or dependent care, up to a certain limit, to assist working families. |

| Low-Income Tax Credit | Provides a refundable credit to low-income individuals and families, helping to offset their tax burden. |

Tax Filing and Payment

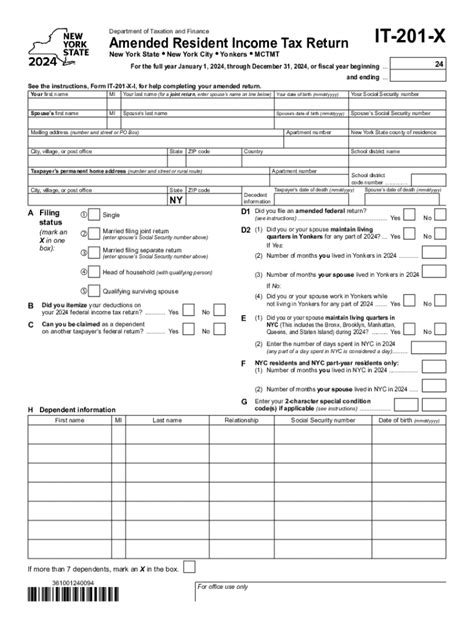

New York residents and non-residents with taxable income must file an annual New York State Resident Income Tax Return (Form IT-201) or Nonresident and Part-Year Resident Income Tax Return (Form IT-203), respectively. The filing deadline is typically aligned with the federal tax filing deadline, which is usually April 15th of each year.

Electronic Filing and Payment Options

The New York Department of Taxation and Finance encourages taxpayers to file their returns electronically using approved software or the department’s online filing system. Electronic filing is faster, more secure, and reduces the risk of errors compared to paper filing. Additionally, taxpayers can choose to pay their taxes electronically through direct debit or credit card payment.

Estimated Tax Payments

If you expect to owe $1,000 or more in New York income tax for the year, you may need to make estimated tax payments. These payments are typically required quarterly and help ensure that you meet your tax obligations throughout the year, avoiding penalties for underpayment.

Tax Compliance and Penalties

Maintaining tax compliance is essential to avoid penalties and interest. New York imposes penalties for late filing, late payment, and underpayment of estimated taxes. Additionally, taxpayers who intentionally fail to file or underreport their income may face criminal charges and substantial fines.

It's crucial to keep accurate records, including income statements, receipts, and other supporting documents, to substantiate your tax return. These records can help in case of an audit and ensure that you are properly claiming all eligible deductions and credits.

Future Implications and Tax Reforms

The New York income tax rate is subject to periodic reviews and adjustments to address changing economic conditions and revenue needs. The state’s tax policies can have a significant impact on individuals’ financial planning and businesses’ decision-making processes.

In recent years, there have been discussions and proposals for tax reforms, including the potential expansion of tax brackets, adjustments to the tax rates, and changes to deductions and credits. These reforms aim to promote economic growth, provide tax relief to certain sectors, and ensure a fair and sustainable tax system.

Staying informed about these developments is crucial for taxpayers to adapt their financial strategies accordingly. Regular updates from the New York Department of Taxation and Finance, as well as tax professionals, can provide valuable insights into potential changes and their implications.

Conclusion

Understanding the New York Income Tax Rate is an essential aspect of financial planning for individuals and businesses operating within the state. The progressive tax structure, residency considerations, and available deductions and credits all play a significant role in determining an individual’s or entity’s tax liability.

By staying informed about the tax system, taxpayers can optimize their financial strategies, ensure compliance, and take advantage of available tax benefits. As the state's tax policies continue to evolve, staying updated is key to navigating the ever-changing tax landscape effectively.

What is the income tax rate for non-residents in New York?

+Non-residents of New York are taxed at a flat rate of 8.82% on their New York-sourced income, including wages, business income, and investment income.

Are there any tax exemptions for New York residents?

+Yes, New York offers exemptions for certain types of income, such as interest on municipal bonds, capital gains from the sale of a primary residence, and certain retirement benefits. These exemptions can significantly reduce taxable income.

What are some common tax deductions available in New York?

+Common tax deductions in New York include the standard deduction, personal exemptions, medical expenses, mortgage interest, and state and local taxes paid. There are also specific credits for low-income individuals, education expenses, and energy-efficient home improvements.

When is the New York State income tax return due?

+The filing deadline for New York State income tax returns is typically aligned with the federal tax filing deadline, which is usually April 15th of each year. However, it’s important to check for any changes or extensions announced by the state.

What happens if I fail to file or pay my New York income taxes on time?

+Failing to file or pay your New York income taxes on time can result in penalties and interest. Late filing penalties range from 5% to 10% of the unpaid tax, and late payment penalties are 0.5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25%. It’s crucial to stay compliant to avoid these penalties.