New Tax Laws

Welcome to a comprehensive exploration of the latest tax legislation and its profound impact on individuals and businesses alike. In this article, we delve into the intricacies of the newly enacted tax laws, shedding light on their implications and offering expert insights to help navigate the complex landscape.

Unraveling the New Tax Landscape: Key Provisions and Insights

The recent overhaul of tax laws has brought about significant changes, affecting a wide range of taxpayers. From individual taxpayers to small businesses and corporations, understanding these new regulations is crucial for effective financial planning.

Individual Tax Reform: A Simplified Approach

One of the notable changes introduced by the new tax laws is the simplification of tax brackets for individuals. The reform aims to provide a more straightforward tax system, with updated income thresholds and revised tax rates. For instance, the 2023 tax year sees the introduction of seven tax brackets, ranging from 10% to 37%, each designed to cater to different income levels. This shift not only simplifies the tax calculation process but also offers potential tax savings for those who understand the new brackets.

| Tax Bracket | Tax Rate | Applicable Income Range |

|---|---|---|

| 10% | Single filers: Up to $10,275 Married filing jointly: Up to $20,550 |

|

| 12% | Single filers: $10,276 to $41,775 Married filing jointly: $20,551 to $83,550 |

|

| 22% | Single filers: $41,776 to $89,075 Married filing jointly: $83,551 to $178,150 |

|

| 24% | Single filers: $89,076 to $170,050 Married filing jointly: $178,151 to $340,100 |

|

| 32% | Single filers: $170,051 to $215,950 Married filing jointly: $340,101 to $431,900 |

|

| 35% | Single filers: $215,951 to $539,900 Married filing jointly: $431,901 to $647,850 |

|

| 37% | Single filers: Above $539,900 Married filing jointly: Above $647,850 |

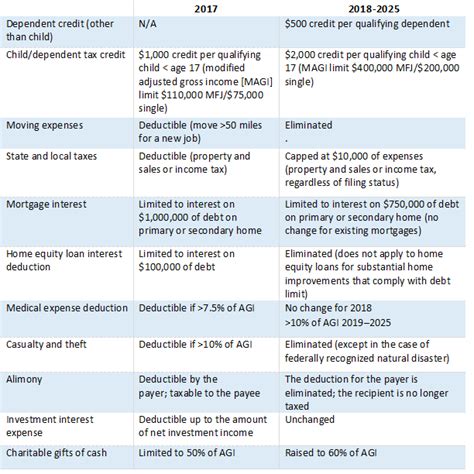

Furthermore, the new tax laws have expanded the scope of tax credits and deductions, providing additional relief to eligible taxpayers. For example, the Child Tax Credit has been increased, offering up to $3,000 per qualifying child aged 6 to 17, and $3,600 for children under 6. This change aims to ease the financial burden on families and encourage investment in the next generation.

Business Tax Advantages: Navigating the New Opportunities

Businesses, too, stand to benefit from the recent tax reforms. The new laws introduce incentives for investment and job creation, particularly for small and medium-sized enterprises (SMEs). One notable provision is the full expensing allowance, which allows businesses to deduct the full cost of certain assets in the year they are placed in service. This measure encourages businesses to invest in new equipment and infrastructure, promoting economic growth.

Additionally, the new tax laws have streamlined the process for claiming research and development (R&D) credits. The R&D Tax Credit provides a powerful incentive for businesses to innovate and invest in cutting-edge technologies. By claiming this credit, businesses can offset a portion of their tax liability, making it a significant advantage for those engaged in research-intensive industries.

Impact on Real Estate and Investments

The real estate sector is not exempt from the effects of the new tax laws. The Qualified Business Income (QBI) deduction allows real estate investors and owners to deduct up to 20% of their qualified business income from their taxable income. This provision aims to encourage investment in real estate and promote economic growth in local communities.

Moreover, the new tax laws have introduced changes to capital gains taxation. Long-term capital gains, arising from the sale of assets held for more than a year, are now taxed at a maximum rate of 20% for individuals in the highest tax bracket. This change incentivizes long-term investment strategies and discourages short-term speculation.

Analyzing the Long-Term Effects: A Forward-Looking Perspective

While the immediate impact of the new tax laws is significant, it is essential to consider their long-term implications. The reforms are expected to have a lasting influence on the economy, shaping investment patterns and business strategies.

Economic Growth and Investment Trends

The incentives introduced by the new tax laws are designed to spur economic growth and encourage investment. The full expensing allowance, for instance, is anticipated to boost business investment, leading to increased productivity and job creation. This, in turn, could contribute to a more robust and resilient economy, fostering long-term prosperity.

Furthermore, the expansion of tax credits and deductions is likely to stimulate consumer spending and encourage business expansion. The increased Child Tax Credit, for example, provides families with additional disposable income, which can be spent on goods and services, thereby supporting local businesses and the overall economy.

Potential Challenges and Opportunities

While the new tax laws offer numerous advantages, they also present challenges. For instance, the complexity of the tax system may still persist, particularly for those with more intricate financial situations. Additionally, the changing tax landscape requires continuous adaptation and a proactive approach to tax planning.

However, these challenges also present opportunities. Businesses and individuals who stay informed and engage with tax professionals can identify strategies to optimize their tax positions. This could involve restructuring business operations, adjusting investment strategies, or taking advantage of specific tax provisions tailored to their circumstances.

Conclusion: Navigating the Complex Tax Landscape

The recent tax reforms have undoubtedly transformed the tax landscape, offering both challenges and opportunities. By understanding the key provisions and staying informed, taxpayers can effectively navigate this complex terrain. Whether it’s simplifying tax brackets for individuals, providing incentives for business investment, or shaping real estate strategies, the new tax laws have the potential to shape the economic trajectory for years to come.

How do the new tax laws affect small businesses?

+The new tax laws provide several advantages for small businesses. These include the full expensing allowance, which allows businesses to deduct the full cost of certain assets in the year they are placed in service, and streamlined R&D tax credits, which incentivize innovation. These provisions aim to support small businesses and promote economic growth.

What are the key changes for individual taxpayers in the new tax laws?

+For individual taxpayers, the new tax laws simplify tax brackets and offer expanded tax credits and deductions. The reform introduces seven tax brackets with rates ranging from 10% to 37%, and increases the Child Tax Credit, providing up to 3,000 per qualifying child aged 6 to 17, and 3,600 for children under 6.

How do the new tax laws impact real estate investments?

+The new tax laws provide a boost to real estate investors through the Qualified Business Income (QBI) deduction, allowing them to deduct up to 20% of their qualified business income from their taxable income. Additionally, changes to capital gains taxation, with a maximum rate of 20% for long-term capital gains, encourage long-term investment strategies.