What Is North Carolina Sales Tax

North Carolina's sales tax system is a crucial aspect of the state's economy, impacting both residents and businesses alike. Understanding the intricacies of this tax is essential for individuals and businesses operating within the state, as it influences financial planning, budgeting, and compliance with state regulations. This comprehensive guide aims to delve into the specifics of North Carolina's sales tax, shedding light on its rates, exemptions, collection processes, and potential implications for various industries and consumers.

Unraveling North Carolina Sales Tax: Rates and Structures

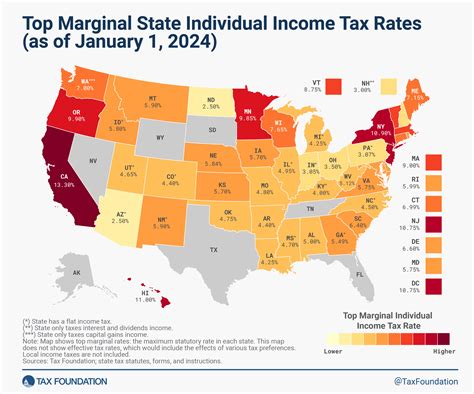

North Carolina imposes a statewide sales and use tax on most tangible personal property and certain services. As of [current year], the general state sales tax rate stands at 4.75%, one of the lowest in the country. However, it’s important to note that this is not the only tax levied on sales within the state.

In addition to the state sales tax, local governments in North Carolina have the authority to impose their own local sales and use taxes. These taxes are typically charged on top of the state rate, resulting in a combined rate that varies depending on the location of the transaction. The maximum combined rate allowed is 2.50%, although some counties choose to levy the full amount, resulting in a combined state and local sales tax of 7.25%.

For instance, in the city of Raleigh, the local sales tax rate is 1.75%, bringing the total sales tax to 6.50% when combined with the state rate. In contrast, Charlotte has a local sales tax rate of 2.25%, resulting in a combined total of 7.00%.

It's crucial for businesses operating in multiple counties or cities within North Carolina to be aware of these varying rates to ensure accurate tax collection and remittance.

Sales Tax Holidays: A Break for Consumers

To provide relief to taxpayers, North Carolina occasionally offers sales tax holidays. These are specific periods during which certain items are exempt from sales tax, offering consumers a chance to save on essential purchases. The state typically declares sales tax holidays for items like school supplies, clothing, and electronics.

For example, in [year], North Carolina held a Back-to-School Sales Tax Holiday from [date] to [date]. During this period, eligible school supplies and clothing items under [dollar amount] were exempt from sales tax, encouraging parents to stock up on essentials for the new school year.

Navigating Sales Tax Exemptions: A Guide for Businesses

Understanding the sales tax exemptions in North Carolina is vital for businesses to ensure they are compliant with the law and avoid potential penalties. The state offers a range of exemptions, some of which are mandatory, while others are optional.

Mandatory Exemptions

Certain categories of sales are exempt from sales tax by law, and businesses must be aware of these to avoid overcharging their customers.

- Food and Drugs: Most unprepared food items, including produce, meat, and dairy products, are exempt from sales tax. However, prepared foods, such as meals from restaurants, are taxable.

- Prescription Medications: Sales of prescription drugs are exempt from sales tax, but non-prescription medications and over-the-counter remedies are taxable.

- Residential Rent: Leases and rentals of residential properties, including apartments and houses, are exempt from sales tax.

- Manufacturing Equipment: Sales of machinery and equipment used directly in manufacturing or processing are exempt, provided they meet specific criteria outlined by the North Carolina Department of Revenue.

Optional Exemptions

North Carolina also allows certain optional exemptions that businesses can choose to utilize. These exemptions often require specific registration and compliance procedures.

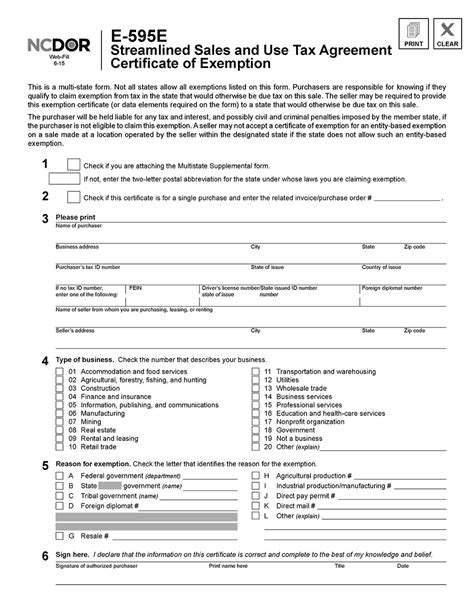

- Resale Exemptions: Businesses that purchase goods for resale can claim an exemption on their purchases. This is a crucial exemption for retailers, as it allows them to avoid paying sales tax on inventory that will ultimately be sold to consumers.

- Agriculture and Forestry Exemptions: Sales of agricultural and forestry equipment, supplies, and livestock are often exempt from sales tax. This exemption supports North Carolina's agricultural industry.

- Government Exemptions: Sales to state and local governments, as well as certain non-profit organizations, may be exempt from sales tax. This exemption varies based on the type of purchase and the entity's status.

Businesses should consult the North Carolina Department of Revenue's guidelines and seek professional advice to ensure they are claiming the correct exemptions and fulfilling their tax obligations accurately.

Sales Tax Collection: The Role of Businesses

Businesses operating in North Carolina play a critical role in the state’s sales tax collection process. They are responsible for collecting the appropriate tax rate from customers and remitting it to the state on a regular basis.

Registering for a Sales Tax Permit

Any business making taxable sales in North Carolina must register for a sales and use tax permit with the North Carolina Department of Revenue. This permit allows the business to collect and remit sales tax legally.

The registration process typically involves completing an online application, providing business details, and obtaining a unique permit number. Businesses may also need to provide additional information, such as their North American Industry Classification System (NAICS) code, to ensure they are classified correctly.

Calculating and Remitting Sales Tax

Once registered, businesses must calculate the appropriate sales tax on each taxable transaction. This involves applying the correct tax rate, which may vary based on the location of the sale and any applicable exemptions.

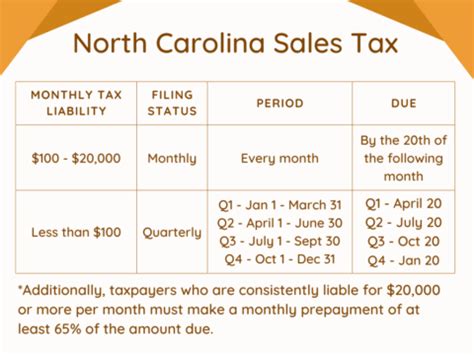

Businesses typically collect sales tax at the point of sale, either by adding it to the purchase price or displaying it separately on the receipt. They must then remit the collected tax to the state on a regular basis, usually quarterly or monthly, depending on their sales volume.

The remittance process involves completing a sales tax return, which summarizes the taxable sales made during the reporting period, and paying the corresponding tax amount. Late payments or failures to remit sales tax can result in penalties and interest charges.

Record-Keeping and Audits

Businesses are required to maintain detailed records of their sales, purchases, and tax collections. These records must be retained for a minimum of three years to comply with audit requirements.

The North Carolina Department of Revenue has the authority to conduct audits to ensure businesses are accurately calculating and remitting sales tax. During an audit, businesses must provide all relevant records and documentation to support their tax filings.

Sales Tax Implications for Industries and Consumers

North Carolina’s sales tax structure has significant implications for both industries and consumers within the state. Understanding these implications can help businesses strategize their pricing and marketing approaches, while consumers can make more informed purchasing decisions.

Impact on Industries

The sales tax rate directly influences the pricing of goods and services, which can have a cascading effect on various industries.

- Retail: Retailers must carefully consider the impact of sales tax on their pricing strategies. A higher tax rate can make it challenging to remain competitive, especially when consumers have the option to shop online or in neighboring states with lower tax rates.

- Hospitality and Tourism: The sales tax rate can significantly impact the cost of dining out, hotel stays, and other tourism-related expenses. A higher tax rate may deter visitors, affecting the state's tourism industry.

- Construction and Real Estate: Sales tax on construction materials and related services can increase the overall cost of building projects. This can influence the affordability of housing and commercial developments.

- Manufacturing: While certain manufacturing equipment and supplies are exempt from sales tax, the tax on other inputs can impact the overall cost of production, affecting the competitiveness of North Carolina's manufacturing sector.

Consumer Behavior and Purchasing Decisions

Sales tax can influence consumer purchasing behavior, especially when it comes to big-ticket items or frequent purchases.

- Price Comparison: Consumers may opt to shop around, comparing prices across different retailers or even in neighboring states with lower tax rates, to find the best overall price.

- Online Shopping: The convenience and often lower prices of online shopping can entice consumers to purchase goods online, especially if the online retailer is based in a state with no sales tax or a lower rate.

- Timing of Purchases: Consumers may time their purchases to coincide with sales tax holidays or other promotional periods to save money.

- Budgeting: Sales tax can impact household budgets, especially for lower-income families. A higher tax rate can make it more challenging to afford essential goods and services.

Future Outlook and Potential Changes

As with any tax system, North Carolina’s sales tax structure is subject to potential changes and reforms. The state government regularly reviews its tax policies to ensure they remain fair, effective, and aligned with the needs of its citizens and businesses.

Potential Reforms

In recent years, there has been growing discussion around the potential for broadening the sales tax base to include services, which are currently taxed at a lower rate or not taxed at all. This could generate additional revenue for the state but may also face resistance from certain industries and consumers.

Additionally, there have been proposals to simplify the tax system by reducing or eliminating the local sales tax, which would result in a uniform tax rate across the state. This could make tax collection and compliance easier for businesses and consumers but may also reduce revenue for local governments.

Emerging Trends

The increasing popularity of online shopping and the rise of e-commerce platforms have led to a growing focus on sales tax compliance for online retailers. North Carolina, like many other states, is working to ensure that online retailers collect and remit sales tax accurately, especially for sales made to in-state customers.

Furthermore, the state is exploring ways to enhance its tax collection infrastructure to accommodate the evolving nature of commerce. This includes investing in technology and data systems to improve tax administration and enforcement.

Conclusion

North Carolina’s sales tax system is a complex but crucial component of the state’s fiscal landscape. Understanding the rates, exemptions, and collection processes is essential for businesses and consumers alike to navigate this system effectively. As the state continues to evolve, its sales tax structure will likely undergo further changes and reforms to adapt to the needs of its citizens and businesses.

How often do businesses need to remit sales tax in North Carolina?

+Businesses with a monthly tax liability of 50,000 or more must remit sales tax monthly. Those with a liability between 10,000 and 49,999 must remit quarterly, and those with a liability of less than 10,000 may remit annually. However, annual remittance requires approval from the North Carolina Department of Revenue.

Are there any penalties for late sales tax payments in North Carolina?

+Yes, late payments of sales tax in North Carolina can result in penalties and interest charges. The penalty for late payment is typically 5% of the tax due, and interest is charged at a rate of 0.5% per month or fraction of a month that the tax remains unpaid.

How does North Carolina handle sales tax on online purchases?

+North Carolina requires online retailers to collect and remit sales tax on purchases shipped to addresses within the state. This applies to both in-state and out-of-state retailers, provided they meet certain criteria, such as having a physical presence or a significant economic presence in the state.