Nj Tax Records Ocean

In the state of New Jersey, tax records are a vital aspect of the financial landscape, especially when it comes to the oceanfront properties along the Jersey Shore. These records provide valuable insights into the economic health of the region and are a key consideration for investors, homeowners, and businesses alike. Let's delve into the world of NJ Tax Records with a specific focus on the oceanfront properties, exploring their significance, the data they contain, and the implications they hold.

Understanding the Importance of NJ Tax Records for Oceanfront Properties

The New Jersey tax system is a complex network of laws and regulations that govern the assessment and collection of various taxes, including property taxes. For oceanfront properties, these tax records play a critical role in determining the value of these prime real estate assets. The state’s tax assessment process is designed to ensure fairness and accuracy, providing a transparent framework for property owners and stakeholders.

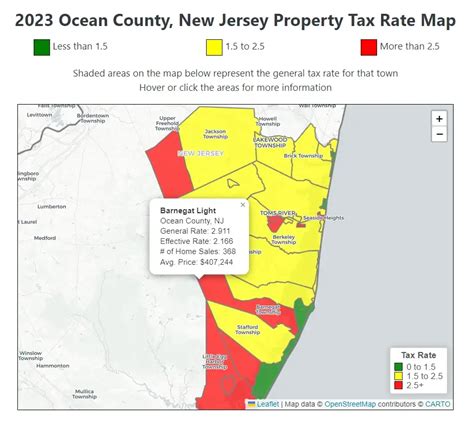

Oceanfront properties along the Jersey Shore are often considered a premium asset class, attracting high-net-worth individuals and investors. These properties not only offer stunning views and direct access to the Atlantic Ocean but also present unique challenges and opportunities when it comes to taxation. NJ tax records for oceanfront properties encompass a range of data points, including property assessments, tax rates, and historical sales data, all of which contribute to a comprehensive understanding of the market.

Key Metrics and Insights from NJ Tax Records

One of the primary purposes of NJ tax records is to provide a fair and accurate assessment of property values. For oceanfront properties, this assessment is crucial, as it directly impacts the tax liability of the property owner. The assessment process takes into account various factors such as the property’s location, size, amenities, and recent sales data to determine its taxable value. Here’s a breakdown of some key metrics found in NJ tax records for oceanfront properties:

| Metric | Description |

|---|---|

| Property Assessment | The estimated value of the property for tax purposes, determined by the county tax assessor. |

| Taxable Value | The assessed value multiplied by the applicable tax rate, which determines the property's tax liability. |

| Tax Rate | The percentage rate applied to the taxable value to calculate the annual property tax bill. |

| Sale Price History | A record of the property's sales over time, providing insights into market trends and value appreciation. |

| Property Characteristics | Details about the property's features, including square footage, number of rooms, and special amenities. |

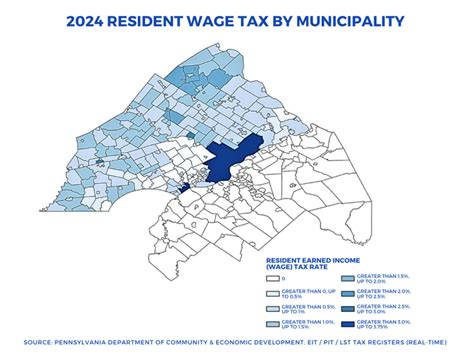

These metrics offer a comprehensive view of the property's value and tax obligations. For instance, a property's tax rate can vary depending on its location within the state, with certain areas having higher rates due to the cost of local services and infrastructure. Understanding these rates is crucial for both buyers and existing homeowners.

Analyzing Oceanfront Property Values and Tax Implications

The analysis of NJ tax records for oceanfront properties provides a unique perspective on the real estate market along the Jersey Shore. These records offer a historical perspective on property values, allowing for trend analysis and forecasting. By studying the sale price history and tax assessments of these properties, investors and analysts can identify patterns, such as seasonal fluctuations or long-term value appreciation.

For instance, a property that consistently sees higher sale prices during the summer months may indicate a strong demand for seasonal rentals, influencing its overall value and tax assessment. Additionally, NJ tax records can highlight areas with a history of value appreciation, making them attractive targets for investors seeking long-term capital growth.

Moreover, tax records can provide insights into the economic health of the region. A sudden increase in tax delinquencies or a drop in property assessments could signal underlying economic issues, prompting further investigation. Conversely, stable or increasing assessments indicate a healthy market with sustained property values.

Expert Insights and Strategies for Oceanfront Property Owners

For homeowners, understanding their tax obligations is crucial for financial planning. NJ tax records provide a clear picture of the annual property tax bill, allowing homeowners to budget accordingly. Additionally, keeping track of these records can be beneficial when considering home improvements or renovations, as certain upgrades may impact the property's assessment and subsequent tax liability.

Investors, on the other hand, can leverage NJ tax records to make informed decisions about their real estate investments. By analyzing tax data alongside other market indicators, investors can identify undervalued properties, assess the potential for value growth, and make strategic decisions about buying, selling, or holding properties.

Future Outlook and the Impact of NJ Tax Records on Oceanfront Development

As the Jersey Shore continues to be a desirable location for both residents and tourists, the demand for oceanfront properties is expected to remain strong. NJ tax records will play a pivotal role in shaping the future of this real estate market, influencing investment strategies and development trends.

One notable trend is the increasing focus on sustainable and resilient development along the coast. As climate change impacts become more pronounced, there is a growing emphasis on building practices that mitigate the risks associated with rising sea levels and storm surges. NJ tax records, especially those that capture property characteristics and recent sales data, can help identify areas where sustainable development is taking root and provide insights into the market's response to these initiatives.

Furthermore, as the state and local governments continue to invest in infrastructure and amenities along the shore, NJ tax records will reflect these improvements. Areas with enhanced access to public transportation, improved flood protection measures, or new recreational facilities may see an increase in property values, as reflected in the tax assessments. This, in turn, can drive further investment and development, creating a positive feedback loop.

In conclusion, NJ tax records for oceanfront properties are a treasure trove of information for anyone interested in the Jersey Shore real estate market. They provide a comprehensive view of property values, tax obligations, and market trends, offering valuable insights for homeowners, investors, and stakeholders alike. As the market evolves, these records will continue to be a critical tool for understanding and shaping the future of oceanfront development in New Jersey.

How often are NJ tax assessments conducted for oceanfront properties?

+In New Jersey, tax assessments are typically conducted every two years, with some counties conducting assessments annually. However, for oceanfront properties, the assessment process may be more frequent due to the dynamic nature of the market and the potential for rapid value fluctuations.

What steps can homeowners take if they believe their property assessment is inaccurate?

+Homeowners who disagree with their property assessment have the right to appeal. The process involves submitting an appeal to the county tax board, providing evidence to support their claim, and potentially attending a hearing. It’s advisable to consult with a tax professional or attorney for guidance.

How do NJ tax records impact investment decisions for oceanfront properties?

+NJ tax records provide critical data for investors, offering insights into property values, tax obligations, and market trends. By analyzing these records alongside other market indicators, investors can make informed decisions about buying, selling, or holding oceanfront properties, optimizing their investment strategies.