City Wage Tax In Philadelphia

The City Wage Tax in Philadelphia is a significant factor in the financial landscape of the city, impacting both residents and businesses alike. With a unique tax structure and a long history, it plays a crucial role in shaping the economic environment of the City of Brotherly Love. This comprehensive guide will delve into the intricacies of the City Wage Tax, exploring its history, current status, and its implications for various stakeholders.

A Historical Perspective

The roots of the City Wage Tax can be traced back to the mid-20th century when Philadelphia, like many other cities, faced financial challenges. In 1939, the city implemented the Wage and Net Profits Tax, a measure designed to boost revenue and stabilize the municipal budget. This tax initially applied to both residents and businesses, with rates varying based on income and profitability.

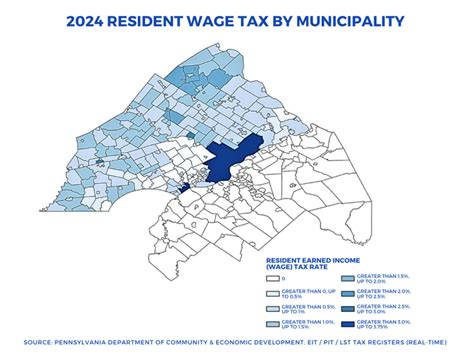

Over the decades, the City Wage Tax has undergone several transformations. In the 1970s, it was restructured to its current form, with separate taxes for residents and businesses. This move aimed to provide a more equitable tax burden, considering the diverse economic activities within the city. The resident wage tax rate was set at 3.848%, while the business privilege tax rate stood at 6.229% (as of 2024 tax year). These rates are applied to earned income, with specific exemptions and deductions in place.

The tax is administered by the Philadelphia Department of Revenue, which handles collection, enforcement, and taxpayer assistance. The revenue generated from the City Wage Tax is a critical component of Philadelphia's annual budget, funding essential services such as education, public safety, infrastructure development, and social programs.

The Impact on Residents

For Philadelphia residents, the City Wage Tax is a direct deduction from their earnings. While the tax applies to all forms of compensation, including salaries, bonuses, and commissions, certain types of income are exempt. For instance, Social Security benefits and some pension income are not subject to the wage tax. Additionally, Philadelphia offers a Homestead Exemption, providing a reduction in tax liability for homeowners who meet specific criteria.

The tax has a notable impact on the financial planning of residents. It influences decisions regarding employment, retirement, and even residency. For instance, individuals working in neighboring counties may opt to reside in those counties to avoid the city wage tax. Similarly, retirees often consider the tax implications when deciding where to spend their golden years.

Strategies for Residents

To mitigate the impact of the City Wage Tax, residents can explore various strategies. One popular approach is to maximize pre-tax contributions to retirement accounts, such as 401(k)s and IRAs. These contributions reduce taxable income, thus lowering the wage tax liability. Additionally, residents can take advantage of the Homestead Exemption, ensuring they meet the requirements to qualify.

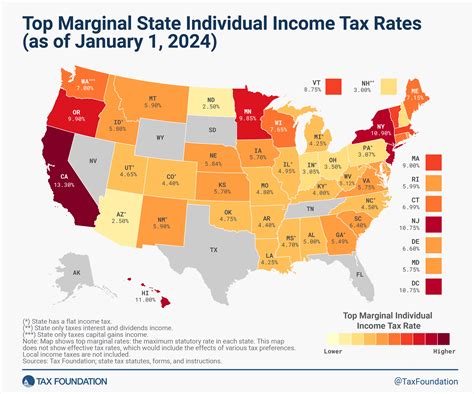

For those considering a move, researching and comparing tax rates in different municipalities can be insightful. While the City Wage Tax is a significant factor, other taxes and costs should also be considered in the decision-making process.

Businesses and the City Wage Tax

Businesses operating in Philadelphia are subject to the Business Privilege Tax, which is distinct from the resident wage tax. This tax applies to gross receipts from business activities within the city limits. The rate is 6.229% for the 2024 tax year, making it a substantial cost for companies doing business in Philadelphia.

The Business Privilege Tax is a key consideration for businesses when deciding on their operational footprint. It influences decisions regarding office locations, staffing, and overall business strategy. Companies often factor in the tax when determining their pricing structures and profitability estimates.

Tax Strategies for Businesses

Businesses have several strategies to optimize their tax liability. One common approach is to leverage tax credits and incentives offered by the city and state governments. Philadelphia, for instance, provides tax incentives for various industries, such as film production and green energy initiatives. These incentives can significantly reduce the effective tax rate for qualifying businesses.

Additionally, businesses can explore tax-efficient staffing models. For instance, utilizing contractors or remote workers can reduce the gross receipts subject to the Business Privilege Tax. However, businesses must ensure they comply with all relevant employment laws and regulations when employing such strategies.

The Role of Exemptions and Deductions

Both residents and businesses can benefit from various exemptions and deductions offered by the City Wage Tax system. These provisions are designed to alleviate the tax burden for specific categories of taxpayers.

Resident Exemptions

For residents, the most notable exemption is the Homestead Exemption, which provides a tax credit for homeowners. To qualify, residents must own and occupy their primary residence in Philadelphia and meet certain income thresholds. The exemption can significantly reduce the tax liability for eligible homeowners.

Additionally, certain types of income are exempt from the City Wage Tax. As mentioned earlier, Social Security benefits and some pension income are not subject to the tax. This exemption is particularly beneficial for retirees and individuals relying on these sources of income.

Business Deductions

Businesses can deduct certain expenses from their gross receipts before calculating the Business Privilege Tax. These deductions include costs associated with doing business, such as rent, utilities, and employee compensation. By optimizing these deductions, businesses can effectively lower their taxable gross receipts and, consequently, their tax liability.

Comparative Analysis: Philadelphia vs. Other Cities

When considering the City Wage Tax, it’s essential to put it into perspective by comparing it to other major cities. While Philadelphia’s tax rates are relatively high, they are not unique in the context of urban tax structures.

For instance, New York City imposes a city income tax of up to 3.876% for residents and a Commercial Rent or Occupancy Tax of up to 6.85% for businesses. Chicago, on the other hand, has a flat-rate city income tax of 2.4% for residents and a Business Privilege Tax of 5.25% for businesses.

While these cities have different tax structures, they all aim to balance revenue generation with economic competitiveness. The City of Philadelphia continuously evaluates its tax policies to ensure it remains an attractive location for businesses and residents while maintaining a sustainable budget.

Future Implications and Potential Reforms

As Philadelphia continues to evolve, the City Wage Tax is likely to undergo further scrutiny and potential reforms. The tax has been a subject of debate, with some advocating for rate reductions to boost economic growth and others emphasizing the need for sustainable revenue generation.

One potential reform could involve a restructuring of the tax rates to make them more competitive with neighboring cities. This could attract businesses and residents, potentially boosting the city's economic growth. Additionally, exploring alternative revenue streams, such as a potential increase in property taxes, could reduce the reliance on the City Wage Tax.

Another area of focus could be tax incentives and credits. By offering more targeted incentives, Philadelphia could encourage specific industries or business activities, further diversifying its economy. Such incentives could be particularly attractive to tech startups, renewable energy companies, and other innovative sectors.

Furthermore, the city could explore options to simplify the tax system, making it more user-friendly for taxpayers. This could involve streamlining tax forms, improving online filing systems, and enhancing taxpayer education initiatives.

A Balancing Act

Any reforms to the City Wage Tax must carefully balance the need for revenue generation with the goal of attracting and retaining businesses and residents. The tax system must be flexible enough to adapt to changing economic conditions while remaining fair and equitable for all stakeholders.

Philadelphia's leaders and policymakers must continuously assess the impact of the City Wage Tax and make informed decisions to ensure the city's long-term financial health and prosperity.

Conclusion

The City Wage Tax in Philadelphia is a complex and significant component of the city’s financial ecosystem. It impacts the daily lives of residents and the strategic decisions of businesses. Understanding its history, current status, and potential future reforms is crucial for anyone considering a move to or expansion within the city.

By providing a comprehensive analysis and offering practical strategies, this guide aims to empower individuals and businesses to navigate the City Wage Tax landscape effectively. Whether it's optimizing tax deductions, exploring incentives, or making informed residency decisions, knowledge is key to mitigating the impact of this critical tax.

What is the current resident wage tax rate in Philadelphia for the 2024 tax year?

+The resident wage tax rate for the 2024 tax year is 3.848%.

How does Philadelphia’s City Wage Tax compare to other major cities in the U.S.?

+Philadelphia’s tax rates are relatively high compared to some other major cities. However, it’s important to consider the overall tax structure and incentives offered by each city. New York City, for instance, has a higher resident income tax rate but also offers various tax credits and incentives.

Are there any tax incentives or credits available for businesses in Philadelphia?

+Yes, Philadelphia offers a range of tax incentives and credits to attract and support businesses. These include the Keystone Opportunity Improvement Zones (KOIZ) program, the Neighborhood Improvement Zones (NIZ) program, and various tax credits for job creation and investment.

Can residents of Philadelphia deduct their City Wage Tax payments from their federal taxes?

+No, the City Wage Tax is a local tax and is not deductible for federal tax purposes. However, residents can deduct certain expenses, such as charitable contributions and mortgage interest, on their federal tax returns.

How often are the City Wage Tax rates reviewed and adjusted in Philadelphia?

+The City Wage Tax rates are typically reviewed annually as part of the city’s budgeting process. Adjustments can be made to align with economic conditions, revenue needs, and policy priorities.