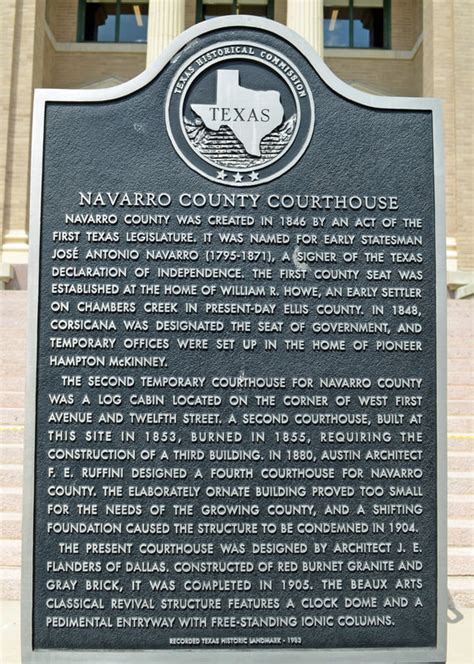

Navarro County Tax Office

Welcome to the comprehensive guide on the Navarro County Tax Office, a vital government institution responsible for managing and collecting taxes in Navarro County, Texas. This article aims to provide an in-depth exploration of the office's functions, services, and its crucial role in the local community. With a rich history spanning decades, the Navarro County Tax Office has evolved to meet the needs of its constituents, offering a range of tax-related services and resources. By delving into its operations, we can gain a deeper understanding of the significance of this office in the daily lives of Navarro County residents.

A Historical Perspective: The Evolution of Navarro County Tax Office

The Navarro County Tax Office traces its roots back to the early 20th century, a period marked by significant changes in the tax administration landscape. Established in 1909, the office was initially tasked with assessing and collecting property taxes, a critical function that supported the county’s infrastructure and public services. Over the years, the office has undergone several transformations, adapting to the evolving needs of the community and the complexities of the tax system.

One of the most notable milestones in the office's history was the introduction of modern tax assessment methods in the 1960s. This era saw the implementation of advanced appraisal techniques, ensuring a more accurate and fair evaluation of properties. The office also expanded its reach during this time, establishing branches across the county to improve accessibility for residents.

In recent decades, the Navarro County Tax Office has embraced technological advancements, digitizing its processes to enhance efficiency and convenience. Online platforms now allow residents to access a wide range of services, from tax payments to property record searches, right at their fingertips. This digital transformation has not only streamlined operations but also improved transparency and accountability in tax administration.

Core Functions and Services of Navarro County Tax Office

At the heart of the Navarro County Tax Office’s operations are its core functions, which revolve around the assessment, collection, and administration of various taxes. Let’s delve into these key responsibilities:

Property Tax Assessment

The office’s primary role involves the annual assessment of properties within Navarro County. This process determines the value of each property, which forms the basis for calculating property taxes. Highly skilled appraisers employ a range of methodologies, including sales comparison, cost approach, and income capitalization, to ensure fair and accurate assessments.

To maintain transparency and public trust, the Navarro County Tax Office provides detailed information on its assessment processes and offers avenues for property owners to appeal their assessed values. This commitment to openness has fostered a culture of collaboration and understanding between the office and the community.

Tax Collection and Payment Options

Once property taxes have been assessed, the Navarro County Tax Office is responsible for collecting these taxes. Residents have a range of convenient payment options, including online payments, in-person transactions, and automated bank drafts. The office also offers flexible payment plans for those facing financial difficulties, ensuring that taxpayers have options that suit their individual circumstances.

Furthermore, the office provides clear guidelines and deadlines for tax payments, helping residents stay informed and avoid penalties. This proactive approach has significantly reduced instances of late payments and non-compliance, contributing to a more efficient tax collection process.

Tax Research and Record Maintenance

Maintaining accurate and up-to-date tax records is another crucial aspect of the Navarro County Tax Office’s work. The office employs sophisticated database systems to store and manage property information, tax assessments, and payment histories. This ensures that taxpayers have access to their records whenever needed, facilitating transparency and ease of reference.

The office also conducts thorough research on tax-related matters, providing valuable insights to residents and stakeholders. This research encompasses tax law changes, property ownership transfers, and the impact of economic shifts on tax assessments. By staying informed, the Navarro County Tax Office can offer timely guidance and support to its constituents.

Community Engagement and Outreach Initiatives

Beyond its administrative duties, the Navarro County Tax Office actively engages with the community, fostering a culture of transparency and collaboration. Various outreach initiatives have been instrumental in building trust and ensuring that residents understand their tax obligations and rights.

Educational Workshops and Seminars

The office regularly organizes educational workshops and seminars to demystify the tax system for residents. These events cover a wide range of topics, from basic tax concepts to advanced strategies for tax planning. By providing accessible and practical information, the Navarro County Tax Office empowers residents to make informed decisions about their finances and tax obligations.

For instance, one of the office's signature programs is the "Tax Tips for Homeowners" seminar, which offers valuable insights on property tax assessments, exemptions, and appeals. This initiative has proven to be a valuable resource for homeowners, helping them navigate the complex world of property taxes with confidence.

Community Partnerships and Collaboration

The Navarro County Tax Office recognizes the importance of collaboration in serving the community effectively. It actively partners with local organizations, schools, and businesses to promote tax awareness and compliance. Through these partnerships, the office can reach a wider audience and address specific tax-related concerns in different sectors.

One notable partnership is with the Navarro County Chamber of Commerce, which has resulted in joint initiatives to support local businesses with tax guidance and resources. This collaboration has not only benefited businesses but has also contributed to the overall economic growth and stability of the county.

Digital Transformation: Enhancing Services and Accessibility

In line with its commitment to innovation, the Navarro County Tax Office has embraced digital technologies to enhance its services and improve accessibility for residents. The launch of its online platform, NavarroTaxOnline, has revolutionized the way taxpayers interact with the office.

NavarroTaxOnline: A Digital Revolution

The NavarroTaxOnline platform offers a user-friendly interface that allows residents to access a wide array of services. From checking property tax assessments to making online payments, the platform has streamlined the tax experience, making it more convenient and efficient. Users can also subscribe to alerts and notifications, ensuring they stay informed about important deadlines and updates.

Furthermore, the platform provides an online portal for property owners to submit appeals and disputes, eliminating the need for in-person visits. This digital transformation has not only saved time and resources for taxpayers but has also reduced the office's administrative burden, allowing staff to focus on complex cases and strategic initiatives.

Mobile Accessibility and On-the-Go Services

Recognizing the increasing reliance on mobile devices, the Navarro County Tax Office has also developed a dedicated mobile app. This app offers many of the same features as the web platform, allowing users to access tax information and services from their smartphones or tablets. The app’s intuitive design and real-time updates have made it a popular choice for busy residents who prefer on-the-go solutions.

The mobile app's most notable feature is its push notification system, which alerts users about critical tax-related information and deadlines. This proactive approach ensures that taxpayers stay informed, reducing the risk of late payments and missed opportunities.

Future Outlook: Navigating Challenges and Opportunities

As the Navarro County Tax Office looks to the future, it faces a landscape marked by both challenges and opportunities. The ongoing digital transformation presents new avenues for enhancing services, but it also necessitates continuous adaptation and innovation.

Adapting to Technological Advances

To remain at the forefront of tax administration, the office must continuously evaluate and adopt emerging technologies. This includes exploring artificial intelligence (AI) and machine learning for more efficient data analysis and predictive modeling. By leveraging these technologies, the office can further streamline its processes and improve the accuracy of tax assessments.

Additionally, the Navarro County Tax Office can leverage technology to enhance its cybersecurity measures, protecting sensitive taxpayer information. As cyber threats evolve, the office must stay vigilant and proactive in safeguarding its digital systems and the data they contain.

Addressing Social and Economic Disparities

Another key challenge for the Navarro County Tax Office is addressing social and economic disparities within the community. The office must work towards ensuring that tax policies and procedures are equitable and do not disproportionately impact vulnerable populations. This involves conducting thorough impact assessments and making necessary adjustments to promote fairness and social justice.

Furthermore, the office can play a pivotal role in educating residents about tax-related benefits and incentives, especially those targeted at low-income households. By doing so, the Navarro County Tax Office can empower these communities to take advantage of available resources and improve their financial well-being.

Collaborative Partnerships for Sustainable Growth

Looking ahead, the Navarro County Tax Office can leverage collaborative partnerships to address complex challenges and drive sustainable growth. By working closely with other government agencies, non-profit organizations, and community leaders, the office can develop comprehensive strategies to enhance tax administration and community development.

For instance, partnering with local schools and universities can provide opportunities for skill development and innovation. Students can gain hands-on experience in tax administration, while the office benefits from fresh perspectives and talent. This collaborative approach not only strengthens the office's capabilities but also fosters a culture of civic engagement among the youth.

How can I pay my property taxes in Navarro County?

+You can pay your property taxes through various methods, including online payments via NavarroTaxOnline, in-person transactions at the Tax Office, or by setting up an automated bank draft. The office also offers flexible payment plans for those who require them.

What happens if I miss the tax payment deadline?

+If you miss the tax payment deadline, you may incur penalties and interest charges. It’s important to stay informed about the payment deadlines and reach out to the Tax Office if you anticipate any difficulties in meeting them.

How can I appeal my property tax assessment?

+If you wish to appeal your property tax assessment, you can follow the procedures outlined by the Navarro County Tax Office. This typically involves submitting an appeal form and providing supporting documentation. The office provides detailed guidelines on its website for a smooth and transparent appeal process.

Are there any tax incentives or exemptions available in Navarro County?

+Yes, Navarro County offers various tax incentives and exemptions. These include homestead exemptions for primary residences, exemptions for certain agricultural properties, and discounts for early tax payments. You can find more information on these incentives and their eligibility criteria on the Tax Office’s website or by contacting their team.

How does the Navarro County Tax Office ensure data security and privacy?

+The Navarro County Tax Office takes data security and privacy seriously. It employs robust cybersecurity measures to protect taxpayer information, including encryption protocols and access controls. The office also conducts regular security audits and stays updated on emerging threats to maintain the integrity of its systems.