How Much Is New Jersey Sales Tax

Sales tax is an essential aspect of any jurisdiction's revenue stream, and it plays a significant role in the economic landscape of New Jersey. The state's sales tax rate is a crucial factor for consumers, businesses, and the government alike. In this comprehensive article, we will delve into the intricacies of New Jersey's sales tax, exploring its history, current rates, exemptions, and the impact it has on the state's economy. By the end of this guide, you'll have a thorough understanding of how much sales tax you can expect to pay in the Garden State.

A Historical Perspective on New Jersey Sales Tax

New Jersey’s journey with sales tax began in the early 20th century. The state introduced its first sales tax in 1966, with a 3% rate applied to most retail sales. This marked a significant shift in the state’s revenue collection strategies, moving away from reliance on property taxes alone. Over the years, the sales tax rate has undergone several adjustments, reflecting the changing economic landscape and the state’s fiscal needs.

One of the most notable adjustments occurred in 1970, when the sales tax rate was increased to 4%. This increase aimed to address budget shortfalls and provide a more stable revenue stream for the state. Since then, the rate has seen further fluctuations, with the most recent change taking place in 2018, when it was set at the current rate of 6.625%.

Understanding New Jersey’s Current Sales Tax Rate

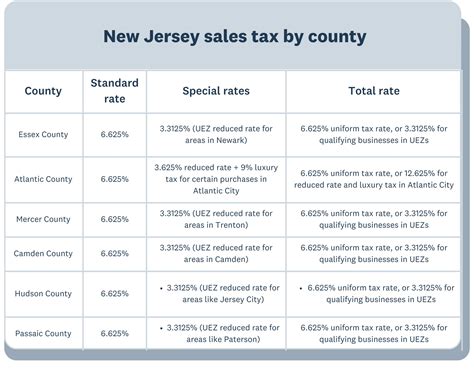

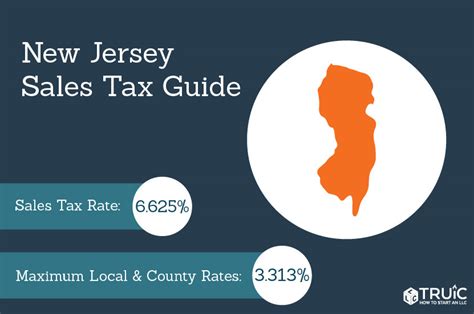

As of January 1, 2023, the statewide sales and use tax rate in New Jersey stands at 6.625%. This rate is applicable to most retail sales, including goods purchased online or through mail-order catalogs. However, it’s essential to note that the sales tax rate can vary at the local level, with additional taxes imposed by counties and municipalities.

For instance, in Atlantic City, the combined state and local sales tax rate is 7.875%, with an additional 1.25% added to the state rate. Similarly, in Hudson County, the total sales tax rate is 7.625%, with an extra 1% levied on top of the statewide rate. These local variations are crucial for businesses and consumers to be aware of, as they can significantly impact the final price of goods and services.

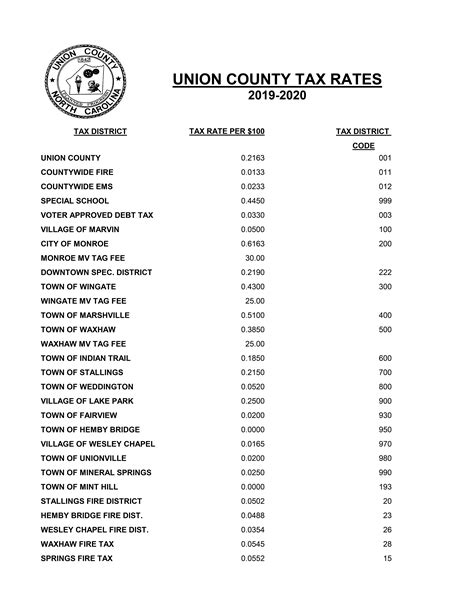

| County | Additional Local Sales Tax Rate |

|---|---|

| Atlantic County | 1.25% |

| Cape May County | 0.5% |

| Cumberland County | 0.5% |

| Hudson County | 1% |

| Salem County | 0.5% |

Exemptions and Special Considerations in New Jersey Sales Tax

While the majority of retail sales in New Jersey are subject to the sales tax, there are certain categories of goods and services that are exempt. These exemptions can significantly impact the total tax burden for both consumers and businesses.

Food and Grocery Items

One of the most notable exemptions in New Jersey’s sales tax regime is for food and grocery items. Most food products, including staple groceries, are exempt from sales tax. This exemption aims to ease the tax burden on households, especially those with lower incomes.

Clothing and Footwear

Clothing and footwear purchases are also exempt from sales tax in New Jersey, provided they meet specific criteria. Items with a selling price of 100</strong> or less per unit are tax-free. However, if the purchase price exceeds 100, the entire transaction becomes taxable.

Prescription Medications

Prescription medications and certain medical devices are exempt from sales tax. This exemption is designed to ensure that essential healthcare items are more accessible to residents.

Educational and Cultural Institutions

Sales tax exemptions also apply to certain educational and cultural institutions. For instance, sales to schools, universities, and museums are generally exempt from sales tax. This encourages the development and accessibility of educational and cultural resources.

Impact of Sales Tax on New Jersey’s Economy

New Jersey’s sales tax plays a pivotal role in the state’s economic health and stability. It is a significant source of revenue for the state government, contributing to various public services and infrastructure development.

The sales tax revenue is allocated to fund critical areas such as education, healthcare, transportation, and public safety. It also supports social services, environmental initiatives, and economic development programs. By collecting sales tax, the state can invest in its future and improve the overall quality of life for its residents.

Moreover, the sales tax system in New Jersey encourages businesses to thrive and innovate. The state offers various tax incentives and credits to attract and retain businesses, fostering a competitive business environment. These incentives can include sales tax holidays, tax-free zones, and reduced tax rates for specific industries.

Conclusion: Navigating New Jersey’s Sales Tax Landscape

Understanding New Jersey’s sales tax is essential for both consumers and businesses operating in the state. The current sales tax rate of 6.625%, coupled with potential local variations, can significantly impact the final cost of goods and services. By staying informed about the sales tax regime, individuals and businesses can make more informed financial decisions.

Additionally, the exemptions and special considerations in New Jersey's sales tax law offer opportunities for savings and economic development. From tax-free food and clothing to incentives for businesses, the state's sales tax system is designed to promote growth and accessibility.

As we navigate the complex world of sales tax, it's crucial to stay updated on any changes or adjustments to the rates and exemptions. Whether you're a resident, a business owner, or a visitor, understanding New Jersey's sales tax will ensure a smoother and more enjoyable experience in the Garden State.

How often does New Jersey adjust its sales tax rate?

+New Jersey’s sales tax rate is subject to periodic adjustments based on the state’s fiscal needs and economic conditions. While there is no set schedule for these changes, they typically occur when there is a need to address budget shortfalls or to stimulate the economy. The most recent adjustment took place in 2018, when the rate was increased from 6.875% to the current 6.625%.

Are there any sales tax holidays in New Jersey?

+Yes, New Jersey occasionally offers sales tax holidays to encourage consumer spending and provide relief to shoppers. These holidays typically waive the sales tax on specific categories of goods for a limited time. Past sales tax holidays have included back-to-school sales tax holidays, where clothing, footwear, and school supplies are tax-free for a designated period.

How does New Jersey’s sales tax compare to other states?

+New Jersey’s sales tax rate of 6.625% is relatively moderate compared to some other states. However, when combined with local sales taxes, the total rate can be higher. It’s important to compare the combined state and local rates to get an accurate picture of the sales tax burden in a specific area. Additionally, certain states have unique sales tax structures, such as destination-based sales tax, which can make direct comparisons challenging.