City Of Milwaukee Tax Bill

Welcome to an in-depth exploration of the City of Milwaukee Tax Bill, a critical component of the city's fiscal framework. Understanding the intricacies of the tax system is essential for residents, businesses, and anyone interested in Milwaukee's economic landscape. This article will provide a comprehensive guide to the tax bill, covering its components, calculation methods, and the impact it has on the city's financial health.

Understanding the City of Milwaukee Tax Bill

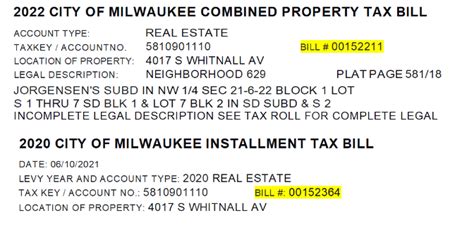

The City of Milwaukee, like many other municipalities, relies on a comprehensive tax system to generate revenue for essential services, infrastructure development, and overall city operations. The tax bill, a document detailing the amount owed by property owners, is a vital part of this system. It is a complex yet crucial aspect of Milwaukee’s financial ecosystem, and an understanding of its workings is essential for all stakeholders.

Milwaukee's tax bill is designed to ensure a fair distribution of the city's financial responsibilities among its residents and businesses. The bill is calculated based on various factors, including the assessed value of properties, the tax rate, and any applicable exemptions or deductions. This system aims to provide a stable revenue stream for the city while also promoting economic growth and community development.

Key Components of the Tax Bill

The City of Milwaukee Tax Bill consists of several key components, each playing a unique role in the overall tax calculation. These components include:

- Assessed Value of Property: The estimated market value of a property as determined by the Milwaukee County Department of Revenue. This value is crucial as it forms the basis for tax calculations.

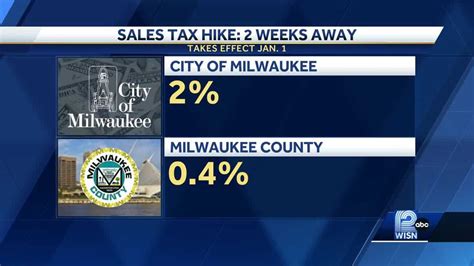

- Tax Rate: Determined by the City of Milwaukee, this rate is applied to the assessed value to calculate the tax amount. The tax rate can vary based on factors like the type of property (residential, commercial, etc.) and the city's budget requirements.

- Exemptions and Deductions: Certain properties or individuals may be eligible for tax exemptions or deductions. These can include homestead credits, senior citizen credits, and other special provisions aimed at reducing the tax burden for specific groups.

- Tax Bill Details: The tax bill itself provides a detailed breakdown of the calculated tax amount, including any applicable credits or deductions. It also outlines the due date and payment options available to the taxpayer.

By understanding these components, residents and businesses can better comprehend how their tax contributions fit into the city's financial framework and the role they play in supporting Milwaukee's development and services.

The Impact of the Tax Bill on Milwaukee’s Economy

The City of Milwaukee Tax Bill is not just a revenue-generating tool; it is a critical factor in the city’s economic health and growth. The tax system’s design and implementation have far-reaching implications for Milwaukee’s economic landscape, affecting everything from property values to business investments.

Stability and Predictability

A well-managed tax system provides stability and predictability, two key factors in attracting investments and fostering economic growth. Milwaukee’s tax bill, with its clear calculation methods and transparent processes, offers a reliable framework for residents and businesses to plan their financial strategies. This stability encourages long-term investments and promotes a healthy business environment.

Equitable Distribution of Financial Burden

The tax bill is designed to distribute the city’s financial responsibilities fairly among its residents and businesses. By considering factors like property value and providing exemptions and deductions, the tax system ensures that the burden is shared equitably. This approach not only promotes social justice but also encourages community support for essential city services and projects.

Impact on Property Values

The assessed value of properties, a critical component of the tax bill, directly influences property values in Milwaukee. A well-managed tax system that keeps property taxes affordable and predictable can contribute to stable or increasing property values. This, in turn, can attract new residents and businesses, further boosting the city’s economic growth.

Support for City Services and Development

Revenue generated from the tax bill is a vital source of funding for various city services and development projects. This includes everything from maintaining public safety and infrastructure to funding education and community initiatives. By understanding the impact of their tax contributions, residents and businesses can actively participate in shaping the city’s future and supporting the services that matter most to them.

Tax Bill Calculation and Payment

The calculation of the City of Milwaukee Tax Bill is a meticulous process, involving several steps to ensure accuracy and fairness. Once the tax bill is issued, taxpayers have a range of payment options available, offering flexibility and convenience.

Tax Bill Calculation Process

The calculation of the tax bill begins with the determination of the assessed value of properties by the Milwaukee County Department of Revenue. This value is then subject to the applicable tax rate, which is set by the city based on its budget needs and other considerations. The final tax amount is calculated by applying the tax rate to the assessed value and adjusting it for any applicable exemptions or deductions.

For example, if a residential property has an assessed value of $200,000 and the tax rate is 2%, the initial tax amount would be $4,000. If the homeowner qualifies for a $500 homestead credit, the final tax bill would be $3,500.

Tax Bill Payment Options

The City of Milwaukee offers several convenient payment options for taxpayers to settle their tax bills. These options include:

- Online Payment: Taxpayers can make secure online payments using a credit card, debit card, or e-check. This option is available 24/7 and provides a quick and convenient way to settle tax obligations.

- Mail-in Payment: Taxpayers can send their payments via mail using a check or money order. The payment should be made payable to the City of Milwaukee and include the tax bill stub to ensure accurate processing.

- In-Person Payment: For those who prefer a more traditional method, in-person payments can be made at designated City of Milwaukee offices. Taxpayers can pay using cash, check, or money order during regular business hours.

- Automatic Payment Plans: To provide flexibility and ease of payment, the city offers automatic payment plans. Taxpayers can set up automatic payments from their bank account, ensuring timely payments without the need for manual transactions.

By offering a variety of payment options, the City of Milwaukee ensures that taxpayers can choose the method that best suits their needs and preferences.

Future Implications and Potential Reforms

As Milwaukee’s economic landscape evolves, so too must its tax system. The city’s leaders and policymakers are continually evaluating the tax system’s effectiveness and exploring potential reforms to ensure it remains fair, efficient, and aligned with the city’s economic goals.

Potential Reforms and Their Impact

One potential reform under consideration is the introduction of a property tax cap, which would limit the amount by which property taxes can increase annually. This measure aims to provide greater stability and predictability for taxpayers, especially those on fixed incomes. While this reform could help control tax burdens, it may also impact the city’s ability to generate sufficient revenue for essential services.

Another potential reform involves expanding the range of tax incentives and credits available to businesses. By offering more attractive tax incentives, the city could encourage business growth and investment, potentially leading to job creation and increased tax revenue in the long term. However, such reforms would require careful planning to ensure they do not unduly burden residential taxpayers.

Community Engagement and Transparency

Effective tax reforms often require active community engagement and transparency. The City of Milwaukee recognizes the importance of involving residents and businesses in the decision-making process. By holding public forums, sharing data, and providing clear explanations of proposed reforms, the city aims to foster a sense of trust and collaboration among stakeholders.

Community engagement not only ensures that reforms are well-received and understood but also provides valuable insights and feedback that can shape the final implementation of these reforms. This collaborative approach is essential for maintaining a healthy and sustainable tax system that serves the best interests of all Milwaukeeans.

Looking Ahead

As Milwaukee continues to grow and evolve, its tax system will play a pivotal role in shaping the city’s economic trajectory. By staying informed about the tax bill and engaging in discussions about potential reforms, residents and businesses can actively contribute to the city’s future prosperity. Together, Milwaukee can continue to build a vibrant, sustainable, and thriving community.

How often are tax bills issued in Milwaukee?

+Tax bills in Milwaukee are issued annually, typically in the late spring or early summer. Property owners can expect to receive their tax bills by mail, detailing the amount due and the payment options available.

Can I appeal my tax assessment in Milwaukee?

+Yes, property owners in Milwaukee have the right to appeal their tax assessment if they believe it is inaccurate or unfair. The process involves submitting an appeal to the Milwaukee County Board of Assessors, providing evidence to support the claim, and potentially attending a hearing to present their case.

What happens if I don’t pay my tax bill on time in Milwaukee?

+Late payment of tax bills in Milwaukee can result in penalties and interest charges. It’s important to pay your tax bill by the due date to avoid additional financial burdens and potential legal consequences. The City of Milwaukee provides information on late payment policies and options for resolving delinquent accounts.

Are there any tax relief programs available in Milwaukee for low-income residents?

+Yes, Milwaukee offers several tax relief programs to assist low-income residents with their property tax obligations. These programs include the Homestead Credit, which provides a refund for eligible homeowners, and the Senior Citizen Tax Relief Program, which offers tax credits to qualifying senior citizens. It’s important for residents to research and understand the eligibility criteria for these programs to maximize their potential benefits.