Missouri Tax Rate

In the state of Missouri, understanding the tax landscape is crucial for both residents and businesses alike. Missouri's tax system, while relatively straightforward, offers a unique blend of sales, income, and property taxes that can impact financial planning and decision-making. This article aims to delve into the specifics of Missouri's tax rates, providing a comprehensive guide to help navigate the state's fiscal obligations.

Missouri’s Tax Structure: An Overview

Missouri operates a combined system of taxes, which includes a state-wide sales tax, income tax, and property tax. These taxes form the backbone of the state’s revenue generation, with each tax type contributing significantly to Missouri’s overall fiscal health. The state’s tax structure is designed to provide a stable and reliable income stream, while also offering certain incentives and deductions to taxpayers.

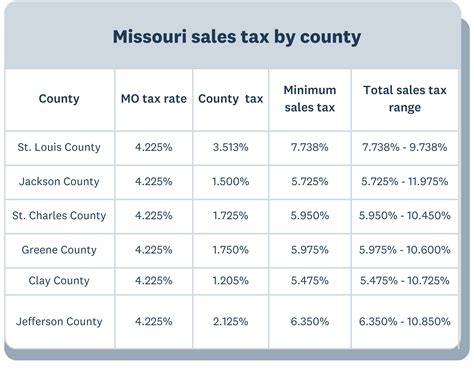

Sales Tax in Missouri

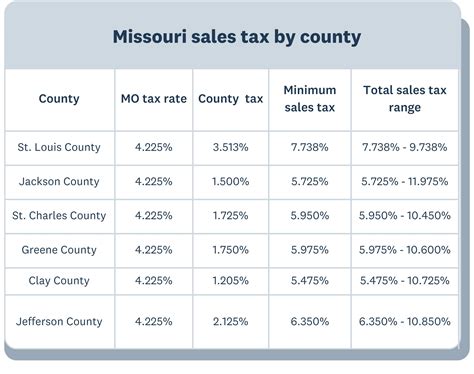

Sales tax is a significant component of Missouri’s tax revenue. As of [current year], the state imposes a 6.225% sales and use tax on most goods and services. This base rate is applicable across the state, ensuring a consistent tax burden for consumers. However, it’s important to note that certain localities may add additional sales tax, creating a tax rate bracket that varies from place to place.

For instance, in the city of St. Louis, the sales tax rate stands at 9.225%, which includes the state base rate and a 3% local tax to fund the transportation system. Similarly, Kansas City has a 8.725% sales tax, with a 2.5% local tax dedicated to funding various infrastructure projects.

These local additions to the sales tax demonstrate Missouri's commitment to local governance and decision-making. By allowing municipalities to impose additional taxes, the state empowers communities to address their specific needs and fund essential services.

| Locality | Sales Tax Rate |

|---|---|

| St. Louis | 9.225% |

| Kansas City | 8.725% |

| Springfield | 8.125% |

| Columbia | 7.825% |

Income Tax in Missouri

Missouri also levies an income tax on both individuals and businesses. The income tax rate for individuals ranges from 1.5% to 5.9%, depending on taxable income. For corporations, the flat tax rate is set at 6.25% of taxable income.

One notable aspect of Missouri's income tax system is its use of tax brackets. These brackets ensure that individuals and businesses pay taxes commensurate with their income levels. As income increases, so does the tax rate, creating a progressive tax structure that aims to balance revenue generation with fairness.

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | Up to $1,000 | 1.5% |

| 2 | $1,001 to $2,000 | 2.25% |

| 3 | $2,001 to $3,000 | 3% |

| 4 | $3,001 to $4,000 | 3.5% |

| 5 | $4,001 and above | 5.9% |

For businesses, the flat tax rate of 6.25% simplifies the tax filing process, offering a consistent and predictable tax burden. This uniformity can be advantageous for businesses planning their financial strategies and forecasting their tax obligations.

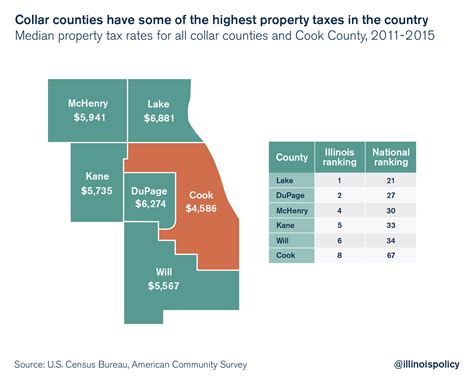

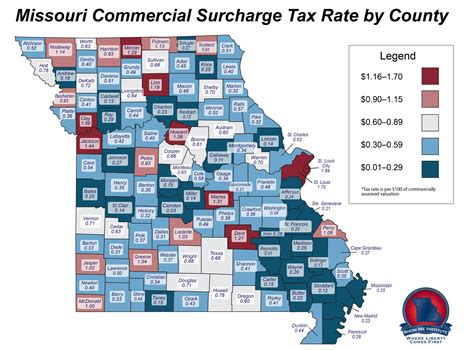

Property Tax in Missouri

Property tax is another critical component of Missouri’s tax system. Property taxes are assessed at the local level, with each county setting its own tax rates. This means that property tax rates can vary significantly across the state, depending on the locality and the specific use of the property.

In Missouri, property taxes are primarily used to fund local services such as schools, fire protection, and other essential public services. The state's property tax system ensures that local governments have the financial means to provide for their communities, while also allowing for some degree of local control over tax rates.

The property tax assessment process involves several steps. First, the property is appraised to determine its value. This value is then multiplied by the applicable tax rate to arrive at the tax assessment. The tax assessment is then billed to the property owner, who is responsible for paying the tax.

While the process may seem straightforward, it's important to note that property tax rates can be influenced by various factors, including the type of property, its location, and any applicable exemptions or deductions. For instance, Missouri offers a homestead exemption for primary residences, which can reduce the taxable value of a property, thereby lowering the tax assessment.

Tax Incentives and Deductions in Missouri

Missouri recognizes the importance of incentivizing economic growth and supporting its residents. As such, the state offers a range of tax incentives and deductions that can help reduce the tax burden for individuals and businesses.

Individual Tax Credits and Deductions

For individuals, Missouri provides several tax credits and deductions to ease the tax burden. Some of the notable ones include:

- Low-Income Housing Credit: This credit provides a reduction in tax liability for individuals who invest in qualifying low-income housing projects.

- Estate Tax Deduction: Missouri allows a deduction for state estate tax paid, which can reduce the overall tax liability for individuals with significant estates.

- Educational Assistance Credit: This credit is available for individuals who make contributions to certain scholarship funds, providing a direct reduction in tax liability.

Business Tax Incentives

Missouri also offers a variety of tax incentives to attract and support businesses. These incentives can significantly reduce a business’s tax burden and promote economic growth.

- Enterprise Zone Tax Credits: Businesses operating in designated enterprise zones can qualify for various tax credits, including those related to job creation, investment, and rehabilitation of buildings.

- Research and Development Tax Credit: This credit provides a tax benefit for businesses engaged in research and development activities, encouraging innovation and technological advancement.

- Manufacturing Machinery and Equipment Tax Exemption: Missouri offers an exemption from sales and use tax for certain machinery and equipment used in manufacturing, promoting investment in this crucial sector.

Tax Filing and Payment in Missouri

Understanding the tax filing and payment process is essential for Missouri residents and businesses. The state provides a user-friendly online portal for tax filing, making the process more accessible and efficient.

Individual Tax Filing

Individuals in Missouri are required to file their tax returns annually. The deadline for filing is typically April 15th, aligning with the federal tax filing deadline. However, it’s important to note that this deadline can vary based on specific circumstances, such as extensions or special filing requirements.

Missouri offers several methods for individuals to file their tax returns, including online filing, paper filing, and e-filing. The online filing system, MO Tax, is a secure and convenient way to file taxes, offering a step-by-step guide to ensure accuracy and ease of use.

Business Tax Filing

Businesses in Missouri have a slightly different tax filing process, depending on their legal structure and tax obligations. For instance, corporations are required to file their income tax returns annually, typically on a calendar year basis. However, some businesses may choose a fiscal year, which requires them to file within 2.5 months after the fiscal year-end.

In addition to income tax, businesses in Missouri may also need to file sales and use tax returns, property tax returns, and various other tax-related forms and schedules. The Missouri Department of Revenue provides detailed guidance and resources to help businesses navigate the tax filing process.

Conclusion

Missouri’s tax system is a complex yet well-structured framework that plays a vital role in the state’s economic landscape. From sales and income taxes to property taxes, each component contributes to the state’s fiscal health and supports essential services. Understanding these tax rates and incentives is crucial for individuals and businesses alike, as it allows for informed financial planning and decision-making.

As Missouri continues to evolve and adapt to economic changes, its tax system will likely undergo revisions and updates to ensure it remains fair, efficient, and supportive of the state's growth and development. Staying informed about these changes is essential for navigating the tax landscape successfully.

What is the average property tax rate in Missouri?

+

The average property tax rate in Missouri varies depending on the county and the specific use of the property. However, the state-wide average effective property tax rate is around 0.89% of the property’s assessed value.

Are there any sales tax holidays in Missouri?

+

Yes, Missouri does have sales tax holidays. These are specific periods during the year when certain items, often back-to-school supplies or energy-efficient appliances, are exempt from sales tax. These holidays are a great way for consumers to save money on essential purchases.

Can I file my Missouri taxes online?

+

Absolutely! Missouri offers a user-friendly online tax filing system called MO Tax. This system allows individuals and businesses to file their tax returns securely and efficiently. It’s a convenient way to ensure timely and accurate tax filing.

What is the penalty for late tax filing in Missouri?

+

Late tax filing in Missouri can result in penalties and interest charges. The penalty for late filing is typically 5% of the tax due for each month the return is late, up to a maximum of 25%. Additionally, interest is charged at a rate of 0.5% per month on the unpaid tax.