Colorado Property Tax

Colorado's property tax system is an essential component of the state's revenue stream, contributing significantly to the funding of local governments, schools, and essential services. This article aims to provide an in-depth exploration of the Colorado property tax landscape, offering a comprehensive understanding of its workings, implications, and unique features.

Understanding Colorado’s Property Tax System

Colorado’s property tax is a vital source of revenue for local governments, providing funding for essential services such as education, infrastructure, and public safety. Unlike some other states, Colorado has a unique approach to property taxation, with a focus on fairness and transparency.

The property tax system in Colorado is governed by a set of laws and regulations that aim to ensure an equitable distribution of tax burdens among property owners. The state's approach to property taxation is often considered progressive, taking into account the value of the property, its location, and the specific use of the land.

One of the key features of Colorado's property tax system is the Gallagher Amendment, which was adopted in 1982. This amendment aims to maintain a stable ratio between the values of residential and non-residential properties for tax purposes. It ensures that homeowners do not bear an unfair share of the property tax burden compared to commercial property owners.

Assessment and Valuation Process

The assessment process in Colorado involves the determination of the actual value of a property by county assessors. This value, known as the actual value, is then adjusted to calculate the assessed value, which is the basis for property tax calculations.

The assessed value is calculated using a formula that takes into account factors such as the property's market value, its location, and any applicable exemptions or deductions. This ensures that properties with similar characteristics are taxed at a similar rate, promoting fairness across the state.

Colorado employs a unique valuation system called the "Point System," which assigns points to various property characteristics. These points are then used to calculate the property's assessed value. This system ensures that properties with similar features are valued consistently, regardless of their location within the state.

| Property Feature | Points Assigned |

|---|---|

| Square Footage | 2-5 points per square foot |

| Age of Property | 0-3 points per year |

| Garage Space | 1-3 points per square foot |

| Landscaping | 0-2 points per feature |

| View | 0-5 points |

Tax Rates and Levies

Colorado’s property tax rates are determined at the local level, with each county setting its own mill levy. A mill levy is a tax rate expressed in mills, where one mill represents 1 of tax for every 1,000 of assessed property value.

The mill levy for a particular property is the sum of the mill levies from various taxing authorities, such as the county, school district, and special districts. These mill levies fund a range of services, including schools, fire protection, libraries, and other local government operations.

For example, consider a property with an assessed value of $300,000 located in a county with a mill levy of 50 mills. The property tax for this property would be calculated as follows:

Property Tax = Assessed Value * Mill Levy

Property Tax = $300,000 * 0.050 = $15,000

Therefore, the property owner would pay $15,000 in property taxes for that year.

Tax Exemptions and Deductions

Colorado offers various tax exemptions and deductions to eligible property owners, which can significantly reduce their tax liability. These include:

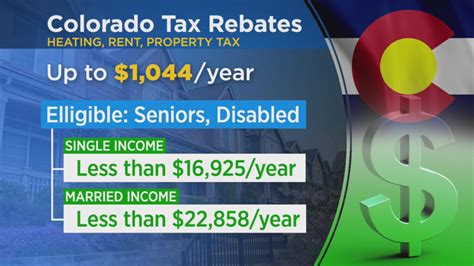

- Senior Citizen Property Tax Exemption: Property owners aged 65 or older may be eligible for a property tax exemption on a portion of their home's value.

- Veterans' Property Tax Exemption: Veterans with a service-connected disability may be eligible for a property tax exemption.

- Disabled Person Property Tax Exemption: Property owners with certain disabilities may qualify for a tax exemption.

- Open Space and Agricultural Land Preservation Programs: Property owners who voluntarily enroll their land in these programs can receive reduced property tax assessments.

Impact on Property Owners and the Community

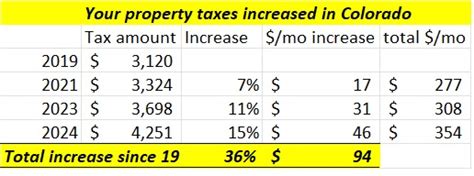

Colorado’s property tax system has a significant impact on both property owners and the broader community. For property owners, it represents a financial obligation that must be met annually. The amount of property tax owed can influence a property owner’s financial planning and budget considerations.

On the other hand, property taxes are a crucial source of revenue for local governments and schools. They fund essential services such as education, public safety, infrastructure maintenance, and community development. Property taxes play a vital role in shaping the quality of life and the overall well-being of Colorado's communities.

Factors Influencing Property Tax Rates

Several factors can influence property tax rates in Colorado, including:

- Property Value Increases: As property values rise, the assessed value of a property also increases, leading to higher property taxes.

- Local Government Budgets: Counties and municipalities may adjust their budgets, which can impact the mill levy and, consequently, property tax rates.

- School District Needs: School districts often have significant influence over property tax rates, as they require funding for various educational programs and facilities.

- Special District Services: Special districts, such as fire protection or water districts, may also impact property tax rates based on the services they provide.

The Role of Property Taxes in Community Development

Property taxes play a crucial role in community development and infrastructure improvement. They fund projects such as road repairs, bridge maintenance, park upgrades, and the construction of new schools and community centers.

Additionally, property taxes support local businesses and economic growth. They contribute to the development of commercial properties, which in turn create jobs and generate revenue for the community. Property taxes are a key driver of economic vitality in Colorado's cities and towns.

Future Implications and Potential Reforms

As Colorado’s population continues to grow and its economy evolves, the state’s property tax system may face new challenges and opportunities. Here are some potential future implications and reforms to consider:

Addressing the Gallagher Amendment

The Gallagher Amendment, while ensuring fairness between residential and non-residential property owners, has led to a decrease in the residential assessment rate over time. This has resulted in a shift in the tax burden, with homeowners paying a larger share of property taxes. Addressing this issue may involve adjustments to the assessment rates or exploring alternative methods to maintain a balanced tax structure.

Technology-Driven Assessments

Advancements in technology could revolutionize the property assessment process. For instance, the use of aerial imagery and machine learning algorithms could enhance the accuracy and efficiency of property valuations. This could lead to more precise assessments and potentially reduce the administrative burden on county assessors.

Reforming Tax Exemptions and Deductions

Colorado’s tax exemptions and deductions, while beneficial to eligible property owners, may need periodic review to ensure they align with the state’s changing demographics and economic landscape. A comprehensive evaluation of these programs could identify areas for improvement and ensure that they effectively serve the needs of the community.

Community Engagement and Transparency

Promoting community engagement and transparency in the property tax process can foster a better understanding of the system and its impact. Educating property owners about the factors influencing their tax bills and involving them in discussions about local budgets and tax rates can lead to more informed decision-making and increased trust in the system.

How often are property values reassessed in Colorado?

+Property values in Colorado are reassessed every two years. This reassessment ensures that property taxes remain fair and accurate, reflecting changes in the market value of properties.

Are there any ways to appeal property tax assessments in Colorado?

+Yes, property owners in Colorado have the right to appeal their property tax assessments if they believe the valuation is inaccurate. The appeal process involves submitting evidence to support the claim and may require a hearing before a county board of equalization.

How can property owners stay informed about changes in property tax rates and exemptions?

+Property owners can stay informed by regularly checking the websites of their county assessor’s office and local taxing authorities. These websites often provide updates on tax rates, assessment schedules, and any changes to tax exemptions or deductions.