Form 5498 Needed For Taxes

As tax season approaches, many individuals and businesses are preparing their financial records and ensuring they have all the necessary documents to file their taxes accurately. One crucial form that often comes into play is the Form 5498, specifically designed for reporting various retirement-related contributions and transactions. In this comprehensive guide, we will delve into the intricacies of Form 5498, exploring its purpose, importance, and the impact it has on your tax obligations.

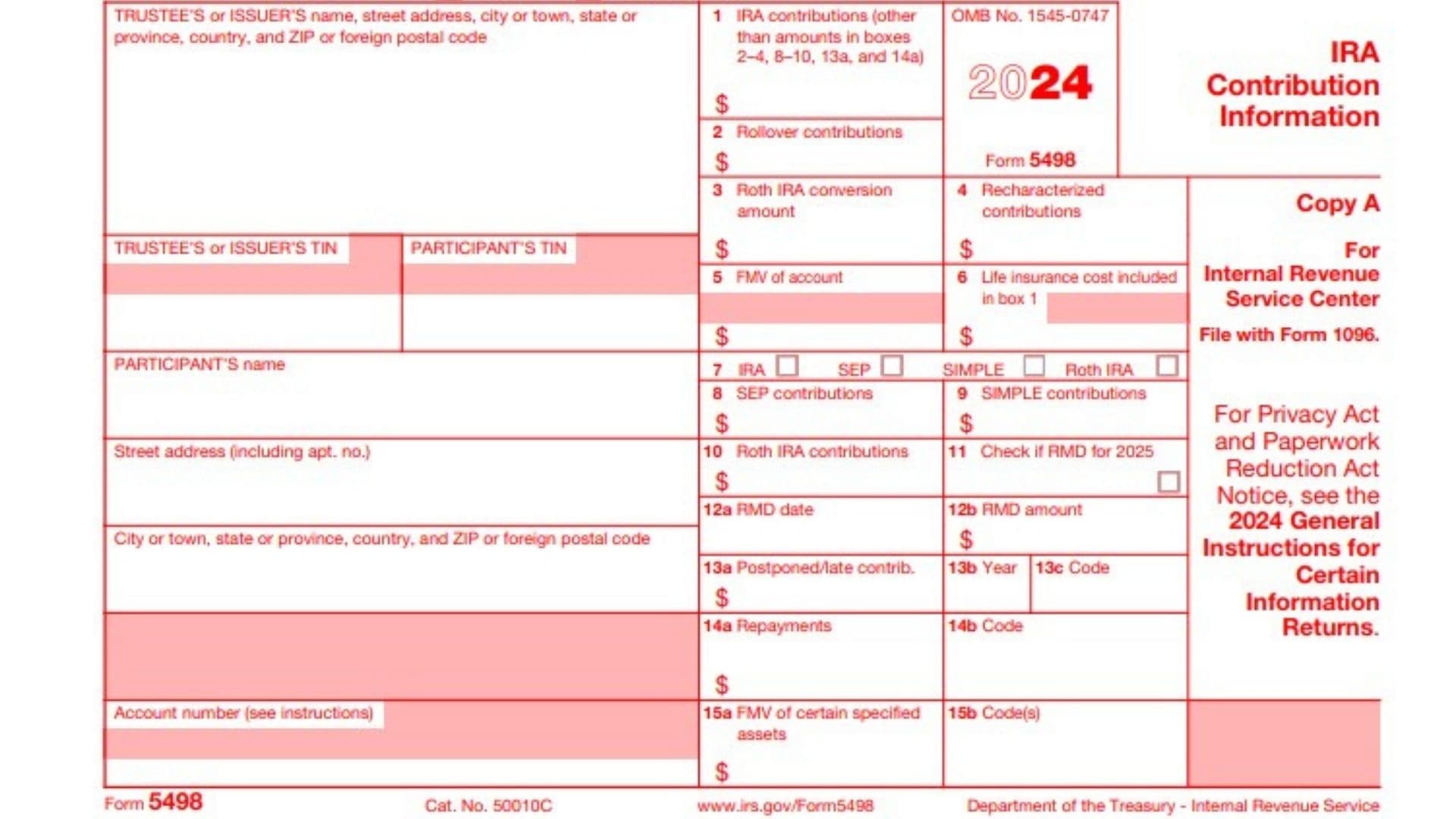

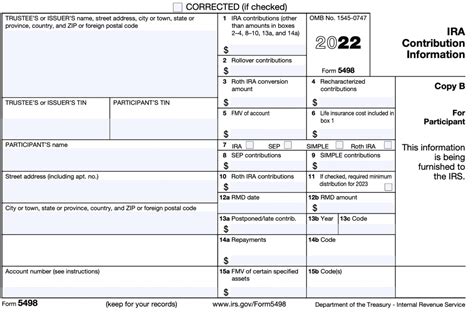

Understanding Form 5498: The Basics

Form 5498, officially titled "IRA Contribution Information", is a tax document used to report certain types of contributions and transactions related to Individual Retirement Accounts (IRAs) and certain retirement plans. It serves as a vital tool for both taxpayers and the Internal Revenue Service (IRS) to keep track of specific retirement account activities.

The form's primary purpose is to inform the IRS about contributions made to IRAs, including traditional IRAs, Roth IRAs, and SEP IRAs. It also covers certain rollovers and transfers between retirement accounts. By requiring taxpayers to report these activities, the IRS can ensure compliance with tax laws and regulations governing retirement savings.

Additionally, Form 5498 plays a critical role in calculating the maximum contribution limits for IRAs. The information provided on the form helps taxpayers determine their eligibility for tax deductions and credits associated with retirement savings.

Who Needs to File Form 5498?

The requirement to file Form 5498 typically applies to individuals who have made contributions to their IRAs or have had certain transactions involving their retirement accounts during the tax year. This includes both taxpayers who make their own contributions and those who receive contributions from their employers or other sources.

It's important to note that the filing obligation often extends to financial institutions, such as banks and brokerage firms, that hold IRA accounts. These institutions are responsible for issuing Form 5498 to their customers, ensuring that all relevant information is accurately reported.

Key Information on Form 5498

Form 5498 requires specific details about the taxpayer's IRA contributions and transactions. Here are some of the key pieces of information that the form typically includes:

- IRA Type: The type of IRA to which contributions were made, such as traditional, Roth, or SEP.

- Account Holder's Information: Personal details of the account holder, including name, address, and taxpayer identification number (TIN or SSN).

- Contributions: The total amount of contributions made to the IRA during the tax year, including any rollover or transfer amounts.

- Rollover/Transfer Details: Information about any rollovers or transfers between retirement accounts, including the dates and amounts involved.

- Deductible Contributions: The portion of contributions that are deductible for tax purposes, if applicable.

Importance of Form 5498 for Tax Filing

Form 5498 holds significant importance when it comes to tax filing for several reasons. Firstly, it ensures accurate reporting of retirement account contributions, which is essential for calculating tax deductions and credits. By having a clear record of these contributions, taxpayers can maximize their tax benefits and avoid potential penalties for underreporting or overreporting.

Additionally, Form 5498 helps taxpayers stay within the contribution limits set by the IRS for IRAs. Exceeding these limits can result in excess contribution penalties, which can be costly. By having the form on hand, taxpayers can easily track their contributions and ensure they remain within the allowable limits.

For those who participate in rollover transactions, Form 5498 provides a comprehensive record of these activities. Rollovers can have tax implications, and proper reporting ensures that taxpayers understand the tax consequences and comply with the necessary requirements.

Using Form 5498 for Tax Preparation

When it comes to tax preparation, Form 5498 serves as a valuable reference tool. Taxpayers can use the information provided on the form to complete their tax returns accurately. Here are some key ways in which Form 5498 aids in tax preparation:

- Calculating Deductions: Taxpayers can refer to the form to determine the amount of deductible contributions made to their IRAs, which can be claimed as tax deductions on their tax returns.

- Maximizing Tax Benefits: By understanding the contributions and transactions reported on Form 5498, taxpayers can strategize their retirement savings and tax planning to optimize their tax benefits.

- Avoiding Penalties: Having Form 5498 on hand helps taxpayers avoid penalties for exceeding contribution limits or making improper rollovers. It serves as a reminder to stay within the legal boundaries.

Form 5498 and Retirement Savings Strategies

Form 5498 not only aids in tax filing but also plays a crucial role in shaping retirement savings strategies. Here's how it influences retirement planning:

Setting Contribution Goals

Taxpayers can use the information on Form 5498 to set realistic contribution goals for their IRAs. By understanding their current contribution levels and the maximum allowable limits, they can plan their savings accordingly, ensuring they make the most of their retirement accounts.

Maximizing Tax-Advantaged Savings

Form 5498 highlights the tax advantages associated with IRAs. Taxpayers can strategize their contributions to take full advantage of tax deductions and potential tax-free growth, especially for Roth IRAs. This information is vital for optimizing retirement savings plans.

Planning Rollovers and Transfers

For those considering rollovers or transfers between retirement accounts, Form 5498 provides a clear record of previous transactions. This helps taxpayers make informed decisions about future rollovers, ensuring they comply with the necessary regulations and avoid potential tax pitfalls.

Form 5498 for Business Owners

Form 5498 is not exclusive to individual taxpayers; it also applies to business owners who offer retirement plans to their employees. Here's how it affects business owners:

Reporting Employer Contributions

Business owners who contribute to their employees' retirement plans, such as SIMPLE IRAs or SEP IRAs, must report these contributions on Form 5498. This ensures transparency and compliance with retirement plan regulations.

Managing Employee Retirement Benefits

Form 5498 assists business owners in managing their employees' retirement benefits. By staying informed about contribution limits and requirements, business owners can ensure their retirement plans remain attractive and compliant with tax laws.

Simplifying Tax Filing for Businesses

By accurately reporting retirement plan contributions on Form 5498, business owners can streamline their tax filing process. This reduces the risk of errors and helps ensure that their business tax obligations are met efficiently.

Common Misconceptions about Form 5498

Despite its importance, there are several misconceptions surrounding Form 5498. Let's address some of the most common ones:

Misconception: Form 5498 is a Tax Deduction

A common misunderstanding is that Form 5498 itself is a tax deduction. However, the form is merely a reporting tool. It provides the necessary information for taxpayers to claim tax deductions or credits associated with their retirement contributions.

Misconception: Form 5498 is Only for High-Income Earners

Another misconception is that Form 5498 is exclusively for high-income individuals. In reality, the form applies to anyone with an IRA or eligible retirement plan, regardless of their income level. It's a universal tool for reporting retirement account activities.

Misconception: Form 5498 is Optional

Some taxpayers believe that filing Form 5498 is optional. However, for those with applicable retirement accounts and transactions, it is a mandatory requirement. Failing to file the form can result in penalties and may raise red flags during tax audits.

FAQs about Form 5498

What happens if I don't receive Form 5498 from my financial institution?

+If you do not receive Form 5498 from your financial institution, you should contact them directly to request the form. They are responsible for issuing it to you. In the meantime, you can still report your IRA contributions and transactions on your tax return using the information you have available.

Can I use Form 5498 to calculate my taxable income for the year?

+Form 5498 does not provide all the necessary information to calculate your taxable income. It primarily focuses on reporting IRA contributions and transactions. To calculate your taxable income, you'll need to refer to other tax forms and records, such as Form W-2 and Schedule 1 (Form 1040) for traditional IRA deductions.

Are there any penalties for overreporting contributions on Form 5498?

+Yes, overreporting contributions on Form 5498 can result in penalties. It's crucial to ensure the accuracy of the information provided on the form. If you discover an overreporting error, you should correct it on your tax return and consider filing an amended tax return if necessary.

Can I use Form 5498 to roll over my traditional IRA to a Roth IRA?

+Form 5498 itself does not facilitate the rollover process. However, it provides a record of your traditional IRA contributions, which can be used as a reference when initiating a rollover to a Roth IRA. You'll need to follow the specific guidelines and procedures for Roth IRA conversions.

Is Form 5498 required for all types of retirement accounts?

+Form 5498 is primarily used for reporting contributions and transactions related to IRAs (Individual Retirement Accounts). Other types of retirement accounts, such as 401(k) plans or pension plans, may have different reporting requirements. It's essential to understand the specific reporting obligations for each type of retirement account you hold.

Conclusion

Form 5498 is an indispensable tool for taxpayers and financial institutions alike, ensuring accurate reporting of IRA contributions and transactions. Its importance extends beyond tax compliance, as it influences retirement savings strategies and helps taxpayers maximize their tax benefits. By understanding the purpose and implications of Form 5498, individuals and businesses can navigate their retirement savings and tax obligations with confidence.