Marion County Taxes

Understanding the intricacies of property taxes is essential, especially for homeowners and investors. In this comprehensive guide, we delve into the world of Marion County taxes, exploring the factors that influence tax rates, the assessment process, and the steps homeowners can take to navigate the system effectively. Join us as we uncover the complexities of Marion County's tax landscape, offering valuable insights and strategies to manage your property tax obligations.

Unraveling the Marion County Tax System

Marion County, a vibrant region known for its diverse communities and economic activities, presents a unique tax landscape. The tax system in Marion County, like many other counties, is a complex interplay of property assessments, tax rates, and various exemptions. This section aims to demystify the key components of Marion County taxes, providing a clear understanding of the process and its impact on homeowners.

Property Assessment: The Foundation of Taxation

At the heart of the Marion County tax system lies the property assessment process. This critical step determines the value of each property within the county, serving as the basis for calculating property taxes. Assessors in Marion County employ a systematic approach, considering factors such as:

- Market Value: The current market value of a property is a key determinant. Assessors analyze recent sales data and property trends to estimate the fair market value.

- Property Characteristics: Physical attributes like size, location, age, and improvements are taken into account. For instance, a newly renovated home may have a higher assessed value compared to similar properties.

- Neighborhood Influence: The overall neighborhood and its amenities can impact property values. Assessors consider factors like school districts, proximity to commercial areas, and community infrastructure.

The assessed value, determined through a rigorous process, forms the basis for calculating property taxes. It’s worth noting that Marion County, like many jurisdictions, employs a mass appraisal approach, where assessors use statistical models and sampling techniques to ensure uniformity and fairness in assessments.

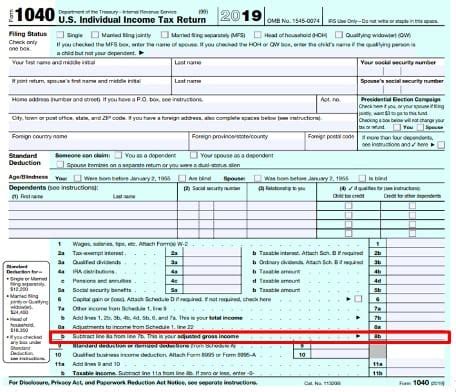

Tax Rates and Levies: Understanding the Calculation

Once the assessed value of a property is established, the tax rate comes into play. Marion County, like other counties, has a millage rate, which is a tax rate expressed in mills (one-thousandth of a dollar). This rate is set by various taxing authorities, including the county government, school districts, and special taxing districts.

The tax rate, when multiplied by the assessed value, determines the annual property tax liability. For instance, if a property has an assessed value of 200,000 and the millage rate is 10 mills, the annual property tax would be calculated as:</p> <table> <tr> <th>Assessed Value</th> <th>Millage Rate</th> <th>Annual Tax</th> </tr> <tr> <td>200,000 10 mills $2,000

It’s important to note that the millage rate can vary across different areas within Marion County, reflecting the specific needs and services provided by each taxing authority.

Exemptions and Reliefs: Reducing Tax Burden

Marion County offers various exemptions and relief programs aimed at reducing the tax burden for eligible homeowners. These programs provide opportunities to lower property tax obligations and are an essential aspect of the tax landscape.

- Homestead Exemption: One of the most common exemptions is the Homestead Exemption, which provides a reduction in the assessed value of a primary residence. In Marion County, homeowners can apply for this exemption, which typically results in a lower tax liability.

- Senior Citizen Exemption: Elderly homeowners may be eligible for additional exemptions or relief programs. These programs often provide a reduction in taxes for seniors who meet certain age and income criteria.

- Veteran’s Exemption: Marion County recognizes the service of veterans by offering exemptions or reduced tax rates for eligible military personnel or their surviving spouses.

Understanding the specific criteria and application processes for these exemptions is crucial for homeowners to maximize their tax savings.

Navigating the Marion County Tax Process

Now that we’ve explored the fundamentals of Marion County taxes, let’s delve into practical strategies for homeowners to navigate the tax process effectively.

Stay Informed: Understanding Tax Notices

One of the first steps in managing your property taxes is understanding the tax notices you receive. Marion County typically sends out annual tax notices, providing details on the assessed value, tax rates, and the amount due. It’s crucial to carefully review these notices, ensuring the information is accurate and up-to-date.

If you notice any discrepancies or have questions, reach out to the Marion County Tax Assessor’s Office. They can provide guidance and clarify any uncertainties regarding your property’s assessment and tax liability.

Appealing Assessments: Ensuring Fairness

In some cases, homeowners may believe their property’s assessed value is inaccurate or unfair. Marion County provides a formal process for appealing property assessments. Here’s a step-by-step guide to the appeal process:

- Review the Assessment: Carefully examine the assessment notice, comparing it to recent sales data and property values in your neighborhood.

- Gather Evidence: Collect relevant documents and evidence to support your case. This may include recent appraisals, sales data of comparable properties, or information about property improvements.

- Submit an Appeal: Follow the instructions provided by the Marion County Tax Assessor’s Office to submit a formal appeal. Be sure to meet all deadlines and provide comprehensive documentation.

- Attend the Hearing: If your appeal is accepted, you may be required to attend a hearing. Prepare your case and present your evidence to the assessment board.

- Await the Decision: The assessment board will review your appeal and make a decision. You will receive notification of the outcome, and if successful, your assessed value may be adjusted, leading to a lower tax liability.

It’s important to approach the appeal process with a well-prepared case, ensuring you have a strong foundation for your argument.

Maximizing Exemptions and Reliefs

As mentioned earlier, Marion County offers a range of exemptions and relief programs. To maximize these benefits, homeowners should:

- Stay Updated: Keep abreast of any changes or updates to exemption programs. Marion County may introduce new initiatives or modify existing ones, so staying informed is crucial.

- Apply Timely: Ensure you meet all application deadlines for exemptions. Missing these deadlines could result in missed opportunities for tax savings.

- Understand Eligibility: Carefully review the criteria for each exemption. Different programs have varying requirements, so ensure you meet the specific conditions to qualify.

- Seek Professional Advice: If you’re unsure about your eligibility or the application process, consider consulting a tax professional or a trusted real estate advisor.

The Future of Marion County Taxes

As we look ahead, the future of Marion County taxes is shaped by a dynamic landscape of economic growth, demographic changes, and evolving tax policies. Here’s a glimpse into the potential implications and trends:

Economic Growth and Tax Revenue

Marion County’s thriving economy, characterized by a diverse industrial base and a growing population, presents a promising outlook for tax revenue. As businesses expand and new developments emerge, the county can anticipate increased tax collections. However, it’s essential to strike a balance between encouraging economic growth and maintaining affordable tax rates to support sustainable development.

Demographic Shifts and Property Values

Shifts in the demographic composition of Marion County, including an aging population and changing household structures, can influence property values and tax assessments. Older homeowners, for instance, may benefit from exemption programs tailored to their needs, while the influx of younger professionals could drive demand for certain areas, impacting property values and tax rates.

Policy Reforms and Tax Equity

Marion County, like many jurisdictions, is likely to consider policy reforms aimed at enhancing tax equity and fairness. This may involve revisiting assessment methodologies, adjusting tax rates, or introducing new exemption programs to address emerging challenges. Staying informed about these policy changes is crucial for homeowners to adapt their strategies and ensure compliance.

How often are property assessments conducted in Marion County?

+Property assessments in Marion County are typically conducted annually. However, in certain circumstances, such as a significant property improvement or a change in ownership, an assessment may be triggered outside the annual cycle.

What is the process for applying for a Homestead Exemption in Marion County?

+To apply for a Homestead Exemption, homeowners in Marion County need to complete and submit the appropriate application form, which is typically available from the Tax Assessor’s Office or online. The application requires details about the property and the applicant’s residency status. It’s important to meet the deadlines and provide accurate information to ensure a successful application.

Can I appeal my property taxes if I believe they are too high?

+Yes, if you believe your property taxes are too high, you have the right to appeal. Marion County provides a formal appeal process, allowing homeowners to challenge their assessments. It’s important to gather evidence and follow the prescribed steps to ensure a successful appeal.