Charleston County Real Estate Tax

Charleston County, nestled along the scenic South Carolina coast, is renowned for its charming architecture, vibrant culture, and bustling economy. As one of the most sought-after regions in the state, it attracts residents and investors alike. However, with this popularity comes the inevitable discussion of real estate taxes, which can significantly impact one's financial planning and decisions regarding property ownership.

In this comprehensive guide, we will delve into the intricacies of Charleston County real estate taxes, exploring the factors that influence tax assessments, the process of tax calculation, and the avenues available for taxpayers to navigate this complex landscape. By understanding these aspects, property owners can make informed decisions, effectively manage their tax obligations, and optimize their financial strategies.

Understanding Real Estate Taxes in Charleston County

Real estate taxes, also known as property taxes, are a crucial component of local government revenue in Charleston County. These taxes are levied on both residential and commercial properties, contributing to the funding of essential public services, infrastructure development, and community projects. The tax assessment process is a meticulous endeavor, taking into account various factors to determine the value of each property and, consequently, the tax liability.

The Charleston County Assessor's Office plays a pivotal role in this process. Their primary responsibility is to evaluate properties fairly and accurately, ensuring that the tax burden is distributed equitably among property owners. This involves periodic revaluations to account for changes in property value due to market fluctuations, improvements, or other factors.

Factors Influencing Real Estate Tax Assessments

Several key factors influence the assessment of real estate taxes in Charleston County. Understanding these elements is essential for property owners to grasp the rationale behind their tax obligations.

- Property Value: The assessed value of a property is a critical determinant of its tax liability. This value is typically based on fair market value, which represents the price a willing buyer would pay to a willing seller in an open market transaction.

- Property Characteristics: The assessor considers various physical attributes of a property, including its size, age, condition, and any improvements made. These factors can significantly impact the assessed value and, consequently, the tax bill.

- Location: The location of a property plays a significant role in its tax assessment. Properties in prime locations, such as those with water views or in desirable neighborhoods, may command higher assessments due to their increased desirability.

- Tax Rates: The tax rate, set by local government bodies, is another crucial factor. This rate is applied to the assessed value of the property to calculate the tax liability. Tax rates can vary significantly across different jurisdictions within Charleston County.

- Assessor's Methodology: The Assessor's Office employs specific methodologies and guidelines to ensure consistency and fairness in tax assessments. These methods may include mass appraisal techniques, sales ratio studies, and cost-based approaches.

The Process of Real Estate Tax Calculation

The calculation of real estate taxes in Charleston County involves a series of steps, each contributing to the final tax bill. Understanding this process empowers property owners to anticipate their tax obligations and plan their finances accordingly.

Step 1: Property Assessment

The first step in the tax calculation process is the assessment of a property's value. The Assessor's Office conducts regular revaluations to ensure that property values remain up-to-date. During this process, assessors consider the factors mentioned earlier, such as property characteristics, location, and market conditions.

Assessors may utilize various methods to determine property value, including:

- Sales Comparison Approach: This method involves comparing the subject property to similar properties that have recently sold in the area. Adjustments are made for differences in features and conditions to arrive at an estimated value.

- Cost Approach: Here, assessors estimate the cost of replacing the property, minus depreciation, to determine its value. This approach is particularly useful for unique or specialized properties.

- Income Approach: Suitable for income-generating properties, this method assesses the property's value based on its potential income-earning capacity.

Step 2: Tax Rate Determination

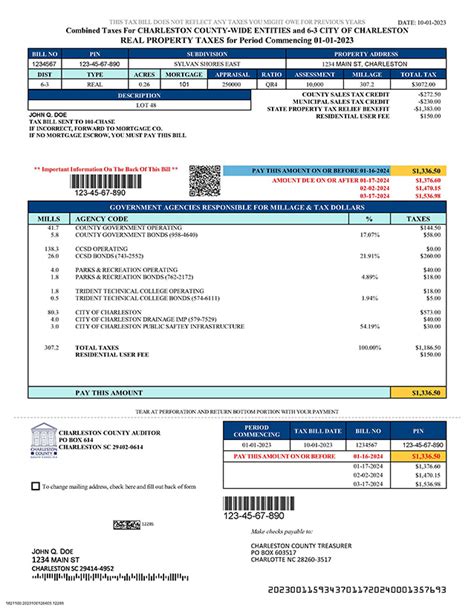

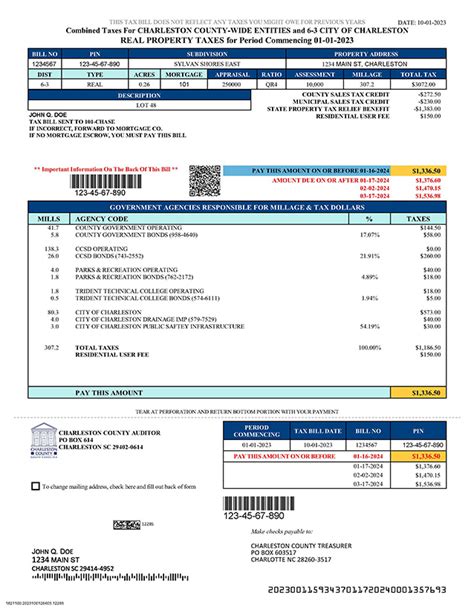

Once the assessed value of a property is established, the next step is to determine the applicable tax rate. Charleston County, like many other jurisdictions, operates with a millage rate system. A millage rate represents the amount of tax levied per $1,000 of assessed property value.

The millage rate is set by local government bodies, such as the county council or school board, based on their budgetary needs and the desired level of services to be provided. These rates can vary significantly across different areas within the county, as each jurisdiction has its own specific financial requirements.

Step 3: Tax Calculation

With the assessed value and tax rate determined, the final step is to calculate the real estate tax liability. This is a straightforward process of multiplying the assessed value by the applicable millage rate. The result is the property owner's tax obligation for the year.

For example, if a property has an assessed value of $300,000 and the applicable millage rate is 500 mills (or 0.5%), the tax calculation would be as follows:

| Assessed Value | $300,000 |

|---|---|

| Millage Rate | 500 mills (0.5%) |

| Real Estate Tax | $1,500 |

Managing Real Estate Tax Obligations

Understanding the real estate tax landscape is just the first step; property owners also need to know how to effectively manage their tax obligations. Here are some strategies and considerations to navigate the complex world of real estate taxes in Charleston County.

Tax Bills and Payment Options

Real estate tax bills are typically sent to property owners annually. These bills provide a detailed breakdown of the tax assessment, including the assessed value, tax rate, and the total amount due. It is crucial for property owners to review these bills carefully, ensuring accuracy and identifying any potential discrepancies.

Charleston County offers various payment options to accommodate different financial situations. Property owners can choose to pay their taxes in full by the due date or opt for installment plans, which allow for payments to be spread out over several months. Online payment portals and mobile apps often provide convenient alternatives to traditional methods.

Appealing Tax Assessments

If a property owner believes that their tax assessment is inaccurate or unfair, they have the right to appeal. The process of appealing a tax assessment involves gathering evidence, such as recent sales data or appraisals, to support the claim. It is essential to follow the prescribed procedures and timelines set by the Assessor's Office to ensure a successful appeal.

Appeals can result in a reduction of the assessed value, leading to lower tax obligations. However, it is important to note that appeals can also be unsuccessful, especially if the evidence presented is not compelling enough. Seeking professional advice from tax consultants or attorneys can be beneficial in navigating the appeal process.

Exemptions and Deductions

Charleston County offers various exemptions and deductions that can reduce a property owner's tax liability. These incentives are designed to provide relief to specific groups or situations. Common exemptions include:

- Homestead Exemption: This exemption is available to primary residence owners and provides a reduction in taxable value. It is intended to assist homeowners in managing their tax obligations, especially those on fixed incomes.

- Senior Citizen Exemption: Seniors who meet certain age and income requirements may be eligible for this exemption, which can provide significant tax relief.

- Veteran's Exemption: Charleston County offers exemptions to honorably discharged veterans, providing a reduction in taxable value based on the veteran's disability status.

- Agricultural Use Valuation: Properties used for agricultural purposes may qualify for a special assessment, resulting in a lower tax liability.

The Impact of Real Estate Taxes on Property Ownership

Real estate taxes have a significant impact on property ownership, influencing both the cost of owning a property and the overall financial planning of residents and investors. Understanding these impacts is crucial for making informed decisions and optimizing one's financial strategies.

Financial Considerations

Real estate taxes are a substantial expense for property owners, often forming a significant portion of their annual financial obligations. These taxes must be considered alongside other costs, such as mortgage payments, insurance, and maintenance, when evaluating the affordability of a property.

For investors, real estate taxes can impact the profitability of their ventures. High tax obligations may eat into potential rental income or capital gains, affecting the overall return on investment. On the other hand, lower taxes can make a property more attractive and increase its investment potential.

Planning and Budgeting

Real estate taxes are a recurring expense, typically due annually. Property owners must incorporate these obligations into their long-term financial planning and budgeting. Failure to adequately plan for tax payments can lead to financial strain or even legal consequences.

To effectively manage real estate taxes, property owners should consider the following:

- Establish a dedicated fund for tax payments to ensure sufficient funds are available when due.

- Review tax bills and assessment notices carefully, identifying any changes or discrepancies.

- Explore tax relief programs and exemptions to reduce tax obligations and improve financial viability.

- Consider tax implications when making property improvements or alterations, as these can impact assessments.

Community Impact

Real estate taxes are a critical source of revenue for local governments, funding essential services and infrastructure development. These taxes contribute to the overall well-being and prosperity of the community, impacting residents' quality of life.

The funds generated through real estate taxes support various public services, including:

- Education: Schools, from elementary to high school, receive funding to provide quality education to the community's youth.

- Public Safety: Real estate taxes contribute to the funding of police and fire departments, ensuring the safety and security of residents.

- Infrastructure: Roads, bridges, and public transportation systems are maintained and improved, enhancing connectivity and accessibility.

- Community Development: Tax revenue is often allocated for community projects, such as parks, recreational facilities, and cultural initiatives.

Future Implications and Trends

The landscape of real estate taxes in Charleston County is subject to ongoing changes and evolving trends. Staying informed about these developments is essential for property owners to adapt their financial strategies and make informed decisions.

Changing Tax Rates

Tax rates are not static and can fluctuate over time. Local governments may adjust millage rates to address budgetary needs or changing economic conditions. Property owners should stay updated on these changes to anticipate potential increases or decreases in their tax obligations.

Charleston County, like many other jurisdictions, often holds public hearings to discuss proposed tax rate changes. These hearings provide an opportunity for residents to voice their concerns and influence the decision-making process. Being proactive and engaged in these discussions can help shape the future tax landscape.

Property Value Fluctuations

Real estate markets are dynamic, and property values can experience fluctuations due to various factors, including economic conditions, supply and demand, and local developments. These fluctuations can directly impact tax assessments, leading to changes in tax obligations.

For instance, a property in a rapidly developing area may see its value increase, resulting in higher tax assessments. Conversely, a property in a declining market may experience a decrease in value, leading to lower tax obligations.

Technology and Innovation

Advancements in technology are transforming the real estate industry, including the assessment and taxation processes. Charleston County, like many other jurisdictions, is embracing technological innovations to enhance efficiency and accuracy.

One notable example is the use of remote sensing technologies, such as aerial imagery and LiDAR, for property assessments. These technologies provide detailed data on properties, enabling assessors to make more informed decisions and potentially reducing the need for on-site inspections.

Community Engagement and Transparency

Charleston County recognizes the importance of community engagement and transparency in tax matters. The Assessor's Office actively seeks input from residents and stakeholders to ensure fairness and accountability in the assessment process.

Regular public meetings, workshops, and online resources provide opportunities for residents to learn about tax assessments, understand the calculation process, and voice their concerns. This open dialogue fosters trust and empowers property owners to actively participate in shaping the tax landscape.

FAQs

How often are real estate taxes assessed in Charleston County?

+

Real estate taxes in Charleston County are typically assessed annually. The Assessor’s Office conducts regular revaluations to ensure that property values remain up-to-date and tax obligations are fair and accurate.

Can I appeal my real estate tax assessment if I disagree with it?

+

Yes, property owners have the right to appeal their tax assessment if they believe it is inaccurate or unfair. The process involves gathering evidence, such as recent sales data or appraisals, and following the prescribed procedures set by the Assessor’s Office. It is recommended to seek professional advice for a successful appeal.

Are there any exemptions or deductions available to reduce my real estate tax liability?

+

Yes, Charleston County offers various exemptions and deductions to provide tax relief to specific groups or situations. These include the Homestead Exemption for primary residence owners, the Senior Citizen Exemption for eligible seniors, and the Veteran’s Exemption for honorably discharged veterans. Agricultural properties may also qualify for special assessments.

How can I stay updated on changes to real estate tax rates and assessments in Charleston County?

+

Property owners can stay informed by regularly checking the Charleston County Assessor’s Office website, which provides updates and announcements regarding tax assessments and rates. Additionally, attending public meetings and workshops, as well as following local news sources, can help keep you abreast of any changes or developments.

What happens if I fail to pay my real estate taxes on time?

+

Failure to pay real estate taxes on time can result in penalties, interest charges, and potential legal consequences. In extreme cases, non-payment of taxes may lead to tax liens being placed on the property, which can affect its ownership and future sale or transfer.