Property Tax Las Vegas

When discussing property ownership, one of the most important considerations is the financial responsibility associated with it. In the vibrant city of Las Vegas, property taxes play a significant role in the local economy and can impact the financial planning of both residents and investors alike. Understanding the ins and outs of property taxes in Las Vegas is crucial for anyone looking to buy, sell, or invest in real estate within this dynamic market.

Navigating Property Taxes in the City of Las Vegas

Las Vegas, renowned for its vibrant entertainment scene and bustling tourism industry, is also a city with a thriving real estate market. As such, property taxes in this region are an essential aspect to consider for both homeowners and investors. In this comprehensive guide, we will delve into the intricacies of property taxes in Las Vegas, exploring how they are calculated, the factors that influence them, and the steps one can take to navigate this crucial financial aspect of property ownership.

Understanding the Assessment Process

The journey towards understanding Las Vegas property taxes begins with the assessment process. In Nevada, the county assessor is responsible for appraising and evaluating the value of each property within their jurisdiction. This process involves considering various factors such as the property’s location, size, age, condition, and any recent improvements or additions. The assessed value serves as the foundation for calculating the property taxes owed by the owner.

The assessment process typically occurs every three years, with the assessor conducting a physical inspection of the property to ensure accuracy. However, if there are significant changes to the property, such as additions or renovations, the assessor may conduct a revaluation more frequently. This ensures that the property's assessed value remains up-to-date and reflects any improvements that could impact its market value.

Calculating Property Taxes: A Step-by-Step Guide

Once the assessed value of a property is determined, the calculation of property taxes in Las Vegas follows a straightforward process. Here’s a breakdown of the key steps involved:

- Assessed Value Determination: As mentioned earlier, the county assessor's office assesses the property's value, taking into account various factors. This assessed value forms the basis for calculating property taxes.

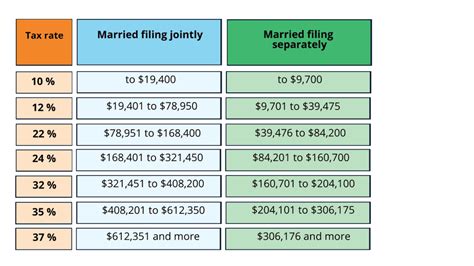

- Applying Tax Rates: Las Vegas, like other jurisdictions, has specific tax rates set by the local government. These rates are applied to the assessed value of the property to determine the preliminary tax amount.

- Exemptions and Credits: Property owners in Las Vegas may be eligible for various exemptions and credits that can reduce their taxable value. These include homeowner's exemptions, senior citizen exemptions, and disability exemptions, among others. Understanding and applying for these can significantly impact the final tax bill.

- Calculating the Final Tax Amount: After considering all applicable exemptions and credits, the final tax amount is calculated. This amount is then divided into two installments, typically due in June and December, to ensure a manageable payment schedule for property owners.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 1.10 |

| Commercial | 2.80 |

| Industrial | 2.50 |

Note: The above tax rates are for illustrative purposes only and may vary based on the specific location and type of property within the Las Vegas region.

Factors Influencing Property Taxes in Las Vegas

Several key factors can impact the property taxes owed by homeowners and investors in Las Vegas. Understanding these factors is essential for accurate financial planning and can also provide insights into potential strategies to manage property tax expenses.

- Property Value: As expected, the assessed value of a property is a significant determinant of the property taxes owed. Higher-value properties generally attract higher tax rates, while lower-value properties may enjoy more favorable tax assessments.

- Location: The location of a property within Las Vegas can also impact its tax assessment. Properties in prime locations, such as those near popular tourist attractions or business districts, may be subject to higher tax rates due to their increased value and desirability.

- Property Type: Different types of properties, such as residential, commercial, or industrial, are taxed at varying rates. As shown in the table above, commercial and industrial properties often have higher tax rates compared to residential properties.

- Improvements and Renovations: Any improvements or renovations made to a property can impact its assessed value and, consequently, its property taxes. Adding a new wing, updating the kitchen, or even landscaping improvements can lead to a reassessment, potentially resulting in higher taxes.

- Local Government Budgets: Property taxes are a significant source of revenue for local governments, and changes in government budgets can influence tax rates. When local governments face financial challenges or require additional funding for specific projects, they may adjust tax rates to meet their budgetary needs.

Strategies for Managing Property Taxes

While property taxes are a necessary expense for property owners, there are strategies that can help manage and potentially reduce the financial burden. Here are some practical approaches to consider:

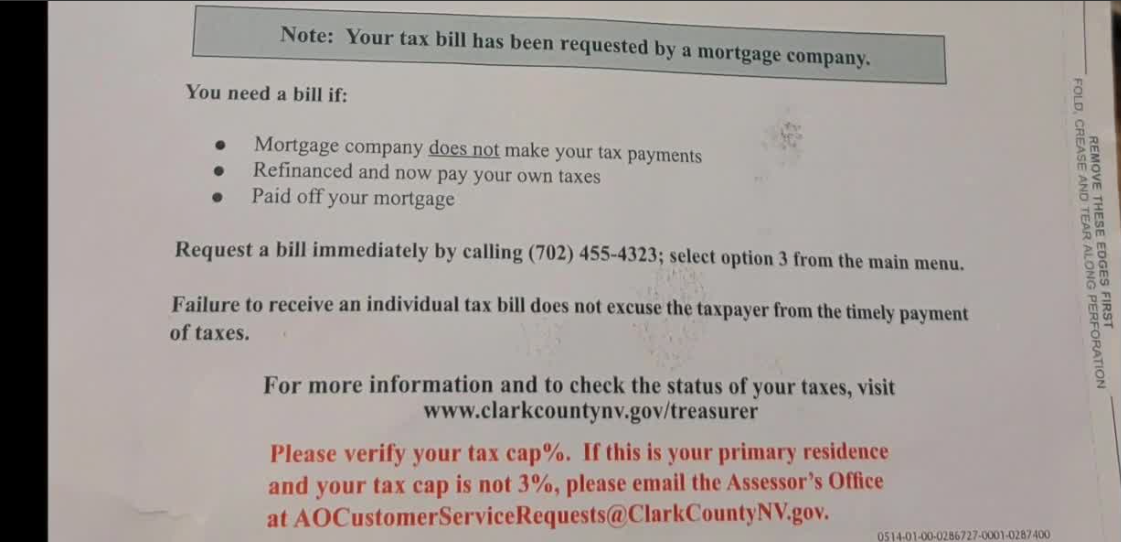

- Review Assessment Notices: Property owners should carefully review their assessment notices to ensure accuracy. If there are discrepancies or errors, it's important to dispute them promptly with the county assessor's office.

- Apply for Exemptions and Credits: As mentioned earlier, various exemptions and credits are available to property owners in Las Vegas. Researching and applying for these can significantly reduce the taxable value of the property, leading to lower property taxes.

- Consider Property Improvements Strategically: While improvements can enhance the value and appeal of a property, they may also trigger a reassessment and higher taxes. Property owners should carefully consider the timing and nature of improvements to minimize potential tax implications.

- Explore Tax Abatement Programs: Some areas within Las Vegas offer tax abatement programs to encourage economic development or attract specific industries. These programs can provide significant tax relief for qualifying properties. It's worth researching and understanding the eligibility criteria for such programs.

- Consult with Tax Professionals: Navigating the complexities of property taxes can be challenging. Engaging the services of a qualified tax professional or accountant who specializes in real estate can provide valuable insights and ensure compliance with tax regulations.

The Impact of Property Taxes on Real Estate Investments

For investors considering real estate opportunities in Las Vegas, understanding the impact of property taxes is crucial for financial planning and strategy development. Here’s how property taxes can influence investment decisions:

- Cash Flow Analysis: Property taxes are a recurring expense that must be accounted for in cash flow projections. Investors should carefully calculate and budget for these expenses to ensure the investment remains profitable.

- Return on Investment (ROI) Calculations: Property taxes can impact the overall ROI of an investment. Higher taxes may reduce the net income generated by the property, affecting the overall profitability and return on investment.

- Tax Strategies for Investors: Investors can employ various tax strategies to optimize their financial outcomes. This may include structuring ownership entities, utilizing depreciation benefits, or exploring tax-efficient investment structures to minimize tax liabilities.

- Impact on Rental Income: For investors with rental properties, property taxes can be passed on to tenants through rental agreements. However, it's essential to ensure that rental rates remain competitive and that tenants are aware of any tax-related adjustments to their rent.

Conclusion: A Comprehensive Approach to Property Taxes in Las Vegas

Understanding and managing property taxes in Las Vegas is a crucial aspect of responsible financial planning for both homeowners and investors. By grasping the assessment process, calculation methods, and the factors influencing property taxes, individuals can make informed decisions and implement effective strategies to navigate this important financial obligation.

Whether it's reviewing assessment notices, applying for exemptions, or seeking professional advice, there are numerous avenues to explore for optimizing one's financial position regarding property taxes. By staying informed and proactive, property owners and investors can ensure their real estate ventures remain profitable and sustainable in the dynamic Las Vegas market.

How often are property taxes assessed in Las Vegas?

+Property taxes in Las Vegas are typically assessed every three years, although revaluations may occur more frequently if significant changes are made to the property.

Can I dispute my property tax assessment in Las Vegas?

+Yes, property owners have the right to dispute their assessment if they believe it is inaccurate or unfair. The process involves submitting documentation and evidence to support their case to the county assessor’s office.

Are there any tax incentives or abatements available in Las Vegas for certain types of properties or investments?

+Yes, Las Vegas offers various tax incentives and abatements to encourage economic development and attract specific industries. These programs vary based on location and the type of investment, so it’s essential to research and understand the eligibility criteria.