File Sales Tax Online Nj

In today's digital age, managing financial obligations like sales tax has become more accessible and efficient, thanks to online platforms. This article will delve into the process of filing sales tax online in New Jersey, providing a comprehensive guide for businesses and individuals navigating this essential aspect of compliance.

Understanding Sales Tax in New Jersey

Sales tax in New Jersey is a consumption tax imposed on the sale of tangible personal property and certain services. It is a critical revenue source for the state, with businesses acting as intermediaries in collecting and remitting the tax to the New Jersey Division of Taxation. The tax rate varies depending on the location of the sale, with a standard state sales tax rate of 6.625%, effective as of January 1, 2020.

New Jersey also allows municipalities to levy their own local sales taxes, creating a unique landscape where the total sales tax rate can vary significantly across the state. As of October 2023, the highest combined state and local sales tax rate in New Jersey is 7.875%, while the lowest is 6.625%, making it crucial for businesses to understand the specific rates applicable to their locations.

| Sales Tax Rates in New Jersey | Rate |

|---|---|

| State Sales Tax Rate | 6.625% |

| Highest Combined Rate | 7.875% |

| Lowest Combined Rate | 6.625% |

It's important to note that certain items and services are exempt from sales tax in New Jersey. These exemptions can include prescription drugs, certain food items, and more. A complete list of exempt items and services can be found on the New Jersey Division of Taxation's website, which is a valuable resource for businesses to ensure compliance and avoid unnecessary tax liabilities.

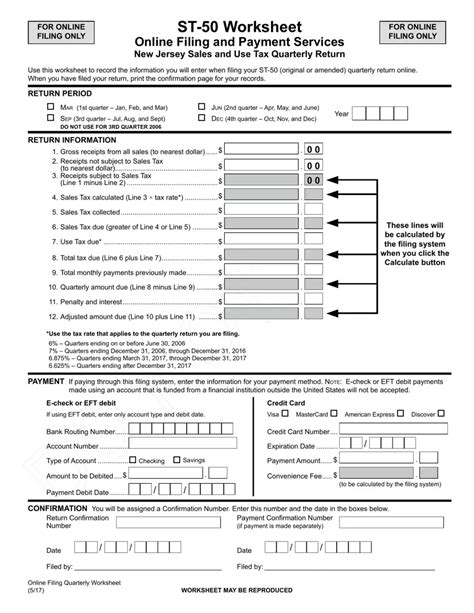

The Online Filing Process

The New Jersey Division of Taxation offers a user-friendly online platform, NJ TAXPAYER ACCESS POINT (TAP), to facilitate the filing of sales tax returns. This platform is designed to simplify the process, making it more accessible for businesses of all sizes.

Registering on TAP

Before you can file your sales tax returns online, you must first register on the NJ TAP platform. The registration process is straightforward and can be completed by following these steps:

- Visit the NJ TAP website and click on the "Register" button.

- Provide your basic information, including your business name, address, and contact details.

- Choose a unique username and a strong password for your account.

- Select the type of tax you wish to register for, which in this case is "Sales and Use Tax."

- Review and accept the terms and conditions of the platform.

- Submit your registration, and you will receive a confirmation email with further instructions.

Once your registration is complete, you will have access to your TAP account, where you can manage all your tax obligations, including sales tax filing.

Filing Sales Tax Returns

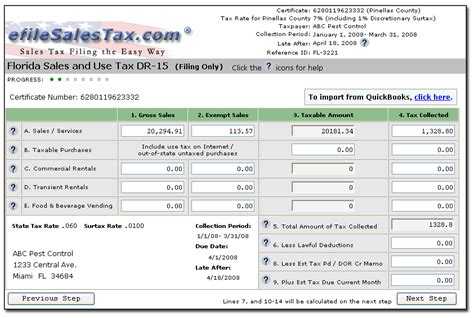

After registering on TAP, you can start filing your sales tax returns online. Here’s a step-by-step guide to the process:

- Log in to your TAP account using your username and password.

- Navigate to the "Sales and Use Tax" section and select the "File Return" option.

- Choose the relevant tax period for which you are filing the return.

- Enter the total taxable sales and purchases for the period.

- Calculate the total tax due, considering the applicable sales tax rate for your location.

- Review and confirm the information entered.

- Submit your return, and you will receive a confirmation message or email.

It's important to note that the due date for filing sales tax returns in New Jersey is typically the 20th day of the month following the tax period. For example, the return for the month of January would be due on February 20th. Late filings may incur penalties and interest, so it's crucial to stay on top of these deadlines.

Making Online Payments

NJ TAP also allows you to make online payments for your sales tax obligations. This feature provides a convenient and secure way to remit your tax payments without the need for physical checks or cash.

- Log in to your TAP account and navigate to the "Payments" section.

- Select the "Make a Payment" option and choose the tax type as "Sales and Use Tax."

- Enter the amount you wish to pay and select your preferred payment method (e.g., credit card, electronic funds transfer).

- Review the payment details and confirm the transaction.

- You will receive a confirmation message or email once the payment is processed.

It's worth noting that there may be transaction fees associated with certain payment methods, so it's essential to review the terms and conditions before making your selection.

Benefits of Online Filing

Filing sales tax online in New Jersey offers several advantages to businesses, including:

- Convenience: The online platform is accessible 24/7, allowing you to file returns and make payments at your convenience without visiting a physical tax office.

- Accuracy: Online filing reduces the risk of errors often associated with manual calculations and paperwork, ensuring more accurate tax returns.

- Timely Reminders: The NJ TAP platform sends automated reminders for upcoming due dates, helping you stay on top of your tax obligations.

- Secure Transactions: Online payments are encrypted and secure, providing peace of mind for businesses making tax payments.

- Quick Refunds: In cases where you overpay your sales tax, the online platform facilitates quicker refunds compared to traditional methods.

Challenges and Considerations

While online filing offers numerous benefits, there are a few considerations to keep in mind:

- Technical Issues: Online platforms may occasionally experience technical glitches or outages, which could impact your ability to file on time. It's essential to plan ahead and allow for potential delays.

- Learning Curve: Navigating a new online platform can take time, especially for those unfamiliar with technology. Businesses may need to invest in training or seek assistance to ensure a smooth transition to online filing.

- Data Security: While online platforms are secure, businesses must still take precautions to protect their sensitive financial information, such as using strong passwords and enabling two-factor authentication.

Future of Sales Tax Filing in New Jersey

The adoption of online filing for sales tax in New Jersey is part of a broader trend towards digital transformation in the tax landscape. As technology advances, we can expect to see further enhancements to the NJ TAP platform, making it even more user-friendly and efficient.

Additionally, the state may explore the implementation of real-time tax reporting, where businesses would provide sales data on a more frequent basis, potentially reducing the burden of quarterly or monthly filings. This would require significant infrastructure changes and may face resistance from businesses, but it could streamline the tax collection process and improve revenue management.

Conclusion

Filing sales tax online in New Jersey offers a modern and efficient approach to tax compliance. By leveraging the NJ TAP platform, businesses can streamline their tax obligations, reduce errors, and stay up-to-date with their tax responsibilities. While there may be challenges along the way, the benefits of online filing far outweigh the potential drawbacks, making it a valuable tool for businesses operating in the state.

How often do I need to file sales tax returns in New Jersey?

+

In New Jersey, the frequency of sales tax filing depends on your business’s sales volume and the state’s requirements. Generally, businesses with higher sales volumes are required to file more frequently. The standard filing frequency is quarterly, but businesses with substantial sales may be required to file monthly. It’s essential to consult the New Jersey Division of Taxation’s guidelines or seek professional advice to determine the appropriate filing frequency for your business.

Can I file my sales tax returns late, and what are the consequences?

+

While it is not recommended, you can file your sales tax returns late in New Jersey. However, late filings may result in penalties and interest charges. The penalty for late filing is typically 5% of the tax due, and interest may accrue on the outstanding balance. It’s crucial to stay on top of filing deadlines to avoid these additional costs and maintain good standing with the state.

Are there any resources available to assist with sales tax filing in New Jersey?

+

Yes, the New Jersey Division of Taxation provides a wealth of resources to assist businesses with sales tax filing. Their website offers detailed guides, tutorials, and frequently asked questions. Additionally, they provide a helpline for taxpayers to seek assistance and clarification on sales tax matters. It’s always a good idea to familiarize yourself with these resources to ensure a smooth filing process.

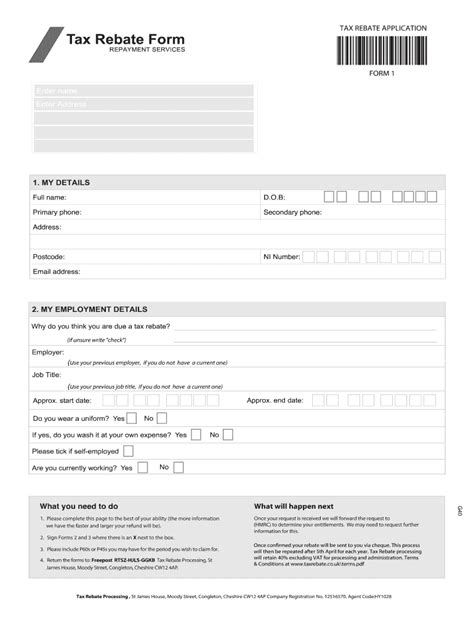

What happens if I make a mistake in my sales tax filing?

+

Mistakes can happen, and if you discover an error in your sales tax filing, it’s important to correct it as soon as possible. You can file an amended return to rectify the mistake. The process for filing an amended return may vary, so it’s best to consult the NJ TAP platform’s guidelines or seek professional advice to ensure you follow the correct procedures.