Maryland Ev Tax Credit

The Maryland Ev Tax Credit, officially known as the Electric Vehicle Tax Credit, is a significant incentive program designed to encourage the adoption of electric vehicles (EVs) and promote a greener transportation system across the state. This initiative is a crucial component of Maryland's broader strategy to combat climate change and reduce greenhouse gas emissions.

Understanding the Maryland Ev Tax Credit

The Maryland Ev Tax Credit offers a substantial financial incentive to residents who purchase or lease qualifying electric vehicles. This credit is intended to offset the higher upfront costs associated with electric vehicles, making them more affordable and accessible to a wider range of consumers.

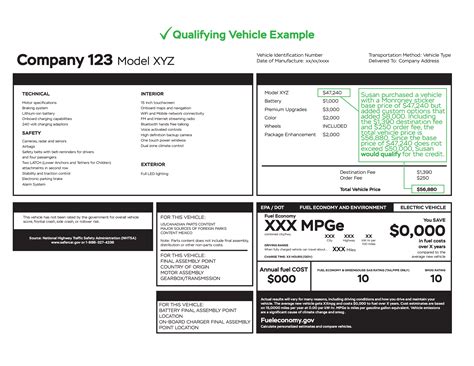

Eligible vehicles include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs). The credit amount varies depending on the type of vehicle and its battery capacity or fuel cell range. For instance, BEVs with a battery capacity of at least 12 kWh are eligible for a credit of up to $3,000, while PHEVs and FCEVs can receive a credit of up to $2,500.

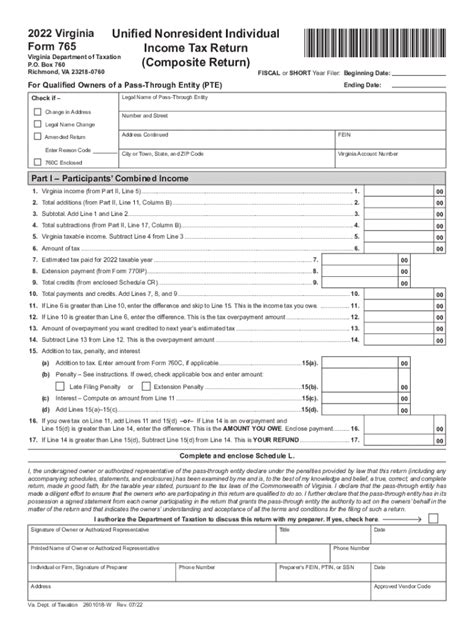

The credit is applied as a direct reduction to the purchaser's state income tax liability. In cases where the credit exceeds the tax liability, the excess amount can be carried forward to future tax years. This flexibility ensures that the credit remains accessible to a broad spectrum of taxpayers.

Qualifications and Requirements

To qualify for the Maryland Ev Tax Credit, several criteria must be met. Firstly, the vehicle must be purchased or leased by a Maryland resident and registered in the state. This ensures that the benefits of the program are felt directly within Maryland’s borders.

Secondly, the vehicle must be new, meaning it has not been previously registered or titled to any person or entity. This incentive is designed to promote the sale of new electric vehicles, stimulating the market and driving down prices over time.

| Vehicle Type | Credit Amount |

|---|---|

| Battery Electric Vehicles (BEV) with battery capacity ≥ 12 kWh | $3,000 |

| Plug-in Hybrid Electric Vehicles (PHEV) | $2,500 |

| Fuel Cell Electric Vehicles (FCEV) | $2,500 |

Additionally, the vehicle must be used primarily for personal, non-business purposes. This ensures that the credit is targeted towards individual consumers rather than commercial fleets.

Impact and Benefits

The Maryland Ev Tax Credit has had a significant impact on the state’s transition to electric mobility. Since its implementation, there has been a notable increase in the number of electric vehicles on Maryland’s roads, contributing to a reduction in carbon emissions and improving air quality.

The credit has been particularly effective in encouraging the adoption of electric vehicles among middle- and upper-income households. By offsetting the higher costs associated with EVs, the credit makes these vehicles a more feasible option for a broader demographic. This, in turn, leads to a more diverse and inclusive EV market.

Environmental and Economic Advantages

From an environmental perspective, the Maryland Ev Tax Credit has played a crucial role in reducing the state’s carbon footprint. Electric vehicles produce zero tailpipe emissions, which significantly improves air quality and reduces the health risks associated with air pollution.

Furthermore, the increased adoption of EVs has led to a reduction in the state's dependence on fossil fuels, contributing to Maryland's overall energy security and sustainability goals. The state's investment in EV infrastructure, including charging stations, has also created new economic opportunities and jobs.

Economically, the Maryland Ev Tax Credit has stimulated the EV market, driving competition and innovation among manufacturers. This has resulted in a wider variety of EV models available to consumers, with improved features and performance. The credit has also attracted EV-related businesses and investments to the state, further strengthening Maryland's economy.

Community Engagement and Education

The Maryland Ev Tax Credit program has also fostered community engagement and education around electric mobility. The state has organized various initiatives, such as EV ride-and-drive events and educational campaigns, to raise awareness about the benefits of electric vehicles and dispel common misconceptions.

These efforts have helped build a supportive environment for EV owners and prospective buyers. They have also facilitated the sharing of experiences and best practices among EV enthusiasts, further promoting the adoption of electric mobility.

Future Prospects and Challenges

Looking ahead, the Maryland Ev Tax Credit program is expected to continue playing a vital role in the state’s transition to a cleaner and more sustainable transportation system. However, there are several challenges and opportunities that policymakers and stakeholders should consider.

Policy and Infrastructure Development

One of the key challenges is ensuring that the state’s EV infrastructure keeps pace with the increasing demand. This includes expanding the network of charging stations, especially in rural and underserved areas, to provide convenient and reliable access to EV charging.

Additionally, policymakers should continue to monitor and evaluate the effectiveness of the tax credit program. This includes gathering feedback from EV owners and stakeholders to identify any potential barriers to EV adoption and ensure the program remains accessible and effective.

Market Dynamics and Technological Advancements

The rapid pace of technological advancements in the EV industry presents both opportunities and challenges. On the one hand, improvements in battery technology and vehicle performance can make EVs more appealing to consumers. However, these advancements can also lead to rapid changes in the market, potentially rendering certain incentives less effective over time.

Policymakers should stay abreast of these market dynamics and be prepared to adapt the Maryland Ev Tax Credit program accordingly. This may involve adjusting the credit amounts or eligibility criteria to ensure the program remains relevant and attractive to consumers.

Community Outreach and Equity

As the EV market continues to grow, it is essential to ensure that the benefits of the Maryland Ev Tax Credit program are accessible to all communities. This includes reaching out to underserved populations and providing education and resources to ensure they can also participate in the transition to electric mobility.

By promoting equity in EV adoption, the state can ensure that the benefits of cleaner transportation are felt across all segments of society, contributing to a more sustainable and resilient future for all Maryland residents.

Conclusion

The Maryland Ev Tax Credit is a powerful tool in the state’s efforts to combat climate change and transition to a cleaner, more sustainable transportation system. By incentivizing the adoption of electric vehicles, the program has successfully driven down emissions and improved air quality.

As Maryland continues to lead the way in EV adoption, it is crucial to maintain a forward-thinking approach, adapting policies and incentives to keep pace with market dynamics and technological advancements. By doing so, the state can ensure a bright and sustainable future for its residents and the environment.

What is the eligibility period for the Maryland Ev Tax Credit?

+

The Maryland Ev Tax Credit is available for vehicles purchased or leased after January 1, 2020. The credit can be claimed for up to 5 years from the date of purchase or lease.

Can I claim the credit if I lease an EV?

+

Yes, the Maryland Ev Tax Credit is available for both purchases and leases. However, the credit amount may vary depending on the lease terms and the vehicle’s battery capacity or fuel cell range.

Are there any income restrictions for claiming the credit?

+

No, there are no specific income restrictions for claiming the Maryland Ev Tax Credit. However, the credit is applied as a reduction to your state income tax liability, so your eligibility will depend on your overall tax situation.

Can I combine the Maryland Ev Tax Credit with other incentives?

+

Yes, the Maryland Ev Tax Credit can be combined with other federal, state, or local incentives, including the federal tax credit for electric vehicles. However, it’s important to review the terms and conditions of each incentive to ensure they can be stacked.

Where can I find more information about the Maryland Ev Tax Credit program?

+

For detailed information about the Maryland Ev Tax Credit program, including eligibility criteria, application process, and frequently asked questions, you can visit the official website of the Maryland Department of the Environment or consult with a tax professional.