Fl Tax Refund

Financial relief and economic empowerment are two critical aspects of the tax refund system, especially in states like Florida. The Florida tax refund, or the FL Tax Refund, is a vital mechanism for many residents, offering a potential boost to their financial well-being. This article aims to delve into the intricacies of the FL Tax Refund, exploring its significance, the processes involved, and its impact on Floridians' economic stability.

Understanding the FL Tax Refund: A Lifeline for Many

The FL Tax Refund, an initiative by the Florida Department of Revenue, is a refund of overpayments made by taxpayers during the fiscal year. It serves as a crucial financial tool, providing much-needed relief to individuals and families across the state. While tax refunds are common across the United States, Florida’s refund system has unique characteristics and processes that are worth exploring.

Eligibility and Criteria

To qualify for the FL Tax Refund, taxpayers must meet specific criteria. The eligibility requirements primarily consider the taxpayer’s income level, residence status, and timely tax filing. The income threshold for eligibility varies annually and is typically determined based on federal poverty guidelines. For instance, in the 2022 tax year, individuals with an adjusted gross income (AGI) of 43,350 or less, and married couples with a combined AGI of 54,150 or less, were eligible for the maximum refund.

| Income Level | Refund Amount |

|---|---|

| AGI $43,350 or less | $100 - $600 |

| AGI above $43,350 | Proportional to income |

It's important to note that the refund amount also varies depending on the taxpayer's income level, with higher refunds available for lower-income earners. This progressive structure ensures that the refund benefits those who need it most.

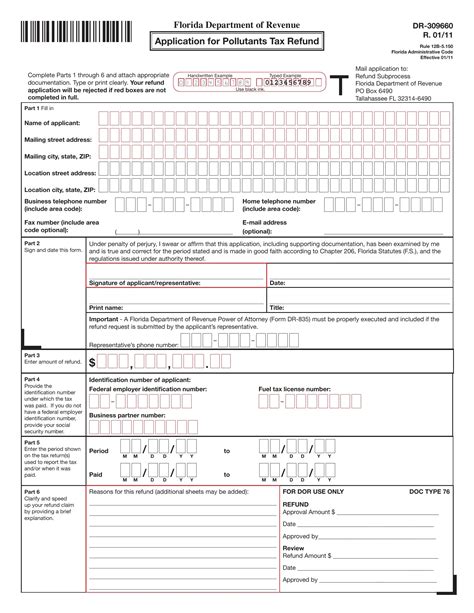

The Application Process

Applying for the FL Tax Refund involves a straightforward process. Taxpayers must file their state income tax return using Form DR-400, which is available online or through tax preparation software. The form requires basic personal and financial information, including income details and any deductions or credits claimed. Once submitted, the Department of Revenue processes the return and, if eligible, issues the refund.

The refund is typically issued within a few weeks of filing, but processing times may vary depending on the volume of returns and any issues with the submitted information. Taxpayers can check the status of their refund online through the Department's website or by calling the tax refund hotline.

The Impact of FL Tax Refunds: More Than Just Money

The FL Tax Refund’s impact extends beyond the financial benefits it provides. For many Floridians, especially those from low- and moderate-income backgrounds, this refund serves as a critical financial cushion. It can help cover essential expenses, such as rent, utilities, or healthcare costs, providing much-needed stability and peace of mind.

Economic Stimulus and Consumer Spending

The influx of tax refunds into the economy has a significant impact on consumer spending and local businesses. A study by the Florida Chamber Foundation found that tax refunds lead to increased spending on essentials and discretionary items, boosting the state’s economy. This stimulus effect is particularly beneficial for small businesses, which often rely on local consumer spending for their survival and growth.

Additionally, the FL Tax Refund can encourage savings and investment, as taxpayers may choose to allocate a portion of their refund towards long-term financial goals. This can include building an emergency fund, saving for education or retirement, or investing in the stock market or other financial instruments.

Addressing Income Inequality

The progressive nature of the FL Tax Refund system plays a role in addressing income inequality within the state. By providing larger refunds to lower-income earners, the system aims to reduce the gap between the rich and poor, promoting a more equitable distribution of wealth. This aligns with the broader goal of creating a more inclusive and prosperous society.

Maximizing the Benefits: Strategies and Tips

For taxpayers looking to maximize the benefits of the FL Tax Refund, there are several strategies to consider. Firstly, ensuring timely and accurate tax filing is essential. Late or incomplete returns may result in delays or even disqualification from the refund program. Utilizing tax preparation software or seeking assistance from tax professionals can help ensure compliance and maximize deductions and credits.

Optimizing Deductions and Credits

Taxpayers can optimize their refund by taking advantage of various deductions and credits offered by the state. For example, the Low-Income Tax Credit provides a refundable credit for low-income earners, further increasing their refund. Additionally, taxpayers who qualify for the Child and Dependent Care Credit can claim a credit for childcare expenses, reducing their taxable income and potentially boosting their refund.

It's crucial to note that the availability and requirements of these credits may change annually, so taxpayers should stay informed about the latest tax laws and regulations.

Planning for the Future

While the FL Tax Refund provides short-term financial relief, it’s important to consider long-term financial planning. Taxpayers can use their refund as a starting point for building financial security. This could involve creating an emergency fund, paying off high-interest debt, or investing in education or business ventures.

Financial advisors often recommend allocating a portion of the refund to these long-term goals, ensuring a more secure financial future. This proactive approach to financial management can help taxpayers break the cycle of financial instability and achieve greater economic independence.

FAQs: Common Questions about the FL Tax Refund

When will I receive my FL Tax Refund?

+

The timing of your FL Tax Refund depends on various factors, including the volume of tax returns and the accuracy of your submitted information. Typically, refunds are issued within 4-6 weeks of filing. However, it’s advisable to check the Department of Revenue’s website or call their tax refund hotline for the most up-to-date information.

Can I track the status of my FL Tax Refund online?

+

Yes, you can track the status of your FL Tax Refund online through the Department of Revenue’s website. You will need to provide your Social Security Number, date of birth, and the refund amount you expect. This tool provides real-time updates on the processing status of your refund.

What if I don’t receive my FL Tax Refund within the expected timeframe?

+

If you haven’t received your FL Tax Refund within the expected timeframe, it’s recommended to first check the status online or call the tax refund hotline. If the refund is delayed due to an issue with your return, the Department will contact you with further instructions. In some cases, you may need to file a claim for refund, which can be done online or by mail.

Are there any income restrictions for the FL Tax Refund?

+

Yes, there are income restrictions for the FL Tax Refund. The eligibility criteria consider your adjusted gross income (AGI). For the 2022 tax year, individuals with an AGI of 43,350 or less, and married couples with a combined AGI of 54,150 or less, were eligible for the maximum refund. Income levels above these thresholds may still qualify for a partial refund.

Can I use my FL Tax Refund to pay off debts or invest in my future?

+

Absolutely! The FL Tax Refund is your money, and you have the freedom to use it as you see fit. Many taxpayers choose to allocate their refund towards paying off high-interest debts, such as credit cards or personal loans. This can save you money on interest and improve your financial health. Others may invest their refund in their future, whether it’s through an emergency fund, education savings, or other financial goals.

The FL Tax Refund system offers a beacon of hope and economic empowerment for many Floridians. By understanding the eligibility criteria, optimizing deductions and credits, and planning for the future, taxpayers can make the most of this financial relief. As the state continues to evolve and adapt its tax policies, the FL Tax Refund remains a critical component of Florida’s financial landscape, providing stability and growth opportunities for its residents.